The issues surrounding company tax payments have been building in the UK over the last few years and show no sign of abating. Almost daily headlines and accusations about this company or that, some more believable than others, appear to have generated genuine anger among the public and among politicians over whether companies operating in the UK are paying their “fair share” of tax.

Despite the use of phrases such as “offshore royalties” and “transfer pricing” becoming almost daily currency in the press, the level of understanding around tax outside of the tax profession remains low. Rather than complain to each other that the public are angry because they just do not understand what we do, we have a collective responsibility to engage and to raise the level of the debate.

We do not do ourselves any favours by using opaque language, often derived from the phraseology used in tax legislation and accounting standards, which fails to convey much meaning to the man on the street. Who would like to try to explain, for example, “movements in unrecognised deferred tax assets”? We should try to peel away some layers of complexity so that tax reporting is expressed in clear language, intelligible to a wider audience.

Until we are able to articulate with clarity that a company’s corporation tax payments can be low for completely innocent reasons, such as the use of government tax incentives or brought forward losses, and that this is nothing to do with tax avoidance, the hostility to tax and the negative reporting in the press will continue.

This requires those of us with responsibility for tax within companies to provide both additional and better information.

Legal & General’s approach

We believe that paying and collecting taxes is an important part of our role as a business, and our contribution to society. We have seen that consumers can consider tax as a differentiating factor when choosing between businesses – for example in deciding which outlet to buy coffee from. However, consumers cannot arrive at an informed decision without having a reasonable level of information on which to base their views.

Accordingly, at Legal & General we have made an effort over the last few years to improve the quality of our tax reporting. Like all good plans, this was a three step process.

The first step, often the hardest, was not to simply roll forward what was in last year’s accounts. We made a conscious decision to try to review all of our disclosures and to re-write them using plain language as far as possible. We also set out to try to answer the questions that are being asked of business, but which are not currently requirements of the accounting disclosures. Questions such as: “How much tax do you pay?” and “Where do you pay it?”.

The second step, therefore, was to simplify the language used in the statutory accounting disclosures in the notes at the back of our accounts. So, for example in the tax reconciliation, instead of using the phrase “Overseas tax”, we have said “Higher rate of tax on profits taxed overseas”. A few extra words convey considerably more meaning to the reader.

The third step was to obtain some space in the front section of the accounts, in which we have more licence to set out the information we want to report about the Group’s tax affairs. In our 2012 accounts, this is within the Corporate Social Responsibility report.

The tax page in our accounts can be found at: http://reports.legalandgeneralgroup.com/2012/ara/ourapproach/oursocialpurpose/taxmatters.html

We currently include in this section paragraphs on the following topics:

· Why tax matters;

· Tax governance;

· Our relationship with HMRC, including that we were rated ‘low risk’ in 2012;

· Commentary on the current tax environment; and

· Our tax strategy, which includes what we will not do, as well as what we will.

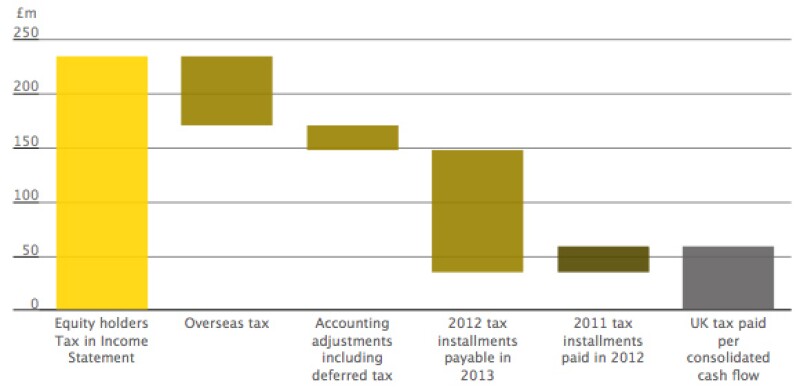

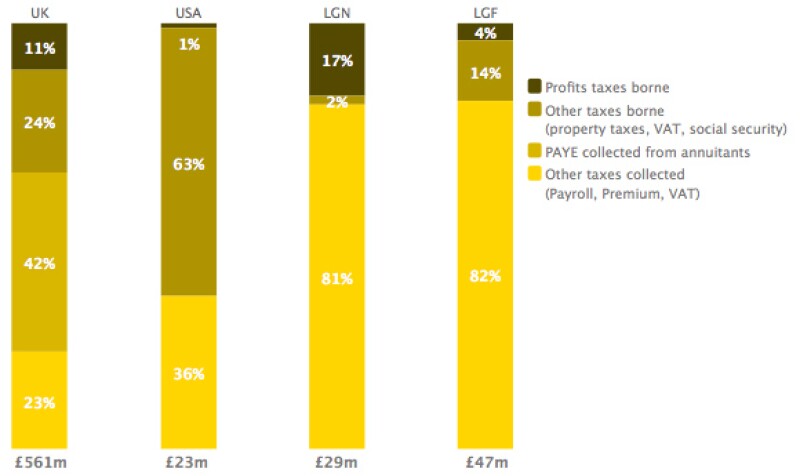

We also included two diagrams. The first shows country-by-country analysis of taxes borne and collected, and the second is a reconciliation between the tax charge per the income statement and the cash tax actually paid per the consolidated cash flow statement.

We decided to publish the country-by-country analysis for two reasons. First, due to the calls for such reporting, which are increasingly being directed at sectors beyond the extractive industries where they originated. Legal & General supports country-by-country reporting and so the second reason was to show that it is reasonably easy to do provided you do not go into too much detail. We made the decision to present our country-by-country reporting in the format of the total tax contribution information for each of the major countries in which we operate: UK, US, France and Netherlands. We decided not to include details for Ireland, which has de minimis profits, and for our joint venture businesses in India, Egypt and The Gulf.

We felt the reconciliation between the tax charge per the income statement and the tax paid was also important. Ultimately it is cash paid which goes to fund public services. We found that we could explain the main reconciling items using reasonably straightforward language. Simple concepts, such as the timing of corporation tax payments and the use of brought forward losses, can explain much of the difference. They also reinforce the danger of trying to draw too many conclusions from looking at data relating to a single year.

Tax in the wider context

Our contributions to the wider debate around tax have not been limited to our accounts. As a FTSE 100 listed company with more than seven million individual policyholders we think we have a responsibility to engage in the current debate. Over the last year we have:

Discussed our ambition to be low risk rated with HMRC and shared the related wording for the accounts with our customer relationship manager (CRM) before publication;

Talked to HMRC in real time in relation to transactions we were contemplating;

Met with ActionAid and others to discuss tax reporting, understand their agenda and how they think our disclosures could be improved;

Responded to numerous HMRC consultations, including in relation to the general anti-abuse rule (GAAR) which we supported; and

Provided responses to Parliament on questions relating to tax (Stephen McPartland MP and the House of Lords Economic Affairs Committee enquiry on Corporate Taxation).

The thought we have given to each of these interventions has helped to develop our own thinking and helped others to see our perspective.

What might the future hold?

Now that the ink is dry on the 2012 accounts we have started to think about changes we could make for 2013. One issue we are debating is whether to include taxes collected in our country-by-country analysis next year or just use taxes borne.

The conscious policy switch by governments away from profit based taxes to consumption taxes means that capturing taxes borne will continue to be relevant. Though the information is helpful in showing the broader picture, when used inappropriately it can look like an attempt at ‘smoke and mirrors’ to deflect challenges over the level of corporation tax which companies pay. By removing taxes collected from the table and focussing only on taxes borne (though not solely on corporation tax) we might present a clearer picture.

Some form of wider, compulsory country-by-country reporting feels inevitable. For 2012 we included information for Ireland within the UK because taxes borne and collected were less than £1million ($1.5 million) though others may consider that each country should be disclosed individually, even where not material. We also excluded our small joint ventures. Where to draw the line will no doubt be a subject for debate.

The reporting process must evolve

Oliver Wendall Holmes, Jnr, a former Associate Justice of the US Supreme Court, said “taxes are the price we pay for a civilised society”. Not everyone will agree on what that price should be, and charting a course between acceptable and unacceptable tax planning amid shifting public perceptions is not an easy task.

When there is such focus on public spending as there is now, it is right to ask whether the burden of funding public services is being fairly shouldered. Sitting on our hands and hoping that questions do not come to us, or that someone else will clarify the meaning of the “spirit of the law”, are not practical responses.

Tax is proving to be a good story for the media. Those of us working in tax should be focussing on how to improve the information we provide. The alternative is waiting for someone else to do it for us but, either way, the tide is turning.

Simon Burke is group tax director, and Laurence Youngman is international tax manager, at Legal & General. The company’s efforts in this area have been recognised, with Legal & General winning PwC’s 2012 Building Public Trust Award for Best Tax Reporting in the FTSE 100.