|

Arun Jaitley was also in the Global Tax 50 2016, 2015, and 2014 |

After 17 years of discussions on a GST, Jaitley was the one who led the final campaign to introduce the new structure that harmonised an array of different indirect taxes across the country's 29 states. There is no other structure worldwide that can compare to this regime. Even the closest comparatives across the EU and the GCC are dwarfed by it.

Although there have been bumps in the road over how and when to implement the GST regime, Jaitley has been a key figure in mediating between conflicting interests and opinions, as well as communicating and championing the change to the media and the public.

Tax professionals have described the new GST regime as a "paradigm shift from the previous indirect tax reform in India" and a "game-changer for the Indian economy", transforming the whole country into a single commercial market.

Although the GST regime has been implemented, the finance minister is still committed to the initiative. Through the GST Council, which he chairs, Jaitley is adapting the tax system to address initial glitches and complaints. This is a task that will continue in the coming year and it is likely to be influenced by inevitable disputes over GST compliance.

But the finance minister's work has not been isolated to the GST regime in the past year. When he was first appointed as finance minister, Jaitley told International Tax Review that his priorities for business were to reduce compliance costs (including litigation) and increase tax certainty. This mission was evident in the 2017 annual budget and in the subsequent legislative changes.

In what could be described as a mature and balanced budget, Jaitley promised to clean up India's economy in an effort to boost revenue through better compliance measures, rather than through tax hikes. Among others changes, administrative burdens on foreign portfolio investments (FPIs) were reduced, companies were given a longer period to carry forward minimum alternative tax (MAT) credits, and a series of tax measures were unveiled to boost the "Make in India" initiative, which included tax benefits for the manufacturing sector.

Elsewhere, under Jaitley's leadership, the finance ministry and tax authorities have been working to tackle corruption and the black economy, and to boost tax transparency and make India's tax system more welcoming for foreign businesses and investors. For example, numerous advance pricing agreements (APAs) have been negotiated, and other initiatives to prevent disputes put in place, over the past year to provide tax certainty and avoid repeating past mistakes.

To date, Jaitley has fulfilled his goal of introducing the GST regime and has made big strides in aligning India's tax regime with international standards and the BEPS project.

Looking ahead, Jaitley is expected to turn his attention to other prominent challenges that include ensuring India's economic growth bounces back from the changes that have damaged it in 2017 such as the GST regime and sudden demonetisation of INR 500 and INR 1,000 banknotes. Consultations on the 2018-19 budget, which will be presented on February 1 2018, are underway and Jaitley will use this opportunity to boost economic activity.

The finance minister is a strong advocate of coordinated policy actions and growth strategies, especially in light of globalisation and multilateralism. His retention of a position in the Global Tax 50 for a fourth consecutive year is recognition of how his efforts have helped to transform India's tax system. His ability to foresee future issues within India's economic model has allowed for the development of new initiatives like the GST regime.

While Jaitley continues his efforts to create a tax system that competes with the international economy and attracts investors in a competitive global market, taxpayers are working to align their tax structures with the changes. His efforts to improve the tax landscape for businesses operating in India will help to foster relationships with other countries and continue to provide various opportunities for business.

The Global Tax 50 2017 |

|

|---|---|

The top 10 • Ranked in order of influence |

|

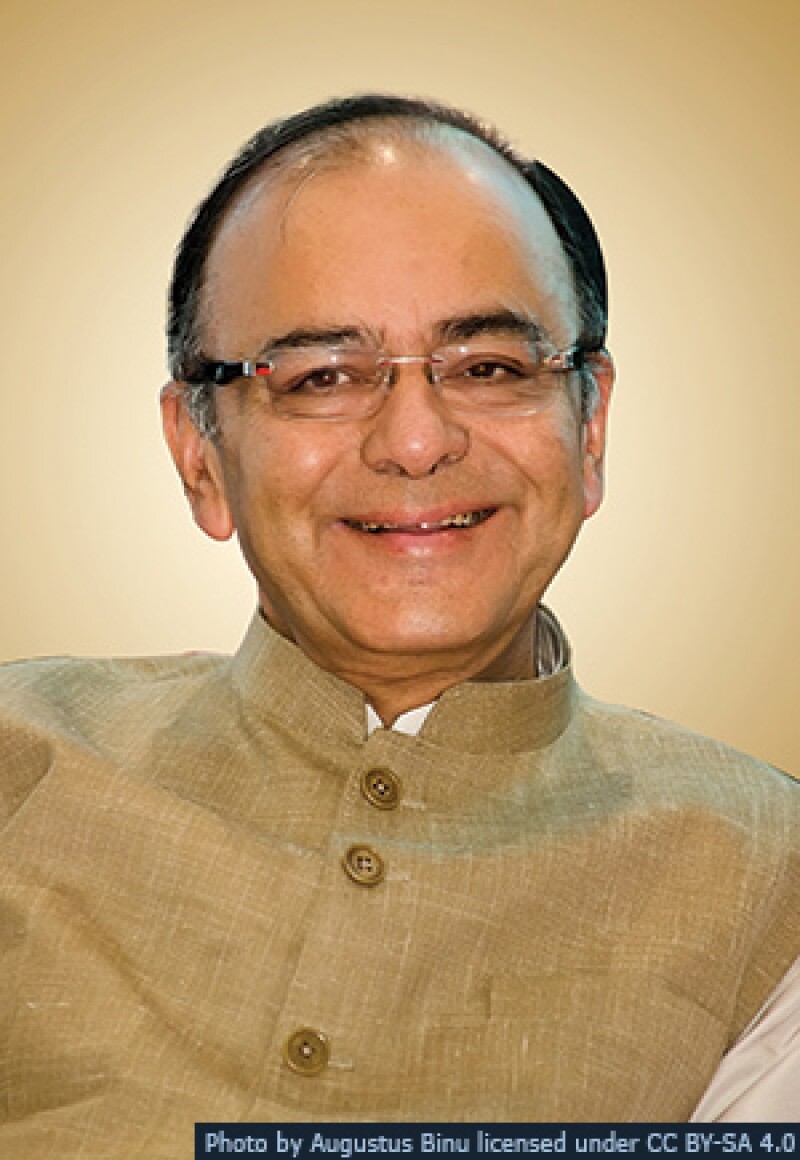

6. Arun Jaitley |

|

The remaining 40 • In alphabetic order |

|

| The Estonian presidency of the Council of the European Union |

|

| International Consortium of Investigative Journalists (ICIJ) |

|

| United Nations Committee of Experts on International Cooperation in Tax Matters |

|