|

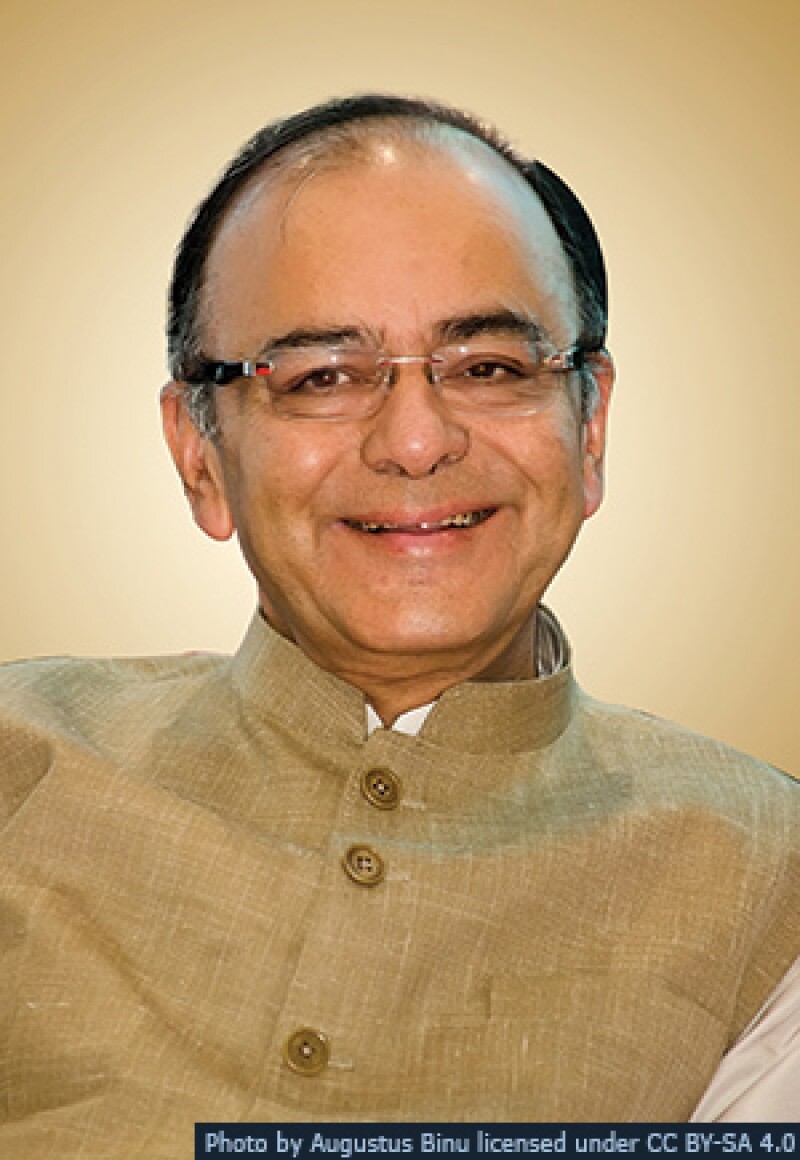

Arun Jaitley has pulled a hat-trick and remained in the Global Tax 50 for the third year running for his continued efforts to overhaul India's tax system and rid it of corruption and opaque policies.

2016 has been a busy year for the Indian finance minister, who has been moving forward with the planned goods and services tax (GST) regime and phasing out corporate tax exemptions, among other things. He has also been an important figure in strengthening tax compliance and combatting tax avoidance and evasion. "Moderate tax rates and evasion cannot coexist. When we evade taxes, it also brings aberrations in tax structures," he said in August.

When he was first appointed as finance minister, Jaitley told International Tax Review that his priorities for business were to reduce compliance costs (including litigation) and increase tax certainty. To date, Jaitley has fulfilled this goal by introducing tax measures that align with international standards and BEPS, as well as revising a number of tax treaties and reducing the amount of available tax exemptions to facilitate a future cut in the corporate tax rate.

To make India more competitive in the global market and to drive investment, Jaitley has hinted at the gradual decrease in the corporate tax rate to make it easier to do business. Earlier this year, at the SP Jain Institute of Global Management, Jaitley said that the Indian government had resolved various legacy issues in regards to taxation and is gradually working to bring down the rate from 30% to the more standard global level of 25%.

In addition, the planned GST regime finally made some progress after the upper house of parliament, Rajya Sabha, passed the 122nd Constitutional Amendment Bill for GST on August 3. The bill's passage has paved the way for the most far-reaching tax reform ever to be implemented in India in 2017. Since August, a GST Council has been established, chaired by Jaitley, which has agreed on a four-tier GST rates structure. Other details still require agreement before a final GST Model Law can be submitted to parliament.

For the GST to come into force in April 1 2017, India's federal and state governments must pass the legislation by the end of this year, but the regime could be stalled if the federal and state officials fail to agree on who should administer the tax.

Implementing GST in India has been a long and tedious process that began back in 2003. Its introduction would allow for a big reduction to compliance costs for manufacturers, and would also mean the harmonisation of the varying taxes, both at the federal and state level, applied to goods and services sold across India. If GST is implemented, Jaitley is confident that the tax rates will come down. When asked what his top economic policy priorities were, Jaitley told a conference in September that he was determined to stick to a "very stiff" schedule that anticipates the implementation of critical enabling legislation for the GST regime by the end of 2016.

Looking ahead, Jaitley is expected to turn his attention to other prominent challenges that include putting public sector banks back on track and re-booting stalled infrastructure projects to further boost economic activity. His work in re-shaping India's economy include initiatives like 'Make in India', '100 Smart Cities' and the liberalised foreign direct investment (FDI) regime to boost investment and trade. These projects are a priority in Jaitley's infrastructure plan to stimulate growth in the economy.

Another area of significant change in India has been the move from bank notes to cashless transactions. Jaitley is confident that physical currency must be phased out to expand the economy. This is part of a larger objective to move towards digitalising financial processes such as digital IDs, expanding access networks and financial benefit transfers.

Jaitley is a firm believer of coordinated policy actions and growth strategies, especially in light of globalisation and multilateralism. His reoccurring position in the Global Tax 50 is due to his transformation of India's tax system. His ability to foresee future issues within India's economic model has allowed for the development of new initiatives like the GST regime, and the momentum to kick-start work on stalled projects.

While Jaitley continues his efforts to create a tax system that competes with the international economy, taxpayers are working to align their tax structures with new compliance measures that promote fairer taxation. His efforts to improve the tax landscape for businesses operating in India will help to foster relationships with other countries and provide various opportunities for business.

The Global Tax 50 2016 |

|

|---|---|

The top 10 • Ranked in order of influence |

|

2. The International Consortium of Investigative Journalists |

|

3. Brexit |

4. Arun Jaitley |

5. Jacob Lew |

|

10. Donald Trump |

|

The remaining 40 • In alphabetic order |

|