The competitive nature of the insurance sector has led to the increased use of global distribution models by multinational insurance groups. Technology is reshaping distribution and the sales culture within insurance companies. For example, in the property and casualty (P&C) markets, mobile application technology and online distribution channels are commonly used by insurers to differentiate their sale processes due to the increased competition.

Under traditional global distribution models, underwriters and senior executives of multinational insurance groups have often delegated underwriting authority to bind business or at least participate in material contractual pricing negotiations. This is common in global multinational insurance programmes where underwriters and actuaries tend to travel regularly to different jurisdictions to meet potential clients and negotiate the terms of policies either directly with clients or with insurance intermediaries (for example, brokers and independent financial advisers).

In certain markets, companies or partnerships known as managing general agents (MGAs) or cover holders in the Lloyd's market have been delegated underwriting authority to conclude insurance contracts on behalf of the insurer under a binding authority agreement for full or limited authority. The level of underwriting authority is determined by reference to a number of factors, including senior management's trust in the underwriter and the underwriter's experience in writing that class of business.

The act of negotiating and concluding insurance contracts by mobile underwriters, senior executives, and MGAs risks creating a taxable presence or permanent establishment (PE) of the primary insurer or reinsurer in the jurisdiction where these activities take place. When a PE is created, profits must be attributed to the PE for tax purposes, and the insurer will be required to file a corporation tax return in that jurisdiction.

The focus of this article is identifying those circumstances under which a PE is created (the so-called PE threshold) in the insurance sector, which are set out in Article 5 of the OECD Model Tax Convention, and reflected in many double tax treaties.

The PE threshold has also been a recent focal point for the OECD as part of its Base Erosion and Profit Shifting (BEPS) initiative, in particular Action 7 of the BEPS Action Plan, which deals with "Preventing the Artificial Avoidance of PE Status".

Existing rules

The threshold of activity that triggers the existence of a PE under the current OECD Model Tax Convention (and is present in many double tax treaties) is typically determined by two tests in Article 5. First, under the fixed place of business test, there must be "a fixed place of business" through which the business of an enterprise "is wholly or partly carried on". When it is concluded that there is no fixed place of business, it is still possible for the activities of a dependent agent to create a PE for a foreign principal. Under the OECD model treaty's Article 5(5), the test for assessing whether an agent creates a permanent establishment in a particular country is as follows:

"… [W]here a person – other than an agent of an independent status to whom paragraph 6 applies – is acting on behalf of an enterprise and has, and habitually exercises, in a Contracting State an authority to conclude contracts in the name of the enterprise, that enterprise shall be deemed to have a permanent establishment in that State …"

The "agent of an independent status" to whom paragraph 6 applies is defined in Article 5(6) as "a broker, general commission agent or any other agent of an independent status, provided that such persons are acting in the ordinary course of their business".

In addition, the Commentary to Article 5(6) states that there is also a test of legal and economic dependence, and case law in this area has considered similar factors as well. For example, the Canadian case American Income Life Insurance Co. v. The Queen, 2008 DTC 3631, 2008 TCC 306 (AIL) took into account factors such as control and ownership, income and remuneration of agents, exclusivity, and the bearing of economic risk.

Traditionally, the practical difficulties with the application of the test under Article 5(5) in the insurance sector have involved the operation of the independent agent exemption under Article 5(6), and this will likely continue given the proposed changes under the OECD's BEPS project. However, the proposed changes to Article 5(5) will also likely create challenges for insurance enterprises going forward.

BEPS – What is going to change and what are the potential practical implications for the insurance sector?

The focus of the OECD's BEPS project is ensuring that profits are taxed in the locations where the economic activities that generate those profits take place. As part of the BEPS project, a series of new guidelines have been proposed, including lowering the threshold for the creation of PEs under Action 7 of the BEPS Action Plan.

Following publication of an initial Action 7 discussion draft in October 2014 and a public consultation on the same, the OECD released a subsequent discussion draft on PEs in May 2015 for further comments, with a final version expected in September or October 2015 to serve as the basis for updating the Model Tax Convention. Implementation of the new rules in some double tax treaties is expected to occur via a multilateral instrument under Action 15 by the end of 2016. However, not all countries are likely to participate in the multilateral instrument; the US, for example, may opt out.

The first Action 7 discussion draft released in October 2014 floated the idea of a separate PE rule specific to the insurance sector. However, the May 2015 discussion draft states that "…no specific rule for insurance enterprises should be added to Article 5". It further states that insurance is to be instead dealt with by means of the general provisions set out in the revisions to Article 5, or via transfer pricing or special measures.

Although some uncertainty remains regarding the final output on Action 7, many of the proposed changes in the May 2015 discussion draft are close to finalisation. This article details a number of focus areas, outlined below, that are most likely to be of specific interest to the insurance sector.

Artificial avoidance of PE status

Part A of the May 2015 discussion draft targets the use of arrangements put in place to shift profits from a country where sales take place (Country A) to another country (Country B) without creating a permanent establishment of a company resident in Country B in Country A.

To address this, the May 2015 discussion draft, in paragraph 23, proposed changes to the text of Articles 5(5) and 5(6). Article 5(5) has been redrafted so that a person who "habitually concludes contracts, or negotiates the material elements of contracts" on behalf of an enterprise "…shall be deemed to have a permanent establishment". This introduction of a subjective element – "negotiates the material elements of contracts" – represents a clear departure from the existing rules, and the draft commentary provides guidance on what this might mean in practice.

The May 2015 discussion draft proposes amending Article 5(6) to remove the references to "broker" and "general commission agent", referring only to "independent agent". Certain countries (including the UK) have a form of the broker exemption in their domestic legislation; given this proposed change, the future of these domestic exemptions is uncertain. Article 5(6) now also limits the potential accessibility of independent agent status in the case of related parties, stating that: "Where, however, a person acts exclusively or almost exclusively on behalf of one or more enterprises to which it is connected, that person shall not be considered to be an independent agent…" For companies, connection is defined as possessing "at least 50 percent of the aggregate vote and value of the company's shares or of the beneficial equity interest", or control.

Given these potentially wide-ranging changes, the focus of this article will be on the proposed changes to Article 5(5) and 5(6).

Profit attribution to PEs and interaction with action points on transfer pricing

The May 2015 discussion draft specifically excluded any coverage of attribution of profits issues for PEs, by clarifying in paragraph 57 that this work "will be carried on after September 2015 with a view to providing the necessary guidance before the end of 2016, which is the deadline for the negotiation of the multilateral instrument that will implement the results of the work on Action 7".

Case studies

Notwithstanding the fact that the existing PE rules are expected to change under BEPS, tax authorities have continued to raise PE challenges based on existing PE rules. The following case studies illustrate two common arrangements that are becoming increasingly scrutinised and are likely to continue to be in a post-BEPS world.

Case study 1 – mobile sales forces

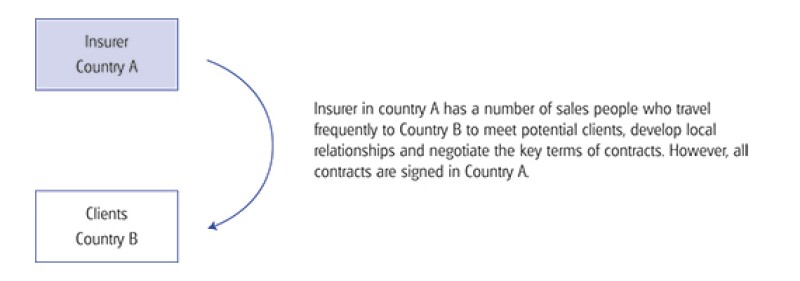

As set out in Diagram 1, Insurer in Country A has a mobile team of underwriters who travel frequently to various jurisdictions, including Country B, to meet potential clients, develop local relationships, and negotiate the terms of policies locally. However, these individuals do not have any authority to bind the Insurer; this authority is retained by senior personnel based in Country A, and all contracts are signed in Country A. These individuals do not have an office or other dedicated premises at their disposal from which they work, instead working from hotels and client sites that vary from visit to visit.

Diagram 1: Insurance mobile underwriters |

|

Existing rules

It would be difficult to assert a fixed place of business PE of the Insurer under the current fixed place of business PE rules, because client premises in Country B are not at the disposal of the Insurer in Country A to carry out its business.

Under the existing Article 5(5), the activities of the mobile sales force should not create a dependent agent PE of the Insurer, because the sales force does not have the authority to conclude contracts. For example, in the AIL case, the court found that a US-resident life insurance company did not have a permanent establishment in Canada. The offices of its Canadian agents were not at its disposal (it did not have freedom to enter the buildings, did not have control over the manner in which the buildings were used, and did not pay the expenses of the premises). Furthermore, the Canadian agents did not habitually exercise in Canada an authority to conclude contracts in the name of the taxpayer.

Proposed rules

It would be difficult to assert a fixed place of business PE of the Insurer under the proposed fixed place of business PE rules, because client premises in Country B are not at the disposal of the Insurer in Country A to carry out its business.

However, under the proposed revisions to Article 5(5), the fact that the mobile sales force negotiates the key terms of contracts is critical and could result in this team creating a PE of the Insurer in Country B if the "negotiates material elements" test is met. The proposed commentary in paragraph 32.5 and 32. 6 offers some insight in this regard, explaining that the threshold is "aimed at situations where contracts that are essentially being negotiated … are subject to formal conclusion, possibly with further approval or review, outside that State", and broadens the scope to cover standardised contracts as well.

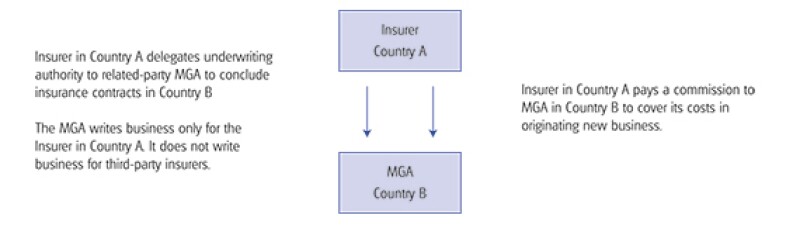

Diagram 2: Binding authority agreements and MGAs |

|

Case study 2 – Cover holders and MGAs operating under binding authority agreements

Existing rules

It would appear that the test of concluding contracts under Article 5(5) is satisfied. The implication is that the MGA will create a PE of the Insurer in Country B. Thus, in this example the Insurer would, on the face of it, be required to attribute profits to the PE and file corporate income tax returns locally.

The next practical issue to consider is whether the MGA can qualify for the independent agent exemption under Article 5(6). If the MGA is an independent agent and acts in the ordinary course of its business, then the Insurer in Country A will not be found to have a PE under the test. As a result, the fundamental distinction lies in the extent to which the MGA is regarded as an independent agent for these purposes.

Under the current rules, whether an agent is independent is determined by reference to a number of factors, none of which is determinative in isolation. This is discussed in detail in the current commentary:

The commentary refers to the degree of control the principal exerts over its agent as being important for determining if there is the requisite level of independence. In circumstances when the MGA is subject to very detailed instructions or control, the MGA would not normally be regarded as operating in an independent manner. In addition, the commentary notes that a principal's reliance on the agent's special skill or knowledge (for example, of the local market or of certain lines of business) to perform a service that the principal would not be able to perform itself is evidence of the agent's independence.

As noted above, the commentary states that there is also a test of economic dependence. In practice, many MGAs also write business on behalf of third-party insurers and therefore may qualify for the independent agent exemption on the basis that they are legally and economically independent. It is also imperative that the MGA be able to demonstrate that it is able to support its own assets and risks. This seems to be the determinative test applied by tax authorities in practice.

Given the above, whether the MGA is considered to be independent will depend on the facts and circumstances of the case. For example, if it is found that the Insurer relies on the MGA's expertise and that the MGA is legally and economically independent, the implication could be that the MGA is an independent agent that does not create a PE of the Insurer in Country B.

Proposed rules

Under the proposed changes to Article 5(6), a key test is that if the MGA in Country B acts "exclusively or almost exclusively on behalf of one of more enterprises to which it is connected" it would not qualify as an independent agent. The proposed commentary does not specifically define "almost exclusively," noting only that activities performed on behalf of enterprises to which a person is not connected would need to make up a "significant" portion of that person's business, and citing an example in Paragraph 38.7 where these fall below 10 percent as not meeting the test.

Furthermore, the ability to access legal and economic independence in the round under the existing commentary has been eliminated in the May 2015 Discussion Draft. As such, although the MGA could potentially demonstrate such independence, it is no longer a relevant factor for consideration.

Therefore, in this example, because the MGA writes business exclusively on behalf of the Insurer it would not meet the independent agent test under the proposed Article 5(6) and therefore it would create a PE.

So what if you have a PE?

As noted earlier, in circumstances where a PE of the foreign insurer is created, profits must be attributed to the PE for tax purposes and the foreign insurer will be required to file tax returns for the PE in that jurisdiction. Failure to do so can lead to potential penalties or interest accruing on outstanding tax.

However, based on our experience, tax authorities may take a practical approach and not assert a PE when the transfer pricing of the commission paid to the MGA is equal to or greater than the underwriting profit that would have been attributable to the PE under Article 7. In those circumstances, there would be no incremental profit over and above the transfer pricing remuneration for the tax authority to tax.

Furthermore, creating a PE increases the potential risk of double taxation for multinational insurance groups, where the profits or income are subject to tax in both the country of residence and the PE country, because the two tax authorities may not be able to agree on the PE position and attribution of profits. From an accounts and financial statement perspective, insurers will be required to analyse and disclose or provide for potential tax liabilities associated with the PE exposure. Given the uncertainties involved in assessing the PE risk and in determining the profits attributable to the PE, the quantification of the PE exposure can be a time-consuming and difficult process.

What should you do about it?

All in all, the practical considerations in determining whether a PE is created are complex and the analysis should be based on the specific facts and circumstances. Given the momentum of the BEPS Action Plan, coupled with increasing tax authority scrutiny, multinational insurance groups should continue to monitor the PE developments closely, not only to avoid being caught off guard but also to make a timely assessment of the potential impact of any changes. In the first instance, this would entail a detailed factual and functional analysis to identify the insurer's core profit-generating functions (such as core underwriting, claims management, etcetera) and the extent to which these activities are carried out by underwriters and senior executives who regularly travel to conduct business in overseas operations. Multinational insurance groups can engage with tax authorities in certain jurisdictions to obtain PE clearances, perhaps in the form of an informal agreement with a tax authority on the PE position. Some tax authorities may provide a "low risk rating" on the PE position. Alternatively, taxpayers could obtain a tax ruling to attain certainty on the PE position. In some countries, a PE clearance can be obtained as part of an advance pricing agreement, which can provide certainty both on the PE position and the transfer pricing of intragroup transactions.

|

|

Sebastian Ma'ileiDeloitte Tel: +44 (0) 20 7007 1596 Sebastian leads the UK insurance transfer pricing team. He has more than 12 years of transfer pricing experience in the insurance industry. He has advised clients operating in the Lloyd's, London-Bermuda and life insurance markets. He worked on the first UK unilateral reinsurance APA and the first UK-German bilateral APA on branch profit attribution. |

|

|

Jeremy BrownDeloitte Tel: +44 (0) 20 7007 5350 Jeremy specialises in transfer pricing for financial services clients in Deloitte's London office, with a particular focus on the insurance and asset management sectors. He has broad experience in advising multinational clients on transfer pricing documentation, planning, economic analysis and defence. |