During the history of the Brazilian real (BRL), which has been the official currency since July 1 1994, there have been only two other occasions where the exchange rate to the US dollar (USD) exceeded 3.50 reals to the dollar. The first was during the presidential election of 2002, when investors were unaware of the economic policy to be implemented by the front runner candidate; and the second was during the former president's impeachment process, between August 2015 and May 2016.

Such exceptional influence on the exchange rate variation may be attributed not only to the political instability that the country is facing because of the upcoming presidential election, but also to the reduction of the Brazilian official interest rate (SELIC), the austerity measures applied by the Brazilian government, and the tariff increase by the US on imports.

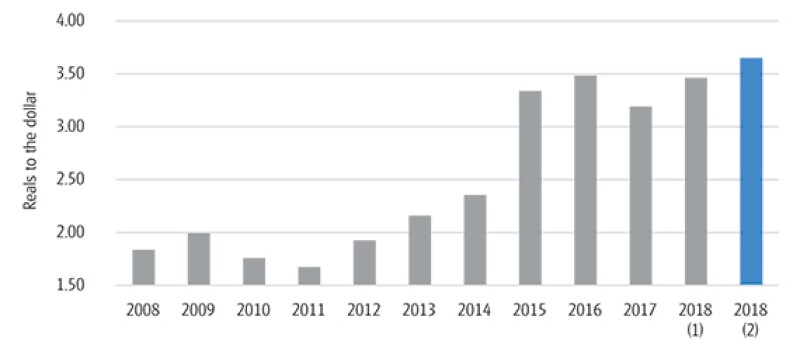

Figure 1 shows that the yearly average exchange rates of the BRL to the USD, since the impeachment process, have not been subject to substantial fluctuation, and thus, have not represented a special challenge for Brazilian importers. The main issue will be calendar year 2018 projections if the existing level of exchange rate remains similar until the end of the calendar year.

If the actual average exchange rate at the end of 2018 follows (or worse, surpasses) the existing projection of approximately 3.65 (see (2) in the table below), we are about to witness the highest annual average exchange rate of BRL to USD since the inception of the BRL currency.

In addition to the above analysis, the recent Brazilian Central Bank FOCUS market report estimates that the BRL to USD exchange rate by the end of calendar year 2018 will be 3.70, a substantial increase in comparison to the December 2017 rate of 3.40. According to this recent report, even with a steady decrease in the existing rate in the Central Bank's projection, the 2018 calendar year will present an average yearly rate of 3.61.

With this outlook, Brazilian importers may face a challenge not forecasted in their budgets for the previous quarters of the year. Although taxpayers will be able to pass on the additional import costs to the sale prices, importers will still realise a reduction in gross profitability for calendar year 2018.

Taxpayers domiciled in countries that adopt rules based on the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (OECD Guidelines) are required to make an economic analysis to evaluate their intercompany transactions, which allows these taxpayers to address exchange rate variations that could influence their results. However, Brazil does not follow OECD guidelines, and the local TP rules do not provide any formal procedures to adjust exchange rate variations for the most common calculation methods.

The BRL devaluation imposes an increase of acquisition costs for importers, as well as an increase in exporters' revenue. Since this second consequence will not be an issue for taxpayers, with the exception of those for whom TP documentation is waived based on the materiality of export revenues compared with the total revenue recognised in the calendar year – the so-called representativeness safe harbour – the focus of this article will be the import transactions.

Brazilian TP legislation prescribes four methods to determine the maximum deductible amount for imports from related parties or from entities located in favourable tax jurisdictions, which may result in adjustments to the taxable base. Local rules require a product-by-product analysis, per type of imported goods, service or right, and that the taxpayer may select the alternative that results in the lowest tax burden. The methods are:

The resale minus profit method (PRL): this involves determining the deductibility limit based on local gross profitability, calculated based on the average of the resale price for goods, services or rights, diminished from unconditional discounts, taxes and contributions levied on the sales, commission and brokerage fees paid, and a fixed profit margin defined by law in accordance with the economic sector in which the imported goods, services, or rights were applied (see Figure 2).

The comparable independent prices method (PIC): this entails determining local deductibility based on market prices, considering the weighted average of uncontrolled prices of similar goods, services, or rights as calculated in the Brazilian market or in other countries, in purchases or sales carried out under similar market circumstances;

The cost plus profit method (CPL): this involves defining the limit for deductibility based on the foreign supplier or provider's gross profitability, calculated over the weighted-average production costs of equivalent or similar goods, services, or rights in the country of origin; increased by taxes and duties imposed on exports by the referred country; and by a gross profit margin of 20% computed on the identified cost base; and

The quotation import price method (PCI): this is applicable exclusively to traded commodities and considers the daily rates as the basis for determining the deductibility limit.

Figure 1: Average yearly exchange rate BRL to USD

Daily exchange rate source – Brazilian Central Bank (www.bcb.gov.br)

(1) Existing average exchange rate; and

(2) Projection average exchange rate, assuming recent rate at the same level until the end of calendar year 2018.

Figure 2: The resale minus profit method |

|

Profit margins |

Economic sector |

40% |

Pharma chemicals and pharmaceuticals products |

Tobacco-related products |

|

Optics, photography, and cinematographic equipment and instruments |

|

Medical and dentistry-related machinery and equipment |

|

Extraction of oil and natural gas |

|

Oil-related products |

|

30% |

Chemical products |

Glass and glass-related products |

|

Cellulose, paper, and paper products |

|

Metallurgy |

|

20% |

All other sectors |

Figure 3: Example of situations with existing and projected average exchange rates for PRL formula |

|||

Situations |

Current average exchange rate |

Projected average exchange rate |

|

(A) Import price (USD) |

$1,000.00 |

$1,000.00 |

|

(B) Exchange rate |

BRL 3.46 |

BRL 3.65 |

|

(C) Import price (BRL) = A × B |

BRL 3,460.00 |

BRL 3,650.00 |

|

(D) Other import costs (1) |

BRL 346.00 |

BRL 365.00 |

|

(E) Acquisition costs (C + D) |

BRL 3,806.00 |

BRL 4,015.00 |

|

(F) Net sale price |

BRL 4,757.50 |

BRL 4,757.50 |

|

(G) Ratio (C/E) |

90.90% |

90.90% |

|

(H) Ratio of net sale price (F × G) |

BRL 4,325.00 |

BRL 4,325.00 |

|

(I) Profit margin (20%) |

BRL 865.00 |

BRL 865.00 |

|

(J) Deductibility limit (H - I) |

BRL 3,460.00 |

BRL 3,460.00 |

|

(K) Adjustment (C - J) |

BRL 0,00 |

BRL 190.00 |

|

(L) Result (F - E) |

BRL 951.50 |

BRL 742.50 |

|

(M) Taxable result (L + K) |

BRL 951.50 |

BRL 932.50 |

|

(N) Income tax (M × 34%) |

BRL 323.51 |

BRL 317.05 |

|

(1) Other import costs, such as import tax, international freight and insurance and customs clearance costs estimated at 10% of the import price, given its influence in such costs. |

|||

Once all the information required for applying the PRL method is within the Brazilian entity, which makes it easier for local tax authorities to gather and analyse it, this is the most commonly applied method in Brazil for evaluating import transactions. Unfortunately, this is the only import method that does not provide rules for adjusting foreign exchange rate variations, which can substantially impact the taxpayer's results in case of BRL devaluation. The PRL formula considers as variables the resale price in BRL and the import price in foreign currency, consequently, increases in the exchange rate directly influence the outcome.

To demonstrate this, the example in Figure 3 compares situations with existing and projected average exchange rates, for a product with a resale price determined in order to secure a PRL statutory gross profit margin of 20%:

The situations in Figure 3 demonstrate the impact on the taxpayer result and income tax amounts considering the foreign exchange rate variation and the absence of rules to adjust the PRL TP adjustments.

Since the Brazilian legislation allows the taxpayer to apply different methods for the same products and choose the result with the lowest tax impact, the PIC and CPL methods are alternatives to be considered. However, these methods require the availability of the mandatory information and impose on the taxpayer the burden of being prepared to support eventual tax authority inspections. Other alternatives to avoid PRL adjustments include import price management with negotiation with foreign suppliers, or the possibility of a true up to avoid double taxation.

For each alternative there is a demand: true ups must be issued and paid within the calendar year; price negotiation demands time for inventory to impact on cost; and PIC or CPL requires obtaining information from foreign entities, which could be time consuming.

Therefore, the best approach for taxpayers to avoid unnecessary adjustments from import transactions in view of an unfavourable exchange rate is to anticipate the TP analysis with preliminary calculations during the 2018 calendar year, and carefully evaluate which strategy better suits their needs.

Daniel Macedo |

|

|---|---|

|

Director – transfer pricing Deloitte Touche Tohmatsu Av. Dr. Chucri Zaidan 1240 Golden Tower – 11º andar São Paulo, 04709-111 Tel: +55 11 5186-1643 Fax: +55 11 5181-3693; +55 11 5181-2911 Daniel Macedo is a director based in Sao Paulo with more than 13 years of experience. He actively participates in the application of Brazilian transfer pricing (TP) legislation, focusing on the determination of comparable prices, evaluation of imports and exports among related companies, price management and analysis of the tax and financial impacts of this legislation. Having worked at Deloitte since 2002, he has extensive experience in advising local and international clients on import and export operations, loans among related parties, services agreements and pricing policies. The main projects in which he is involved include providing tax consulting services, TP studies, calculation reviews, TP planning, technical solutions for presenting information to tax authorities, inspection attendance, development of calculation procedures and international TP policies. He assists international clients in the pre-operational stage, in order to determine the best approach for transactions in Brazil with regard to the local TP legislation. He has assisted in the development of the Deloitte calculation software in Brazil for complying with TP legislation, and in the process of controlling and administering TP with related parties, as well as with regard to the related tax and financial effects. He has presented seminars on Brazilian TP legislation for local clients, chambers of commerce and industrial associations. He has also assisted with the development and implementation of TP policies for multinational groups in Brazil. In 2012, he was transferred to the Calgary, Canada office to work with TP projects using the OECD approach, matching Brazilian and international rules. He holds a bachelor's degree in international relations from the Pontificia Universidade Catolica – PUC SP (2002). He speaks Portuguese (native), English and Spanish. |