What do recent Western economic sanctions against Russia; the US' growing energy independence; and ultra-deepwater oil and gas (O&G) discoveries off the coast of Brazil and in the Gulf of Mexico have in common? Each of these events is driven by technological advancements in the O&G sector.

Innovations in the use of horizontal drilling, hydraulic fracturing, and seismic imaging in US shale formations have allowed US oil production to climb from less than 5 million barrels per day (BPD) in 2005 to over 8 million BEP in 2014. Similarly, US natural gas production has increased to almost 12 million BPD (converted from cubic feet to barrels of oil equivalent) over this same period. While this shale boom has yet to take hold internationally, countries such as Russia are dependent on Western equipment and technology to develop their new energy frontiers, in particular shale opportunities in Siberia. This makes the Western sanctions which were imposed on Russia because of actions in Ukraine especially restrictive for Russia's declining O&G production, because they prohibit the export of such technology.

Western O&G expertise and seismic imaging technology have also allowed exploration and production (E&P) companies to discover and produce hydrocarbons from deeply buried reservoirs far offshore. Other technologies in the O&G sector have helped create kit suitable for high-pressure/high-temperature deepwater environments, remote/automated drilling operations, and enhanced oil recovery from mature oil fields. New processes and down-hole measurement tools are mitigating the risk of a loss of well control, such as that which preceded the Macondo disaster and the Gulf oil spill in 2010.

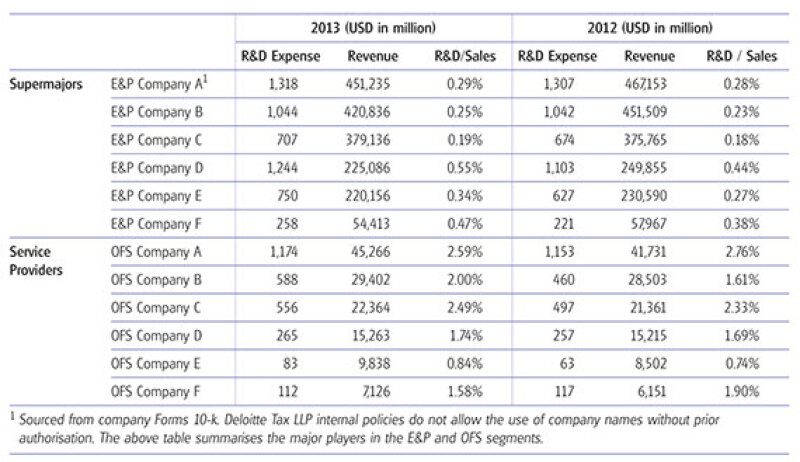

Indeed, the O&G sector is replete with technology and other forms of intangible property (IP) that allow participants to access hydrocarbons from increasingly difficult environments, and more safely than ever. A stylised fact of this industry is that the research and development (R&D) expenditures that give rise to O&G IP are fairly small relative to sales, specifically when compared to R&D/sales ratios found in high-tech and pharmaceutical industries. R&D expense for "supermajor" E&P companies (the largest of the independent oil companies, or IOCs) and the largest oilfield services (OFS) providers are displayed in Table 1. Note that the supermajors have a smaller R&D/sales ratio than the OFS providers, but still spend more on R&D in absolute terms. Also, note that R&D for the whole upstream sector has increased between 2012 and 2013, a trend that has been relatively constant since 2008.

Table 1

O&G companies must deploy the IP generated by this R&D across the globe so that it can be used by their local operating companies. Transfer pricing and tax regulations dictate that where there are cross border transfers of IP, appropriate compensation must be paid to the IP owner. But while transfer pricing methods for IP transactions are well developed for most industries, applying such methods in the upstream O&G sector can be complex. Intangibles used by E&P companies have often been developed in tandem with petroleum engineers and geoscientists at major universities, industry consortia, and oilfield services firms. These non-proprietary assets are typically shared freely with joint venture partners and national oil companies (NOCs) in the quest for hydrocarbons, most often on a royalty-free basis. Due to this ambiguity of ownership and the openness by the industry to share know-how, leading practices, and technology, allocating a price to this IP may remain convoluted.

Further complicating intercompany IP valuations is the fact that there are so many different services, processes, and IP coming together at the well site to produce hydrocarbons. Few of these assets and activities are significant on a stand-alone basis; it is therefore difficult to value their separate contributions. In other industries, a royalty payment for the value of the IP would be paid to appropriately compensate the IP owner; in the upstream O&G sector, bifurcating the revenue stream from the sale of the resulting hydrocarbon between the amount resulting for the use of the IP (be it a tool, technique, process, or patent) and that associated with more routine contributions is difficult because of the convolution of IP and activities at the wellhead.

The transfer pricing regimes promulgated across the globe accommodate a range of approaches for dealing with these issues. Depending on the characterisation of the transaction, a taxpayer can elect to classify these intercompany transactions as a complex engineering service or a service bundled with IP. In practice, E&P and OFS companies have addressed these issues differently.

E&P companies' approach to IP transfer pricing

In general, E&P companies employ one of two basic transfer pricing mechanisms to allow for the development and use of IP.

Global IP ownership model

A number of E&P companies, including some of the supermajors, engage in expansive, multiparty cost sharing arrangements (CSAs) whereby all operating entities share the cost of IP development and are allowed the use of the resulting IP on a royalty-free basis. In many cases, such arrangements have been in place for several decades and effectively turn each participant into a co-owner of the intangibles being developed.

Two characteristics of a global ownership model make this approach appealing to E&P companies. First and foremost, it eliminates the need for a royalty, because every legal entity is the economic owner of its share of the IP. This allows these companies to avoid the contentious issue of how to bifurcate the hydrocarbon revenue at the well site and calculate royalties on the portion attributable to IP. A second advantage of the global ownership approach is that it allows companies to avoid a markup on intercompany charges for engineering, geological, and geophysical services, as these services can be viewed as part of the intangible development costs covered by the CSA. This is no small accomplishment, given that some tax authorities have taken the position that such intercompany services should command a high markup, yet the joint venture partners and NOCs that have to pay a share of these costs are reluctant to pay the markups.

There are some downsides to the global ownership model: it forces E&P companies to calculate complicated valuation analyses as legal entities enter or exit the CSA, and the structure itself may be more tax inefficient than having a principal company own all the IP to be used offshore.

Central IP ownership model

Other E&P companies eschew the administrative structure of a CSA and allow IP to be developed and owned in one or a few R&D locations where such development naturally occurs. They may charge their operating affiliates for the R&D performed on their behalf at cost or cost plus a small markup, but no effort is made to collect royalties on the use of any resulting IP and such arrangements are not codified in a formal CSA. Those models may not produce tax efficiencies and are most prone to being criticised by the tax authorities, because IP ownership and use is difficult to ascertain and open to dispute. From an administrative standpoint, however, such arrangements are quite elegant. Arguments supporting this approach rely on the fact that much of the IP in use by E&P companies is in the public domain and developed jointly with universities, upstream partners, and oilfield services companies, and are not otherwise compensable.

Some E&P companies using this model have a "natural hedge" against tax authority adjustments in that they centralise IP ownership in two locations, each of which uses the other's IP. A tax authority's attempt to impose a transfer pricing adjustment on one of the entities by asserting royalties for the implicit IP license could be forced to consider the corresponding inbound royalty payment for what amounts to very similar IP.

In addition to the above two IP transfer pricing models, a number of E&P industry participants have historically maintained that the nature of the industry does not allow for any type of meaningful transfer pricing management of IP, and have argued against intercompany charges for intangibles.

OFS companies' approach to IP transfer pricing

E&P companies outsource most of the heavy lifting around exploring, developing, and producing O&G to OFS companies. OFS companies also undertake a significant portion of the IP development in the industry. IP in the oilfield services business lies in the industry's ability to provide engineering services consistently across different reservoirs (deepwater, unconventional plays such as shale or coal bed methane, and mature), geologies (sandstone, carbonates, shale, coal beds) and geographies (onshore, offshore, North & South America, Europe, Asia, West Africa, the Middle East) while satisfying stringent health, safety, and environmental regulations, decreasing nonproductive time, reducing delivery and service costs, and meeting the demanding requirements of NOCs and IOCs. From a transfer pricing perspective, the OFS industry IP is viewed to be a combination of:

Technologies that provide the science behind building the tools used in providing services;

Local engineering knowledge, field know-how, and processes that allow for the adaptation of the tools to provide consistent services under differing conditions across differing geologies and well requirements; and

Business development knowledge that creates marketing intangibles (trademarks, trade names, reputational integrity), develops customer relationships, provides customer satisfaction, and drives sales and customer contracts.

Technology intangibles

Technology in this industry is delivered to the client via the tools and systems that companies use in the provision of their services. Technology normally is a qualifying factor that allows a company to bid for services, as opposed to a clear-cut differentiating factor. Services contracts usually specify particular technologies needed for a given job. An OFS company that does not have the specified technologies in its repertoire would be disqualified from bidding on the contract.

The large companies operating in the oilfield industry own very similar technology portfolios. IOCs and NOCs, the customers of the oilfield services industry, have a vested interest in maintaining the competitive balance within the industry. It is common for IOCs and NOCs to diversify suppliers as well as related technology to avoid sole-sourced technology. That is one of the motivations for the consortia between E&P companies and oilfield services companies and research universities discussed above.

Technology within this industry is normally centrally designed, developed, and managed. Hence, most OFS companies employ a central IP ownership model. Even when mergers and acquisitions lead to technologies changing hands, the acquired technologies are typically also centrally owned and developed. This approach to IP development and maintenance has historically meant that most local affiliates of OFS companies pay a royalty to the technology IP owner(s).

The centralised and specific nature of the technology IP also allows OFS companies to share the risk and costs of IP developments through CSA arrangements.

Processes and local know-how

Processes and local know-how in this industry directly affect service quality and are the means by which a company's technology is provided to the customer. Processes and people have been so important in OFS after the Macondo incident that an OFS provider's process, safety, reliability, repeatability, and people have come to be viewed as more important than technology. NOCs and IOCs require consistency in service delivery, which allows them to better control their costs and enhance their production plans.

As a matter of practice, processes in the OFS industry are developed based on the experiences gained and lessons learned by engineers and field personnel operating in the various geologies and on different well sites across the globe. Such processes and standards are usually maintained in centrally controlled databases or knowledge sharing platforms.

Consequently, processes and know-how IP are developed across all jurisdictions and in some cases are jurisdiction-specific. As a matter of practice, it would be difficult to track and charge for contributions of specific affiliates to a company's combined depository of processes and know-how. However, the part of this IP that is thought to be attached to and accompanying the technology IP is normally charged through the same royalty mechanism as technology IP.

Marketing

Marketing IP in the oilfield services industry relates to trademarks, trade names, strategic customer relationships, and value-add business development activities.

Trademarks and trade names do matter, but are not a big value driver in the oilfield services industry. The discussion about the importance of consistent service quality, tender qualification processes, service provider diversification by clients, and importance of local on-the-field personnel to the oilfield services business makes it clear that trade names and trademarks do not provide a large competitive advantage.

The marketing value drivers in the OFS industry are usually the business development organisations driving sales and creating customer relationships.

The importance of business development organisations relates to the fact that sales in this industry are highly technical, so a sales person must have specific knowledge of the types of physics a tool or service uses, and the geology in which it is employed. This makes it difficult for someone outside this discipline to be an effective salesperson.

Similar to the processes and know-how IP, marketing intangibles are often locally developed and managed, with some component of central supervision due to organisational reporting lines and centralised management of major accounts. It would be difficult to track and charge for contributions of specific affiliates to the marketing IP, especially given that most of the benefit associated with this type of intangible is realised at the local country – or even the local field – level.

Conclusion

Global politics has often played an important role in natural resource policies. Recent technological advancements in the O&G sector will make sure that this continues to be the case. As IP becomes increasingly important to the success of O&G exploration, development, and production activities, market participants will find it necessary to develop cogent IP management policies to mitigate their transfer pricing risks.

|

|

John WellsPrincipal, Transfer Pricing Deloitte Tax LLP 2200 Ross Ave., Ste. 1600 Dallas, TX 75201 Tel: +1 214 840 7558 John Wells is the leader of Deloitte Tax's US transfer pricing practice and serves as Deloitte's global transfer pricing leader for the oil and gas industry. John has served clients across the industry spectrum, including Fortune 500 companies in chemicals, energy, engineering, manufacturing, retail, software, transportation, and telecom. He is experienced in managing large projects involving quantitative analysis in the areas of transfer pricing, intangible valuation, finance, fiscal policy, and modeling. He has been consistently nominated to the list of the World's Leading Transfer Pricing Advisers by Euromoney and Legal Media Group's "Best of the Best" Transfer Pricing Advisers. Before joining Deloitte, Wells was the lead economist for the global energy and natural resources sector of another Big 4 firm, and an economic adviser to the Kuwait Government. Wells also spent four years on the faculty of Auburn University, where he taught Ph.D.-level courses in time-series analysis, macroeconomics and international finance. |

|

|

Vitaliy VoytovychDirector, Transfer Pricing Deloitte Tax LLP 1111 Bagby Street, Suite 4500 Houston, TX 77002 Tel: +1 713 982 2910 Vitaliy is a director in Deloitte Tax's Houston, Texas transfer pricing practice. He has more than 11 years of experience in transfer pricing and economic analysis. Before his career in transfer pricing, Vitaliy was an Economist with a private equity firm, and also worked in the IT consulting industry. Vitaliy specialises in the oil and gas industry (oilfield services and equipment, exploration and production, drilling, marketing, LNG) but has considerable experience in a number of other industries as well, including engineering services, semiconductors, and chemicals. He has extensive experience managing large transfer pricing engagements, including US and global documentation and planning studies, advance pricing agreement (APA) negotiations, and audit defence work. |

|

|

Firas ZebianSenior Manager, Transfer Pricing Deloitte Tax LLP 2200 Ross Ave., Ste. 1600 Dallas, TX 75201 Tel: +1 214 840 1349 Firas Zebian is a Ph.D. economist and a senior manager in Deloitte Tax's Dallas, Texas transfer pricing practice. He has more than six years of transfer pricing consulting experience. Firas has managed various engagements for large Fortune 500 clients, overseeing engagements related, but not limited, to global restructuring, global documentation, cost sharing, intangible valuation, headquarter cost allocation, intercompany financing, planning studies and audit defence. He also provided services to clients in Europe, Latin America, and Asia. Firas has experience in multiple industries (energy, software, food & agribusiness, retail, services, and information technology) and is a regular speaker on transfer pricing and business model optimisation issues at the International Bureau of Fiscal Documentation and Tax Executive Institute, among others. |