The Chinese mergers and acquisition (M&A) market saw a very active year in 2016. This was especially true of China outbound M&A, which accounted for $220 billion of deals. Chinese buyers were the number one buyer of global assets by value in 2016. However, since the introduction of stricter policies on outbound investment and tightened capital remittance controls in late 2016, outbound M&A activity has slowed down significantly. Statistics show that the value of outbound M&A deals in Q1 2017 was $12.5 billion, which is 85% lower than that in Q1 2016 ($82 billion). As a result, in 2017, the gap between the values of inbound and outbound transactions has been closing. According to Thomson Reuters, as of February 2017, inbound M&A deals in China reached $7.1 billion, which is double the amount in the same period in 2016. On the other hand, the outbound M&A deals in the same period in 2017 have decreased by 40% to $8.4 billion.

In recent years, there has been considerable M&A activity, both by domestic and international investors, in hot sectors such as telecommunications, media and technology (TMT) and healthcare (including hospitals). Given China's fast developing and uncertain tax landscape, tax due diligence (TDD) and tax planning strategy are crucial to managing tax risks in China M&A transactions. In this chapter, we will explore some of the common TDD issues faced by investors in these hot sectors, as well as those faced in take-private transactions. We will also discuss the practical approaches investors may take to deal with potential challenges in an M&A transaction.

In Chinese M&A transactions, it is not uncommon to see internal restructuring being undertaken by a seller or buyer pre- or post-M&A. In this regard there is a particular need to deal with Announcement 7, and we focus below on the practical difficulties in qualifying for the Announcement 7 group restructuring 'safe harbour'. Furthermore, we look at the different investment structures adopted by investors to mitigate the risk of tax exposures impacting on investment returns.

The China State Administration of Taxation (SAT) also recently issued the long awaited Announcement 37 on 'Issues Relating to Withholding at Source of Income Tax of Non-resident Enterprises', which replaces both SAT Circular 3 [2009] and SAT Circular 698 [2009] effective from December 1 2017. While Announcement 37 is welcomed by industry and provides clarity on certain issues, it also leaves certain areas of uncertainty. In this chapter, we look to highlight some of these key issues for M&A transactions.

Common China tax due diligence issues in hot sectors

Telecommunication, media and technology (TMT)

Since 2013, we have observed a remarkable growth in M&A activity in the TMT sector. Both domestic and overseas investors are keen to participate in the explosive growth in this market. The deal size varies significantly, depending on the business and lifecycle stage of the target company. Among the target companies in the TMT sector, the hottest type for the past few years has been online to offline (O2O) companies. Most of the investors in this sector are private equity (PE) and venture capital (VC) funds, which usually have a higher tolerance for historical risks attached to target companies, especially when the target companies are in their start-up stage.

The typical tax issues in the TMT sector include:

Under-withholding of individual income tax (IIT) liabilities for agents (e.g. service providers) who are individuals, and who receive cash payment from the TMT companies;

Under-reporting and under-payment of taxes, facilitated through maintaining multiple sets of accounts for tax avoidance purposes in the initial stage of business operations (this issue is, as a general matter, not unusual for small, privately owned companies in China); and

Improper use of invoices and improper employee expense reimbursements.

In addition, there are foreign exchange issues. In particular, due to regulatory restrictions on foreign investment in the TMT industry, variable interest entity (VIE) structures are very popular. Under a typical VIE structure, it is difficult to transfer funds from an overseas company to the VIE. It is therefore not uncommon for the funds to be remitted to China via the founder's personal bank accounts, which may give rise to potential foreign exchange risk. In addition, there could be fictitious transactions between a VIE and wholly-foreign owned enterprises (WFOEs) to manage the cash flow between the entities.

Healthcare and hospital sector

From 2013 to 2014, medical and health system reform measures were issued to encourage the establishment of medical institutions funded by social (i.e. private) capital. Furthermore, in August 2014, the government issued a notice to allow foreign investors to take full ownership of hospitals in seven cities and provinces. Investors including MNEs, local listed companies and PE funds have consequently been seeking to enter into China's fast-growing private hospital sector through M&A.

Investors looking at targets in the private hospital sector should be aware of the following potential tax exposures:

Sales of medicine and medical services by hospitals can avail of specific exemptions from VAT. However, some of the private hospitals, being considered as investment targets, may have been claiming VAT exemption for non-medical income (such as sales rebate income, accommodation income, training income, etc.). Consequently there may have been VAT underpayment by the target hospitals;

Not-for-profit hospitals can potentially enjoy a corporate income tax (CIT) exemption upon application and approval by the tax authority. However, defects in the conduct of application procedures may give rise to potential CIT exposures;

Some private hospitals may have granted compensation to their part-time doctors, without properly withholding IIT for the doctors;

Many entities in the private hospital sector are not-for-profit organisations. To the extent these entities were to be transformed into for-profit organisations before transaction closing, one-off payment of the exempted CIT of previous periods might be requested to be made (subject to negotiation with the tax authority). The additional tax cost should be taken into account in the valuation; and

Potential tax exposures may arise from conversion of not-for-profit hospitals to for-profit hospitals, post transaction.

While investors may still proceed with the transactions in spite of the historical tax issues, the following actions may need to be taken in order to reduce the tax risks:

Obtain a specific tax indemnity in the sale and purchase agreement (SPA);

Request the target to rectify the incorrect tax practice before closing, negotiate with local tax authorities regarding the method to make up the underpaid taxes, and/or obtain an official tax clearance certificate from the local tax authority; or

Work together with the target and advisers to improve the tax compliance level post transaction. For cases where the investor has an expected timeline to exit (e.g. initial public offering (IPO)), a clear step plan would be essential to the transaction.

Common tax issues in take-private transactions

Planning for a takeover transaction

In take-private transactions involving listed Chinese group companies, apart from regulatory and legal restrictions, there are several factors that investors need to take into consideration. Tax planning is crucial as any tax leakage directly affects the return on investment of shareholders and the availability of external acquisition finance for the M&A transaction. Investors should consider their investment objectives and holding intentions, such as the length of holding period, investment structure and the potential future exit strategies.

Dealing with target management/employee shares

A common feature of a take-private transaction is the involvement of target management post transaction. This typically involves continuing participation of key management personnel. In order to align the interests between the shareholders and target management, it is common for the target to issue a portion of its shares/equities to key management personnel as an incentive. In this regard, investors should take into account the potential tax implications arising from the share-based incentive schemes (e.g. IIT that may be imposed on share remuneration received by the key management personnel).

Profit repatriation/acquisition debt funding

When planning an appropriate investment structure for a take-over transaction, a common tax consideration is the potential tax leakage on future repatriation of profits from the operating subsidiaries. It needs to be considered whether such income (dividend, interest, royalties, etc.) would be taxable locally, as this would impact on the return on investment for shareholders and/or affect the fund repayments on any acquisition loan financing.

For example, dividends paid by Chinese target companies are subject to a 10% withholding tax (WHT), unless a relevant double tax agreement (DTA) with a lower WHT rate applies. Dividends can only be paid after certain specified conditions are met, including that a minimum of 10% of the Chinese target company's after-tax profits are allocated to a statutory reserve annually, until a ceiling of 50% of its registered capital is reached. These restrictions on the timing and amount of cash dividends that a Chinese target company can repatriate back to the investors should be taken into account as this would affect the investment returns for the investors.

Historically, where a Chinese company distributes dividends to a non-resident enterprise, the Chinese enterprise would withhold and remit the CIT payable to the Chinese tax authorities when a resolution on the profit distribution has been passed. However, under the new Announcement 37, the withholding obligations on dividend distributions paid offshore arise on the actual dividend payment date. In practice, most companies pay tax when dividends are distributed. Therefore, Announcement 37 provides clarity and certainty to companies on when the tax would be imposed and provides better cash flow management as the tax payment is effectively deferred until actual dividend payment date.

In addition, to some extent, availability of external acquisition finance for a takeover transaction is affected by the estimated cash flow available to debt providers. If tax leakage from target companies is reduced through tax planning, the cash flow available to potential debt providers should be greater, which will enable investors to obtain a larger loan and take full advantage of debt financing. Therefore, in a leveraged buyout, an understanding of cash traps and historical tax compliance status is paramount to understand the quantum of available cash to fulfil the target's debts and hence should be one of the focus points of the TDD procedures.

Exit strategy

For PE funds or other short term investors, an exit strategy is central in tax planning. The planning should ensure that the acquisition structure provides adequate flexibility and efficiency for future exit. Exit may be achieved via IPO or a trade sale, and it is common to model the expected tax consequences and costs arising from the future exit.

Maximising returns requires consideration of:

Exit level: understand how and at what level the investors will look to exit (e.g. through an IPO or a future sale). A trade sale is more commonly used as an exit option as it allows planning to sustain maximum investment cost base at the level of acquisition, which will minimise the seller's tax liabilities on exit. A common pitfall in take-private or other M&A transactions is where a mismatch occurs between the amount of capital contributed by investors (e.g. at the acquisition company level or target company level) and the deductible cost base at the level at which investors intend to exit (e.g. at the onshore operating company level). The tax exposures can be mitigated either via tax planning or by modelling such future tax costs into the acquisition price.

Potential buyer: it is important to understand the profile of the buyer (i.e. onshore or offshore buyer) as this may be relevant to regulatory restrictions, such as restrictions on foreign ownership in certain industries. Managing these hurdles may require a group restructuring in order to facilitate completion of the acquisition. The investment structure adopted post-transaction should therefore be flexible enough to cater to future buyers. To the extent that a restructuring of the target group is required to facilitate future exit plans, the restructuring costs should be considered and factored into the valuation model at the time of acquisition. Further tax considerations for offshore restructuring are discussed below.

Exit planning: offshore and onshore level transactions are subject to different tax implications in China. Specifically, capital gains derived by Chinese companies are subject to 25% CIT and those derived by foreign sellers are subject to 10% WHT (unless exempted under a DTA). As noted below, there is a growing trend towards conducting exits onshore.

In summary, for M&A transactions, and specifically for take-private transactions, tax is a key consideration. Investors should clearly identify their investment and holding intentions to facilitate effective tax planning. This will contribute to maximising investor returns and improve the availability of external debt financing.

Recent SPA tax considerations – are you protected?

Tax filing/reporting obligations

Sale and purchase agreement (SPA) tax protection clauses are necessary to shield investors from the potential tax exposures identified during the TDD procedures, such as the examples above for TMT, the health sector and take-private acquisitions. Another common negotiation point in Chinese M&A transactions is the responsibility for tax payment and withholding. The relevant tax considerations depend on whether the seller is a corporate or an individual, and whether the seller, buyer and target companies are resident or non-resident. Tax payment and withholding issues have become increasingly complicated in recent years following the 2015 release of SAT Announcement 7. The notice stipulates that the buyer has a withholding obligation in relation to capital gains tax arising in an offshore M&A transaction. In consequence, the buyer has a perceived vested interest in flexible SPA provisions to ensure that the seller bears the cost of a crystallised capital gains tax liability and secure future tax cost base on exit. As such, core issues that should be clarified in the SPA include:

Will the transaction be reported to the Chinese tax authorities, and if so, by whom and by when?

Which party is to liaise and settle the tax payment with the Chinese tax authorities?

What documentation will be provided to the buyer as evidence of tax reporting, filing and settlement?

A further issue is raised under the new Announcement 37. Under Announcement 7, where an indirect transfer of shares in a Chinese entity has been recharacterised as a direct share transfer, and WHT of 10% arises, the seller is required to pay the tax where the withholding agent fails to withhold it. No penalty interest would, however, be imposed, on top of the tax payable, so long as the taxes were settled before June 1 of the year following the year in which the transaction was completed. However, Announcement 37 states that the tax authorities will now prescribe a timeframe for sellers to pay tax where the withholding agent fails to do so, and that payment within this prescribed timeframe will be recognised by the Chinese tax authorities as being an 'on time settlement'. There is consequently a degree of uncertainty as to whether the late interest portion would be imposed on the seller if the tax was paid to the Chinese tax authorities within the prescribed timeframe (as set by the authorities under Announcement 37), but after the June due date, as stipulated under Announcement 7.

Further, it is noted that the Chinese tax authorities would typically request additional documents following the initial tax reporting, in order to determine whether or not the share transfer was taxable. Therefore, during the SPA negotiation process, aside from obtaining vendor SPA commitments to conduct the tax reporting and provide tax settlement evidence, investors may need to go further. It may be worthwhile for the investors to consider obtaining most or all of the following documents (to the extent that these were not obtained during the TDD procedures). These would typically be requested by the Chinese tax authorities in an Announcement 7 review:

Audited financial statements of the Chinese target company for the latest two to three years;

Valuation and documentation in support of the transfer consideration;

The business licence and certificate of incorporation of the various parties, including the seller, transferee and Chinese target company; and

Evidence of any overseas income tax paid by the seller in respect of the share transfer.

The investor should also be aware of the ambiguity that exists concerning the appropriate local tax bureau with which to file the Announcement 7 report. This could impact on whether a document could be obtained from the tax bureau to confirm the successful filing.

Case study

In a recent Announcement 7 practical case involving an indirect transfer of a Chinese entity located in a Tier 3 city in Zhejiang province (Tier 3 city) to a Chinese buyer based in a Tier 1 city (Tier 1 city). The intention of the Chinese buyer was to make an Announcement 7 filing with the tax authorities in the Tier 3 city. However, the tax authorities in the Tier 3 city refused to accept the Announcement 7 filing, as they considered that the Chinese buyer had the obligation to withhold and remit the 10% WHT to its in-charge tax authorities in the Tier 1 city. After negotiating with the local tax authorities in the Tier 3 city, the Tier 3 city tax authorities ultimately agreed to accept the Announcement 7 filing but refused to issue any acknowledgement receipt to confirm their acceptance of the filing documents. The requirement of the authorities to issue such a receipt is provided for under a supplemental circular to Announcement 7, and is commonly required by buyers to be presented to them as evidence of the Announcement 7 reporting obligation being fulfilled. Ultimately, as an alternative to requiring the formal acknowledgement receipt issued by the tax authorities, the buyer finally accepted a written letter issued by the seller's third party service provider confirming that the Announcement 7 filing had indeed been done. Such issues should be considered when negotiating and drafting the SPA.

Announcement 37 now states that, if the withholding agent does not withhold tax for and on behalf of the seller, then the seller has the obligation to pay tax in the location where the Chinese company being transferred is located (in this example, the Announcement 7 filing would therefore be made to the local tax authorities in the Tier 3 city).

Escrow arrangements

Apart from incorporating tax protection clauses in the SPA, escrow arrangements are commonly adopted for offshore transfers. In some cases, such escrow arrangements are designed to protect the buyer from certain historical tax exposures of the target. The buyer and seller will design a release schedule for the escrow to reflect these exposures. In light of the terms of the Chinese tax statute of limitations, and of local tax audit practices, it is generally reasonable to agree a gradual release of an escrow over a three to five year period.

Escrow arrangements may also be adopted to withhold the seller's potential transaction tax costs (e.g. income tax), especially for indirect transfers of Chinese companies. This can facilitate relevant tax reporting (whether buyer or seller) or tax filing/payment, in line with Announcement 7. This is a common arrangement as, while the tax reporting for Announcement 7 is due within 30 days of signing the SPA, in practice, Chinese tax authorities have no fixed timeframe to revert to the taxpayer with a tax basis position. To accommodate such uncertainty, the escrow period would also need to be negotiated.

Under Announcement 7, if the withholding agent does not withhold the payment for and on behalf of the seller, then there is a risk that the Chinese tax authorities would impose penalties on the buyer (although the tax payable should still be recovered from the offshore seller). However, Announcement 37 states that the Chinese tax authorities could now impose the tax payable on the buyer. Therefore, it becomes even more imperative for the buyer to negotiate and agree with the seller on their respective reporting responsibilities and seek necessary protections and escrow from the seller during the SPA negotiation process.

Earn-out arrangements

Earn-out arrangements also have been commonly used in recent years. These can incentivise the seller's management and/or employees to remain in the acquired company. They are also useful given that very often (especially with privately owned targets) the level of historical tax compliance might be low, and it is generally unlikely that sellers will voluntarily settle tax payments with the Chinese tax authorities pre-closing. For such cases, an earn-out (and escrow) arrangement can ensure that the sellers retain an economic interest in the target, within the tax statute of limitations period.

Difficulties in qualifying for group restructuring relief under Announcement 7

Another contentious issue under Announcement 7 is qualifying for group restructuring relief. Under the general principles of Announcement 7, where there is an indirect transfer of equity in a Chinese resident enterprise by a non-resident enterprise, and where the arrangement was undertaken without 'reasonable business purposes' with the aim to avoid CIT in China, the arrangement would be recharacterised as a direct transfer of equity in the Chinese resident enterprise. Under the China general anti-avoidance rule (GAAR), this recharacterisation results in the disposal gain being subject to tax in China.

However, there are safe harbour provisions under Announcement 7 that exempt certain indirect offshore transfers from tax in China. In particular, in order for an internal group restructuring to qualify for the safe harbour, it must satisfy all of the following conditions:

A minimum 80% (100% for China land-rich companies) direct or indirect common shareholding relationship between the transferor and the transferee;

The CIT on subsequent indirect transfers will not be reduced post-restructuring, when compared to the original structure; and

The consideration is paid entirely in the form of equity.

In practice, it is difficult to satisfy all of the above conditions under Announcement 7. This is particularly true of the equity consideration requirement, since it may not be commercially realistic for many group restructurings. Nevertheless, even if the conditions cannot be satisfied, this does not mean the restructuring will automatically be subject to China tax. Instead, the 'reasonable business purpose' test would need to be further analysed to determine whether the indirect equity transfer, resulting from the group restructuring, was taxable under Announcement 7 (i.e. whether it was tax-motivated).

Indirect transfer case study

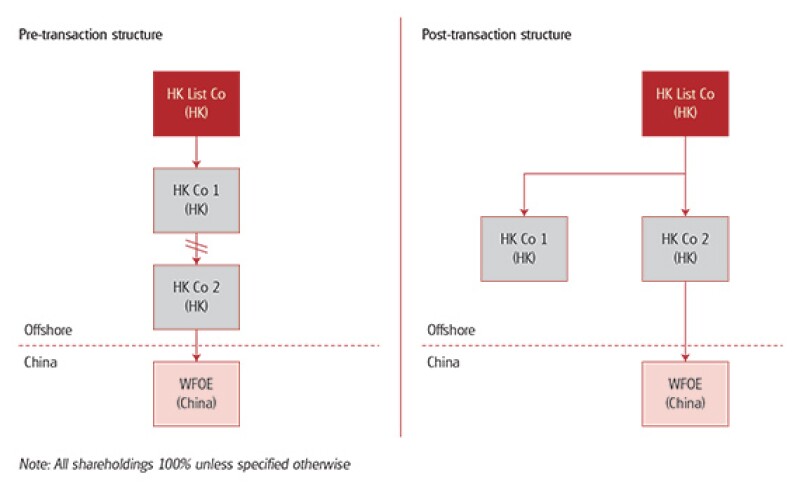

For instance, in a recent practical case, a Hong Kong (HK) listed group underwent an internal group restructuring, which resulted in an indirect transfer of a China WFOE located in a Tier 1 city. At the outset, the transferor (HK Co 1) indirectly held a China WFOE, via another HK company (HK Co 2; the transferred entity). HK Co 1 transferred HK Co 2 to its ultimate partner company, HK List Co (the transferee), meaning that the transaction in question was a subsidiary-to-ultimate-parent transfer. All of the relevant HK companies were HK incorporated and tax resident companies. The transfer would, prima facie, fall within the scope of the Announcement 7 indirect transfer rules.

While the first two conditions of the safe harbour provisions were satisfied, it was not commercially feasible to satisfy the third condition, as the consideration for the share transfer could not be paid in the form of equity. This was because the primary objective for transferring the shares in HK Co 2 was to achieve the outcome that HK Co 1 would become a standalone entity (without any direct subsidiaries that were not relevant to its operations) in order for the HK listed group to meet and manage its various regulatory obligations. Therefore, it would not make commercial sense to have HK Co 1 holding the shares of HK List Co, its parent company, nor to substitute the restructuring with a direct transfer of the equity interest in the China WFOE, as this would not achieve the commercial objective of the restructuring.

While the internal group restructuring did not meet all the conditions for tax relief, the restructuring was ultimately not subject to tax. The China tax authorities were satisfied that the share transfer had reasonable business purposes, particularly given there was no change to the ultimate shareholder and tax position, post-restructuring. The non-taxation of this restructuring case is not unique, as long as the internal group restructuring has a strong business case.

Deal structure trends in the China M&A market – more domestic deals

The recent trend is that more deals are being done in China. However, the transaction period is getting longer. This is because both buyers and sellers are looking at different structures to mitigate some of the potential tax risks noted above. The choice of transaction structure (e.g. onshore deal versus offshore deal, share deal versus asset deal) needs to be carefully considered, as this affects the tax result and impacts the investment return.

Onshore acquisition vs. offshore acquisition

In order to decide whether to use an onshore or offshore acquisition vehicle, the following factors should be considered from a tax and cash return perspective:

Future exit – where the future investment exit is expected to occur at the onshore level, an offshore acquisition could create issues. It could result in a mismatch in the tax basis, giving rise to additional tax leakage for the investors upon future exit. Furthermore, differences in applicable tax rates should be factored in. An offshore transferor is subject to 10% WHT (potentially reduced to 0% under an applicable DTA) whereas an onshore transferor will be subject to CIT at a higher rate (the statutory CIT rate is 25%).

Cash-trap – Chinese companies must retain 10% of their annual after-tax profit as a statutory general reserve. They must add to this reserve each year until the accumulated amount of the reserve reaches a certain level of its registered capital. This means more layers of onshore companies will result in more cash being trapped in China.

Re-investment in China – to the extent the investor intends to recycle and reinvest China profits in other Chinese investments, potential tax leakages should be considered. Unless a China holding company (CHC) is used, the reinvestment in China would typically be deemed as dividend repatriation and then a capital investment, resulting in WHT leakages for foreign investors. However, on July 28 2017, the State Council proposed to temporarily permit the deferral of WHT on dividends where the relevant amounts were reinvested in 'encouraged' projects. This may facilitate the use of offshore platforms to make investments in China going forward, though detailed implementation rules are yet to be clarified.

Asset vs. share deal – which option is right?

There are broadly two options for onshore China deals: asset deal and share deal. In recent years, more and more asset deals were used, especially for acquisitions of privately owned enterprises (POEs) in traditional industries. This was due to the investor's pressing need for investment, and the relatively low tax compliance level among POEs in China, which speak against acquiring the entity itself with its legacy tax exposures.

When deciding on deal structures, the following tax factors should be considered:

Non-inheritance of the target's pre-existing contingent liabilities and tax exposures in an asset deal versus potential retention of use of tax losses and subsidies etc. in a share deal;

While tax indemnification can be sought to protect the buyer from the potential tax exposures in a share deal, it may not be ideal. Enforcement could be difficult, especially where sellers are individuals; and

Asset deals typically give rise to relatively higher tax costs (potentially double tax under certain structures) for the seller, although the buyer will be able to step up the tax cost base of the assets acquired.

In addition, under Announcement 37, for transfers that involve multiple instalment payments, the obligation to pay tax would not arise until all instalment payments were made. However, Announcement 37 does not provide a clear definition on what qualifies as multiple instalment payments. As such, the buyer should consider whether the instalment payment terms in an M&A transaction should be specified in the SPA.

Where are we heading?

Since 2016, China has tightened its policies on outbound foreign investment. These measures have aimed to curb capital outflows from diminishing foreign exchange reserves and devaluation of the Chinese Yuan. However, going forward, with the Belt and Road Initiative (BRI), we expect a significant long-term increase in M&A transactions by Chinese companies in BRI countries. For further detail, see the chapter, A thousand miles begin with a single step: tax challenges under BRI. Therefore, careful TDD and tax planning will play a key role for companies investing onshore and offshore.

Further, in order to boost investors' confidence in investment in China, it is hoped that the Chinese tax authorities will provide more clarity for uncertain areas, like Announcement 7 safe harbours and tax calculation for indirect transfers of Chinese assets. Clarifications are also needed for the tax treatment of Chinese partnerships, in view of the growing trend for foreign investors looking to setting up their own Chinese investment platform.

While Announcement 37 is welcomed and addresses some of the previous uncertain tax issues surrounding Announcement 7, it does create uncertainty in other areas as highlighted. It is to be hoped that the Chinese tax authorities will provide further clarity on these areas in the near future.

The authors would like to thank Elaine Chong and Alison Chen for their contribution to this chapter.

John Gu |

|

|---|---|

|

Partner, Tax KPMG China 8th Floor, Tower E2, Oriental Plaza Beijing 100738, China Tel: +86 10 8508 7095 John Gu is a partner and head of deal advisory, M&A tax and private equity for KPMG China. He is based in Beijing and leads the national tax practice serving private equity clients. John focuses on regulatory and tax structuring of inbound M&A transactions and foreign direct investments in China. He has assisted many offshore fund and CNY fund formations in China and has advised on tax issues concerning a wide range of inbound M&A transactions in China in the areas of real estate, infrastructure, sales and distribution, manufacturing, and financial services. |

Yvette Chan |

|

|---|---|

|

Partner, Tax KPMG China 8th Floor, Prince's Building 10 Chater Road, Central, Hong Kong Tel: +852 2847 5108 Yvette Chan has advised a variety of clients on regulatory and tax issues arising from M&A transactions, including foreign direct investments in China and outbound investments by Chinese companies, and has assisted clients with regard to transaction structuring and devising tax efficient strategies for implementing business operations and arrangements. Yvette has also advised on a number of tax structuring, tax due diligence, tax modelling review, M&A, corporate restructuring, pre-IPO restructuring, leasing, and tax compliance projects in China and specialises in the tax structuring of investment funds, M&A and financial transactions. Yvette services clients in a wide range of industries including private equity funds, real estate, infrastructure, consumer and industrial markets, telecommunications, e-commerce, education, and financial services. Yvette's clients include multinationals headquartered in the US and Europe, private equity funds, as well as Chinese state-owned and privately owned enterprises. Yvette has taught internal courses and spoken at external seminars on Chinese taxation, particularly in relation to non-resident tax issues for inbound investments, as well as Chinese tax issues and considerations on outbound investments |

Christopher Mak |

|

|---|---|

|

Partner, Tax KPMG China 26th Floor, Plaza 66 Tower II 1266 Nanjing West Road Shanghai 200040, China Tel: +86 21 2212 3409 Christopher Mak has more than 15 years experience in advising multinational clients across a wide range of sectors such as the consumer, industrial and manufacturing, real estate, technology, media and telecommunications (TMT) industries in relation to appropriate corporate holding and funding structures to conduct their proposed business activities in Australia and China. Since joining the Shanghai office, he has been heavily involved in assisting foreign companies on China tax issues arising from their investment into China including proposed global restructuring, company set-ups, tax due diligence, foreign exchange remittance issues and M&A transactions. |

Sam Fan |

|

|---|---|

|

Partner, Tax KPMG China 9th Floor, China Resources Building 5001 Shennan East Road Shenzhen 518001, China Tel: +86 755 2547 1071 Sam Fan started his tax consulting career in Hong Kong in 2001. In 2003 Sam was transferred to KPMG in Shenzhen focusing on China tax and customs advisory matters. Sam focuses on regulatory and tax structuring aspects of various inbound M&A transactions and foreign direct investments in China, and specialises in the structuring of foreign investments in China as well as M&A transactions from a regulatory and tax perspective. Sam advises clients on tax structure and has been involved in a number of due diligence projects in different sectors, including consumer markets, infrastructure, mining and manufacturing. Sam also advises multinational companies on tax, business regulatory and investment matters relating to the establishment of business vehicles, continuing operation models, and investment and funding structures. With more than 14 years in the southern China region, Sam has extensive practical experience, including leading a number of successful tax and customs dispute resolution cases. His advice spans the private equity, infrastructure, consumer and industrial markets. |