In 2013, Chinese President Xi Jinping announced plans to rebuild China's old trade links with Europe and Asia via the Silk Road Economic Belt and the 21st Century Maritime Silk Road – the BRI. The BRI is aimed at building essential infrastructure and boosting financial and trade links to enhance commerce, and spread prosperity, across the more than 60 countries that lie along the BRI routes.

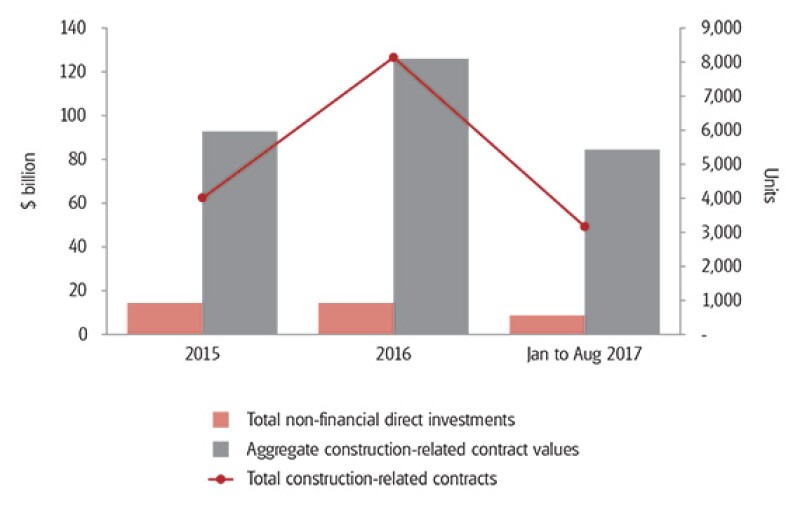

The BRI has already drawn strong participation from Chinese companies. Statistics from China's Ministry of Commerce indicate that non-financial related direct investment by Chinese companies into BRI countries was almost $38 billion during the period from January 2015 to August 2017 (see Figure 1). The statistics also indicated that Chinese companies had signed more than 15,300 new construction related contracts, with an aggregate project value of more than $303 billion, in BRI countries over this same period.

Figure 1: Chinese non-financial direct investment and construction-related contracting in Belt and Road countries

This BRI investment growth is expected to continue following the recent Chinese government pronouncement, Guo Ban Fa [2017] No. 74, issued on August 18 2017. This set out a regulatory classification of outbound investments as encouraged, restricted and prohibited. From the list of encouraged outbound investments, it is evident that the BRI is being strongly supported by the government. The encouraged list includes:

Infrastructure and construction projects under the BRI;

Outbound investment facilitating China exports of machinery, industrial equipment, and technical standards;

Outbound investment that serves to strengthen investment cooperation with overseas high-tech and advanced manufacturing enterprises;

Outbound investment in overseas research and development (R&D) centres;

Participation in projects for the exploration and development of offshore oil and gas, mineral and other energy resources;

Outbound investment in the agricultural sector;

Outbound investment in services sectors, such as commerce, trade, culture, logistics; and

Set up of branches and overseas service networks by qualified financial institutions.

At the same time, the Chinese authorities continue to tighten the approval requirements for outbound investments in 'sensitive' sectors. The most recent example is draft rules, released in November 2017, which clarify that investment transactions conducted through an offshore subsidiary of a Chinese company, using funds raised outside of China, will still be within the scope of the pre-approval procedures. The authorities refer to this as a 'substance over form' approach to the oversight of Chinese investment overseas.

Driven by the BRI initiative, Chinese companies are extensively participating in overseas BRI projects. For many, these investments and projects are their first undertaking outside China. BRI projects are predominately large-scale infrastructure construction and natural resource extraction and production works, and they offer a wide range of roles that Chinese companies can play. This includes roles as engineering, procurement and construction (EPC) contractors, operators, equipment manufacturers/suppliers, project financiers, and equity investors.

However, Chinese enterprises may not be fully prepared for the challenges that may arise from these overseas projects, particularly in the area of taxation. This is particularly the case if they are unfamiliar with the overseas tax systems of the countries in which they operate/invest. Tax matters can also be problematic if the Chinese companies have inadequate tax risk management systems in place to tackle the issues, before or as they arise. Most of the countries involved in the BRI are emerging or developing economies, whose tax laws and regulations are not yet fully developed and frequently subject to different local interpretations and unanticipated changes. Accordingly, Chinese enterprises may encounter difficulties in managing their overseas tax affairs, creating tax risks and costs that ultimately reduces their returns from the investment/projects, and consuming management time and attention.

This chapter looks at a few of the key corporate income tax (CIT) related risks that Chinese companies may face as they embark on overseas projects under the BRI. There are other tax issues that could also impact the tax risks and costs associated with overseas BRI related projects, such as VAT and customs duty on imported equipment and other construction inputs, tax reporting and withholding for seconded staff, etc. We will also look at measures announced by the Chinese tax authorities to support Chinese companies with these tax challenges.

Permanent establishment (PE) risk

Chinese tax resident EPC contractors and project operators are subject to China taxation on their worldwide profits at the standard China CIT rate of 25%. However, these companies will also find themselves liable to overseas taxes on their overseas projects to the extent they are derived through a PE in the project country. What constitutes a PE will be based on the domestic tax legislation in the project host country and any applicable double tax agreement (DTA) with China. Broadly speaking, a PE requires there to be a physical presence in the country (i.e. people, tangible assets, etc.) and a measure of permanence for such presence (e.g. through recurrent activities).

There are a number of steps that non-resident companies may take to limit the incidence and/or scope of project host country PEs. The non-resident company may use a separate local subsidiary to perform in-country project related activities. Alternatively, the non-resident contractor may look to split a project into separate contracts. The contracts can thus separately cover the PE activities undertaken within the project host country (e.g. construction services), and the activities undertaken outside the project host country (e.g. sale of equipment).

However, these approaches are being increasingly challenged. Changes are being made in countries at a tax policy level in response to proposals made by the OECD's BEPS Action Plan 7 (Preventing the artificial avoidance of permanent establishment status), and individual countries looking to enforce more rigorously their domestic law and DTA standards on PE. This has seen increasing levels of PE disputes for Chinese contractors in project host countries. For example, in 2016 in India, ZTE faced a challenge over PE profit attribution for its telecommunication equipment supplies (ZTE Corporation v. ADIT, ITA 5870/Del/12 and others), and Zhenhua Port Machinery faced a PE recognition challenge in relation to a port construction project in Gujarat Pipavav Port Limited v. ITO (ITA No. 7878/Mum/2010).

In 2017, Shanghai Electric faced a PE challenge in relation to its project for the supply, installation and commissioning of power plant related equipment in India (Shanghai Electric Group Co. Ltd. v. DCIT [2017] 84 taxmann.com 44 (Del)). In that case, the authorities disregarded the separation of the (offshore) supply and (onshore) service contracts and taxed the combined profits from the two 'linked' contracts as being from a supervisory PE in India. This was done without regard to the facts of whether the activities were undertaken within or outside India.

Haier, Huawei and Dongfang Electric have similarly all been engaged in high profile Indian tax disputes involving PEs in India. These cases are just a sample of those arising for Chinese enterprises in India. With Chinese investments covering a range of more than 60 countries along the BRI, tax from a multitude of national tax authorities is becoming a key challenge for Chinese outbound companies to manage.

Overseas PE tax impositions may not always result in a net tax leakage for Chinese enterprises where the PE countries apply the same (or a lower) CIT rate as China. This is because a foreign tax credit should generally be available for the foreign corporate income taxes, paid by the Chinese contractor, when they compute their China CIT on the project profits. However, there can be issues in obtaining the credit due to differences, between the host country and China, in the timing of tax impositions e.g. due to timing differences for project profit accounting recognition. Furthermore, penalties and interest charged by the overseas tax authorities may not be creditable in China. We consider that PE related disputes will certainly remain a concern for Chinese contractors undertaking projects in higher taxed jurisdictions (e.g. India), and companies will need to pay close attention.

Double taxation on financing and equity returns

Chinese companies are providing significant funding to BRI projects, most commonly in the form of debt financing or equity investment. The overseas tax treatment of the returns earned by Chinese persons from these loans/investments can differ from country to country. A full or partial tax exemption may be applied to interest, dividends and gains from the disposal of the loans/investments, or the source country may impose tax on a withholding basis that must be deducted by the payer. These differing tax positions can significantly alter the after-tax returns and Chinese companies should consider this when evaluating the economics of such transactions.

Source country withholding tax (WHT) on interest, dividends and gains can potentially be reduced under an applicable DTA – China has DTAs with the vast majority of the BRI countries. However, there is considerable divergence in the scope, conditions and benefits under China's various DTAs, which merit close review. It is also noteworthy that variable and burdensome local administrative practices for granting DTA relief can potentially create cash flow issues. In this regard a key consideration is whether the local tax authorities grant DTA relief up-front, or by way of a subsequent WHT refund application. The latter can be highly problematic in practice.

How the Chinese tax authorities are supporting Chinese BRI investors

The State Administration of Taxation (SAT) recently announced various measures to support Chinese enterprises participating in BRI investments and projects. In particular, per SAT Circular 42 [2017], the SAT is committed to:

Assisting Chinese enterprises to negotiate with overseas tax authorities. This is with the aim of safeguarding and protecting the legal rights and interests of Chinese enterprises investing overseas (e.g. mutual agreement procedure (MAP) negotiations to resolve disputes);

Improving the China domestic tax law and regulations relevant to Chinese enterprise overseas investments and operations. This is with a view to eliminating double taxation under CIT (with consideration being given to a participation exemption), improving and simplifying the VAT export refund/exemption rules and procedures, and streamlining the process for issuing China tax residency certificates;

Publishing studies on the tax regimes of the BRI countries for Chinese enterprise reference; and

Strengthening cooperation with the overseas tax authorities in the BRI countries.

The SAT encourages Chinese companies to study the tax practices of intended project host countries, in order to understand the tax compliance obligations in such countries and the impact of tax on operations and costs. To this end, the SAT has already published investment guides for 59 of the BRI countries and the SAT expects to release similar guides for the remaining countries by the end of 2017. The SAT also released a 245-page 'Go Global' Taxation Guide in October 2017 to help companies mitigate potential overseas tax risks. The guide covers the following four areas:

Overview of Chinese tax policies applicable to Chinese outbound companies;

Overview of China's network of DTAs and an explanation of common provisions within China's DTAs applicable to Chinese outbound companies;

Overview of the China tax-related registration and reporting obligations for Chinese outbound companies in relation to their overseas investments/projects; and

Overview of the key supporting services offered by the SAT regarding Chinese outbound companies in relation to their overseas investments/projects.

At the same time, the SAT has recommended that Chinese outbound companies should seek assistance from tax advisers to ensure that they are properly advised in respect of their overseas investment structures and business operating models.

The SAT has provided, and continues to provide, assistance to Chinese companies encountering tax issues abroad. In line with the SAT's efforts to raise awareness of the availability of such support, SAT-resolved MAP cases have been reported on government online platforms with increasing frequency throughout 2016 and 2017. However, the details tend to be somewhat limited, being whatever the tax authorities are willing to disclose. For example:

In a case publicised in August 2016 on the Beijing State Taxation Bureau (STB) website, an overseas subsidiary of a Chinese enterprise had been denied DTA WHT relief on an interest payment made on a loan received from the China Development Bank (CDB). It was reported that the foreign tax authority focused on the DTA provision that indicated that loans guaranteed by a foreign government could benefit from a 0% WHT rate on interest and disputed that the terms of the subject loan did not meet such requirements. The Chinese enterprise's position, supported by the SAT in the MAP discussions, was that CDB was a wholly-owned Chinese government institution and therefore a separate provision of the DTA should in any case grant DTA relief. When the case was concluded in the Chinese enterprise's favour in February 2015 it had taken just 36 days to be resolved and a tax reduction of in excess of $5 million was secured.

In a case publicised in May 2017 on the Beijing STB website, a leading Chinese glass manufacturer invested CNY 1.17 billion ($176 million) in the construction of two glass production lines in Malaysia. These were expected to generate an average annual profit of approximately CNY 150 million. However, it was reported the company encountered difficulties when the local tax authorities imposed WHT on its outbound interest payments from Malaysia to China, contrary to the intended position under the China-Malaysia DTA. The company sought assistance from the SAT to negotiate with the Malaysian tax authorities. As a result of agreement being reached, a WHT saving of CNY 34 million was achieved. As a follow up to the case, an inter-governmental exchange of notes in relation to the China-Malaysia DTA clarified the position that wholly state-owned institutions are eligible for an interest WHT exemption under the China-Malaysia DTA.

In a case publicised in May 2017 on the Beijing STB website, a Chinese shoe manufacturing group had set up a number of factories in Ethiopia. It was reported the Ethiopian tax authorities had looked to impose a 10% WHT on a dividend received by the Chinese company from its Ethiopian operations. This was different from the 5% reduced rate prescribed under the China-Ethiopian DTA. Upon the group's application, the Dongguan tax authorities took action to assist the group to lodge an appeal letter with the Ministry of Finance of Ethiopia. Following several rounds of communication, the Ethiopian Ministry of Finance accepted the Chinese manufacturer's position and a tax saving of $300,000 was secured.

With the continuing growth in outbound activity associated with the BRI, reliance by Chinese enterprises on advance pricing arrangements (APAs) and the MAP is expected to become ever greater. We also expect to see the SAT more involved in helping Chinese outbound companies to manage their overseas tax issues.

More to come

Chinese enterprises are ever more exposed to changes in tax laws and regulations, and uncertainties inherent in tax systems, of the BRI countries in which they invest. Chinese companies must therefore critically evaluate the capability of their existing in-house tax resources and systems to ensure they can meet their overseas tax obligations. Where necessary, they should seek assistance from external advisers to supplement or address any gaps.

Michael Wong |

|

|---|---|

|

Partner, Tax KPMG China 8th Floor, Tower E2, Oriental Plaza Beijing 100738, China Tel: +86 10 8508 7085 Michael Wong is a partner and head of the outbound tax practice for KPMG China. He is based in Beijing and leads the national outbound tax practice serving state-owned and privately owned China companies in relation to their outbound investments. Michael has extensive experience leading global teams to assist Chinese state-owned and privately owned companies conduct large-scale overseas M&A transactions in various sectors including energy and power, mining, financial services, manufacturing, infrastructure and real estate. |

Joseph Tam |

|

|---|---|

|

Partner, Tax KPMG China 8th Floor, Tower E2, Oriental Plaza Beijing 100738, China Tel: +86 10 8508 7605 Joseph Tam is a tax partner at KPMG specialising in advising Chinese clients on tax issues arising from their overseas business operations and/or investments. In particular, Joseph has advised his clients on tax structuring, tax due diligence, tax modelling review, sales and purchase agreement (SPA) negotiation, corporate restructuring, etc. Joseph has also assisted clients in applying for tax incentives and advance tax rulings. Joseph services clients in a wide range of industries including infrastructure, power, industrial markets, real estate and financial services. Joseph is a frequent speaker at seminars on Chinese outbound investment, the Belt and Road initiative and international production capacity cooperation. He is also a member of the Hong Kong Institute of Certified Public Accountants. |

Alan O’Connor |

|

|---|---|

|

Director, Tax KPMG China 8th Floor, Tower E2, Oriental Plaza Beijing 100738, China Tel: +86 10 8508 7521 Alan O'Connor joined KPMG Hong Kong from Australia in 2000 and became a director in 2013. He worked in Hong Kong for more than 10 years before relocating to Beijing in 2011 where he continues to provide tax services to Chinese outbound investors. Alan has extensive experience providing due diligence and transaction related tax advisory services to major Hong Kong and Chinese based clients, and has been involved in international tax planning projects, merger and acquisition transactions and due diligence exercises involving Asia, Europe and North America. |

Karen Lin |

|

|---|---|

|

Director, Tax KPMG China 26th Floor, Plaza 66 Tower II 1266 Nanjing West Road Shanghai 200040, China Tel: +86 21 2212 4169 Karen Lin joined KPMG Hong Kong in 2005 and KPMG Beijing in 2011. Since 2011, Karen has been specialising in international taxation and assisting Chinese multinational corporations with outbound M&A transactions, including international tax structuring, tax due diligence and transaction-related tax advisory services. During 2014 and 2015, Karen joined a NASDAQ-listed multinational media group focusing on managing the group's taxation matters covering the Asia Pacific region. |

Cloris Li |

|

|---|---|

|

Partner, Tax KPMG China 21th Floor, CTF Finance Centre, 6 Zhujiang East Road Zhujiang New Town, Guangzhou 510623, China Tel: +86 20 3813 8829 Cloris Li has more than 15 years of experience working with KPMG across a wide range of international and China tax advisory areas including M&A, international tax planning, IPOs and related structuring, tax disputes, and indirect tax. Cloris is now focusing and specialising in outbound investment tax services, including outbound M&A, deal structure advice, international tax planning on outbound investment structures, financing and business operation planning. Cloris has built up a broad range of industry experience across a number of sectors, including automotive, manufacturing, real estate, technology media and telecommunications (TMT), logistics & transportation, mining, and infrastructure. |