Chinese outbound investment had another record year in 2016, with announced deals by Chinese outbound investors increasing 118.7% to $206.6 billion compared to 2015's previous high of $94.4 billion. This stellar growth could see near-term moderation in the face of recent changes, such as stricter regulatory scrutiny of certain transactions and a tightening of controls on foreign exchange purchases and cross border payments. However, these regulatory changes are not viewed as entailing a shift in China's national 'going-out' strategy and are not expected to stop China actively engaging in outbound investment. With growth continuing in Chinese investment to all parts of the world, we take a closer look at the key tax considerations, and in particular, the tax issues, for Chinese investors when structuring their overseas investments.

Tax can have a significant impact on the after-tax profits that Chinese investors derive from investing overseas. Managing the total tax cost on overseas investments, therefore, needs to be a key consideration for Chinese investors to help maximise their after-tax return from such investments.

Impact that tax can have on investment returns

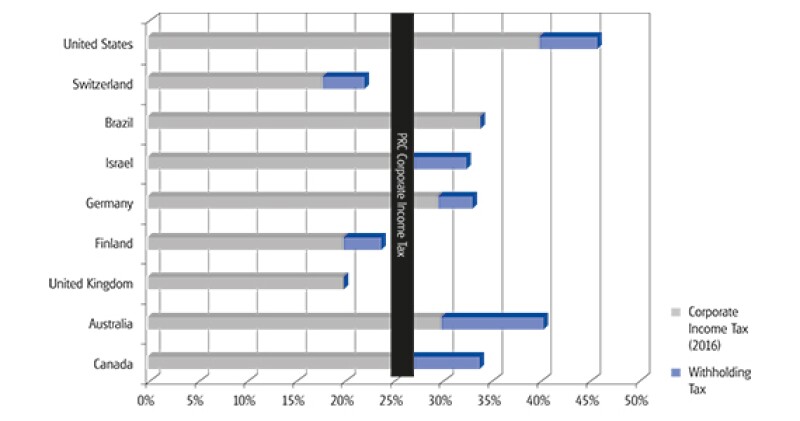

Chinese tax resident companies are subject to worldwide taxation at a standard People's Republic of China's (PRC) corporate income tax rate of 25%. This rate is generally lower than the effective corporate income tax cost for most of the countries that ranked among the top destinations for Chinese outbound direct investment (ODI) in 2016, particularly when the effect of withholding taxes is taken into account – see Figure 1.

Figure 1: Effective corporate income tax rates for top Chinese ODI destination countries in 2016 |

|

Sources: Mergermarket, KPMG analysis |

Therefore, one common focal point for outbound Chinese investors is managing the level of withholding taxes imposed on the repatriation of overseas investment earnings (seen in blue on Figure 1), either through China's double tax treaties (where a direct investment has been made from China) or under the treaties of the jurisdiction of an offshore intermediate holding company, where it is commercially justifiable to do so. The ability of Chinese investors to establish and maintain the necessary commercial substance for such structures to be effective may become more challenging, as China and source countries continue to strengthen their treaty anti-abuse mechanisms in line with the OECD's BEPS Action 6 measures.

However, it is also important for Chinese investors to minimise instances of possible double taxation in China on the earnings of the overseas investment. There are three key features of the Chinese international tax system that are relevant for Chinese outbound investors in this regard – tax residence, taxation of foreign sourced income and controlled foreign company rules. We will look at each of these areas in more detail and the challenges that they present.

Tax residency of offshore entities

Under PRC tax law, an entity that is established outside of the PRC can be subject to PRC corporate income tax on its worldwide income if its "place of effective management" is located in the PRC. Chinese authorities adopt a "substance over form" approach when assessing whether an entity's "place of effective management" is located in the PRC.

Chinese companies must therefore be mindful to implement protocols to ensure their foreign subsidiaries do not have their place of effective management in China and inadvertently become tax resident in China. Some of the business protocols which could be considered include:

Senior management responsible for daily production, operation and management of the enterprise should not perform their duties mainly in the PRC;

Strategic, financial and human resources decisions should not be made or approved in the PRC;

Major properties, accounting records, company stamps, board/shareholders' meeting minutes, etc. should not be kept in the PRC;

The majority of directors (or equivalent) with voting rights or senior management should not habitually reside in the PRC.

These protocols are important because a change in residence of the foreign subsidiary could have a number of negative implications, such as triggering exit taxes under the tax laws of the overseas country, the foreign subsidiary's profits becoming subject to PRC corporate tax at 25%, and/or the foreign subsidiary no longer being able to access double taxation agreements (DTAs) in its country of incorporation.

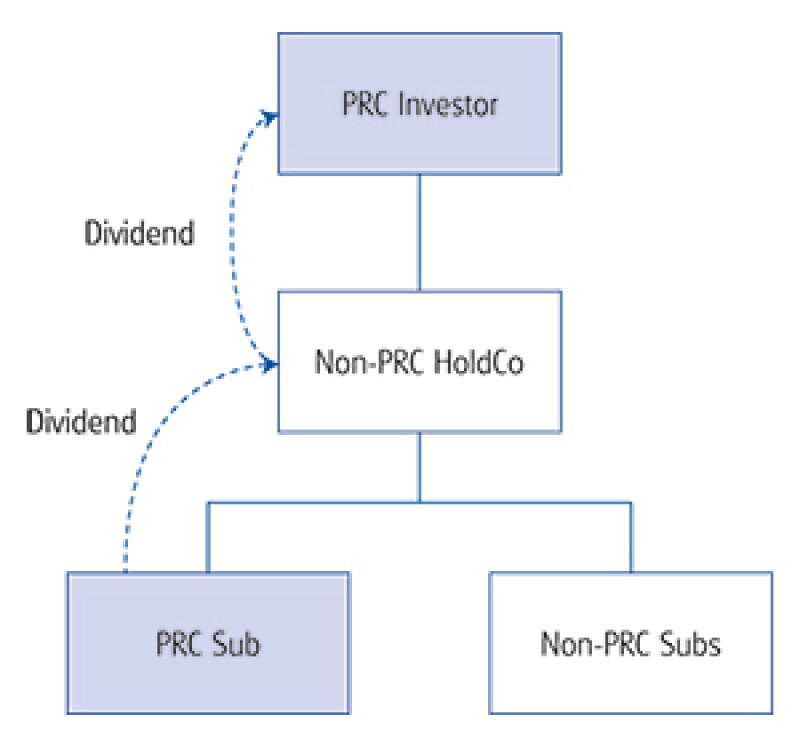

However, there may also be certain situations where it is beneficial for a non-PRC company to apply to be deemed a PRC-resident company, which is possible under Guoshuifa (2009) No. 82 or Notice 82. One such situation could be under a PRC 'sandwich' structure as shown in Figure 2.

Figure 2: PRC “sandwich” for PRC FTC purposes |

|

A PRC 'sandwich' arises where one Chinese operating company (PRC Sub) is held by another Chinese parent company (PRC Parent) through one or more overseas subsidiaries. The profits of the PRC Sub will be fully subject to tax again when they are received by the PRC Parent 'via' the offshore company(s) because the Chinese tax paid by the PRC Sub is not a foreign tax for tax credit purposes. Making the non-Chinese intermediate holding company(s) tax resident in the PRC can help to avoid double PRC taxation on the PRC Sub's earnings when they are repatriated back to the PRC Parent, because dividends paid from one Chinese resident company to another are tax exempt.

A second situation might be where, for non-tax reasons, a Chinese investor has incorporated an offshore company to make its overseas investments. We see Hong Kong commonly used in this way as it helps the Chinese investor to recycle funds from the initial investment for use in other offshore acquisitions and to facilitate future listings. As the funds are outside of China, they will not be subject to PRC foreign exchange and investment approvals. Deeming the foreign holding company as a PRC tax resident may be a way to avoid an offshore company adding an additional tier to the corporate structure for the purposes of claiming foreign tax credits (discussed in more detail below), and should not adversely impact the offshore company's ability to claim benefits under China's double tax treaties.

PRC foreign tax credits

The second key area is China's system for relieving double tax on foreign sourced income. Although many capital exporting countries use the exemption method for taxation of foreign sourced dividends and capital gains, China still operates a credit system. This can lead to potential double taxation if the Chinese investor is unable to claim a credit for foreign taxes paid on foreign sourced earnings.

Dividends received by a PRC entity from its overseas investments are generally subject to PRC corporate tax at 25%. However, a PRC entity will be entitled to credit the foreign taxes paid, which are attributable to such dividends (e.g., withholding tax on the dividend and income taxes paid on the underlying profits of the foreign entity paying the dividend), provided certain conditions are satisfied.

It is important to ensure that foreign tax credits can be claimed when profits are repatriated to the PRC to avoid potential double taxation on such profits. For example, profits derived from a PRC entity's Australian subsidiary would be subject to 30% Australian income tax but no additional PRC income tax would be incurred where a foreign tax credit can be claimed i.e., the profits would be effectively taxed at 30%. Whereas, if no foreign tax credit were allowed, the profits would be subject to tax in both Australia and the PRC, effectively taxing them at 47.5%.

One of the key constraints for claiming foreign tax credits is the limitation on the number of 'layers' of foreign subsidiaries, with an indirect credit only able to be claimed down to the third tier of foreign subsidiaries (certain groups of specified enterprises are able to claim indirect credits up to five tiers). This limitation means that Chinese investors need to pay close attention to both the legal structure of overseas companies, which they are looking to acquire, and the benefits vs costs of using an offshore investment platform to acquire such targets. Where an offshore holding structure pushes the tax-paying operating companies of the foreign target beneath the third tier of offshore subsidiaries, the benefits from accessing a more favourable tax treaty will need to be balanced with the potential additional tax cost that may arise due to the inability to claim a credit for foreign taxes paid for PRC tax purposes on profit repatriations. Alternatively, a restructure of the overseas target group to "flatten" the number of tiers of foreign subsidiaries may be required, which might trigger upfront tax and non-tax costs for the investor.

Controlled foreign companies

Article 45 of the PRC Corporate Income Tax law is the PRC's controlled foreign company regime. Where an offshore entity is considered a controlled foreign company under article 45, the PRC resident shareholder will be required to include an amount equal to its effective interest in the foreign enterprises' undistributed profits as a deemed dividend when computing their own PRC taxable income. In other words, the profits derived by its foreign subsidiaries which are kept outside of the PRC will still be taxable in the PRC notwithstanding that they have not yet been repatriated.

Broadly, article 45 will apply if a foreign entity is controlled by PRC tax residents; if the effective foreign tax burden on the profits of the foreign entity is less than half of the PRC corporate tax rate (i.e., less than 12.5%); and if the foreign entity fails to distribute its profits without a legitimate commercial reason or reasonable operational need.

Managing the application of article 45 to foreign subsidiary entities is crucial to managing PRC tax payments and overall cash flow concerns, particularly where the offshore operations are structured through entities located in jurisdictions which effectively tax the profits at a rate lower than the PRC. Typically, PRC entities with subsidiaries in such jurisdictions would need to demonstrate legitimate commercial reasons or some reasonable operational need for retaining funds and not distributing profits back to the PRC, for example, reinvestment of the funds into underlying business or business expansion.

China issued, in draft form, certain revisions to its controlled foreign companies (CFC) rules in 2015, which would see some tightening around the determination of 'control' for CFC purposes. It also proposed the removal or amendments to certain exclusions provisions from the application of the CFC rules. The Chinese authorities have not yet finalised these new rules, but these are anticipated to be issued sometime in 2017.

We have seen the Chinese authorities invoke the CFC rules on a limited number of enforcement cases in the last few years. However, we expect this issue will become more closely scruitinised once revised rules are finalised and published.

New tax reporting obligations

In addition to managing the overseas and PRC tax costs on its overseas investments, Chinese investors should take notice of new tax reporting obligations, which could potentially cover their overseas investments. Last year, the State Administration of Taxation issued an announcement that updated China's transfer pricing documentation requirements and introduced new country-by-country reporting (CbCR) requirements for Chinese groups and their consolidated subsidiaries (Announcement 42: The Enhancement of the Reporting of Related Party Transactions and Administration of Contemporaneous Documentation).

The new Chinese CbCR obligations will be triggered where the Chinese investor is the ultimate holding company for a multinational group, which has a consolidated revenue of CNY 5.5 billion ($800 million) in its previous fiscal year exceeds, roughly equal to the €750 million threshold under BEPS Action 13. The new CbCR requirements will apply from the 2016 fiscal year onwards and the CBC report will need to be submitted annually together with the Chinese investor's income tax return (due in May of the following year). As such, Chinese investors who have completed or are considering making overseas investments that will result in the group exceeding the CBC reporting threshold should take appropriate steps to compile and report the required data.

Closing remarks

Managing PRC tax issues can be just as important as foreign tax considerations when implementing an effective holding structure for overseas investment. Chinese investors should be careful in observing the relevant PRC tax rules to ensure that their offshore structures are effective and can therefore achieve their intended result of maximising the after-tax returns from such investments.

|

|

John GuPartner, tax KPMG China 8th Floor, Tower E2, Oriental Plaza Beijing 100738, China Tel: +86 10 8508 7095 John Gu is a partner and head of deal advisory, M&A tax and head of private equity for KPMG China. He is based in Beijing and leads the national tax practice serving private equity clients. John focuses on regulatory and tax structuring of inbound M&A transactions and foreign direct investments in the People's Republic of China (PRC). He has assisted many offshore funds and Renminibi (RMB) fund formations in the PRC and has advised on tax issues concerning a wide range of inbound M&A transactions in the PRC in the areas of real estate, infrastructure, sales and distribution, manufacturing, and financial services. |

|

|

Michael WongPartner, tax KPMG China 8th Floor, Tower E2, Oriental Plaza Beijing 100738, China Tel: +86 10 8508 7085 Michael Wong is a partner and head of the outbound tax practice for KPMG China. He is based in Beijing and leads the national outbound tax practice serving state owned and privately owned PRC companies in relation to their outbound investments. Michael has extensive experience leading global teams to assist Chinese state-owned and privately-owned companies conduct large-scale overseas M&A transactions in various sectors including energy and power, mining, financial services, manufacturing, infrastructure and real estate. |

|

|

Alan O'ConnorDirector, tax KPMG China 8th Floor, Tower E2, Oriental Plaza Beijing 100738, China Tel: +86 10 8508 7521 Alan O'Connor joined KPMG Hong Kong from Australia in 2000 and became a director in 2013. He worked in Hong Kong for more than 10 years before relocating to Beijing in 2011, where he continues to provide tax services to Chinese outbound investors. He has extensive experience providing due diligence and transaction related tax advisory services to major Hong Kong and Chinese based clients, and has been involved in international tax planning projects, merger and acquisition transactions and due diligence exercises involving Asia, Europe and North America. |

|

|

Karen LinDirector, Tax KPMG China 50th Floor, Plaza 66 1266 Nenjing West Road Shanghai 200040, China Tel: +86 21 2212 4169 Karen joined KPMG Hong Kong in 2005 and KPMG Beijing in 2011. Since 2011, Karen has been specializing in international taxation and assisting Chinese multinational corporations with outbound M&A transactions, including international tax structuring, tax due diligence and transaction related tax advisory services. During 2014 and 2015, Karen joined a NASDAQ listed multi national media group focusing in managing the group's taxation matters covering the Asia Pacific region. |