|

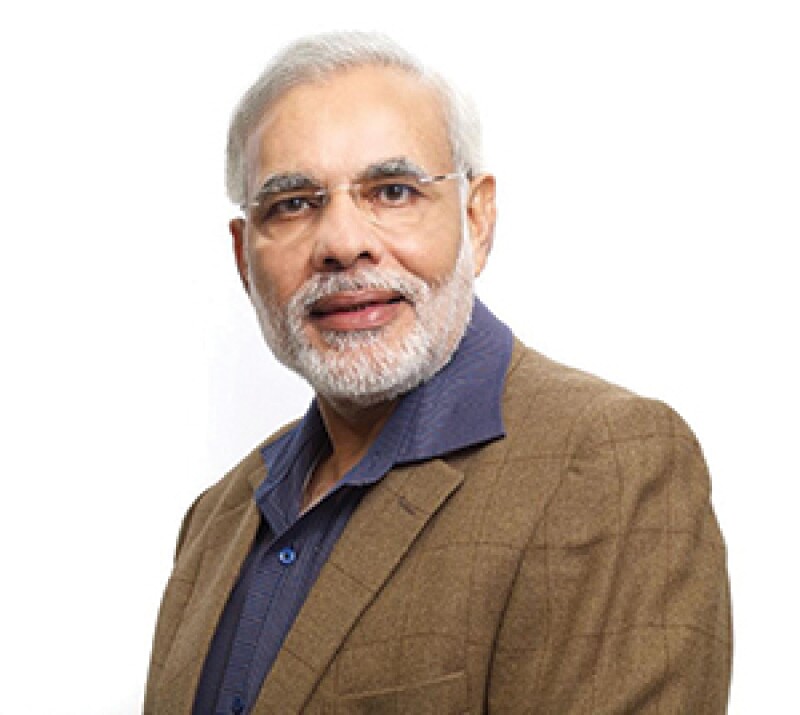

Narendra Modi was also in the Global Tax 50 2016 |

Indian Prime Minister Narendra Modi has accomplished a huge amount since he came to power in 2014 promising to boost foreign investment, simplify the tax code and cut down on bureaucracy.

Modi and Minister of Finance and Corporate Affairs Arun Jaitley (see page 41), were the twin catalysts behind the goods and sales tax (GST) – a transformational regime which was rolled out in July this year after 17 years of discussions. The new regime got rid of state-wide levies and made India a single market. The GST is not only expected to improve India's reputation in terms of ease of doing business, but also boost foreign investment and tempt multinationals to move their operations to the subcontinent.

However, the GST has also meant a lot of disruption for businesses, which have had little time to prepare for the comprehensive regime. The GST is being blamed for India losing its standing as the world's fastest-growing economy, but Modi's government insists this is only temporary while businesses get acclimatised to the new regime.

India has long been known as one of the most difficult places in the world to do business, in large part due to its dated and complicated tax system. However, the prime minister got a boost in late October when India jumped 30 places to 100th – hardly an impressive ranking, but still a big improvement – in the World Bank's ease of doing business rankings. According to the rankings, India is among 10 countries that have seen big improvements related to ease of doing business.

At the same time, contributions to tax collection from direct taxes have fallen to a decade-low, which could mean Modi might start fulfilling his promises to overhaul India's direct tax laws.

It isn't the first time India has tried to simplify the tax code. The Income Tax Act, which dates back to 1961, has seen many amendments that have made things increasingly complicated for taxpayers. However, after seeing how quickly Modi managed to turned the GST around, many believe changes to the tax code will come in early 2018.

The prime minister wants to ensure paying taxes becomes as easy as possible. Taxpayers should no longer have to submit several tax returns, and dispute processes should be modernised and sped up. In October, he urged tax officials to focus on resolving disputes with the use of technology, as around $153 billion in direct taxes is believed to be tied up in litigation.

India's Central Board of Direct Taxes is also running an advance pricing agreement (APA) programme, which has provided security for nearly 200 multinationals so far and is expected to reduce disputes.

In addition, an income tax app has been launched as part of Modi's plans to provide better services for taxpayers. The app includes features such as a live chat and important tax updates, and the government hopes it will improve communication between the income tax department and taxpayers.

India still has a long way to go before its tax code is as simple as businesses would like it to be, but is on the right track in this respect under Modi.

The Global Tax 50 2017 |

|

|---|---|

The top 10 • Ranked in order of influence |

|

6. Arun Jaitley |

|

The remaining 40 • In alphabetic order |

|

| The Estonian presidency of the Council of the European Union |

|

| International Consortium of Investigative Journalists (ICIJ) |

|

| United Nations Committee of Experts on International Cooperation in Tax Matters |

|