At the end of last year, the Upper Chamber of the German Parliament adopted the final version of the German Regulation on the Application of the Arm's Length Principle to Permanent Establishments (the Branch Profit Attribution Regulation).

The Branch Profit Attribution Regulation provides detailed guidance regarding the application of the authorised OECD approach (AOA) in Germany, and binds the taxpayer, the tax authorities and the tax courts. The Branch Profit Attribution Regulation confirms the cliché regarding the German affinity for tax law: while the pertinent passages on the AOA in the German Foreign Tax Code include 8 sentences, the related regulation, including the reasoning, includes 142 pages.

The basic idea of the AOA is to treat a permanent establishment as a (nearly) fully independent and separate entity for tax purposes. This implies the consistent application of the arm's-length principle to internal dealings between the permanent establishment (PE) and its head office and between permanent establishments of the same company, based on a function-and-risk analysis. The Branch Profit Attribution Regulation governs, in particular, the principles of asset attribution, the branch capital allocation, and the recognition of internal dealings (so-called assumed contractual relationships in German tax law).

The AOA's general two-step approach for profit attribution has already been introduced in 2013 into Sec. 1 para. 5 German Foreign Tax Code, and is applicable for all financial years that have started after December 31 2012. This is not true for the specific application rules of the Branch Profit Attribution Regulation, which apply only for financial years starting after December 31 2014 (Sec. 40 Branch Profit Attribution Regulation). In addition to the new regulation, the German Ministry of Finance (MoF) is working on Administration Principles for the Audit of Profit Attribution to Permanent Establishments, which will be published later this year and will bind only tax auditors, not taxpayers.

The new tax rules are highly relevant, especially for financial services institutions because banks and insurance companies often operate in a branch structure within the EU.

One advantage of this structure is that the company must deal with only one supervisory authority (the so-called EU passport or single license). Like the OECD Report on the Attribution of Profits to Permanent Establishments (OECD PE Report), the German Branch Profit Attribution Regulation includes special sections on permanent establishments of banks and insurance companies that deal with the specifics of these industries.

This article summarises the special German rules for permanent establishments of financial institutions, and analyses whether they are in accordance with the OECD PE Report.

The AOA's two-step approach and the specifics of the financial services sector

Usually, arm's-length transfer prices are determined taking into account the functions performed, the risks assumed, and the assets used by the related parties involved in the intercompany transaction. In the context of PEs, however, the assets are owned and the risks are borne by the company as a whole, and cannot be legally assigned to a specific part of the enterprise. The AOA solves this dilemma by adopting a strict activity-based focus. In the first step, the significant people functions performed by the PE are identified based on the activities of locally employed personnel. Next, the assets used and risks assumed that are associated with these people functions are attributed to the different parts of the enterprise. Finally, the branch capital is attributed to the PE in relation to the attributed functions and risks. On the basis of this attribution, the internal dealings between the head office and its permanent establishment(s) and between PEs of the same company are identified and an arm's-length remuneration is determined. For this, the guidance of the OECD Transfer Pricing Guidelines can be applied analogously.

The central business activity of banks and insurance companies is the assumption of risks, manifested in the conclusion of loan agreements and insurance contracts respectively. The OECD PE Report attributes the core financial assets of financial services companies (the loans and insurance contracts) and, therewith, the associated opportunities and risks to the permanent establishment that has performed the key entrepreneurial risk-taking (KERT) function, the most important function in the process of risk assumption. All other PEs involved in the business must be remunerated at arm's length for their contribution, based on internal dealings.

Moreover, the international profit attribution with respect to banks and insurance companies must take into account regulatory requirements. In particular, the regulatory law is focused on the capitalisation of financial services institutions, because capital is needed to back the risks assumed. Therefore, capital is a key value driver in the financial services sector and the branch capital allocation has a significant impact on taxable income.

Permanent establishments of banks

Attribution of loans

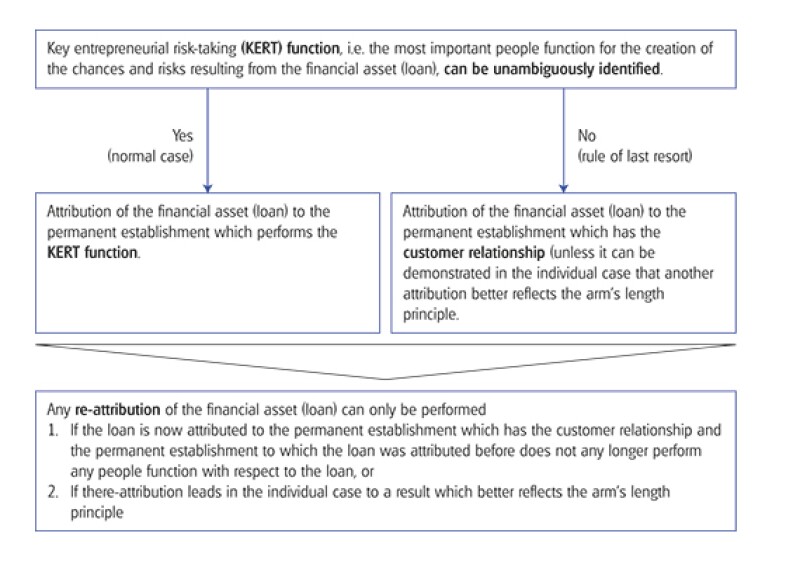

For financial assets resulting from the traditional banking business (loans), the German Branch Profit Attribution Regulation defines the KERT function as that people function responsible for the creation of the associated opportunities and risks (Sec.19 para. 1 Branch Profit Attribution Regulation).

If PEs located in different jurisdictions are involved in this process, the loan must be attributed to the PE that has performed the most important function up to the point in time when the financial asset has been created. The German regulation does not provide any guidance as to which people function should be generally regarded as the most important one up to the conclusion of the loan. According to the OECD PE Report, the sales/trading function will usually be regarded as the KERT function. (OECD PE Report (part II), para. 6 lit. b).This function comprises a bundle of work steps and includes, for example, the establishment of the client's creditworthiness and the bank's overall credit exposure to the client, the decision whether any collateral is needed, the pricing of the loan, the negotiation of contractual terms, and finally the bank's commitment of its capital to the loan. Therefore, the asset attribution decision should be based on a detailed functional analysis that should take into account the bank's organisational structure, the decision-making process, and the decision-making power of the people involved.

In addition, the risk guidelines issued by the German Financial Supervisory Authority (BaFin) should be taken into account in the functional analysis. For the process of issuing a loan, these guidelines require a strict functional segregation between the trading office (so-called Markt) and the middle/back office that performs an upfront risk evaluation (Marktfolge). Both offices must agree independently on the conclusion of the loan. In any credit committee, the Marktfolge must not be in the minority based on the guidelines (Circular dated 14 December 2013, Minimum Requirements for Risk Management, BTO 1.1. No 2). If the company doing the risk control is significantly involved in, or completely prepares Marktfolge vote, an argument could be made for attributing the financial asset upon its creation to the permanent establishment of the bank that performs the risk controlling and management.

If the functional analysis does not lead to a clear-cut result, regarding which people function is the most important one for the creation of the financial asset, the loan agreement must be attributed to the PE that has the customer relationship (this is the rule of last resort). The taxpayer can deviate from this attribution of last resort only if it can demonstrate that attribution to another permanent establishment better reflects the arm's-length principle.

Any reattribution to another PE of the same bank is possible only in two cases. Sec. 19 para. 4 Branch Profit Attribution Regulation. In the first alternative, reattribution is possible if the PE to which the financial asset has been attributed to no longer performs any people functions at all regarding this asset, and the financial asset will be attributed in the future to the PE that maintains that customer relationship. In the second alternative, reattribution is possible if it better reflects the arm's-length principle. The reasoning of the regulation clarifies that reattribution to the risk management function should be possible under the second alternative if risk management plays a central role after the conclusion of the loan agreement. Specifically, if a loan or portfolio of loans becomes non-performing and is therefore managed by a special task force, this condition (central role) seems to be fulfilled.

Diagram 1: Attribution of financial assets (loans) according to the German Branch Profit Attribution Regulation |

|

Diagram 1 summarises the rules for the attribution of loans.

In sum, the Branch Profit Attribution Regulation follows the guidance provided by the OECD PE Report regarding the attribution of loans. In particular, it allows attributing the financial asset to both KERT functions identified by the OECD, namely, the sales/trading function and the ongoing risk management. In comparison to the current rules for the attribution of a loan, the new regulation brings more clarity to asset attribution and avoids the attribution of a loan to several PEs (splitting of assets).

Profit attribution and internal dealings

The attribution of the loan also determines the attribution of the associated opportunities and risks (the debtor's interest payments and any defaults). The PEs that have performed preparatory functions in connection with the creation of the loan or that administer the loan agreement or perform any other auxiliary functions should be remunerated for those services at arm's length. To determine the amount of that remuneration, the cost plus method is usually appropriate. In case of reattribution, the transfer of the loan would constitute an "assumed contractual relationship" within the meaning of Sec. 16 para. 1 No. 1 Branch Profit Attribution Regulation, and the actual market value of the loan should be determined.

As a deviation from the general provisions of the Branch Profit Attribution Regulation, an internal dealing regarding the provision of liquidity is possible for PEs of banks if the taxpayer can demonstrate that such long-term financing of one PE by the rest of the enterprise is in line with the bank's business strategy and with the people functions performed in the other PEs, and better reflects the arm's length principle than allocating the overall external financing of the bank on an annual basis to the PEs according to their liquidity needs. Sec. 19 para. 6 Branch Profit Attribution Regulation.

Branch capital allocation

The rules for the branch capital allocation of banks remain nearly unchanged in comparison to the respective Administrative Principles, which have been in force for 10 years. (Administration principles regarding the determination of the branch capital of internationally operating credit institutions, Federal Ministry of Finance dated 29 September 2004, Federal Tax Gazette I 2004 p. 917).

The capital allocation method is the preferred method for the determination of the capital attributable to domestic PEs of foreign banks. Sec. 20 para. 1 Branch Profit Attribution Regulation. See also the OECD PE Report (part II), para. 98-105 for a discussion of this method. The preferred method for the determination of the branch capital of foreign PEs of domestic banks is the regulatory minimum capital approach. This asymmetric treatment of domestic and foreign banks raises the question whether the new German rules are in accordance with EU law. Under this method, the bank's equity (free capital) must be attributed to the German branch using as allocation key the risk-weighted exposure amounts determined according to the regulatory law of the bank's home country of the bank. According to the reasoning of the regulation, the term "risk-weighted exposure amounts" directly refers to EU-Regulation No. 575/2013 (the so-called Capital Requirements Regulation, or CRR). Based on the language of the CRR, the risk-weighted exposure amounts relate only to the credit and dilution risk and the counterparty risk for certain transaction types. Art. 92 para 3 lit. a and f of the CRR.

With respect to operational and market risk (Art. 312 ff. and 325 ff. CRR), the regulation does not use the phrase "risk-weighted exposure amount", so it seems these risks should not be considered for the branch capital allocation. The German branch must be attributed a share in the equity that equals the bank's total equity – determined according to German tax accounting rules – times the risk-weighted exposure amounts attributable to the German branch, divided by the risk-weighted exposure amounts of the whole bank. If the bank makes use of the solo-waiver according to Art. 7 CRR and the own funds requirements are fulfilled only on a consolidated basis, the bank must provide evidence that the entity to which the German branch belongs is endowed with sufficient capital on a solo basis. Alternatively, the equity and the risk-weighted exposure amounts of the consolidated group should be used for the capital allocation.

For purposes of this calculation, the risk-weighted exposure amounts resulting from internal dealings should not be taken into account. For the sake of simplicity, the taxpayer can use, as the amount of equity, the paid-in capital plus the reserves and retained earnings minus the accumulated deficit – all taken from the foreign balance sheet – if it can demonstrate that it is plausible that the equity amount does not significantly deviate from the equity determined under German tax law. Sec. 12 para. 2 sent. 2 in connection with Sec. 20 para. 5 sent 2 Branch Profit Attribution Regulation.

The taxpayer can apply another method for the capital allocation and attribute less capital to the German branch, if it can demonstrate that this result better reflects the arm's-length principle. Sec. 20 para. 2 Branch Profit Attribution Regulation. If the taxpayer applies this escape clause, the German branch must be attributed at least capital in the amount that would result from applying the regulatory minimum capital approach. This means that the PE must be attributed core capital at least in the amount the branch would be required to hold based on the regulatory law if it operated as a legally separate entity in the German market. This method corresponds to the safe harbour approach (quasi-thin capitalisation/regulatory minimum capital approach in the OECD PE Report (part II), para. 112-115. In addition to this, the German legislation assumes that the branch holds a buffer of 0.5 percentage points of the sum of its risk-weighted exposure amounts to be able to expand the business at any moment. A similar provision is already included in the actual public ruling on the branch capital allocation. In the new regulation, the taxpayer is given the right to demonstrate that a smaller buffer is more appropriate for his business.

The simplification rule for small banks has been extended to domestic permanent establishments of foreign banks with a balance sheet total in their Auxiliary Calculation (discussed in Section 4 of this article) below €1 billion ($1.1 billion) (before that, the threshold was only €500 million).

The PEs eligible for this safe harbor rule do not need to determine their branch capital based on any of the above-mentioned methods if the PE is attributed capital in the amount of at least 3% of its total assets. The 3% corresponds to the Leverage Ratio actually set by the Bank for International Settlements. The minimum amount of capital attributed to the German branch under this rule is €5 million. The taxpayer is free to decline to apply this simplification rule and instead use the standard method if, for example, the capital allocation method leads to a capital of less than 3% of the branch's total assets or to a lower amount than the minimum amount of €5 million.

The Branch Profit Attribution Regulation does not allow the application of one of the methods described above to result in an attribution of free capital to the German PE that is less than the capital that has been recorded in the statutory accounts of the German branch, if such statutory accounts have been prepared. Sec. 20 para. 5 sent. 2 in connection with Sec. 12 para. 5 Branch Profit Attribution Regulation.

After having determined the assets and the branch capital in the Auxiliary Calculation, liabilities must be attributed to the German branch to equalise the balance sheet. If feasible, a direct attribution of liabilities and their associated refinancing expenses must be performed. If a direct attribution is not feasible or causes a disproportionate burden, an indirect attribution of liabilities must be performed and the average refinancing expenses of the indirectly attributable liabilities must be attributed to the German branch. In comparison to the actual public ruling on the branch capital allocation, the simplification rule to apply the average 12-month EURIBOR for any correction of the nondeductible refinancing expenses associated with the free capital did not find its way into the new regulation.

Global trading

Financial instruments traded globally 24/7 must be attributed primarily like assets resulting from the traditional banking business to the PE that performs the KERT function, that is, the people function that is most important for the creation of the associated chances and risks. See Sec. 22 Branch Profit Attribution Regulation. The German regulation defines global trading as – including but not limited to – (i) the global issuance and the global distribution of financial instruments; (ii) acting as market maker for physical securities; (iii) acting on stock and commodities exchanges; and (iv) the development of new financial products.

If global trading is performed via a global book, and if no clear attribution is feasible at all, or only with disproportionate effort, the profits resulting from these financial instruments must be allocated to all PEs involved based on a reasonable allocation key. Because it is often impossible to distinguish between profits that have been realised for tax purposes and unrealised ones, the allocation must be made for both at the same time. Another attribution of the financial instruments is possible (for example, to a central booking location), if the associated opportunities and risks inherent in the global trading are nevertheless attributed to all PEs involved and are taken into account for the determination of their branch capital. In addition, this (central booking) approach must be recorded in the Auxiliary Calculation and the taxable income of the branches involved must remain unchanged by this booking procedure.

If the KERT function in the global trading is performed in different jurisdictions, the transactional residual profit split method must be applied if no other method better reflects the arm's-length principle in the individual case.

PEs of insurance companies

Attribution of insurance contracts

In contrast to banks and all non-financial services companies, the attribution of insurance contracts has a direct impact on the liability side of the insurance company's balance sheet. This is because the attribution of all technical reserves follows the attribution of the insurance contracts. Moreover, the attribution of the technical reserves has a direct impact on the attribution of investment assets; thus, the attribution of insurance contracts is crucial for insurance companies.

According to the OECD, underwriting is typically the KERT function in the insurance sector, that is, it is the most important active decision-making function relevant to the assumption of risks. See OECD PE Report (part IV), para. 50, para. 68-69, para. 73, para. 93-94, para. 103, para. 127 and para. 193. In line with this view, the Branch Profit Attribution Regulation defines underwriting as the (only) KERT function. The German regulation defines underwriting as setting the underwriting policy, risk classification and risk selection, pricing, risk retention analysis, and the acceptance of insured risk. OECD PE Report (part IV), para. 34. Contrary to the OECD PE Report, the German regulation rebuttably presumes that for the reinsurance business, risk classification and risk selection is the KERT function.

If PEs located in different tax jurisdictions are involved in the underwriting process, the insurance contract must be attributed to the PE that performs the most important function in this process. Thus, in those cases, the attribution decision must be based on a detailed functional analysis in particular of the underwriting process that takes into account the characteristics of the specific line of business and the allocation of decision-making powers within the approval chain.

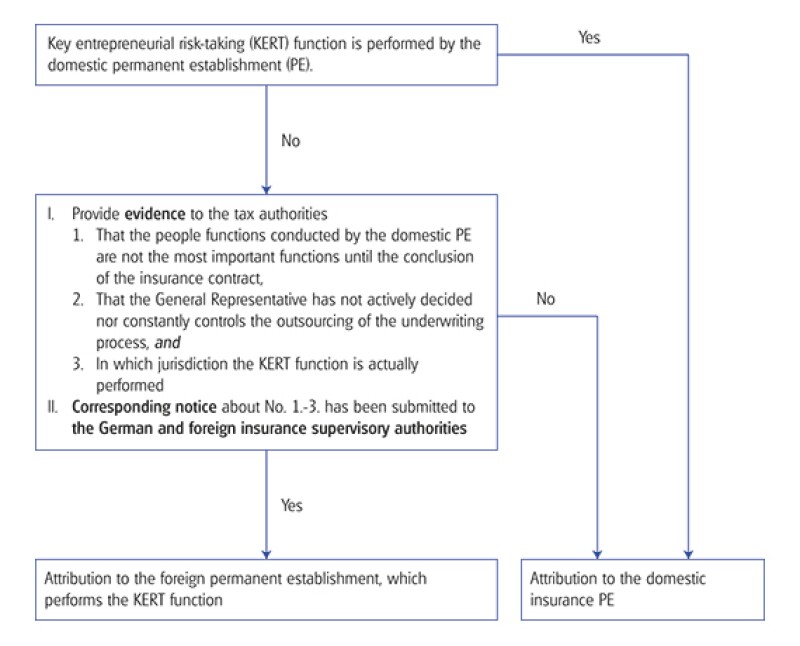

The regulation includes a rebuttable presumption that if a foreign insurance company operates in Germany via a registered branch, the underwriting is performed in the German branch. Sec. 24 para. 5 Branch Profit Attribution Regulation. This presumption is based on the argument that by regulatory law the branch's appointed general representative is authorised to conclude binding insurance contracts with insureds in Germany. Sec. 106 para. 3 sent. 3 Insurance Regulation Act. However, this reasoning stands in clear contradiction to the OECD consensus in cases in which the underwriting is actually not performed by the German branch. As a result, this rule has been heavily criticised in the literature. The only resulting change the German MoF made in the final regulation (compared to the draft version published 5 August 2013), was to allow taxpayers to rebut this presumption. For this, the foreign insurance company must demonstrate to the German tax authorities:

That the domestic insurance branch indeed does not perform the most significant role in the underwriting process;

That the general branch manager has not outsourced the underwriting function by active decision-making and does not control the underwriting performed abroad; and

Where the KERT function is actually performed.

In addition, the foreign insurance company must inform the supervisory authorities in Germany and in its home country about these facts. If the taxpayer does not prepare such documentation, the insurance contracts and all associated opportunities and risk are attributed to the German branch. Diagram 2 summarises the attribution of insurance contracts.

Diagram 2: Attribution of insurance contracts according to the German Branch Profit Attribution Regulation (Inbound) |

|

Profit attribution and internal dealings

The attribution of insurance contracts also determines the attribution of associated opportunities (the premium income) and risks (in particular the claims). All other PEs that contribute to the insurance business (for example, those that perform asset management, claims management, administration of the contracts, and any support functions) must be remunerated at arm's length based on internal dealings. For asset management activities, arm's-length (sub)advisory fees (in basis points of total assets under management) are usually observed in the market. For claims management and other support functions, a cost-based approach seems appropriate. With respect to the recognition of internal dealings, it must be noted that the German regulation explicitly and categorically excludes internal reinsurance dealings. Sec. 28 Branch Profit Attribution Regulation.

Branch capital allocation

The new rules regarding the branch capital allocation for insurance companies represent uncharted waters, given that the actual public ruling on branch capital allocation is rather vague with respect to insurance companies.

According to the Branch Profit Attribution Regulation, the "modified capital allocation method for permanent establishments of insurance companies" is the preferred method for the branch capital allocation to domestic permanent establishments of foreign insurance companies. Conversely, for foreign permanent establishments of domestic insurance companies the minimum capital approach is the preferred method. This method is applied in two steps. First, a share in the (investment) assets of the foreign insurance company that cover the technical reserves and the surplus is attributed to the domestic branch using the technical reserves – determined according to the foreign GAAP – as allocation key. Subtracting from these attributable (investment) assets the technical reserves, other liabilities and deferred items resulting from the insurance business – all determined according to German GAAP – yields the capital attributable to the German branch.

A method other than the capital allocation method can be used if it better reflects the arm's-length principle (Sec. 25 para. 3 Branch Profit Attribution Regulation). An example of such other method (if the taxpayer provides reasons why it better suits the fact pattern) might be the thin capitalisation/ adjusted regulatory minimum approach. If the taxpayer uses another method, the German branch must at least be attributed that amount of capital that would result from the application of the regulatory minimum approach.

The reasoning of the regulation explicitly denies that the escape clause can be used to apply another allocation key than the technical reserves for the capital allocation method. This contradicts the OECD's view, which regards several alternative allocation keys as appropriate (for example, premiums, solvency margin, and hybrid approaches). OECD PE Report (part IV), para. 150. Although the reasoning of the regulation does not represent binding law for taxpayers, it can be expected that German tax auditors will refer to the reasoning if an allocation key other than technical reserves is used.

Regardless of the capital allocation approach applied, the German branch must not be attributed an amount of capital less than the capital that has been recorded in a domestic statutory balance sheet for the domestic branch. Therefore, it is highly recommended that foreign insurance companies check whether the approach used for the capital allocation in the statutory accounts is in line with the new tax regulation before the statutory balance sheet of the German branch is prepared for any financial year starting after December 31 2014.

The German branch must be attributed (net) investment returns associated with the attributable assets if the assets back either the technical reserves, the liabilities and deferred items resulting from the insurance business, or the branch capital of the German branch. Preferably, the net returns are directly attributed to the assets. If this is not feasible (for example, because the German branch does not directly hold any or sufficient assets), the "average net return from invested assets" must be applied. This value must be disclosed by every insurance company in the annual report. It takes into account both the returns from investments and the associated expenses and indirect costs.

New documentation requirements: Auxiliary Calculation

The Branch Profit Attribution Regulation also introduces an obligation for taxpayers to prepare a separate balance sheet and profit and loss statement for the German permanent establishment in accordance with the principles of the AOA (the Auxiliary Calculation). Sec. 3 Branch Profit Attribution Regulation.

The Auxiliary Calculation comprises the assets attributable to the PE, the opportunities and risks, the branch capital, and the liabilities. For this, it seems recommendable going through the tax balance sheet of the bank or the insurance company line by line and checking whether the asset attribution applied so far is in line with the Branch Profit Attribution Regulation. In addition, the fictitious revenues and expenses resulting from internal dealings have to be recorded in the Auxiliary Calculation.

The Auxiliary Calculation must be prepared by the filing date of the PE's tax return for the pertinent fiscal year. This requirement has given rise to the fear that a contemporaneous documentation requirement has been introduced into German tax law through the backdoor. It is appreciated, therefore, that the final version of the regulation states that the reasoning for the asset attribution and the identification of internal dealings must be documented in writing based on the general transfer pricing documentation requirements (Sec. 90 para. 3 General Tax Code). These general rules require only that the taxpayer be able to submit its transfer pricing documentation for its routine intercompany transactions within 60 days upon a tax auditor's request to avoid late submission penalties. Extraordinary business transactions (any relocation of a business function from the German PE to the foreign head office) must be documented within six months after the end of the fiscal year in which they have occurred, and the respective documentation must be submitted within 30 days upon request. The above rules notwithstanding, it is advisable for taxpayers to appropriately document the reasons for the asset attribution when preparing the tax return to ensure consistency between the submitted tax return and the subsequent transfer pricing documentation.

Profit Attribution Health Check recommendable for financial institutions with PEs in Germany

In light of the detailed rules regarding application of the AOA, and the various refutable presumptions found in the Branch Profit Attribution Regulation, it seems highly recommendable for financial institutions with PEs in Germany to perform a health check as to whether their currently applied approach for profit attribution is in line with the new German regulation.

The health check should focus on the specific rules regarding the attribution of loans and insurance contracts to the German branch respectively, and the branch capital allocation methodology. This is particularly true if the bank or the insurance company applies an escape clause. If, for example, the bank deviates from a standard approach because another approach better reflects the arm's-length principle, the reasons for this deviation should be documented in writing. If the German branch of a foreign insurance company does not perform the underwriting, special documentation must be prepared for submission to the tax authorities and disclosure to the supervisory authorities.

|

|

Dr. Oliver BuschFinancial Services Transfer Pricing Transfer Pricing Director Deloitte Tel: +49 69 75695 6906 Oliver is a director in the financial services transfer pricing team located in Frankfurt / Germany. He advises multinational financial services clients, in particular banks, insurance/reinsurance companies, asset management firms, PE houses and real estate companies on all transfer pricing matters, including planning and implementation of global transfer pricing systems, restructuring, documentation and tax audit defense. Examples of the projects led by Oliver include advising on the branch capital allocation methodology for major banks and insurance companies, the alignment of the profit attribution between a head office and its permanent establishment with the principles of the authorised OECD approach, determination of arm's-length fee splits for asset managers, the cross-border transfer of insurance portfolios, the pricing of intragroup retrocession transactions, funds transfer pricing for banks, the analysis of the asset attribution after mergers, the development and implementation of cost allocation systems, cash pooling, and the pricing of guarantees and factoring fees. He has concluded many Mutual Agreement Procedures (MAP) and advised on several advance pricing agreements (APA). Oliver is a German Certified Tax Advisor and holds a PhD in economics. He is assistant lecturer at the Goethe University/Frankfurt and at the Wiesbaden Business School. Oliver publishes on a regular basis articles about hot topics in transfer pricing and recent OECD developments regarding taxation. |

|

|

Jobst WilmannsTransfer Pricing GermanyPartner – Service Line Leader Deloitte & Touche GmbH Wirtschaftsprüfungsgesellschaft Frankfurt, Germany Tel: + 49 69 75695 6243 Jobst Wilmanns is the service line leader of the German transfer pricing team of Deloitte and a member of Deloitte´s Global TP Steering Committee. He has more than 16 years of international experience in TP, especially in documentation projects, structuring, implementation and the defense of multinational business models. Professional experienceJobst is responsible for the development of new consulting concepts, in particular in the areas of intellectual property, implementation of transfer pricing systems and the implementation of international documentation requirements. Jobst is an active member of the "Schmalenbach-Gesellschaft" and an author of various well-known transfer pricing books. Clients and projectsHe has extensive experience in advising international and German-based multinational companies in particular in the financial service industry, technology industry, the chemical, pharmaceutical and automotive industry. |