The introduction of new transfer pricing (TP) regulations by the State Administration of Taxation (SAT), through a series of public notice announcements in 2016 and 2017, brought about an overhaul of the Chinese TP regime. It is now a more rigorous and comprehensive framework for regulating TP arrangements of multinational enterprises (MNEs) in China, both for inbound and outbound activity. In particular, the SAT rolled out the following regulations:

Announcement 42 on the enhancement of the reporting of related-party transactions and administration of contemporaneous documentation, issued in July 2016;

Announcement 64 on the administration of advance pricing arrangements, issued in October 2016; and

Announcement 6 on special tax investigations, adjustments and mutual agreement procedures, issued in March 2017.

These regulations adopt many of the recommendations from the G20/OECD BEPS project, but at the same time codify and reinforce many of the TP concepts that have been used for some time by the Chinese authorities in enforcement cases, and asserted to reflect unique features of the China business environment. The details of these Announcements were discussed in the 2016 and 2017 China Looking Ahead articles.

Following the legislative overhaul, the SAT swiftly trained its focus on ensuring that MNEs complied with the updated Chinese TP regime. The most noteworthy development on this front is the recent introduction of a profit monitoring mechanism covering large MNEs and taxpayers with complex intercompany transactions. This mechanism taps into big data analysis to carry out risk assessments so that more targeted administrative action can be taken. With the increased focus on compliance, the SAT and the local tax authorities are driving good governance among the MNE taxpayers with regards to TP arrangements and related disclosures. The goal of the profit monitoring mechanism is to create harmonious relationships with MNE taxpayers using less confrontational approaches to maintain control over tax collection. The tax authorities would likely resort to punitive methods only when engagement with taxpayers breaks down.

In consequence of this new approach, TP investigations have become less of a focus. Nonetheless, the tax authorities continue to prioritise the build-up of resources to tackle ever more complex tax avoidance arrangements. Cross-border service fees and royalty payments remain conspicuous focus points for TP audit in China, especially for those MNE taxpayers considered to be earning super returns from expanding consumption power in the China market, or which have a largely domestic supply chain. The tax authorities are also actively investigating related-party equity transfers in light of the vibrant M&A market. The merger of the local and state tax bureaus at the provincial level and below also provides an opportune moment for the tax authorities to add wide-ranging resources and new tools to tackle tax avoidance.

Hand-in-hand with these changes, China's continuing commitment to the global tax transparency agenda, and the resolution of mutual agreement procedure (MAP) and advance pricing arrangement (APA) cases, remains resolute. To this end, there has been a surge in China's efforts to resolve MAPs with numerous overseas competent authorities. There had previously been much concern that the backlog of MAP cases was affecting the processing of APA applications (MAPs and APAs are dealt with by a common team at the SAT level). These concerns have, to a large extent, been lessened, as many pending APAs are being added to the agenda at competent authority meetings between China and other countries. This demonstrates the SAT's commitment to promoting an open business and a transparent tax regulatory environment for MNEs operating in China, through engagement with its international counterparts.

This article examines each of these developments in turn.

Compliance agenda: Risk profiling and shifting of the audit focus

April 2018 saw the launch of a new profit monitoring mechanism by the Jiangsu Provincial Tax Bureau (JSTB), which will eventually be rolled out nationwide by the SAT. This latest move builds on a similar initiative introduced before the BEPS era, termed the 'transfer pricing comprehensive indicator system'. In comparison to the latter, the latest initiative is more comprehensive, and it is based on a matrix scoring system.

The new mechanism sets out a risk assessment framework that involves extensive qualitative and quantitative information collection. This enables the authorities to gain a high level understanding of the overall operations of the MNE group, perform risk-based testing using the related-party transaction information gathered, and rank MNE taxpayers according to their risk levels. Risk levels are based on the complexity of the intercompany transactions, as well as the taxpayer compliance level with respect to reporting and disclosure of intercompany transactions. The main thrust of the programme is to enhance the oversight of risk and compliance management, aided by big data analysis. Leveraging the JSTB's advanced IT infrastructure, the information collected by the JSTB will be entered into their systems, allowing them to produce various analyses within the tailored risk assessment framework.

Through the monitoring mechanism, selected taxpayers are expected to be constantly monitored and ranked on a risk matrix based on multiple quantitative and qualitative criteria. The authorities would selectively classify companies according to provinces, cities and districts for clearer identification of 'high risk' entities. The aim is to have swifter and more targeted regulatory actions instead of launching enquiries and investigations on all MNE taxpayers engaging in cross-border related-party transactions.

The latest initiative has some similarities with the previously introduced initiative known as the thousand enterprise initiative (TEI). This is discussed in the chapter, Seeing the tax trees from the data forest – how does Chinese tax administration manage in the digital age? The risk assessment conducted within the TEI framework is, however, primarily focused on the general tax administration of the biggest Chinese-based companies, albeit some foreign MNEs were selected as well. The profit monitoring mechanism, on the other hand, is focused more specifically on TP and on the application of anti-tax avoidance rules to inbound-investing MNE taxpayers.

As the pioneer for the roll-out of this initiative, the JSTB organised a couple of seminars in April 2018, attended by approximately 150 MNEs operating in the Jiangsu province, including their tax advisors, to introduce the profit monitoring mechanism. We have already seen the progressive expansion of the mechanism to other provinces in China; some provincial and major municipal tax bureaus have already begun to send out the initial information-gathering forms for MNE taxpayers to complete under the direction of the SAT. For example, the Shenzhen Municipal Tax Bureau (SZTB), in the Guangdong province, and the Sichuan Provincial Tax Bureau (SCTB) are gathering information from China holding companies (CHCs) and the headquarters of inbound and outbound-investing MNEs, with a focus on industry leaders with substantial numbers of cross-border related-party transactions. The tax authorities sent out nearly 70 survey and data collection forms to gather operational, financial and value chain-related data for the period between 2008 and 2017 (i.e. the 10-year statute of limitations period for TP cases). Such extensive industry statistical and financial data is believed to be used by the SAT for the trial-run of its own TP risk management system. It is understood that the provincial system may be integrated with the SAT system in due course.

Extensive information gathering

The risk assessment framework requires extensive tax and TP information gathering. The annual contemporaneous TP documentation (including master file and local file) and the annual tax returns (including the related-party transaction reporting forms), form the main sources of information for the tax authorities. The contemporaneous TP documentation is prepared and kept on file by the taxpayer for review by the authorities in the event of query or audit, or may otherwise be submitted to the tax authorities upon their request. In contrast, the related-party transaction reporting forms are part of the tax returns and are required to be directly filed with the authorities annually. The TP documentation disclosure requirements of Announcement 42 are rigorous and wide-ranging and provide extensive information to the authorities.

However, this is not all. The tax authorities are also able to gather information from other sources, such as through structured and regular cross-government department data exchanges, for example, information from the State Administration of Foreign Exchange (SAFE), and the State Administration of Market Regulation (SAMR). They also obtain data from enterprise group annual financial reports, filed and exchanged country-by-country (CbC) reports, securities analyst reports, general news reports (much of this collected through web crawler tools), and comparability analysis data in the tax authorities' internal databases, among other sources. All information harvested is entered into the tax authorities' IT systems as part of big data analysis processes, classified into various categories such as: MNE taxpayers' basic information, related-party transaction data, functional profile, industry environment, value chain information, compliance willingness evaluation, risk identification, risk response level, and management effectiveness analysis.

Selected MNE taxpayers have reported that they received requests from some provincial tax bureaus to provide data in a certain format (e.g. specific digital formats) that can be readily fed into the tax authorities' system to run the required analyses. The data requests frequently date back to 2008, when the TP regulations came into effect in China. While the majority of the data requests relate to information that can be obtained from the on-file contemporaneous TP documentation, or from the group CbC reports, they often also require MNE taxpayers to supplement this with detailed segmented information. This requires the MNE taxpayers to drill down into their financial reporting systems.

Dual level assessments – tax risk and compliance level

The analyses is churned out from the collected data feed into a multi-dimensional matrix to assess the tax risk and compliance level of the selected MNE taxpayers. The assessment is based on qualitative factors, with a total of 39 core and supplementary criteria, as well as quantitative factors. The latter have a specific focus on potential tax losses measured against available public data (e.g. external comparables), group value chain profit matrices, group segment financial data, and/or internal databases of comparables (e.g. secret comparable data). Announcement 6 reserves the right of the tax authorities to rely on secret comparable data.

The tax risk assessment focuses on overall group tax planning arrangements and intercompany transactions that are deemed complex. Particular attention is given to the risk of tax avoidance, while the compliance assessment focuses on the extent to which the taxpayer has met his/her compliance obligations with the timely and correct disclosure of relevant information. MNE taxpayers that meet many of the core indicators are categorised as high risk (i.e. the core indicators are described in the negative).

One interesting qualitative criterion worth noting is the compliance willingness test. This focuses on:

1) The extent of the group's global tax planning arrangements;

2) The quality of the reporting of related-party transactions;

3) The quality of the contemporaneous TP documentation;

4) The internal control of related-party transactions;

5) The responsiveness of the taxpayers to questions raised by the tax authorities and in providing solutions to the tax issues identified by the authorities; and

6) The willingness of the management of the MNE taxpayers to communicate with the tax authorities, and/or willingness to disclose relevant information regarding the entities' related-party transactions.

Each area is rated on a scale of one to five, whereby five denotes the MNE taxpayers' complete readiness to co-operate. While these tests may appear to be subjective, they are, nonetheless, one of the mainstays of the profit monitoring mechanism. It should be noted that it has not yet been fully determined how this system will relate to the separate taxpayer risk rating systems, which have been under development at SAT and provincial tax authority level, and which are being piloted in the free trade zones (FTZs).

Integral to the risk framework assessment, the Chinese tax authorities are expected to continually focus on the Chinese entities' contribution to the MNE's global value chains and, therefore, the Chinese entities' appropriate share of global profits. Two key elements of the assessment include the following:

The emphasis on the consistency between the functional profiles of the entities along the value chains and the profit attributed to these entities; and

Chinese market factors that contribute to the value creation process throughout the value chain.

To this end, it would not be a surprise for the Chinese tax authorities to request as much data as possible (it could be either through the CbC reports or other additional data requests, for example, information on overseas operations across the value chain) to enable them to comprehensively assess the reasonableness of profits earned by the Chinese entities.

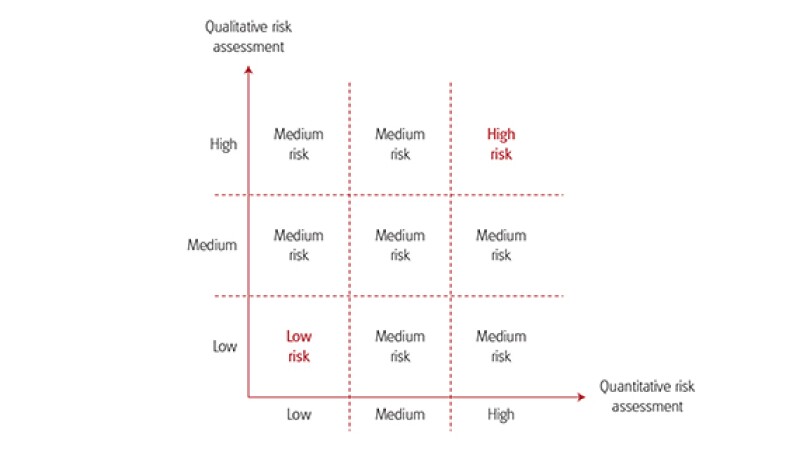

The tax authority risk evaluation is presented in a matrix in Figure 1.

Figure 1

Tiered response from the tax authorities; increase in engagement between taxpayers and the tax authorities

The taxpayer risk assessment results, produced through the risk evaluation matrix, will be subject to different response levels from the tax authorities in line with their response framework. This includes:

Release of generic compliance guidelines to MNE taxpayers on a regular basis;

Proactive communication with MNE taxpayers on the tax authority's position on what they view as 'tax risk points' with the taxpayer's cross-border arrangements;

Issuance of tax risk warnings to MNE taxpayers, particularly for those who are rated as high risk. The warning may summarise the taxpayer's response to highlighted tax issues, and inform the taxpayer which specific tax risks are being treated as high by the tax authorities. The issuance of the warning notices would likely result in taxpayers proactively engaging with the authorities to address the risk issues, and may also result in taxpayers performing TP adjustments voluntarily; and

Taxpayers that did not take any action would remain rated as high risk, under the risk matrix analysis, and may eventually be subject to formal special tax investigations (i.e. tax audit).

We expect that the new monitoring mechanism will lead to more dialogue between taxpayers and the tax authorities, and thereby reduce incidences of tax audit confrontation. The SAT has also made clear in a recent forum with Korean investors that MNE taxpayers which are compliant would receive:

Preferential acceptance into the APA programme;

Assistance to eliminate double taxation to minimise their tax burdens; and

Other tax follow-up assistance.

Compliant taxpayers for this purpose are those rated as low risk, those which proactively reduce risks after receiving warning notices, and those which are cooperative during investigations.

Shift in audit focus

In parallel with the introduction of the compliance programme outlined above, a new trend is emerging, whereby the number of formal TP audits is declining, resulting in a shift of focus in the audits carried out. Statistics from the SAT show that the number of TP assessments dropped in 2017, with 196 cases recorded compared with 254 cases in 2016. The amount of additional taxes collected from TP assessments dropped by more than 40%, from RMB 9.6 billion ($1.4 billion) to RMB 5.3 billion over the corresponding period. The trend may continue as the SAT continues to drive towards creating a more communicative and cooperative compliance environment for MNE taxpayers, relying on compliant MNEs to pay their fair share of tax in line with the specific Chinese market conditions. The reduction in TP audits is a welcome sign of a maturing TP regime.

The trend, however, does not mean the authorities are loosening their grip on TP tax avoidance. As observed in the 2017 China Looking Ahead article, TP in China: all the data in the world, the Chinese tax authorities have, in audit campaigns, placed substantial focus on royalty or service fee transactions and this trend continues. The focus is centred more on taxpayers exploiting the Chinese market (e.g. food and beverage, clothing and other daily consumption goods). In particular, greater scrutiny is applied to taxpayers who pay a large amount of royalties and/or service fees to overseas related parties, despite having a largely domestic supply chain (e.g. buying, making and selling in China).

Such an audit focus is in line with the Chinese view that market access-related benefits, whether in the form of market premium or the contribution by the Chinese entity in promoting the products in China (i.e. the contribution to the market intangibles), should be captured in the taxable profits of the Chinese entity, to reflect the importance of such market features or functions. It has been reported that the SAT has successfully persuaded the competent authorities of a developed country to acknowledge the concept of market premium in a recent MAP case. It is expected that the Chinese tax authorities would have more confidence to play this 'market premium' trump card on the negotiation table in future audit cases and MAP/APA cases.

The emphasis on 'promotion'-based contributions to the value of market intangibles is set out in Announcement 6. Specifically, it provides that when determining the contribution of an enterprise and its related parties to the value creation of intangible assets, and the consequential economic benefits that can be enjoyed, the parties' contribution to the development, enhancement, maintenance, protection, exploitation and promotion (DEMPEP) of the intangible assets will be analysed. Royalty and service fees, which are usually justified by the contribution from overseas related parties to the development of the IP and the provision of the services respectively, are being challenged in audits as disproportional or inappropriate. The critical issue is whether the underlying intangibles or centralised functions are truly as valuable or beneficial in the Chinese market as claimed, especially vis-à-vis strategic market features, such as local purchasing power, and the efforts and responsibilities of the Chinese entity. On the other hand, companies that focus on production for overseas markets, which were primary audit targets for a long time (and which may be more geographically mobile with their operations), are now less often challenged by the Chinese tax authorities.

We are also seeing that the tax authorities are actively investigating related-party equity transfers. The increased interest in the equity transfers of Chinese entities is a natural reaction to the vibrant M&A deal environment witnessed in China as of late. In one recently concluded enforcement case in Zhejiang province (as reported in China Tax News in February 2018), the tax authorities concluded that the equity transfer of a Chinese entity by an overseas entity to a domestic related party was not conducted at arm's length. This was a case where a wholly-owned subsidiary had negative equity due to losses incurred, but owned land and other assets which had appreciated substantially in value. The target was first transferred within the group and then sold to a domestic third-party purchaser. The investigation, however, revealed that the group entered into a sale agreement with the third-party purchaser a few months before the related-party transfer, at a different sale price (the third-party transfer occurred at a higher value). The authorities concluded that the internal transfer did not occur at arm's length, resulting in a tax adjustment of approximately RMB 2 million.

In another equity transfer case reported by the Changchun tax authority in May 2018, the tax authorities insisted on receiving a purchase price allocation valuation report for an equity transfer of a Chinese entity, which was sold together with other group entities. While the tax authorities recognised that the sale by an offshore parent to an overseas third-party purchaser was at arm's length, there should have been a valuation report to allocate the purchase price to each of the entities that were transferred. As the Chinese entity was not able to furnish the relevant documents as requested, this prompted the authorities to conclude that there was an element of tax evasion with respect to the equity transfer of the Chinese entity. The taxpayer was required to pay additional tax due based on the valuation assessment of the tax authorities, including interest.

Increased resources through institutional reform of the state and local tax administrations

In line with central government efforts to increase the efficiency of public service delivery, the State Council recently issued the programme for the institutional reform of the state and local tax administration (reform programme), which merges the local and state tax authorities at provincial level and below. The merger concluded in July 2018. The centralised tax collection system created by the merger is intended to enable the integration of tax collection resources, the aggregation of big data-based tax resources, and the standardisation and centralisation of tax law enforcement and services.

The merger results in larger combined resources at the disposal of the tax authorities. Cities such as Beijing and Shenzhen have already set up new investigation bureaus focusing on special tax investigations with extended headcounts not seen before the merger. Jiangsu province is also rolling out a similar bureau with an estimated headcount of over 100 officers.

Coupled with the roll out of the profit monitoring mechanism discussed above, the additional resources allow more effective enforcement of TP and tax avoidance rules through better organised enforcement action. With the enlarged teams, the authorities are expected to also focus on areas such as individual income tax anti-avoidance (e.g. determination of individual related parties, share transfers between individual related parties, dividend distribution to Chinese nationals overseas, controlled foreign corporations (CFCs) and so on), and other anti-avoidance cases arising from VAT or consumption tax-related disputes.

China's transparency and international cooperation agenda

On the international front, China has been active in driving forward the global tax transparency and international cooperation agendas. It has gradually implemented globally agreed measures, such as the multilateral exchange of CbC reports. The UK, Germany and France were in the first wave of CbC exchange relationships activated by China with other countries, with the OECD notifying the activation of a further 41 in November 2018, for a total of 44 at present. This increases the potential tax exposures of Chinese outbound MNEs in foreign jurisdictions, especially those overseas subsidiaries remaining in a loss position over many years.

China has committed to implementing the G20/OECD BEPS minimum standards. A critical aspect of the Action 14 (dispute resolution) minimum standards is the peer review process, where the effectiveness and efficiency of a jurisdiction's MAP are assessed by its peer jurisdictions. The seventh batch of dispute resolution peer reviews was launched in November 2018 and covers China, among other jurisdictions.

The SAT has increased MAP/APA resources at central level, with a third division set up in 2016 to assist divisions 1 and 2 which primarily handle MAP and APA cases. Previously, SAT resources for these matters were stretched, due to the commitment of relevant personnel to BEPS meetings from 2013 to 2015. With the new organisational structure and resources, the SAT has begun to deal with a large number of MAP cases as a matter of priority. Market intelligence indicates that a number of pending MAP cases have been reactivated with the aim of reaching an expedited solution. On the APA front, it is expected that the enhanced process introduced by the 2016 legislation (i.e. Announcement 64) will contribute to more rapid programme outcomes; this is important as the number of applications continues to increase.

The SAT has shown encouraging progress on the resolution of MAP and APA cases. The SAT's statistics show that there were 14 separate discussions and negotiations in 2017 with competent authorities from eight countries, namely, Japan, South Korea, Australia, New Zealand, the US, Sweden, Denmark, and Germany, involving 35 MAP cases and a further 30 bilateral APA cases. Out of these, 12 MAP cases were resolved and 11 bilateral APAs were reached, eliminating a total double taxation amount of approximately RMB 1.2 billion.

The China APA programme still primarily deals with inbound MNE applicants, and there has been a slow uptake among 'going out' Chinese MNEs. At the same time, the SAT has started to pay attention to tax leakage due to Chinese MNE parents not charging out group service fees or royalty fees to overseas affiliates. In view of this situation, and the expectation that Chinese outbound investment will face more TP challenges by overseas authorities in the future, we anticipate an increase in Chinese MNE demand for APA/MAP to obtain double tax relief and tax certainty.

What lies ahead – ensuring data quality is key

There is a clear trend for the Chinese tax authorities to harness technology and data to manage tax risk and effect targeted enforcement actions at MNE taxpayers. As noted in this and other chapters in this volume, the SAT has made substantial investments in technology, including high capacity IT systems and data warehousing capabilities, to build an effective control system that integrates all industries, tax types, and taxpayers in a single platform.

The extensive information requests presented to MNEs, to feed the profit monitoring mechanism, may prove challenging for MNEs. This will be even more so the case for those with complex multi-faceted supply chains, and for whose IT systems cannot readily satisfy the authorities' requests for data (in this regard it might be noted that China has a 10-year look-back enquiry window for TP adjustments). The tax authorities have increasingly demanding expectations on the quality of the information that should be disclosed to them in the contemporaneous documentation, as well as in relation to subsequent information requests. Taxpayers will need to invest in compliance systems and resources to ensure that, going forward, they can keep pace with these ever-increasing demands, providing quality data that supports taxpayer TP arrangements.

The approach adopted by the Chinese tax authorities through the introduction of their compliance programmes provides an avenue for taxpayers to work collaboratively with them to achieve desired tax outcomes. This can provide the tax authorities with what they perceive as a 'fair share' of tax revenue, through more transparent engagement, while providing taxpayers with improved tax dispute management channels. With greater resources devoted to upgraded, data-driven, desktop audits, field investigations will likely become less frequent, but more incisive.

With the compliance programmes being put in place, MNE taxpayers may be incentivised to engage on a continuing basis with the tax authorities, with positive outcomes from the risk assessment framework putting them in a favourable position to access the MAP and APA programmes, and achieve further certainty in their TP arrangements. Taxpayers should also bear in mind that, in addition to ensuring that value creating activities and substance are aligned, areas such as related-party equity transfers, are now subject to greater scrutiny. Documentation for these needs to be strengthened, as the Chinese tax authorities are expanding their focus and capabilities, with the additional resources now at their disposal.

The authors would like to thank Alfred Wang for his contribution to this chapter.

Cheng Chi |

|

|---|---|

|

Partner, Tax KPMG China 8th Floor, KPMG Tower Oriental Plaza, No. 1 East Chang An Ave., Beijing Tel:+86 (10) 8508 7608 Cheng Chi is a tax partner in KPMG China, based in Shanghai and focused on transfer pricing. Before returning to China in 2004, Cheng started his transfer pricing career in Europe with another leading accounting firm based in Amsterdam. He has led many transfer pricing and tax efficient supply chain projects in Asia and Europe, involving advance pricing arrangement negotiations, cost contribution arrangements, Pan-Asia documentation, controversy resolution, global procurement structuring, and headquarters services recharges for clients in the industrial market, including automobile, chemical, and machinery industries, as well as the consumer market, logistic, communications, electronics and financial services industries. In addition to lecturing at many national and local training events organised by the Chinese tax authorities, Cheng has provided technical advice on a number of recent transfer pricing legislative initiatives in China. He has been recommended as a leading transfer pricing adviser in China by the Euromoney Legal Media Group since 2009 and as a tax controversy leader by International Tax Review. |

Patrick Lu |

|

|---|---|

|

Partner, Tax KPMG China 21st Floor, CTF Finance Centre 6 Zhujiang East Road Guangzhou, China Tel: +86 20 3813 8685 Patrick Lu is a tax partner in KPMG China, based in Southern China. He specialises in transfer pricing and has extensive working experience in mainland China, Hong Kong, Australia and the US. Patrick has been actively assisting companies in transfer pricing risk assessment, documentation, and planning study. He also has experience in corporate funding restructuring, value chain restructuring, transfer pricing due diligence and as advance pricing arrangements (APAs). Patrick's clients include a number of multinational enterprises in a wide range of industries, especially in real estate, consumer market, healthcare, information and communication technology and energy and resource. Patrick is a fellow of the Association of Chartered Certified Accountants and a member of CPA Australia. He holds a bachelor's degree in commerce (first class honours) with the University of Sydney. |

Choon Beng Teoh |

|

|---|---|

|

Senior manager, Tax KPMG China 25th Floor, Building 2 Plaza 66 1266 Nanjing West Road Shanghai 200040, China Tel: +86 21 2212 4527 Choon Beng Teoh is a senior tax manager with the global transfer pricing team of KPMG China based in Shanghai. Choon Beng has experience in multi-jurisdictional planning studies, dispute resolution, value chain analysis and restructuring of operating models, as well as leading and managing global transfer pricing documentation projects. His client portfolio includes top-tier multinational companies across a variety of industries including the pharmaceutical, retail, IT industries. He also occasionally co-authors articles on China related transfer pricing topics for publications. Choon Beng graduated with a law degree from the London School of Economics and is a chartered accountant with the Institute of Chartered Accountants in England and Wales. Prior to joining KPMG China, Choon Beng practiced in another leading accounting firm in London in the area of international tax and transfer pricing. |

Kelly Liao |

|

|---|---|

|

Partner, Tax KPMG China 21 Floor, CTF Finance Center 6 Zhujiang East Road, Zhujiang New Town Guangzhou 510620, China Tel (Shenzhen): +86 (755) 2547 1069 Tel (Guangzhou): +86 (20) 3813 8668 Kelly Liao is a partner in KPMG China, based in Southern China. She started her professional career in 1999 and has extensive working experience in China, Hong Kong and Finland. Kelly became specialised in transfer pricing in 2004. She has been actively assisting multinational enterprises in transfer pricing dispute resolution, value chain planning, rationalising transfer pricing policies, formulating cost recharging policies, applying for advance pricing arrangements and preparing transfer pricing documentation in China. Kelly's clients include a number of multinational enterprises in a wide range of industries, including infrastructure, chemical/oil and gas, consumer goods, retail, electric and electronics, property development, pharmaceuticals, machinery, finance and e-commerce. She is a Chinese Certified Public Accountant, Chinese Certified Tax Agent, Hong Kong Certified Tax Agent and is a member of the Association of Chartered Certified Accountants. |