|

|

Rakesh Dharawat |

Hari Gangadharan |

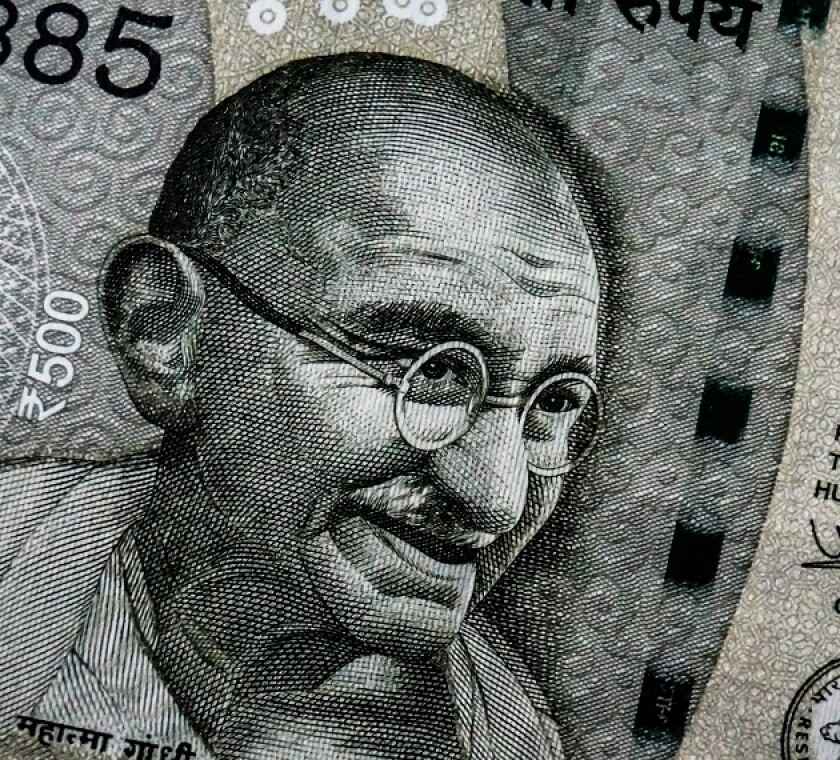

India's annual budget for 2017-18 was announced on February 1 2017. The key tax proposals announced are briefly summarised below.

Corporate tax

The corporate tax rate has been reduced to 25% for companies with a turnover of less than INR 500 million ($7.5 million) in the financial year 2015-16, while the rate for companies with a larger turnover remains at 30%.

Finance Minister Arun Jaitley has also proposed that indirect transfer taxation (i.e. taxation of gains from transfers of foreign company shares deriving value from underlying assets in India) will not be applicable to Category-I or Category-II foreign portfolio investors (FPIs). This exclusion will apply with retrospective effect from financial year 2011-12.

In addition, the concessional withholding tax rate of 5% on interest payments in case of rupee denominated bonds issued to FPIs will now be available for interest payable up to July 1 2020. This was due to expire in 2017. However, the transfer of rupee denominated bonds by one non-resident to another will not trigger capital gains. The benefit of exclusion of rupee appreciation on redemption of rupee denominated bonds has been extended to secondary holders (this was earlier available only to subscribers of such bonds).

Separately, the conversion of preference shares into equity shares will not trigger capital gains tax under the budget proposals. In such cases, the cost of acquisition and the period of holding such equity shares will be the same as that of the original preference shares.

In the case of transferring unquoted equity shares, gains will be calculated based on fair market value (FMV) if the consideration received is lower than the FMV. The manner of determining FMV will be prescribed.

The provisions relating to receipt of specified property without consideration, or for inadequate consideration, have been overhauled. Going forward, any specified property (including immovable property, listed, unlisted shares, etc.), received without adequate consideration by any taxpayer, will be taxed under the head 'income from other sources'. However, business reorganisations and other specified exclusions are carved out from the same.

The time limit for completion of tax assessments (tax audits) by income-tax authorities have been significantly curtailed.

Transfer pricing

The finance minister proposed cutting the scope of domestic transfer pricing provisions in the budget. Going forward, only transactions between two domestic related parties where one of the parties is claiming a profit-linked deduction will be subject to domestic transfer pricing.

Separately, thin capitalisation rules are proposed to be introduced in respect of interest payments exceeding INR 10 million paid to associated enterprises (not applicable to banking and insurance companies). Key aspects include:

Deduction of such interest is restricted to actual interest paid/payable or 30% of EBITDA, whichever is lower;

Excess interest paid will be allowed to be carried forward for eight years; and

Under certain circumstances, loans taken from a third-party lender will be deemed to be from an associated enterprise such as if an associated enterprise provides an implicit/explicit guarantee to the third-party lender.

Finally, taxpayers will be required to carry out secondary adjustments where a primary adjustment to the transfer price has been made in certain circumstances. It is also provided that where a primary adjustment exceeding INR 10 million has been made and funds have not been brought into India, such amounts will be treated as an advance made and interest will be imputed thereon in a prescribed manner.

Rakesh Dharawat (rakesh.dharawat@dhruvaadvisors.com) and Hari Gangadharan (hariharan.gangadharan@dhruvaadvisors.com)

Dhruva Advisors

Tel: +91 22 6108 1000

Website: www.dhruvaadvisors.com