Audit trends

Transfer pricing taxation was introduced in Japan in 1986 and has been enforced for more than 25 years. As is well known, the Japan tax authority conducts audits on a periodic basis and each audit drills down into detail – such consistency and the detailed nature of the audits is probably one of the reasons why the Japanese tax authority is seen so tough.

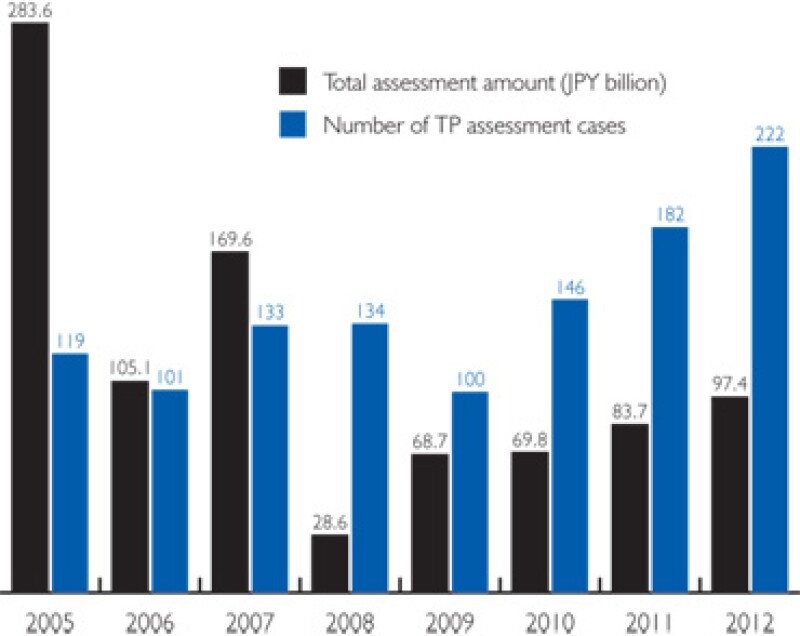

According to the statistics the National Tax Agency (NTA) releases on an annual basis (see below chart), the aggregate amount of assessments has stabilised compared with the peak period but number of assessment cases has been increasing in recent years.

The decline in the total assessment amount indicates that big cases have already gone around, and/or companies with potentially significant risk have taken preventive measures, most commonly advance pricing arrangements (APA). On the other hand, the fact that the number of cases is high means that audit activity itself has expanded to include audits for medium sized companies, including subsidiaries of foreign multinationals. The history of transfer pricing audits in Japan has had different characters depending on the year or the period the audit was conducted and the business/economic climate prevailing at that time. In the mid 2000's there were a lot of transfer pricing audits and assessments for Japan-based manufacturing companies. This is mainly because of the distorted profit distribution between Japan/offshore which was caused by companies relocating manufacturing plants overseas. While many manufacturers relocated plants, that is profit centers, overseas to achieve cost efficiency, the cost center such as administrative functions and R&D facilities remained in Japan. Without taking proper measurers to reallocate the profit, such movement led to profit shifting away from Japan.

Recently, the issue has become even more complicated. The first wave of offshore relocation was primarily focused on the manufacturing function, however, as globalisation progresses and the market potential of emerging markets grow, the offshore subsidiaries are starting to fulfill more non-routine functions as well. In other words, some of the non-routine functions, namely strategic marketing and/or R&D have also shifted offshore to stay close to the high growth market. Therefore, the issue which was primarily return on routine manufacturing now includes non-routine returns, and hence is much more complex. Also challenges from the overseas tax authorities over the return for the increased functionality are increasing.

Changes in the transfer pricing tax audit procedure

In Japan, transfer pricing audits had traditionally been conducted separately from the general corporate tax audits, by a specialised transfer pricing audit team within the tax authority.

The 2011 revision of the tax system in Japan included changes and clarifications on the tax audit procedure as follows.

When commencing a tax audit, the tax authority, in principle, needs to provide a formal notification to the taxpayer which shows in advance what tax items (that is, corporate income tax, consumption tax, individual income tax) will be under the tax audit. Transfer pricing tax issues are considered as part of a corporate income tax item.

When concluding a tax audit, in the event that the tax authority does not make a tax assessment, the tax authority should notify the taxpayer of this in writing. Therefore, once the tax authority issues a formal notification with no adjustment at the end of a corporate tax audit, this means no adjustment is made on transfer pricing as well.

As stated above, transfer pricing tax audit and general corporate tax audit will be conducted at the same time as a single tax audit. However, in exceptional cases, a transfer pricing tax audit may be separated from a general corporate tax audit, in the event that the taxpayer agrees to have a transfer pricing audit conducted separately.

In summary, a transfer pricing audit will by default be conducted in conjunction with general corporate tax audit, and only when taxpayer's prior consent is provided, may the transfer pricing audit be conducted separately.

Under the new procedure, when a tax audit is conducted, the tax authority needs to draw a certain conclusion for both transfer pricing and general corporate tax, and such conclusions should be notified to the taxpayer. Thus, it is expected that transfer pricing issues will be examined in a more comprehensive and detailed manner compared with the past because conducting a separate transfer pricing audit for the same year is basically no longer an option for the tax authority.

It is important for taxpayers to prepare countermeasures in preparation of a transfer pricing audit, such as establishing robust transfer pricing policies based on proper transfer pricing analysis and preparing transfer pricing documentation to support and explain the taxpayer's position.

APAs

In Japan, APAs were initiated in 1987. According to the NTA report, Japan was the first country to implement an APA system, and is one of the most experienced countries in terms of APAs, given the long history and the number of cases handled so far.

The NTA has been recommending bilateral APAs as an effective way to manage transfer pricing risks. APAs provide merits to both taxpayers and the tax authority. Taxpayers can secure predictability and avoid contentious transfer pricing audits. At the same time, the tax authority can reduce the administration costs of conducting audits. According to statistics released by the NTA, roughly 130 APA requests have been made each year over the last few years.

The major APA counterparty countries are the US, followed by Australia and the UK. Reflecting the recent economic trend, cases with countries in the Asia Pacific region are increasing. During the recent five years, the number of APA cases agreed with Asia Pacific countries accounts for approximately one third of all the APA cases agreed, and as of June 2013 there were ongoing APA negotiations with eight Asia Pacific countries, which include Australia, South Korea, China, Hong Kong, India, Indonesia, Singapore and Thailand.

The APA negotiations with these new counterparties typically take longer because of insufficient negotiation experience and the lack of consensus on economic analysis approaches.

Transfer pricing documentation enforcement

What is happening post introduction of the TP documentation rules in 2010? The items requested in the documentation, which are stipulated under Ministry Ordinance, are similar to what is already in place in many other countries. However, what is unique to Japan is the penalty potentially imposed for not having documentation in place. There is no monetary penalty for not having documentation; however, failure to submit the documentation without delay entitles the tax authority to presumptive taxation.

When the new rules were introduced, the explanation by the tax authority was that the introduction of the rule is meant to encourage taxpayers to cooperate, and does not intend to aggressively enforce presumptive taxation unless necessary. So far this seems to be what is actually happening; as long as the taxpayer is willing to cooperate, the sanction has not been triggered. That said, one should not undervalue the fact that this is a formal requirement under the law – the clause information to be provided without delay implies flexibility but that is only when the audit is carried out in a cooperative atmosphere.

While the contents of the items requested are basically similar to those in other countries, one item that needs to be prepared besides the conventional transfer pricing documentation is the system profit information. This is to show the profit earned by each related party involved in an intercompany transaction, that is the total amount of the profit earned by the group companies in one transaction and the share of that pertaining to Japan. As the preparation of such segmented financial information takes considerable time, it is advisable to collate such information before the commencement of an audit.

Reaction to BEPS

The OECD Committee on Fiscal Affairs is chaired by a representative from Japan, and the Japanese government strongly supports the BEPS related actions taken by the OECD. The business has also received the overall initiative positively.

Not many Japanese companies have been engaged in aggressive tax schemes which the BEPS initiative is trying to address and it is perceived that the impact of BEPS on corporate tax strategies would be limited.

However, industry has raised strong concern over the OECD draft on country-by-country reporting requirements. Japan Business Federation (Keidanren) has released a comment stating that "it is unreasonable and counterproductive to impose excessive additional burdens on numerous corporations that have never been engaged in BEPS".

In fact, the reporting format as drafted seems to place significant compliance burden beyond what is currently requested, and many companies think that it is unfair that any taxpayer, including those who have been playing fair on taxes, have to bear an additional burden just because some taxpayers have been engaged in BEPS.

Further, companies are worried whether the information will be interpreted and used appropriately by the relevant tax administrations, and not just as a means to compare the amount of taxes paid in one country or another; this in itself does not mean much, or may even have an adversarial effect if the information is misused.

Biography |

||

|

|

Tomoko WadaKPMG in Japan 1-6-1 Roppongi, Minato-ku Tokyo 106-6012 Japan Tel: +81 3 6229 8344 Fax: +81 3 5575 0761 Email: tomoko.wada@jp.kpmg.com Tomoko Wada is a partner in KPMG Tokyo global transfer pricing services. She has more than 15 years of experience in managing and conducting transfer pricing economic analysis. She has practiced transfer pricing both in US and in Japan, focusing on supporting advance pricing agreements, audit defence, or planning studies to determine appropriate transfer pricing for multinational financial institutions. Prior to her transfer pricing career, she has worked for a financial institution as a corporate finance vice president. |

Biography |

||

|

|

Kenjiro HosomizuKPMG in Japan Osaka Nakanoshima Bldg 15F 2-2-2, Nakanoshima, Kita-ku Osaka 530-0005 Japan Tel: +81 6 4708 5150 Fax: +81 6 4706 3881 Email: kenjiro.hosomizu@jp.kpmg.com Kenjiro Hosomizu is a manager in the transfer pricing practice in KPMG Japan who has 11 years' experience in transfer pricing. He had worked for KPMG Singapore's transfer pricing practice for two years until January 2014, to develop and support KPMG's transfer pricing service for multinational Japanese companies in Asian region. His project experience covers a range of projects such as transfer pricing risk analysis and planning, transfer pricing documentation and transfer pricing audit defence, as well as assistance for competent authority negotiation/bilateral advance pricing agreements involving the US, Singapore, China, Thailand, and Japan. He is the Certified Public Tax Accountant (Japan). |