Background to China's healthcare systems reforms

The new China healthcare system reform (CHCSR) was given its full-scale launch in 2009, with the issuance, by the Central Committee of the Communist Party of China (CPC) and the State Council, of the Opinions on deepening the Healthcare System Reform.

The overall goal of CHCSR is to establish and improve the basic healthcare system covering urban and rural residents, and provide the Chinese people with secure, efficient, convenient and affordable healthcare services. This reform gradually strengthens the leading role of government. It introduced a number of reform measures, such as:

The separation of drug income from total medical income;

Control of medical insurance expenses; and

Reduction of drug prices.

In "Opinions on Deepening the Healthcare Reform in 2016", (Guobanfa (2016) 26, hereafter referred as Circular 26) it is specified that

"… the two invoices system will be rolled out to public hospitals in comprehensive Healthcare Reform pilot provinces. It is encouraged that hospitals directly settle the drug payment with drug manufacturers and drug manufacturers settle the drug logistics fees with distributors, which aims to compress intermediate processes and reduce unrealistically high drug prices."

According to the spirit of Circular 26, the "two invoices system" will be rolled out to the provinces of Anhui, Jiangsu, Fujian, Qinghai, Shanghai, Zhejiang, Hunan, Chongqing, Sichuan, Shanxi and Ningxia. Depending on the result and feedback, then the two invoices system may be rolled out nationwide.

The most pioneering city in healthcare reform in China is Sanming, a city in Fujian province, which has experienced significant reform since 2011. The reform in Sanming has demonstrated significant achievements in terms of savings in social medical insurance funds, reduction of drug prices, optimisation of hospital income structures, income improvements for the medical workforce, and enlargement of social medical insurance coverage. It has had a profound impact on the government, pharmaceutical companies, as well as medical insurance and medical service providers. The details are summarised in the table below.

More details on the Sanming healthcare reform can be found in the KPMG report, entitled "Sanming: The real story of grass-roots healthcare transformation in China".

On September 29 2016, Anhui province issued its detailed implementation rules for the roll out of the "two invoices system" (the Anhui two invoices system plan). Anhui was the first province out of the 11 provinces to put in place the two invoices system, after the Sanming reform, from November 1 2016.

Many other pilot provinces/cities have issued guidance for the roll out of the two invoices system. However, these guidance policies fall short of the details on how the system will be implemented or when it will be implemented. The comments made in this article are mainly based on the practice in Sanming and the Anhui two invoices system plan.

Figure 1 |

Click on image to enlarge |

What is the "two invoices system"?

According to Article 4.2 of Circular 26, the two invoices include the following:

The first invoice refers to the invoice from the manufacturer to the distributor; and

The second invoice refers to the invoice from the distributor to the medical service providers.

Furthermore, pursuant to Article 39 of Weiguicaifa (2010) 64 (Circular 64), the following companies can be deemed as manufacturers:

A commercial enterprise set up by a manufacturing company that sells the products of the company only; and

Master agent of the imported drug for China (only one allowed);

Under the Anhui province two invoices system plan, the deemed manufacturer will also cover the following in addition to the above situations:

Commercial enterprises set up by the manufacturing company that sells the product of the group only; and

A drug listing permit holder who assigns another manufacturing company or commercial enterprise to sell the drug.

By adopting the two invoices system, the unnecessary invoice "pass through" within the value chain is expected to be eliminated, as well as increasing transparency over the pricing of drugs.

What is the impact for pharmaceutical company business models?

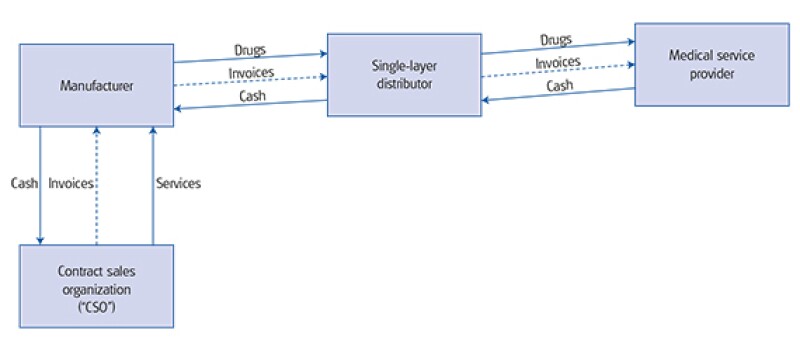

Before we look at the business impact of the two invoices system it is necessary to first understand the existing business models used by pharmaceutical companies. At present, the common business model of pharmaceutical companies could be depicted as shown in Model 1.

The manufacturer will sell the drugs at a relatively low price to the distributor. The margin retained in the distribution channel will be used to cover the promotion, marketing and sales support-related services provided by the distributors. Under this model, the drugs will be sold through multiple distributors before being sold to the medical service provider at a much higher price.

Under Model 2, the manufacturer will sell the drugs at a higher price to the distributor. The distributor will earn a limited margin for the distribution services provided. The promotion, marketing and sales support-related services provided by a third party will be compensated via commission/service fees paid by the manufacturer.

Model 1: Buy-sell model |

|

Model 2: Commission/service fee model |

|

Due to the implementation of the two invoices system, model 1 will be phased out as there will only be one distributor allowed in the value chain. As such, any service providers that exist in the supply chain will need to be compensated separately through the commission/service fee arrangement. It is expected that more and more service providers will become specialised contract sales organisations (CSOs) as shown in model 2. It can also be foreseen that large distribution organisations will carve out their sales support divisions and put that into separate legal entities to comply with the two invoices system.

Where pharmaceutical manufacturers adopt model 2 to comply with the two invoices system, consideration should be given to the business and financial aspects, which are discussed in further detail below.

Business impact

The channel management for the pharmaceutical companies would change from a hierarchical structure to a flat structure under the reforms. Pharmaceutical companies may have to engage different distributors in each province based on the authorised distributor list of each province. More specifically, in some remote areas where the first tier distributor does not have direct presence, pharmaceutical companies would need to deal with the distributors in those locations directly. This will increase the number of distributors to be managed by the pharmaceutical company.

There will also be less invoice "pass through" arrangements due to the two invoices limitation. As such, many of the smaller/regional distributors would be acquired by large distributors or be forced out of business.

Financial impact

For those pharmaceutical companies that are operating under model 1, there are inventories maintained by distributors throughout the supply chain. Before the implementation of two invoices system, there is a need to clear those inventories from the supply chain. This will have an impact on the sales of the pharmaceutical companies in the short term.

Under the Anhui two invoices system plan, the distributor is required to submit the invoice issued by the manufacturer or importer to the hospitals. This requirement will ensure that drugs delivered to the hospitals are the same batch sold by the manufacturer or importer. In the meantime, it also makes the ex-factory price or selling price of the importer transparent to the hospitals. The hospitals procure the drugs based on the pre-determined price through the bidding/negotiation process. Currently, the price differences between the ex-factory price and the hospital purchase price are much greater than the normal margins earned by a pure distributor. The challenge to the manufacturer is how to determine its ex-factory price under the two invoices system.

If the manufacturer decides to increase its ex-factory price to match the purchase price of the hospital (excluding the distributor fee), it may represent a significant upwards adjustment of its selling price. The increase of its selling price will lead to higher VAT payable by the drug manufacturer. While the tax authority would most likely welcome such an increase, it may also raise an enquiry on the price fluctuation and in particular, the lower price adopted in the past.

If the manufacturer decides not to increase its ex-factory price, the two invoices system would disclose this ex-factory price to the hospital, which may demand a reduction of its purchase price. This will help to achieve the objective of lower drug prices set by the healthcare reform. However, this is also likely to lead to lower margins earned by the drug manufacturers if they have to pay the CSOs for the marketing and promotion services provided. Such a drop in the operating margin will likely attract an enquiry from the tax authority immediately. In order to maintain the target operating margin under its current transfer pricing model, the drug manufacturer may look to adjust the transfer pricing arrangement with its overseas supplier, either from the import price of the active pharmaceutical ingredients (API) or other key components required for its operation in China.

The CSO plays an important role in the promotion and marketing of the drugs to hospitals and doctors. Typically, the commission/service fee of the CSO will be calculated as a percentage of sale of a particular drug. There is a question of whether such fees would be treated as commission and subject to 5% deduction limit for commission expenses under the Corporate Income Tax Law. The genuine business substance of the commission/service fee should also be analysed from compliance perspectives.

For imported drugs, most of the multinational pharmaceutical companies will engage a third party logistics service provider to act as the importer and the distributor of the imported drugs due to the distribution license restriction in China. If there are currently more than two invoices in the distribution channel, i.e. from the importer to the hospital, some of the distributors in the supply chain will be eliminated. If those distributors also provide marketing and sales support services, they will need to be compensated by the overseas products owner directly. However, whether the overseas pharmaceutical companies are willing to engage directly with such service providers in China would depend on their assessment on the qualification and compliance status of the service provider. Therefore, it is likely that more multinational pharmaceutical companies will bring the marketing and sales support services into their own subsidiaries in China for better management of such activities.

As mentioned before, it is likely that the two invoices system will give rise to many specialist CSOs which will carry out the marketing and promotion activities historically performed by the multiple-layer distributors and bear such costs. MNE pharmaceutical companies have the option to either engage third-party CSOs directly or engage related party CSOs (or a related party consultancy company which subsequently procures the services from third party CSOs). When the CSOs are related to the MNE pharmaceutical companies, their arrangements with the MNE pharmaceutical companies are subject to transfer pricing regulations which mean that the transactions must be conducted at arm's length.

The exact level of compensation to the related-party CSOs or consultancies will depend, to a large extent, on the nature of activities that will be carried out by the CSOs or consultancies. If the CSOs' activities are akin to what would be carried by the multiple-layer distributors historically and will contribute directly to the sales of drugs, tax authorities are more likely to argue for a commission-based pricing. If, on the other hand, such CSOs or consultancies' activities are more ancillary or supportive in nature, a cost plus arrangement may suffice. This being said, the two invoice" system will have great impact on the commercial landscape of the pharmaceuticals industry in China, and companies' transfer pricing adjustments must adapt to the changing business environment.

In order to better manage the distribution of imported drugs in China, some multinational pharmaceutical companies are looking for ways to acquire the good supply practice (GSP) license. If they are successful, it will consolidate the importation and sale of the imported drugs with the marketing and sales support activities into one commercial legal entity. While this brings greater control to the management and the distribution activities in China, such change presents more challenges when the commercial company with the GSP license tries to minimise the fluctuation of the import price, meeting the targeted operating margin for tax purposes and achieving a reasonable selling price into the hospitals. These considerations send conflicting signals for the determination of the transfer price between the overseas product owner and the Chinese commercial company. Approaching this in a holistic manner and advance consultations with the relevant government authorities would be critical in order to minimise further audits/enquires on the transfer pricing arrangement of the commercial company.

Our suggestions

On a broader scope, pharmaceutical companies should follow closely the evolving healthcare reform, in particular the two invoices system, in China.

Pharmaceutical companies should review and understand the new features of the two invoices system from the latest rules issued in Anhui province and the reform in Sanming. Based on those policies, the pharmaceutical companies should assess their business models with regards to the setting of ex-factory prices and the bidding prices, arrangements with distributors and CSOs, and the transfer pricing arrangements with overseas related companies.

|

|

Grace XiePartner, Tax KPMG China 50th Floor, Plaza 66 1266 Nanjing West Road Shanghai 200040, China Tel: +86 21 2212 3422 Grace Xie started her career as a professional accountant in 1993 in Sydney, Australia. She joined KPMG Hong Kong in 1998 to specialise in China tax, moving to KPMG Shanghai in 2001. In her career as a tax consultant, Grace has rendered advice to multinational clients in a wide variety of industries, including the manufacturing, trading and service sectors. She advises clients on corporate and personal taxation and business matters relating to the establishment of business entities in China, the structuring of remuneration package and ongoing operations. Grace also has extensive experience in advising multinationals on restructuring and M&A activities in China. Grace is the tax leader for the life science and healthcare sector in China. Grace is a member of Institute of Chartered Accountants in Australia and New Zealand and the Hong Kong Institute of Certified Public Accountants. |

|

|

Henry NgaiPartner, Tax KPMG China 50th Floor, Plaza 66 1266 Nanjing West Road Shanghai 200040, China Tel: +86 21 2212 3411 Henry Ngai started his career with KPMG China's tax practice in Hong Kong in 2002. Henry advises multinational clients on taxation, foreign exchange, customs and business regulations in respect of business activities in China. Taxation issues include corporate tax, individual tax, indirect taxes, such as value added tax, business tax and customs duties. Henry has also assisted many foreign investors in their tax due diligence projects and provided subsequent structuring or integration advice from a tax perspective. Henry has provided various tax advisory and compliance services to multinational enterprises in different business sectors, such as pharmaceutical, industrial and hospitality sectors. He has extensive experience in advising clients in appropriate corporate structures for business operations. With over 14 years' China tax experience, Henry has helped many multinational enterprises to establish their company structure, improving tax efficiency of their Chinese businesses and providing tailor-made advice to their future operations. |

|

|

Thomas LiPartner, Tax KPMG China 8/F, KPMG Tower Oriental Plaza, No. 1 East Chang An Ave. Beijing 100738, China Tel: +86 10 8508 7574 Thomas Li started his career with the tax department of KPMG Beijing in 2004 and has more than 12 years of experience of Chinese corporate tax and mergers and acquisition (M&A) tax services. He specialises in consumer markets. Thomas has extensive knowledge in Chinese taxation and the practical application of Chinese taxation regulations. He has been providing advisory services in relation to investment structures, foreign exchange, the setting up of companies, and tax planning for foreign investment enterprises and domestic enterprises. Thomas is the leading tax partner for the life science and healthcare sectors in the Northern China region. He has acted as the tax adviser for many European and Japanese pharmaceutical companies for years. He took charge of the several tax advisory, M&A and tax dispute resolution projects for companies in this industry. |