The Chinese government recognises that innovation is essential to sustaining the momentum of China's economic development, and supporting innovation is a key focus of the government's 13th five-year plan (2016 to 2020). President Xi's speech to the 19th CPC National Congress further emphasised the determination of the government to develop the national innovation system by establishing a market-oriented system for technological innovation in which enterprises are the main players. In this context the government will seek to ensure that the maximum synergies result from the joint efforts of enterprises, universities, and research institutes. The national innovation strategy will interlink with the internet plus action plan, the national big data strategy, and the Made in China 2025 initiative.

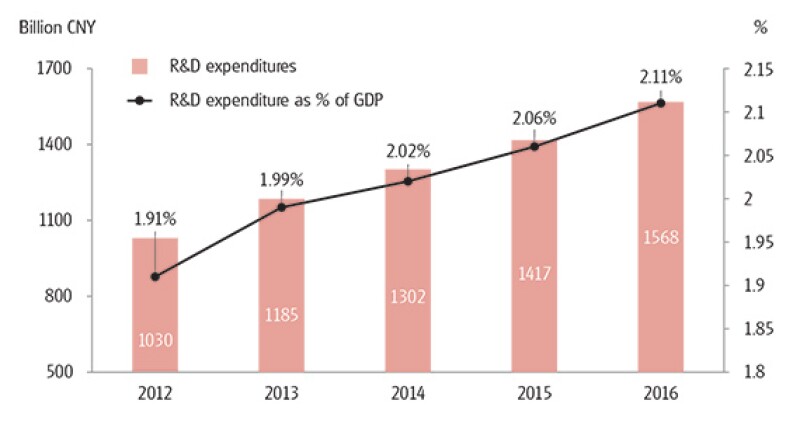

New landmarks are being attained in national innovation metrics. According to a 2016 statistical bulletin from the Chinese National Bureau of Statistics, research and development (R&D) investment in China reached 2.11% of GDP (see Diagram 1). It is targeted to reach 2.5% of GDP by the end of the 13th five-year plan period. By the end of 2016, the total number of China-registered, valid invention patents passed the million mark, meaning China ranks third in the world, after the US and Japan. Progress is also being made in marrying economic development with innovation-driven ecological progress, as energy consumption per unit of GDP fell by 5% in 2016.

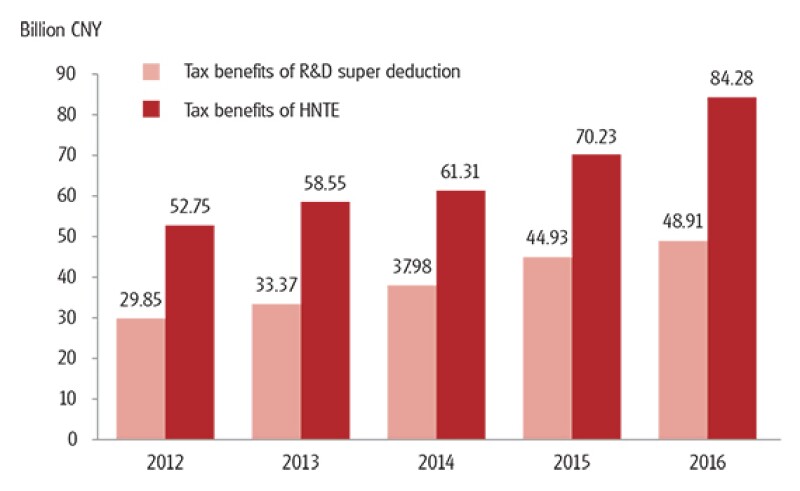

Over the past two years, China has made enhancements to its two flagship corporate income tax (CIT) innovation incentives – the high and new technology enterprise (HNTE) and R&D expense super deduction (super deduction) incentives. The resulting enterprise tax savings have been available for reinvestment into expanded R&D activities, equipment and recruitment, to increase enterprise core competitiveness. As per Diagram 2, based on figures from the National Bureau of Statistics, tax benefits granted in 2016 rose to CNY 48.91 billion ($7.4 billion) for the super deduction and CNY 84.28 billion for HNTE, annual increases of 9% and 20%, respectively.

The Chinese government is pushing a programme of 'mass entrepreneurship and innovation', and has tailored many of its incentives to support small and medium-sized science and technology enterprises (science and technology SMEs). This includes the establishment of special innovation demonstration zones, the expansion of venture capital (VC) tax incentives to foster investment in technology start-ups, and enhancements to the existing innovation incentives for science and technology SMEs (i.e. increase of super deduction bonus deduction from 50% to 75%). We set out below our observations on the progress made with these measures, and implementation issues arising in practice.

Diagram 1: China’s R&D expenditures 2012 to 2016 – in CNY billion and as % of GDP

Diagram 2: Super deduction and HNTE tax benefits 2012 to 2016

New HNTE rules demand better IP project management capabilities

The HNTE incentive provides qualifying enterprises with a 15% CIT rate in place of the standard 25% CIT rate. It also raises the ceiling for deduction of employee training expenses to 8% of employee compensation. The key qualifying conditions for the HNTE incentive were first set out in Guokefahuo (2008) No. 32 and updated in Guokefahuo (2016) No. 32. In order to qualify, the enterprise must:

Own the intellectual property (IP) for the core technologies underpinning the products and services it supplies;

Fall within one of eight specified industrial fields;

Have sufficient science and technology personnel;

Perform R&D and incur sufficient R&D expenses;

Generate sufficient revenue from high-new-technology products; and

Meet a target number of 'points' reflecting the innovative nature of the enterprise.

The eight specified industrial fields are electronic information technology, bioengineering and new medical technology, aeronautical and space technology, new material technology, high-tech service, new energy and energy saving technology, resource and environment technology, and high technology for transforming traditional industries. The calculation of points is conducted using four assessment criteria for the HNTE candidate's operations: core IP sufficiency (maximum 30 points), capability to convert R&D findings into products and services (maximum 30 points), ability to execute and manage R&D activities (maximum 20 points), and growth of revenue and total net assets (maximum 20 points). A company needs 71 points or more to qualify for the HNTE incentive.

This latest iteration of the HNTE rules, effective from January 1 2016, tightens up the IP ownership requirements above. There is more rigorous assessment of whether the IP owned by the enterprises is relevant to the products and services it supplies, to stop enterprises holding IP irrelevant to its products/services from accessing the incentive. For example, in the automotive sector, an enterprise might possess IP for an innovative car seat design. While this IP might have a considerable value, if the enterprise business has pivoted towards engine manufacturing then the company will not be in a position to use its possession of these IP rights as a basis for claiming the HNTE incentive (such matters may have been more loosely scrutinised in the past). The new rules also focus more closely on the criterion of 'capability to convert R&D findings into products and services'. The quality and 'disruptiveness', or transformational nature, of the IP embedded in the applicants' main products will be a central point of scrutiny. The enterprises must demonstrate (including through their preparation of technical documents) that they are capable of analysing and planning the use of their patents and know-how for use in products and services.

From our experience we find that domestically-owned enterprises have additional work to do in building up their IP planning capabilities to meet the new HNTE criteria. Enterprises need to get better at identifying and categorising their technical IP, and at explaining and documenting its economic value. Enterprises should seek patents for their core technologies and key products/processes, which can be shown to be a notable advance over existing technologies. They should also initiate the patent application process once early indicators of research/production show clear promise, and not wait until full production is underway. This is because the patent application will typically take a long time and delays could risk the enterprise failing to meet the HNTE application deadline (patents should be registered already at the time of application). Enterprises should also ensure that their IP management teams are built up, and develop IP development roadmaps at a group enterprise level.

Super deduction for R&D support staff and outsourcing, and enhanced for SMEs

The R&D super deduction provides a 150% tax deduction for qualifying expenses, meaning a net saving of 12.5% for every eligible expense incurred in the relevant year of income (assuming the 25% CIT rate applies). The super deduction is generally more easily accessed than HNTE status because it does not focus on R&D expenses as a percentage of turnover, or on the percentage of revenue derived from hi-tech products. The incentive also does not require that core IP be registered and owned by the Chinese entity. Rather, it focuses on the expenditure incurred being relevant to the development of new knowledge and innovations, including improved products and/or processes.

Qualifying R&D activities may include the customisation and localisation in China of products and processes that result in technical improvements to know-how, which may originally have been developed offshore (e.g. manufacturing a modified product using locally improved technologies).

As with HNTE, the super deduction qualification rules have also been updated in Caishui [2015] No. 119, effective from January 1 2016. The super deduction rules now allow a deduction in respect of costs of technical staff and R&D supporting staff, in addition to the costs of core R&D staff, as long as relevant expenses can be accurately traced and allocated to enterprise R&D projects. On this basis, a project manager or engineering support team member that contributes to a R&D project may be eligible for inclusion as 'technical staff' or 'supporting staff'. Other expenses directly related to R&D activities, such as document translation expenses, business trip expenses and conference expenses, not previously qualifying for the super deduction, now also qualify under the clarified rules. In the latest, November 2017-issued Announcement 2017 No. 40, and in line with government efforts to continually refine the guidance, the SAT helpfully clarify, amongst other matters, the inclusion of stock option plan costs in qualifying R&D expenses.

The super deduction for outsourced contracted R&D activity is also clarified in Caishui [2015] No. 119, and 80% of related expenses can avail of the super deduction. The requirement for the contracted party to provide a detailed breakdown of contracted R&D expenses has been limited to related party transactions only. This update facilitates the implementation of the policy, as it protects third parties from disclosing business details/secrets.

In addition, the clarified rules require that R&D outsourcing contracts must be registered with local Science and Technology Bureaux in order for the deduction to be available. The reluctance of some subcontractors to undertake the registration themselves has caused issues for companies claiming the super deduction, and case-by-case discussions with the authorities are needed to resolve this. A further issue relates to variations in the subcontractor contracts used. Different local authorities expect specific contract templates to be used, and may refuse registration of contracts not in line with the local template. To resolve this, the Ministry of Science and Technology in September 2017 clarified in Shuizongfa [2017] No. 106 that a 'substance-over-form' approach should be taken and that subcontractor agreements containing the essential provisions should be accepted for registration, regardless of variations in the contract format from local templates.

It should be noted that the tax and science and technology authorities are applying more stringent supervision and follow-up audit procedures, so enterprises need to control their tax risks by designing and implementing effective tracking systems and procedures. In practice, some entities have designed detailed implementation manuals to manage their super deduction claims. The manual normally covers the functions and responsibilities of internal business departments, approaches to identifying R&D activities and projects, R&D project management procedures, R&D expense allocation methods and filing requirements. Tailor-made templates, i.e. R&D technical report and labour hour record templates, are also included in the manual. The manual is a useful tool to control the risks.

As noted above, the bonus deduction has been increased to 75% (from 50%) for science and technology SMEs. Such an SME is defined in Guo Ke Fa Zheng [2017] No. 115 (Circular 115) as meeting the following criteria:

It must be a tax resident enterprise registered within mainland China;

The total number of employees must not exceed 500, and neither its annual sales nor its total assets may exceed CNY 200 million;

The products and services provided by the enterprise must not be prohibited or restricted for supply under Chinese law;

The enterprise must not have been involved in any major safety incidents or quality issues, or any serious violations of environmental law or scientific research fraud in the year in which the enterprise makes its online service platform filing, or in the prior year. In addition, the enterprise must not be included on the lists of enterprises, maintained by the State Administration for Industry and Commerce, which have been involved in operational improprieties or fraud; and

The enterprise's comprehensive evaluation score must be no less than 60 points. This is calculated on the basis of a range of innovation-related evaluation indicators specifically set out for science and technology-related SMEs. Within this composite score, the enterprise's score on the scientific and technical staff indicator must be greater than zero points.

An enterprise that meets the requirements set forth in points 1) to 4) may be directly recognised as a science and technology-related SME if it also conforms to one of the following conditions (i.e. such enterprises need not satisfy the points requirements):

It holds a valid high and new technology enterprise qualification certificate;

It has won a national science and technology award within the past five years, and ranked in the top three among all the prize winners;

It is granted recognition as an 'R&D institution' by a science and technology administration at the provincial level or above; or

It has played a leading role in developing international or national technical standards in the past five years.

The above-mentioned criterion 5) includes the three categories: (i) scientific and technical staff, (ii) R&D expenditure, and (iii) scientific and technological achievement. A maximum score of 100 points is possible.

Establishment of innovation demonstration zones in China

The State Council on May 12 2016 issued Guo Ban Fa [2016] No. 35, mandating the establishment of entrepreneurship and innovation demonstration bases, and listing the first batch of 28 zones. This was then supplemented by Guo Ban Fa [2017] No. 54 that established a further 92 bases. The now 100-plus bases provide key support and backing to start-ups and research-driven enterprises. The coverage of the bases is wide. Of the 92 set up in 2017, 45 are set up in designated city zones, including Beijing Shunyi District, and Tianjin Binhai High Tech Industrial Development Zone; 26 are located at universities and scientific research institutions, including Peking University and Fudan University; and 21 are enterprises, including Aviation Industry Corporation of China, and Baidu, among others.

It is intended that the initiative will help to spread mass innovative activity across a wider range of business sectors and a large number of provinces in China. The demonstration zones are expected to set the bar with new rules on the protection of intellectual property rights, and to facilitate the commercialisation of research results. The State Council circular encourages demonstration zones to formulate flexible policies to attract high-quality personnel, and support entrepreneurial activity by Chinese returning from overseas.

Advanced technology services enterprise incentive to be expanded nationwide

An existing pilot programme of corporate tax incentives for advanced technology services enterprises (ATSEs) is in the course of being expanded nationwide. Qualifying ATSEs engaging in service outsourcing businesses are offered preferential CIT treatment, including:

A reduced CIT rate of 15% (standard rate is 25%); and

The ability to tax deduct employee education expenses up to a limit of 8% of total employee expenses (otherwise limited to 2.5%).

As regards the qualifying criteria, compared to HNTE, the IP ownership and R&D investment requirements are less relevant (and consequently less onerous), especially in relation to information technology outsourcing (ITO) and business process outsourcing (BPO). This being said, there are requirements concerning the education level of staff and the proportion of income from 'offshore advanced technology services' (at least 35% of annual income). At present the ATSE incentives are available for enterprises registered in 31 pilot cities, mostly in the developed east of China, with some central and western region cities also in scope. The expansion of the scheme provides key support to China's economic rebalancing, away from simple processing activity, towards advanced, tech-driven services.

Technology start-up CIT and individual income tax (IIT) investment incentives

A crucial underpinning for China's expanding innovation economy is the development of new, flexible financing channels for technology start-ups and SMEs. China's largely state-owned banking sector remains very much oriented towards the needs of large, particularly state-owned, industrial enterprises, and small enterprises frequently face severe challenges in raising capital. To foster the development of VC enterprise and individual 'business angel' investor financing, the authorities have been developing supportive tax policies. The Ministry of Finance (MOF) and the State Administration of Taxation (SAT) issued Cai Shui [2017] No. 38 in April 2017 providing IIT and CIT incentives to be initially piloted in eight designated locations, including Beijing-Tianjin-Hebei, Shanghai, Guangdong, Anhui, Sichuan, Wuhan, Xian, Shenyang, as well as Suzhou Industrial Park. The rules provide that where investments are made in science and technology enterprises seeking capital or start-up stage support (technology start-ups), and where the investment is for a period of two years or more, then 70% of the investment amount can be offset against the taxable income of the investor.

Any unused balance may be carried forward and used against further future disposal gains from equity in the same enterprise. Where an individual investor makes investments in several technology start-ups in the pilot area, and the de-registration/liquidation of one of the invested technology start-ups limits the degree to which the 70% investment deduction for that start-up can be utilised, then this may be offset against taxable gains arising from disposals of equity in other invested technology start-ups. It is yet to be clarified whether these technology start-ups need to be within the same given pilot area or whether this covers invested start-ups in all pilot areas. This offset must be used within 36 months of de-registration/liquidation of the invested technology start-up.

The individual 'business angel' investors cannot be the founders or employees of the invested technology start-ups, there are percentage limitations on holdings, and the investments must be in the pilot zones.

Technology innovation underpins future growth

Technological innovation, particularly by small-to-medium enterprises (SMEs), is a driving force of Chinese economic growth, and a large number of government initiatives are directed at supporting this in the 13th five-year plan period. Enterprises should keep informed of the latest refinements to these incentives so that they can make the most of them. For all the incentives, the manner in which innovation activity is planned and tracked/documented within the enterprise is key. Expert advice should be obtained, where required, to ensure that inadequate systems and procedures do not result in enterprises being 'locked out' of these valuable benefits.

Bin Yang |

|

|---|---|

|

Partner, Tax KPMG China 21 Floor, CTF Finance Center 6 Zhujiang East Road, Zhujiang New Town Guangzhou 510620, China Tel: +86 20 3813 8605 Bin Yang has 13 years of experience with the Department of Commerce, focusing on inbound investment policy advisory and investment project management. He then joined a multinational retailing company as the head of corporate development, legal and government affairs, and was responsible for providing professional opinion and services on development strategy, operational compliance and government affairs. Bin joined KPMG Guangzhou in 2006. He has extensive experience in corporate compliance and corporate structure advisory. Bin's clients include numerous eminent multinational enterprises, as well as small and medium size companies in retailing, manufacturing, real estate and service industries. Having extensive experience working with the government, Bin has in-depth knowledge with respect to the regulations governing both domestic and overseas companies, as well as corporate structure. With sound understanding in the practical requirements of investment approval and management in major cities in mainland China, he has successfully assisted many overseas companies to establish subsidiaries/branches/representative offices in China. In addition, Bin has led many business and tax planning advisory projects for corporate restructuring, and the subsequent implementation tasks. Bin is the leader of the research and development (R&D) team of KPMG China. He has abundant experience in R&D services, including high and new-technology enterprise (HNTE) assessments, R&D expense super deductions, assisting clients in the development of R&D management systems and defending their HNTE status. As a key contact between KPMG and the government R&D department, Bin has maintained strong relationships and sound communication with related departments and provides advice on policy planning. Bin has an MBA. |

Rachel Guan |

|

|---|---|

|

Director, Tax KPMG China 8/F, KPMG Tower Oriental Plaza, No. 1 East Chang An Ave. Beijing, China Tel: +86 (10) 8508 7613 Rachel Guan started her career with a professional accounting firm in Australia in 2002. In 2006, Rachel joined KPMG's Beijing office and has focused on providing China tax services to foreign investors on investment regulatory advisory, foreign exchange, transfer pricing, establishment of companies in China, tax planning and design of tax effective investment structures/restructuring. Rachel has extensive experience in setup services, tax compliance reviews and tax due diligence engagements. Rachel also spent several months in Seattle in 2012, serving as the direct, on-the-ground resource for technical Chinese tax matters for KPMG's local clients in the US, specifically for hi-tech multinational companies. Rachel is one of the key members of KPMG's north China research and development (R&D) tax services practice. She is specialised in providing assistance with R&D tax incentive review and detailed restructuring or improvement implementation plan execution to help entities comply with the R&D tax incentive requirements. Rachel's R&D tax service clients include multinational companies and both state-owned and privately owned enterprises in the manufacturing, fintech, finance and banking, food and beverages, and electronics and IT industries. |

Josephine Jiang |

|

|---|---|

|

Partner, Tax KPMG China 8/F, KPMG Tower Oriental Plaza, No. 1 East Chang An Ave. Beijing 100738, China Tel: +86 10 8508 7511 Josephine Jiang is KPMG's Beijing-based tax partner, focusing on research and development (R&D) tax, as well as mergers and acquisitions (M&A) and international tax. She has been practising tax for more than 15 years. Josephine has extensive experience in Chinese domestic and international tax. She has served many large multinational enterprises, state-owned enterprises, venture capital companies and private equity firms. She has significant experience in dealing with various tax issues including global tax minimisation, tax efficient financing, tax risk management, and domestic tax issues such as pre- initial public offering (IPO) restructuring. She has worked extensively on M&As including due diligence, designing and implementing complex takeover transactions and reorganisations. Being the R&D tax lead partner in Northern China, Josephine has worked closely with her team to provide R&D tax services to clients across industries. From 2008 to 2009, Josephine spent one year practising international tax in the New York office of another Big 4 firm with a focus on China inbound investments by US multinationals. Josephine also participated in the effort to provide commentary to the China tax authority on their recent international tax and M&A regulations. |

Henry Ngai |

|

|---|---|

|

Partner, Tax KPMG China 26th Floor, Plaza 66 Tower II 1266 Nanjing West Road Shanghai 200040, China Tel: +86 21 2212 3411 Henry Ngai started his career with KPMG China's tax practice in Hong Kong in 2002. Henry advises multinational clients on taxation, foreign exchange, customs and business regulations in respect of business activities in China. Taxation issues include corporate tax, individual tax, indirect taxes, such as value added tax, business tax and customs duties. Henry has also assisted many foreign investors in their tax due diligence projects and provided subsequent structuring or integration advice from a tax perspective. Henry has provided various tax advisory and compliance services to multinational enterprises in different business sectors, such as pharmaceutical, industrial and hospitality sectors. He has extensive experience in advising clients in appropriate corporate structures for business operations. With over 14 years' China tax experience, Henry has helped many multinational enterprises to establish their company structure, improving tax efficiency of their Chinese businesses and providing tailor-made advice to their future operations. |