In President Xi Jinping's landmark speech on October 19 2017 to the 19th National Congress of the Communist Party of China, repeated references were made to the primacy of tackling inequality as a policy goal. As such, we had predicted in last year's IIT chapter, This time it's personal: China IIT on the eve of a major revamp, that the reform would be introduced in 2018, with measures to counter the economic trends driving inequality. Sure enough, on June 19 2018, during the third session of the 13th National People's Congress (NPC, i.e. Parliament), the Minister of Finance Liu Kun outlined the proposed IIT amendments to China's IIT rules.

Echoing the objectives mentioned by President Xi previously, Liu delivered two important messages about the IIT reform:

The IIT reform is intended to reduce the tax burden on working people and deepen reform of the income distribution system. This is to be achieved by (i) raising the threshold at which IIT becomes payable, (ii) aggregating income of a similar nature in order to tax it on a consolidated basis, and (iii) introducing additional itemised deductions for taxpayers; and

At the same time, the IIT reform is to revise existing rules that are not consistent with international practices, close loopholes, and protect the integrity of the tax base.

Subsequently, on August 31 2018, the standing committee of the NPC passed an amendment to the IIT Law (IIT amendment), which was promulgated through Presidential Decree No 9, and will take full effect from January 1 2019. In advance of this, revised IIT standard personal deduction and tax rates tables apply from October 1 2018. On October 20 2018, draft implementation guidance was issued for a brief period of consultation. At the time of writing the consultation period has ended but the final implementation guidance had not yet been released.

Key IIT reform changes

With the China IIT reform well underway, it is imperative for individual taxpayers and employers to understand the key changes.

Tax residence rule

The IIT amendment seeks to align China's IIT definitions for residents and non-residents more closely with China's treaties and with practices in other countries. Under the existing IIT Law, a key distinction revolves around a person being a domiciliary or non-domiciliary of China. A non-domiciliary of China is defined as an individual who does not habitually reside in China due to his family and economic ties being maintained outside China. Although at present, broadly speaking, an individual with a foreign passport might consider themselves to be a non-domiciliary for IIT purposes, this might not necessarily be the case. Questions of residence and domicile are likely to come under greater scrutiny as the reforms increase the focus on China's international tax boundaries.

Under the existing IIT rules, a non-domiciliary of China would only be treated as a tax resident of China if he or she spends nearly a full year within China. Specifically, they will be tax resident if they have not been physically away from China for more than 30 continuous days, or 90 cumulative days, within a calendar year. This was complemented with a further provision, set out in tax authority IIT guidance, that foreigners were only exposed to IIT on their worldwide income if they were resident in China for five full consecutive years. As explained further below, taking these rules in combination, maintaining a position of non-tax residence in China, over a long period, was generally workable for non-domiciled persons working in China, and they limited their tax exposures to income derived from China.

Under the altered rules of the IIT amendment, however, an individual who is domiciled in China, or a non-domiciliary of China who resides in China for 183 days or more, is considered a 'resident'. They are therefore liable to IIT on income arising within and from outside China. A non-domiciliary of China who does not reside in China or who resides in China for fewer than 183 days is considered a 'non-resident' and is solely liable to IIT on income derived from within China. The change in the tax residence rule modifies China's personal tax residence rule to a 183-day test from the existing one-year test. In other words, even a foreign passport holder will be considered a China tax resident, as long as he or she is physically in China for 183 days or more in a calendar year.

The amended legislation substantially lowers the hurdle to becoming a tax resident of China, which would expand the group of non-domiciled taxpayers subject to worldwide tax in China. The draft implementation guidance, which moderates these outcomes, was consequently received with a note of relief by many expatriates assigned to China, and foreigners based in, or commuting into China.

The draft guidance preserved the five-year concession and the tax break concept for a single trip out of China of more than 30 days (but not the break of more than 90 days in aggregate). As a consequence, the amended tax residence rule will have a less significant impact on many expatriates. The loss of the tax break for aggregated absences of more than 90 days may still create concerns for non-domiciled individuals who spend more than 183 days in China if they commute, say from Hong Kong into the Greater Bay Area (which includes the agglomeration of mainland cities situated beside Hong Kong, including Shenzhen, Guangzhou and others), with such frequency that they are not absent from China for more than 30 days at any one time. In such cases, the individual will need to turn to the double tax agreement between Hong Kong and mainland China to seek relief from China taxes on income from outside of China.

Consolidated IIT calculation

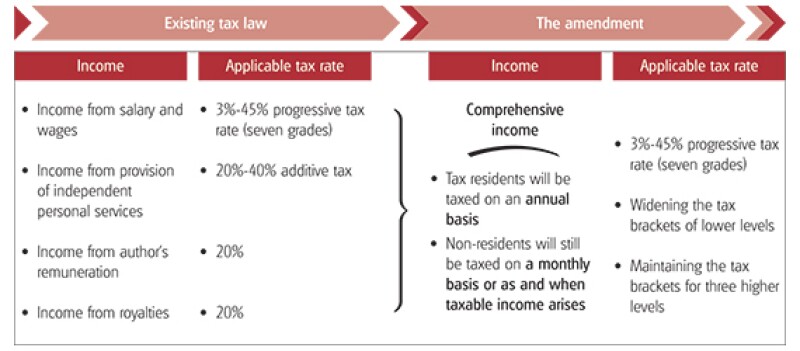

The IIT amendment has grouped four categories of labour income, including income from salary and wages, income from the provision of independent personal services, income from author's remuneration and income from royalties, into the scope of comprehensive income. Comprehensive income is subject to one set of progressive IIT rates; these rates are set out in the section on adjusting income tax brackets below. Figure 1 illustrates the changes from the existing tax law.

At the same time, two previously existing business income categories will be combined. The income from production or business operations, conducted by self-employed persons, and income from contractual or leasing operations for enterprises and institutions, will be reclassified as a new collective category of 'income from operations'.

Figure 1

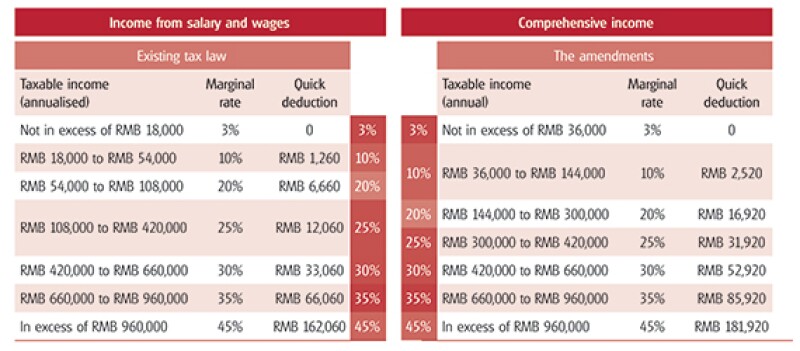

Adjusting income tax brackets

Per the IIT amendment, comprehensive income will be subject to tax on an annual basis, instead of on a monthly basis, as was the case under the old IIT law for its constituent elements. The tax rates for comprehensive income will be based on the existing rates applicable to 'salary and wages'. Separately, it was also indicated that non-residents will still be taxed on their China income on a monthly basis, or on an 'as arises' basis, depending on the nature of the income.

One may wonder: does this mean that tax residents will cease to be subject to monthly tax withholding and filing? The answer is no. Withholding agents will need to use the applicable annual tax rate to calculate the annual tax liability and divide it accordingly for monthly withholding and reporting purposes. In addition, withholding agents must furnish tax withholding statements to individual taxpayers in order for them to lodge accurate annual tax reconciliation returns.

At the moment, only if an individual is a tax resident of China and earns RMB 120,000 ($17,400) or more per calendar year are they required to file an annual tax return. However, once the IIT amendment changes are in effect, the annual tax return filing will apply to all individual taxpayers. Also, the filing deadline for the annual tax return has been shifted from March 31 to June 30. That being said, the timeline for the annual tax return filing for income earned in the calendar year 2018 remains as March 31 2019.

Figure 2 illustrates the change in tax brackets from the existing tax law.

Figure 2

In addition to the changes to tax brackets, for income from the provision of independent personal services, income from author's remuneration and income from royalties, a deemed expense (i.e. fixed deduction) of RMB 800 or 20% of gross income, whichever is higher, will be allowed. The actual expenses incurred cannot be taken into consideration in the IIT calculation, except for commission expenses incurred in order to perform independent personal services. These can be deducted in addition to the fixed deduction, though they do need to be supported with official receipts. Going further, income tax on author's remuneration will be assessed on 70% of the net income, after deducting the 20% deemed expenses (i.e. 56% of gross receipts).

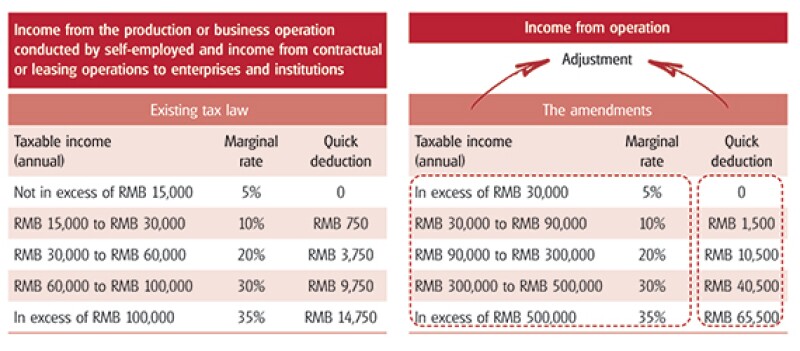

Similarly, the tax rates on income from operations will be set based on the existing tax rates applicable to income from the production or business operation conducted by self-employed persons and income from contractual or leasing operations for enterprises and institutions. Actual costs and expenses are allowed to be deducted in determining the tax base, provided that the business is registered with the appropriate government authorities, and accounting records are properly kept. The tax rates for this category are set out in Figure 3.

Figure 3

Increased personal deductions for comprehensive income

The IIT amendment raises the personal deduction amount for comprehensive income to RMB 5,000 per month (i.e. RMB 60,000 per year; approximately $8,000). For reference, at present the average annual salary in Shanghai and, among China's richest cities, is approximately $17,000. Under the old IIT rules, an individual was entitled to a fixed personal monthly deduction of RMB 3,500. Foreign nationals (including overseas Chinese from Macau, Hong Kong and Taiwan) who are not domiciled in China were previously given an addition fixed personal monthly deduction of RMB 1,300). From the entry into effect of the IIT amendment (i.e. starting October 1 2018), the new personal deduction applies to all, and the step-up in personal deduction for foreign nationals will no longer apply.

Itemised deductions for personal living expenses

New itemised deductions for a range of personal living expenses are being introduced alongside the existing deductible items. This is reflective of the economic transformation which has occurred in China, since the 1980s, with private individuals in China increasingly responsible for covering outlays for education, health, housing for themselves and their families, and for the care of elderly relatives, as well as the increasing cost of meeting these expenses. Figure 4 provides details of the new itemised deductions introduced by the IIT amendment.

The new itemised deductions for personal living expenses will take effect from January 1 2019. They will complement the existing deductions for individual social security contributions (including basic pension and housing fund contributions), commercial health insurance premiums, enterprise annuity and commercial pension insurance contributions (the latter is still being piloted in certain regions). Some of the new itemised deductions are similar in nature to the special fringe benefit exemptions enjoyed by foreign employees and, going forward, the latter may elect to retain the tax-exempt benefits concessions they currently enjoy. In addition, where necessary conditions are met, foreign employees may also claim itemised deductions under the new system. However, they cannot enjoy tax exemptions on fringe benefits, such as children's tuition and housing rental, and simultaneously claim deductions for such expenses under the itemised deduction system.

Figure 4

Click on image to enlarge

IIT anti-avoidance rules

Three anti-avoidance provisions have been introduced to the IIT Law, including a general anti-avoidance rule (GAAR). Anti-avoidance provisions are a feature of many jurisdictions' tax legislation, and China already has a GAAR, as well as other anti-avoidance rules, in its corporate income tax (CIT) law. Furthermore, China has integrated anti-abuse rules into its double tax agreements with 107 jurisdictions. The introduction of IIT anti-avoidance provisions in the IIT amendment signals the determination of the authorities to combat loopholes and deficiencies in existing IIT law and enforcement.

The new rules will empower the tax authorities to adjust tax assessments for individuals who are involved in asset transfers which are not at arm's length (i.e. a form of transfer pricing rules for individuals), in tax avoidance transactions using offshore tax havens (i.e. a form of controlled foreign company rules for individuals), and in arrangements lacking reasonable commercial purposes which lead to inappropriate tax outcomes (i.e. a tax purposes test for artificial tax planning arrangements).

The anti-avoidance provisions introduced as part of the reforms include a GAAR and specific provisions addressing related party transactions and controlled foreign companies. In preparation for implementation, certain terms have been defined, bringing greater focus to issues of control by a taxpayer and a taxpayer's purpose for entering into certain arrangements.

Related-party transactions

Related-party transactions need to be carried out at arm's length. In this context, related parties include a taxpayer's spouse, siblings and direct blood relatives (immediate family), but also entities for which the individual has direct or indirect control over matters such as the flow of capital, operations, or sales and purchases. There is also provision for other economic ties to trigger a related-party relationship, so potentially extending to financial dependents or people acting together in an economic context.

Controlled foreign companies

A controlled foreign company (CFC) is defined as:

A foreign company that is owned by one or more China tax residents (individuals or entities) directly or indirectly, through holdings of at least 50% of the company's shares (including at least 10% of the shares which carry voting rights); or

Effectively controlled by one or more China tax residents by virtue of share ownership, capital, business operations, or authority over purchase and sales related matters.

Having an effective tax rate of less than 50% of the rate under China's CIT law; and

Income of the CFC is not distributed back to China, and there are no reasonable operational needs for retaining it in the company.

Income of a CFC may be attributed to the China tax resident shareholders.

GAAR

The GAAR allows the tax authorities to adjust the tax assessed where an individual enters into an arrangement lacking reasonable commercial purposes, leading to inappropriate tax outcomes. The implementation guidance indicates that an arrangement will be considered to lack the necessary "reasonable commercial purposes" if the main purpose is to reduce, exempt or defer the payment of taxes. This essentially replicates the wording of the GAAR under the CIT law.

Implications of the IIT reform

In this section, we will examine the IIT reform impact on various groups of individuals in China. These are categorised as the low to middle income working people, foreign/expatriate employees and high-net-worth individuals.

Low to middle income working people

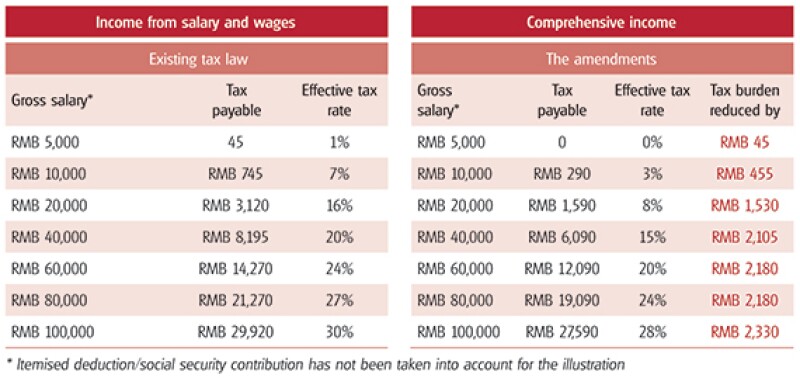

This group of individuals will benefit most from the China IIT reform, in line with the overall policy objectives of the reform to improve income equality outcomes from Chinese economic development. It is estimated by the government that they will be able to enjoy from 10% to 100% reductions in IIT burdens as a result, once the changes are fully implemented. See the illustration in Figure 5 on a 'per month' comparison of IIT on comprehensive income before and after the reform.

Figure 5

For reference, the average monthly wages in Beijing and Shanghai in 2018 are approximately RMB 10,000 per month; these being among the highest average salary levels in China. Workers on the average Beijing wage would see their tax burden fall from 7% to 3% as a result of the reform.

Despite this good news for working people, many challenges still lie ahead to determine the effectiveness in practice of the various IIT amendment changes intended to reduce their tax burdens. For example, if the processes to claim the newly introduced itemised deductions are too complicated or tedious, many low to middle income people may struggle to fulfil the requirements. As such, they may not be able to fully enjoy the intended IIT reductions. In view of this, the tax authorities will likely depend on employers to assist in administering the deductions accurately and efficiently.

Another issue arises for the many working people who perform independent services for a living (e.g. taxi drivers, couriers, and plumbers). These are subject to tax under the IIT category of 'provision of independent personal services', which, as noted above, will become an element of 'comprehensive income' going forward. While the tax rates applicable to them have been lowered, practical issues concerning expense deductions have not yet been addressed.

At the moment, such taxpayers are allowed a fixed 20% deduction from their gross income. In many situations, such as for Didi Chuxing taxi drivers (a popular ride-sharing platform), this is not a good reflection of the expenses they have to incur in providing the services. Consequently, the effective tax rate on their actual income would be very high.

If they were to look to be taxed under the 'income from operations' category, this would demand that they fully account for all expenses incurred, and substantiate these with official tax receipts (fapiao). This would go beyond the capability of many such workers.

It may come as no surprise then that this impacts the compliance levels for such workers, as they have to choose between high effective tax rates under the 'comprehensive income' category, or unworkably complex tax compliance burdens taxed under 'income from operations'. This is a key 'work in progress' area for the Chinese tax administration, going forward, and one could imagine that technology (e.g. mobile scanning of invoices for upload to tax authority websites, mobile-based automatic IIT calculation software linked to tax authority systems, and blockchain-based digital tax invoice administration) may have a key role to play here.

Foreign/expatriate employees

Despite the initial concerned reaction to the law enacting the IIT reform, the subsequent release of the implementation rules has significantly reduced the concerns of foreign individuals and their employers, and helps to position China competitively to continue to attract and retain foreign talents.

Retention of the five-year rule

At the moment, expatriate employees are only exposed to China tax on worldwide income if they are resident in China for five full years in succession. However, in practice, even where foreign workers remain longer than five years in China, a consecutive five-year presence is commonly broken by a period of absence from China – known as a 'tax break'. This allows the expatriate to avoid liability to China IIT on his or her worldwide income. It requires the expatriate to be out of China for an aggregate of 91 days or more during a year, or for a single period of at least 31 days. This needs to be done before the expatriate 'crosses the line' of completing five full years of tax residence in China.

Given the change to the residence rule under the IIT amendment, initially many predicted that this 'five-year rule' would be abolished. However, to the relief of many foreign employees, it has been confirmed in the implementation guidance that the five-year rule will be retained. Although residence will be triggered based on 183 days, a single break in excess of 30 days within five years will continue to create a 'tax break' for determining whether an individual becomes taxable on worldwide income.

Nevertheless, as the five-year concession does not apply to a China domiciliary, we anticipate that 'domicile' may come under greater scrutiny going forward. This is supported by the fact that the implementation guidance provides that eligibility for the concession needs to be validated through a "put-on-record" filing. This may also cause those employed under dual contract arrangements and frequent business travellers to attract greater scrutiny.

Retention of tax-exempt benefits

Some of the new itemised deduction items (e.g. children's tuition and housing rentals) are the same as the fringe benefits provided to foreign employees (who are currently exempted from China IIT on the relevant portions of their income used for such outlays). While some commentators had predicted that the tax-exempt benefits concession would be abolished, the implementation guidance confirms that the tax-free allowances for foreigners will be retained. This mitigates the impact of the China IIT law's high marginal tax rates (at relatively low income brackets) and helps to keep China competitive in the global talent marketplace.

IIT anti-avoidance

The introduction of the IIT GAAR reinforces the trend, very apparent in 2017 and 2018, whereby the Chinese tax authorities significantly increased the frequency of IIT tax audits. The IIT filings of foreign workers in China have been particularly in the spotlight. There is a recent tax audit case, publicised by the national tax authorities, of an expatriate who is the chief representative of a renowned foreign law firm in Beijing. The remuneration he reported to the China tax authorities was significantly lower than his peers in the legal industry, and indeed lower than the local lawyers working under him.

The inconsistency in the reporting of income drew the attention of the Beijing Municipal Local Taxation Bureau during the inspection process. The bureau undertook extensive audit procedures such as collecting and comparing multiple sources of data and found out that the expatriate received payments outside of China for the management work he performed in China; these amounts were not reported. The tax authority then imposed a heavy fine for the under-reporting of income in China – the total tax underpaid plus fines totalled more than RMB 10 million. This shows that if an expatriate taxpayer's income declaration is unreasonably low, the authorities are much more likely, than was previously the case, to perform audit checks to verify the tax payable amount. The introduction of the IIT GAAR and other anti-avoidance rules brings new tax authority 'tools in the toolbox' into play, in this regard.

High-net-worth individuals

The introduction of the IIT GAAR is highly significant in combination with China's September 2018 commencement of the automatic exchange of financial account information (AEOI) under the OECD-led common reporting standard (CRS). These collectively point towards an increase in the rigour of China IIT enforcement vis-a-vis offshore assets beneficially owned by Chinese tax residents. Looking forward, the tax authorities may more frequently raise queries on how these assets were acquired, for example, whether the source of the funds for acquisition was China, and whether the income or gains, out of which these funds arose, were appropriately taxed if China-sourced. In view of this, China tax residents should review their global investment portfolio deployment and strategy, and historic tax compliance status, in order to manage any risk of being asserted as being non-compliant.

Since it signed up to participation in the CRS system, China has concluded bilateral competent authority agreements (CAAs) with several countries as well as activating bilateral exchange relationships with numerous countries through the Multilateral Competent Authority Agreement on CRS (CRS MCAA); the total number of exchange relationships activated through these channels now covers 87 countries and jurisdictions.

Coupled with the adoption of the latest big data technology to perform data analysis, the China tax authorities are now well equipped to supervise and detect non-compliant cases. Once an individual is being investigated, travel restrictions may be imposed causing much inconvenience.

In this regard, reference is frequently made to the high profile case of the internationally famous actress, Fan Bingbing, who has a level of fame in China equal to Jennifer Lawrence or Angelina Jolie in western countries. In June 2018, the Jiangsu Province State Tax Bureau opened a case against Fan concerning possible tax evasion and the use of so-called 'yin-yang' contracts; one contract presented to the tax authorities declaring income for IIT purposes, and a separate contract not declared. In October, after a three-month period in which Fan made no appearance publicly or on social media, she made a public apology over the Weibo social media platform for her non-tax compliance. She was levied with a $130 million bill for underpaid tax and penalties; penalties accounting for $70 million of this amount.

For high-net-worth individuals (HNWI), and the wealth management industry generally, these tax reforms signal a significant change to the landscape. The introduction of CRS and anti-avoidance provisions bring together in the hands of the tax authorities in China both the tools to challenge past structures and arrangements, and the information with which to aim those tools.

All investment structures and arrangements need to be reconsidered to confirm that they remain compliant after January 1 2019. Wealth management and investment planning will become more bespoke, and less commoditised, as the level of control and the individual's facts, circumstances and motivations all need to be considered in determining the proper outcome from a tax perspective.

As greater attention is drawn to the boundaries of the China tax net, matters such as residence and domicile will receive more attention. This has already been signalled by the introduction of the requirement to obtain tax clearance before a household registration (hukou) can be deregistered – a significant factor for determining domicile for a Chinese national.

Although the tax rules in China will become more challenging, they are simply moving into the space that tax regimes in many countries have already been operating, and this direction of movement is likely to continue.

It might be noted that, subsequent to the merger of the state tax bureaus (STBs) and local tax bureaus (LTBs) in 2018, the tax authority talent pools for IIT enforcement (e.g. the international tax departments at provincial tax bureau level) are merged with the resources used for CIT enforcement (these officials have ample experience with anti-avoidance rules, including TP and GAAR). As noted in the chapter, Seeing the tax trees from the data forest – how does Chinese tax administration manage in the digital age?, a more reasonable approach is increasingly being seen with respect to CIT in the first-tier cities. Many commentators foresee that, conversely, IIT enforcement, particularly vis-a-vis wealthy Chinese nationals, may see a significant uptick in severity in the years ahead. In addition, in parallel with the STB-LTB merger, responsibility for social security collection and enforcement passed to the tax authorities from the social security administration. This means that employers and employees need to watch out for more strict and effective enforcement.

Employers

The IIT amendment issues, outlined above, which face working people and expatriate employees also pose great challenges for the companies employing them. These issues are detailed below.

Additional administrative burden for employers

Under the IIT amendment, where tax resident individuals provide information relevant to itemised deductions to the withholding agents (typically their employers), the withholding agent is required to take these deductions into account in calculating tax withheld. The implementation guidelines introduced subsequently also confirm that employers will have a duty of care in the administration of the itemised deduction claims. If improper claims are discovered in the course of employer internal administration processes, the employer should remind their employees to correct the claims, and must notify the tax authority if the individual concerned refuses to make the corrections. Furthermore, the withholding agent is required to retain the relevant tax documents for tax audit purposes, and they will be notified by the tax authority if the authority discovers improper claims made by the taxpayers.

These requirements put some onus on employers to verify certain claims and track itemised deduction limits. Although the implementation guidance went some way to soften the impact for employers, it is likely that when withholding taxes are reviewed by the authorities, the level of itemised deductions for employees will need to be substantiated. In view of this, the IIT reform has certainly increased the administrative burden placed on companies; previously such burdens were limited to the relatively small number of companies handling such arrangements for their expatriate staff, who would also have typically been relatively few in number.

To handle the data collection and record retention to substantiate the claims for itemised deductions, companies will need to establish policies and procedures, and communicate these to employees. As the volume of claims, data and records could be significant, companies should explore the use of technology-enabled solutions to reduce the excessive workload on HR and payroll departments. An example of such a solution is the newly developed system by KPMG known as 'KTEC'. It seeks to:

Effortlessly collect information on all deductible expenses;

Seamlessly consolidate payroll information;

Enhance internal control and thus minimise compliance risk; and

Ensure timely filing of the monthly IIT return.

Such a tool has to be updated regularly and accurately for any updates to China IIT rules. Once implemented, it will reduce the need to increase manpower cost and increase work satisfaction for HR and payroll professionals.

Need to manage communication with employees

Given the significant changes, all employees (including local hires and expatriates) are bound to have many queries regarding the IIT changes. It is therefore important for companies to provide appropriate training to equip their HR personnel with relevant knowledge of the China IIT reform in order to handle the queries, and manage the expectations of the employees. HR should issue email updates to employees and assure them that appropriate actions will be taken by the company to look after their welfare.

Companies will need to analyse current HR policies, determine how the IIT reform will impact them, and formulate appropriate changes to HR policies and corresponding administrative processes to be compliant with the new system post-IIT reform. Once ready, the new policies and processes need to be clearly documented in the HR handbook and communicated to the employees early in order to educate them on the new processes and requirements. Companies should consider holding training sessions and have an online 'frequently asked questions' section on the new policies and processes relating to the IIT reform.

Looking ahead

The introduction of the IIT amendment is an important milestone in the evolution of China's tax system. As noted above, the changes closely followed the two key objectives, which are to reduce the tax burden on working people and to safeguard the integrity of the national tax base. The effectiveness of the changes will, however, very much depend on the processes rolled out to implement them and supervise compliance. Further regulations and guidelines are expected from the State Council in due course. In coming years, along with updated administrative measures to ensure that working people can fully benefit from the new deductions and enhanced tax treatments, we can expect that the tax authorities across China will be strengthening their tax collection and administration over income from the transfer of properties and equities.

Michelle Zhou |

|

|---|---|

|

Partner, Tax KPMG China 26th Floor, Plaza 66 Tower II 1266 Nanjing West Road Shanghai 200040, China Tel: +86 21 2212 3458 Michelle Zhou leads the KPMG people services practice in the eastern and central China region, and has more than 10 years of experience in assisting multinational clients across a broad spectrum of industries on personal income tax compliance and advisory needs. In particular, she has experience in Australian, Chinese and US expatriation taxation, and has served on accounts of various sizes during her career with KPMG. Over the years, she has undertaken speaking engagements at events held by the American Chamber of Commerce, Australian Chamber of Commerce, Canada Business Council and EU Chamber of Commerce to update their members on the latest regulatory developments and trends in Chinese individual income tax, as well as topics on remuneration packaging, equity based compensation structuring, and others. Michelle has also delivered lectures to students in the finance discipline of Fudan University on expatriation taxation. In recent years, Michelle and her team have successfully assisted clients in the tax and foreign exchange registration of equity-based plans in China since the introduction of the relevant regulations in China. She has also actively participated in various projects relating to the design, implementation and roll-out of employee incentive plans, including equity-based compensation plans. Michelle has a master's degree in commerce (advanced finance) from the University of New South Wales, and is an associate member of the Taxation Institute of Australia. |

Jason Jiang |

|

|---|---|

|

Director, Tax KPMG China 26th Floor, Plaza 66 Tower II 1266 Nanjing West Road Shanghai 200040, China Tel: +86 21 2212 3527 Jason Jiang is a director in the people services team in KPMG Advisory (China). He has more than 15 years' experience in providing individual income tax compliance and advisory services to multinational clients from a wide range of industries with international assignment programmes covering both Chinese inbound and outbound assignees. He has assisted multinational enterprises operating in China with managing their individual income tax compliance processes and is experienced in advising clients on:

Jason is also a regular speaker at KPMG and public seminars and workshops. Jason is a Certified Public Accountant of China and a Certified Tax Agent of China. |

Murray Sarelius |

|

|---|---|

|

Partner, Tax KPMG China 8th Floor, Prince's Building 10 Chater Road, Central, Hong Kong Tel: +852 3927 5671 Murray Sarelius is a partner based in Hong Kong, and head of people services for KPMG China. He has more than 20 years of experience with tax issues impacting individuals and businesses operating internationally. Murray's experience spans the international aspects of both personal and corporate tax planning. He works extensively with businesses that are operating or investing internationally. For international businesses, his focus is on helping them to manage the expatriate and employer tax issues associated with an internationally mobile workforce, including executive remuneration, employee share schemes and international tax planning for employment and investment. |

Sheila Zhang |

|

|---|---|

|

Director, Tax KPMG China 8th Floor, KPMG Tower, Oriental Plaza 1 East Chang An Avenue, Beijing Tel: +86 (10) 8508 7507 Sheila Zhang joined KPMG in Beijing in December 1993. She has extensive experience in tax compliance and tax advisory in China. Sheila specialises in assisting multinational clients with planning remuneration packages for their expatriate employees working in China. She has extensive knowledge of personal tax policies, tax planning and tax negotiations in China. Sheila is most familiar with GMS practice and operation in China. She has been providing GMS services to many multinational companies. In addition, Sheila has been providing social security compliance and advisory, foreign exchange and immigration services. Sheila is a member of the China Institute of Certified Accountants and China Institute of Registered Tax Agents. |