A bill of tax amendments submitted by the Executive Branch and approved by the Mexican Congress included changes to Article 5-I of the Value Added Tax Law (VAT Law), regarding the creditable VAT of fixed assets or expenses incurred in preoperative periods (i.e. before generating VAT income on its activities).

Under Article 5-I as it now applies, taxpayers may credit VAT paid on the purchase of fixed assets and/or on expenses incurred in a preoperative period.

Prior to the amendment, which will have effect from January

Under the changes made to the VAT Law, and according to the explanatory memorandum accompany the legislation, if the taxpayer’s activities do not result in a VAT, then the credit against the tax will be disallowed, and therefore the economic burden of the tax will be borne by the taxpayer as the final consumer.

The VAT amendment

From January

The taxpayer may request the related refund to be delayed until the first month in which it performs activities that are subject to VAT (an inflation adjustment is allowed); or

Request the VAT refund in each month in which the preoperative expenses or purchase of fixed assets are incurred, according to a forecast of the activities subject to VAT and provided that the taxpayer submits certain information.

It is important to mention that the provision defines the term “preoperative period” as the period of time in which the expenses and purchase of fixed assets are incurred, prior to the beginning of any activities by the taxpayer involving the sale of the goods, provision of services or leasing of the goods.

The VAT Law also defines that the preoperative period may have a maximum duration of one year from the date of the first VAT refund

However, there is no certainty for the taxpayer that the tax authorities will approve the extension to the preoperative period because there are no specific guidelines for such purposes. As a consequence, this could result in the extension being refused and the refunds being denied.

The financial cost

This amendment will generate a financial cost for investors because the VAT credit will only be allowed

Has started operating; or

In the event that the tax authorities deny an extension to the preoperative period, specifically in the last year of the preoperative period.

For purposes of quantitatively illustrating the financial cost of the bill in the event that the tax authorities deny the request of the taxpayer for an extension, below is a comparison

Total investment: $1 billion

Preoperative period: three years

Operative period: three years

Cash flows for the operative period: $400 million, $450 million and $500 million

Funds source: debt

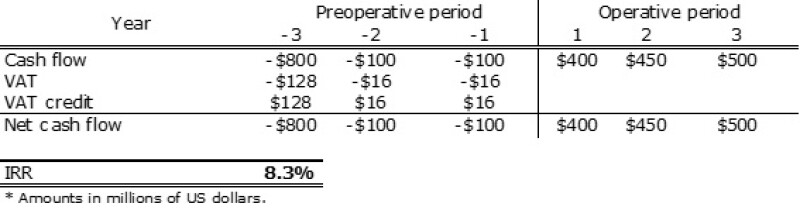

The following table illustrates the cash flow projection, taking into consideration the VAT crediting mechanism in force during the preoperative

As it may be observed in the chart above, the VAT credit is applied on an annual basis on years -3, -2 and -1, which is in the preoperative years of the project, while the resulting internal rate of return (IRR) is 8.3%.

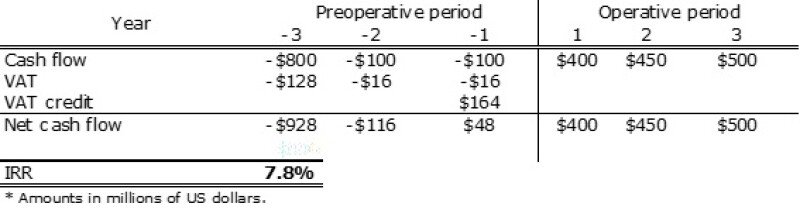

On the other hand, Chart 2 shows the cash flow projection under the VAT crediting scheme that will enter

As it may be observed, the VAT credit is applied

All other things being equal, this change in the VAT crediting mechanism makes this hypothetical investment project 0.50% less profitable due to the fact that the positive inflow of the VAT credit for the investment project is delayed by two years.

From a financial standpoint, the fact that a positive inflow is delayed will reduce the profitability of the project as a whole, provided all other things remain equal. However, the actual reduction in the profitability will depend on the characteristics of each project.

This decrease in the profitability of the project would be transferred to the Mexican government because VAT paid at the beginning of the preoperative period would be held until the last year of the preoperative period, which would involve financial benefits for the Mexican government over time.

The reduction in the profitability of the project, as described above, only derives from the change of the VAT crediting system. It does not consider any other possible impacts, such as the reduction of the cash flows of a project resulting from a higher financing cost.

In this sense, it is important to analyse the financing cost that the amendment of the VAT provisions implies. For such purposes, a hypothetical loan is considered for the project with the following characteristics:

Principal amount: $1 billion

Financing period: six years (three preoperative years and three operative years)

Interest rate: 6.18%

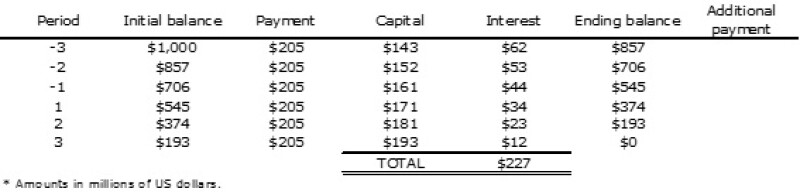

The following table illustrates the amortisation of the

As it may be observed, the total interest expense in the six-year period is $227 and the annual payment is $205.

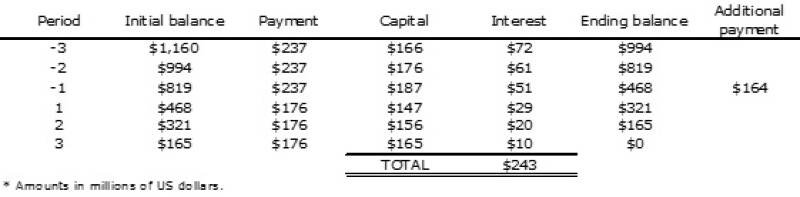

In comparison, the following table illustrates the amortisation of the loan, taking into consideration a 16% increase in the principal amount in order to finance VAT during all the preoperative periods of the project. An additional payment in

As it may be observed, the total interest expense in the six-year period is $243, which represents an increase of 6.9% of the total interest expense on the original loan. Moreover, the annual payment in the preoperative period is increased by $32, which represents a 16% increase from the original amount. This increase will certainly have a negative impact on the cash flows of the project, reducing its profitability.

Moreover, the significant increase in the annual payment may complicate the conditions for the creditworthiness of the investor so that the latter may obtain the loan necessary to start the project and may lead the investor to search for better financial conditions in other countries.

Comparative indicators

Once we have analysed two key indicators of the profitability of a project, it is important to review certain comparative indicators for an investment project in Mexico.

According to the OECD, the average three-month interbank rate across the OECD member countries as of October 2016 is 0.50%, whereas in Mexico it is 5.19%. Furthermore, the average income tax rate across the OECD nations is 22%, while income tax rate in Mexico is 30%. Moreover, according to the OECD, the average consumer price increase for 2016 across OECD countries is 1%, whereas in Mexico it was of 2.8%.

In addition, the following graphic shows the behaviour of the exchange rate (Mexican peso v. US dollar) during the 2005-2015 period.

|

* Exchange rate Mexican peso v. US dollar, to fulfil obligations denominated in foreign currency. Source: Banco de México. |

As shown in the graphic above, the exchange rate of the Mexican peso compared to the US dollar has increased considerably over the past decade. Moreover, considering the maximum exchange rate registered in 2016, it represents a depreciation of the Mexican peso of approximately 20% in 2016 alone.

This situation highlights that if an investment project is funded through a loan denominated in US dollars, the financial cost may increase significantly over the life of the project. On the other hand, if the project is funded in Mexican pesos, the costs of the project may increase

These indicators show that in general terms, Mexico is a country with comparatively high financial and tax costs, as well as a higher than expected increases in prices.

The fact that the financial costs are increased as a result of the changes to the VAT rules mean Mexico has not helped its position as an attractive jurisdiction for investment.

Finally, it is important to note that in the explanatory memorandum of the 2013 tax bill, the VAT has favourable effects on investments, savings and employment and consequently on the economic growth of the country. This is because VAT does not tax the investment because it allows the credit on the VAT paid in the acquisition of fixed assets even in a preoperative period, avoiding an increase in the cost of capital and without establishing a limit for preoperative periods.

Conclusions

The modifications of the VAT provisions from January

|

Ignacio Mosquera, Chevez, Ruiz, Zamarripa |