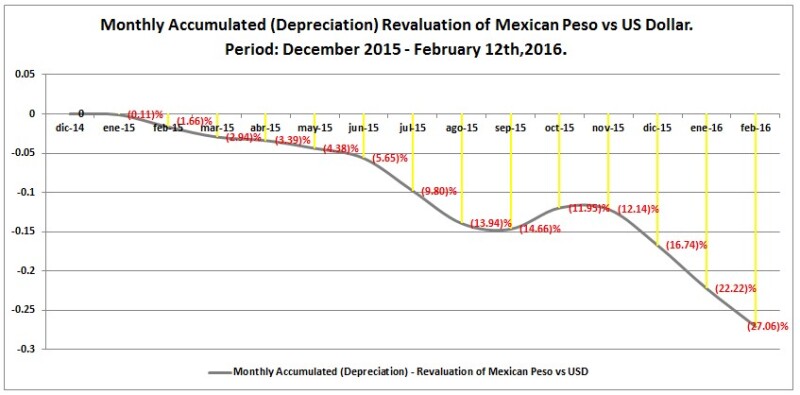

From 2015 until February 12 2016 the exchange rate of Mexican peso with respect to the US Dollar has suffered an average monthly depreciation of 1.93%, which represents accumulated depreciation of 27.06% since December 2014.

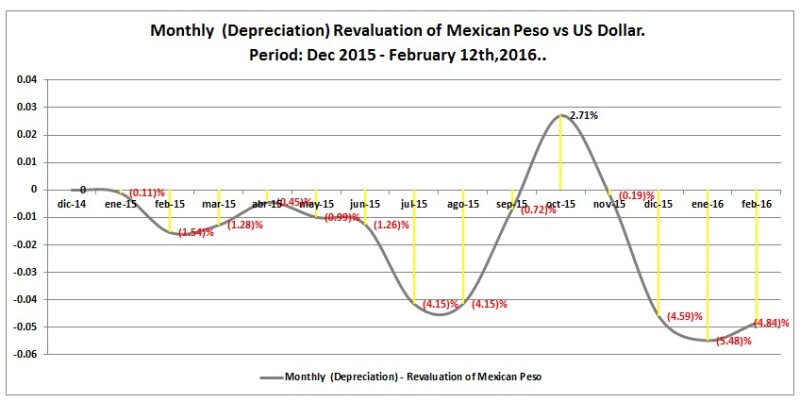

From a monthly basis perspective, the most significant months in 2015 were July and August, each with a 4.15% of depreciation of the Mexican peso. However, until February 12 2016 the depreciation percentage is 4.84% with respect December 2014, as shown in the graphic below:

The monthly accumulated depreciation of the Mexican Peso vs US Dollar from December 2014 to February12 2016 is the following:

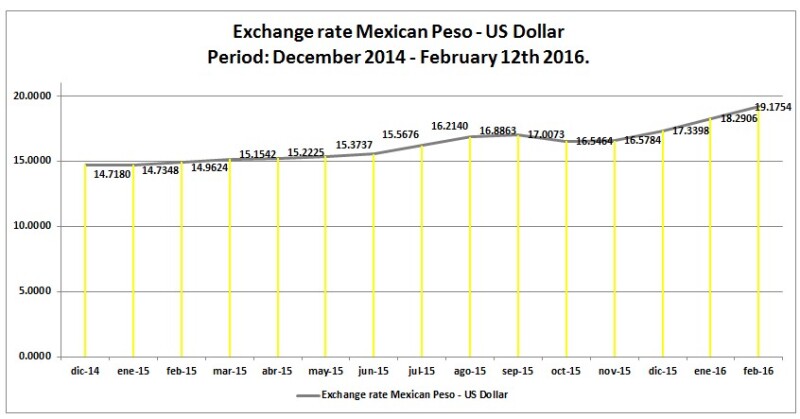

The next graphic illustrates the exchange rate of the peso vs the dollar on a monthly basis from December 2014 to February 12 2016.

US GAAP, IFRS and Mexican financial reporting standards effect on the exchange rate

From a perspective of full compliance with the applicable accounting standards under IFRS, US GAAP and Mexican financial reporting standards, we should be focus on the three key standards that states the treatment of the exchange rate effects in the financial statements of both public (listed entities) and not public entities (not listed entities) as follows:

| Origin of the financial reporting standard |

Applicable financial reporting standard to the treatment of effects of changes in foreign exchange rates. |

| United States |

US-GAAP Accounting Standards Codification – ASC – 830 – Foreign Currency Matters |

| Mexico |

Mexican Financial Reporting Standard – (MFRS) C15 – Foreign Currency Translation. |

| Europe (London) |

IFRS - International Accounting Standard (IAS) - 21 – The effects of changes in foreign exchange rates. |

These applicable financial accounting standards agreed with the importance of identify the following types of currency from a perspective of financial operations and financial reporting:

Registry currency: Is the currency used to prepare and keep the accounting of an entity? (Under Bajo IFRS this concept is not defined).

Functional currency: An entity's functional currency is the currency of the primary economic environment in which the entity operates; normally, that is the currency of the jurisdiction in which an entity primarily generates and expends cash.

Reporting currency: The currency in which a reporting entity prepares its financial statements. (Under IFRS this currency is known as the presentation currency).

Initial measurement

ASC-830 (US-GAAP) and IAS-21 (IFRS) state that at the date a foreign currency transaction is recognised, each asset, liability, revenue, expense, gain, or loss arising from the transaction shall be measured, in the first instance,in the functional currency of the recording entity by use of the exchange rate in effect at that date.

C-15 (MFRS) states the following: all foreign transaction must initially be recognised in the registry currency using the exchange rate in effect at that date (usually known as the historical exchange rate).

Subsequent measurement

ASC-830 (USGAAP), IAS-21 (IFRS) and C15 (MFRS) agreed with respect the treatment of the subsequent measurement of foreign transactions, as follows:

| Kind of asset |

Date of subsequent measurement |

Applicable exchange rate |

Recognition of the foreign exchange rate in the financial statements |

| Monetary assets (for example: cash, financial instruments, accounts receivables in foreign currency) |

At the date of the financial statements. |

Exchange rate at the date of the financial statements. |

Exchange differences arising on the settlement of monetary items or on translating monetary items at rates different from those at which they were translated on initial recognition during the period or in previous financial statements shall be recognised in profit or loss in the period in which they arise, except especial cases such as: exchange differences arising on a monetary item that forms part of a reporting entiy’s net investment in a foreign operation. |

Realisation date (collection or settlement in the case of liabilities) of the transactions in foreign currency. |

Exchange rate at the date of the financial statements. |

||

| Non-Monetary Assets (for example; Inventories, fixed assets, intangibles) |

At the date of the financial statements. |

Keep the historical Exchange rate of the initial recognition, even if the fair value accounting is utilised. · A special case may be found in ASC- 830 US-GAAP) when there is a change in the functional currency , from the reporting currency to the local currency when an economy ceases to be considered highly inflationary shall be accounted for by establishing new functional currency bases for nonmonetary items. |

Without effects. |

Based on the above table, the changes in the exchange rate of the peso with respect the dollar affects directly the profit or loss of the entity.

C. The effects on the effective tax rate 1. Corporate income tax.

1.1. Exchange gains or (losses) under the Mexican Income Tax Law.:

|

|

Article 8 of the Mexican Income Tax Law. |

|

| Concepto |

Treatment of the accrued exchange gain or losses |

Limit of the exchange losses |

| Exchange gain or (loss) |

The treatment that this Law sets forth for interest shall be applied to exchange gains or losses accrued from foreign-currency fluctuations, associated to principal and interest |

Exchange losses may not exceed the amount which would result from using the exchange rate to settle foreign-currency obligations payable in the Mexican Republic established for such purpose by Mexico's central bank and published in the federal register, corresponding to the day on which the loss is sustained. |

Under the Mexican Income Tax Law, the accrued exchange gain will be complete taxable income and will increase the corporate income tax. On the other hand, the exchange loss will be deductible following the limit in the use of the official exchange rate.

2.0 Deferred taxes (income taxes).

The rules of the article 8 of the Mexican Income Tax Law state that the accrued exchange gain or loss will have definitive effects, which means that no deferred taxes will be recognised at all regarding the exchange gain or loss. However, the effective tax rate may be affected in those entities (listed or not) which have the dollar as both functional and reporting currency, if those entities are translating their tax values of the non- monetary assets by using the current exchange rate at the date of the financial statements instead of keeping the historical exchange rate utilised in the initial measurement, as explained above. The more the peso depreciates against the dollar, the lower value in dollars may be found in the tax basis of non-monetary assets. This can cause higher deferred tax liabilities if the entities do not keep the historical exchange rate of the tax basis.

Under the ASC-740 (US-GAAP), IAS-12 (IFRS) or MFRS D-4, which all concern income taxes, there is no guidance regarding the use of an exchange rate for the tax bases of non-monetary assets. For example, under IAS-12, the tax base of an asset or liability is the amount attributed to that asset or liability for tax purposes. Under the Mexican Income Tax Law, the tax base of a non-monetary asset remains the same during its useful life, not impact at all is recognised for the changes in the exchange rate.

In July 2015, the Interpretations Committee of the IASB received a submission regarding the recognition of deferred taxes when the tax bases of an entity’s non-monetary assets and liabilities are determined in a currency that is different from its functional currency. The question is whether deferred taxes arising due to the effect of exchange rate changes on the tax bases of non-current assets are recognised through profit or loss.

In the light of the existing IFRS requirements, the Interpretations Committee determined that neither an interpretation nor an amendment to a standard was necessary, and therefore decided not to add this issue to its agenda.

2.1 Illustration of the effects of changes in the exchange rate in the effective tax rate.

The next example illustrates the effect in the effective tax rate for the increase in the Exchange rate.

|

|

Concept |

Amounts |

Functional currency USD- Increase in the deferred tax liability due to the conversion of fixed assets (non-monetary assets) using exchange rate at the end of the reporting period (instead of using the historical exchange rate of acquisition of fixed assets). * |

Amount with exchange rate |

|

|

Corporate income tax expense |

$1,625,000 |

|

$1,650,000 |

| (+) |

Deferred income tax –benefit |

(400,000) |

150,000 |

250,000 |

| (=) |

Total of income taxes |

1,225,000 |

0 |

1,375,000 |

| (/) |

Profit before income taxes |

3,673,000 |

0 |

3,673,000 |

| (=) |

Effective tax rate |

33.35% |

0 |

37.44% |

*A lower tax value of non-monetary assets may be determined if an entity utilised the exchange rate at the date of the financial statements, instead of using the historical exchange rate of the initial recognition of the non-monetary assets. The higher the exchange rate is of the pesos against the dollar, the lower the tax basis of non-monetary assets and therefore higher deferred tax assets may be determined due to recognition of changes in the tax basis of non-monetary assets that may not be deductible or taxable, since the tax basis as recognised by the tax authorities remains the same.

A number of entities with the dollar as functional currency and tax basis of non-monetary assets in a different currency may have important effects in case of applying the exchange rate at the date of the financial statements to remeasurement of the tax basis in jurisdiction were the tax basis remain the same for tax deduction purposes. This topic should be carefully reviewed in terms of both financial reporting standards and tax rules.

Gustavo Gómez (gustavo.gomez@mx.ey.com) is a tax partner and José Antonio Abrajan (jose.abrajan@mx.ey.com) is a tax accounting partner, at EY Mexico - the principal Mexican correspondents of the Compliance Management channel on www.internationaltaxreview.com

EY’s other tax compliance partners in Mexico City are:

Hector Armando Gama Baca (hector.gama@mx.ey.com)

Fernando Tiburcio Lara (fernando.tiburcio@mx.ey.com

Juan Manuel Puebla Domínguez (juan-manuel.puebla@mx.ey.com)

Raúl Tagle Cázares (raul.tagle@mx.ey.com)

Ricardo Delgado Acuña (ricardo.delgado@mx.ey.com)