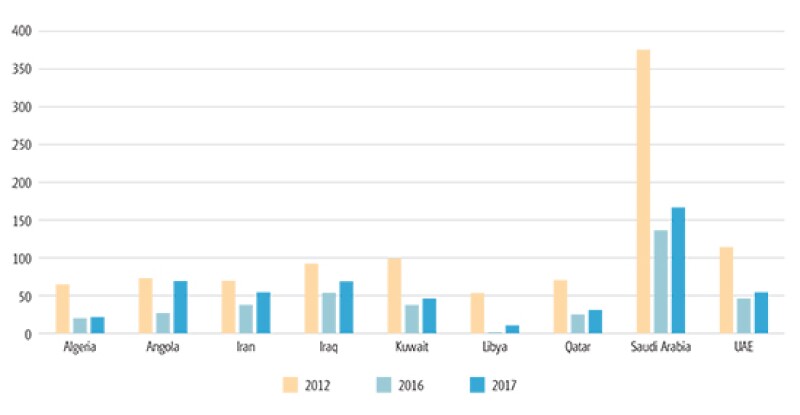

The Middle East's oil and gas (O&G) sector represents the governments' primary source of revenue. As a result of the recent fall in global oil prices, the revenues of OPEC states have fallen by $450 billion, or 60%, from a high of $1.2 trillion in 2012 to $782 billion in 2016. This has led to budget constraints in the Middle East, with governments likely to turn to tax revenues to make up for the shortfall in O&G revenue (see Figure 1).

A number of tax authorities in the region have introduced transfer pricing (TP) regulations in recent months. For example, in October and December 2018, Qatar and the Kingdom of Saudi Arabia (KSA) respectively introduced a number of TP regulations, while others are likely to follow suit in 2019 and 2020. This is a critical time for businesses operating in the region, which should subsequently expect an increase in tax audits going forward.

Revenue in OPEC countries 2012 v 2016 v 2017

The transfer pricing environment

Transfer pricing regulations have been in place in Europe and the US for more than 50 years, and the Middle East and North Africa (MENA) territories have some catching up to do, even though many tax authorities have committed to introducing TP regulations. Since the OECD's publications of the BEPS Action Plan in 2013, the majority of jurisdictions have amended or enhanced their TP rules. A significant number of jurisdictions in the Middle East have adopted, or are soon to adopt, TP regulations.

Oman, Qatar, Bahrain, and the United Arab Emirates (UAE) have all signed the BEPS Inclusive Framework (IF), committing to implementing the four minimum standards, which includes Action 13 (TP documentation and country-by-country reporting, or CbCR). Members of the IF have committed to implement four minimum standards of the BEPS initiative, which in addition to Action 13 include Actions 5, 6 and 14, relating to harmful tax practices, treaty abuses and dispute resolution, respectively.

Other IF signatories for the Middle East include Egypt and Saudi Arabia. Meanwhile, Tunisia and Kuwait have signed the Multilateral Convention (MC), and Lebanon has expressed an interest to do so. While formal TP regulations have yet to be introduced, Kuwait has enacted the arm's-length concept into local law, including deemed profit margins for specific types of transaction. Signing the MC (to implement tax treaty-related measures to prevent base erosion through profit shifting) signals a commitment to be in line with broader international tax developments. There were a number of significant TP changes in the region in 2018, which are discussed below.

Qatar

Qatar introduced CbCR rules in September 2018. Before their introduction, TP obligations were relevant only to companies subject to the Qatar Financial Center (QFC) regime. There have been some instances in which non-QFC companies have been challenged on the arm's-length nature of their intragroup transactions. However, the introduction of CbCR rules marked the first time that all Qatari companies (above the specified threshold) would be required to focus on TP reporting.

Egypt

In October 2018, Egypt updated its TP guidelines (which have been in place since 2010) to provide additional guidance. The updated guidelines now total 126 pages and contain thorough guidance on topics such as the burden of proof and the frequency with which documentation must be updated. The guidelines were mostly in line with OECD standards, and the new level of detail has been helpful to businesses in addressing compliance.

One significant clarification in the updated guidelines relates to the establishment of an advance pricing agreement (APA) programme that will assist companies obtain advance certainty and approval of their intragroup arrangements, which may help mitigate double taxation.

The guidance also clarifies the introduction of the three-tiered documentation approach in Action 13, which includes the master file, the local file and the CbC report. One important observation is that Egyptian-parented groups will be required to file a CbC report if they exceed the threshold of EGR 3 billion ($170 million) in consolidated revenue. This is much lower than the OECD-recommended threshold of €750 million ($845 million), which is something that Egyptian groups will need to take into consideration.

Saudi Arabia

In December 2018, KSA announced detailed TP regulations, which will apply to KSA companies subject to corporate income tax (CIT) from 2018. The rules were finalised on February 15 2019.

The KSA rules require compliance with the three-tiered documentation requirement of Action 13, and KSA companies will have to produce a master file, local file, and file a CbC report. The local file is expected to contain additional information to the OECD's recommendations, such as industry analysis.

The proposed rules required KSA companies to provide the local file to the tax authority within seven days of a request. However, the final rules provide 30 days for taxpayers to provide the local file upon request.

In addition to this documentation requirement, KSA companies will have to prepare and produce a TP disclosure form, due to be submitted for 2018 by April 30 2019, along with tax returns, which will provide detailed information on the companies' controlled transactions and TP policy.

On a more positive note, the KSA TP rules are consistent with the OECD TP guidelines (even though they are not explicitly referenced in the regulations). The final bylaws provide an updated definition of effective control under Article 1 in certain cases. With respect of outstanding loans, guarantees and overall value of business activities, the determination of whether an effective control relationship exists should be made using the year-end balances of the aforementioned transactions.

New jurisdictions to follow

A number of MENA countries have signed the IF and must now act on that commitment. It is difficult to estimate when the new rules will be announced or become effective, but taxpayers should be aware that this region is fast to action when necessary.

For example, in the KSA, the draft TP rules were announced in December 2018, and will be effective for the 2018 financial year, having been finalised in February 2019. KSA is the largest economy in the region, so it may be only a matter of months before another country announces the introduction of TP rules.

The UAE and Bahrain may introduce a form of CbCR in 2019, while Oman may issue some form of TP regulations.

Jurisdictions that may not reform

Other countries may decide to monitor the effect of new TP rules in the region, but not take any action themselves. Countries such as Iran, Iraq, Jordan, Libya, Kuwait, the Palestinian Territories and Yemen have not introduced (or expressed any desire in introducing) TP rules in the near future.

As a result, we do not foresee any abrupt challenges from the tax authorities regarding the arm's-length principle or TP. Nevertheless, taxpayers should remain aware that even operations within these countries could find themselves indirectly subject to MENA TP rules if the counterparty to a transaction is located in a country that has enacted a TP regime.

The TP outlook for MENA

The introduction of TP legislation is of particular interest to O&G multinationals because of the complexity of intragroup transactions and the tax rate differentials created by specific tax legislation.

For example, O&G multinationals must often take into account regulatory issues such as pricing restrictions on commodity products (which may influence TP considerations within a specific jurisdiction and create potential double taxation issues).

The correlation between the introduction, revision and enforcement of TP rules and regulations in MENA countries, and the expanding operations of O&G multinationals, means that TP will continue to grow in importance to the O&G industry in the Middle East.

O&G multinationals operating in the region face the challenge of divergent approaches to TP, which has made it essential for those companies to assess their TP risks and develop strategies to mitigate those risks on a priority basis.

To tackle these challenges, O&G multinationals are advised to assess their group's intragroup transactions and to adopt efficient global documentation strategies that can be tailored to meet local requirements in higher-risk, more complex countries, and devise dispute resolution plans. This should form a key part of risk management, given that the consequences of not doing so effectively can lead to cash tax outflow, penalties and even reputational risks.

By incorporating TP into risk management and business planning, O&G multinationals can maintain a well-managed tax profile with surprises kept to a minimum, thereby enhancing shareholder value and reducing risks.

© 2019. For information, contact Deloitte Touche Tohmatsu Limited.This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited, its member firms or their related entities (collectively, the "Deloitte network") is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No entity in the Deloitte network shall be responsible for any loss whatsoever sustained by any person who relies on this communication.

Shiv Mahalingham |

|

|---|---|

|

Partner Deloitte UAE Tel: +971 45064700 Shiv Mahalingham is a Deloitte UAE partner based in Dubai, where he heads the transfer pricing practice of the Middle East region. Shiv has over 20 years of experience as a TP professional, with 12 years as a partner. He has built a strong reputation for the provision of measured and practical TP advice across all industries and locations. He has concluded design projects, dispute resolutions and negotiated advance pricing agreements (APAs) in a multitude of jurisdictions for Global 1000 companies, private equity houses and hedge funds. Shiv meets with tax authorities on a regular basis to consult on TP issues and the introduction of new/revised regulations. Shiv brings a mix of academic skills, having studied economics and then taxation law before qualifying as a chartered accountant and a chartered tax advisor. He is a regular speaker at international TP conferences and has published hundreds of articles in international journals. Shiv has been listed in Euromoney's (Legal Media Group) guide to the world's leading TP advisers, and is ranked by clients and peers in the "Best of the Best" Guide – one of the top 30 TP advisors worldwide. |

Alena Kovalova |

|

|---|---|

|

Senior manager Deloitte UAE Alena Kovalova is senior manager with Deloitte UAE's transfer pricing and international tax practice in the Middle East. Alena advises clients on international tax planning and TP, with a particular focus on international tax planning, M&A and private equity transactions, corporate reorganisations and planning and design of TP policies. She is experienced in advising clients on cross-border acquisitions, business restructurings, financings, tax treaty matters, deferral and foreign tax credit issues, TP, and withholding tax issues. Alena has experience working with a wide range of clients, from start-ups to supermajors. She is ACCA and CTA qualified. |

Claire Boushell |

|

|---|---|

|

Senior associate Deloitte UAE T: +971 4 506 4700 Claire Boushell is a senior associate with Deloitte UAE and a member of the Dubai transfer pricing team. Before joining Deloitte, she was a member of the TP audit branch in the large cases division in the Office of the Revenue Commissioners in Ireland (Irish tax authority). Claire has over three years' experience with TP interventions by a tax authority, with particular emphasis on TP policies, documentation, restructurings and cross-border transactions. She has TP experience across a wide range of industries, including food and beverages, multiples and retail, manufacturing, pharmaceuticals, financial services and information, communications and technology. Prior to her time at Revenue, Claire was a member of the financial services corporate tax team of another Big Four in Ireland. She holds a bachelor of arts degree in economics from University College Dublin. |