The transfer pricing landscape in Malaysia continues to evolve with the Malaysian tax authority becoming increasingly proactive and vigilant in scrutinising the controlled transactions of multinational enterprises (MNEs). The intensity of tax audits has certainly increased and the Malaysian tax authority has been rather successful.

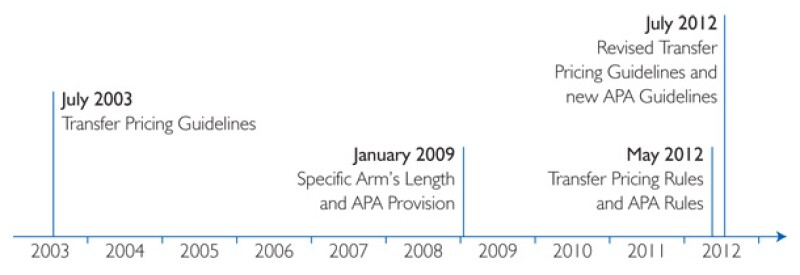

Development of transfer pricing regulations in Malaysia

With the release of a new set of rules and guidelines, as expected, there was a substantial increase in TP audit activities carried out by the Malaysian tax authority in recent years. The Malaysian Inland Revenue Board (MIRB) has been efficient and systematic in redeploying resources to ensure compliance in this area of taxation, often taking aggressive stance in protecting their claims to taxable profits.

Dealing with TP rules and regulations

The Transfer Pricing Rules (TPG 2012) specify the responsibilities of taxpayers regarding TP compliance and also highlight the need to prepare contemporaneous TP documentation to prove that transactions with associated persons are at arm's length. The TPG 2012 sets out thresholds to ease the compliance burden of taxpayers with low levels of controlled transactions and allow them to opt to prepare a limited scope TP documentation. The full scope documentation is needed for taxpayers meeting the following requirements:

Minimum gross income of MYR25 million ($7.6 million) and total amount of controlled transactions exceeding MYR15 million; or

Provision of financial assistance where the value is in excess of MYR50 million.

Taxpayers that fall below these thresholds would still need to comply with the arm's length provision, but they may opt to prepare limited scope TP documentation. Nonetheless, the MIRB still encourages taxpayers falling below the threshold to comply fully with the guidelines.

Having said this, TP documentation is not required to be submitted with the annual tax return although there are suggestions that a disclosure regarding the preparation of TP documentation would need to be made in the tax return in the near future. The documentation needs to be submitted to the MIRB only upon request (usually within 30 days).

It is also worth considering some of the pertinent MIRB practices as clarified in the TPG 2012/TP Rules (2012):

The TPG 2012 emphasises that a year-by-year comparison must be carried out when conducting benchmarking analyses, that is, the results of the controlled transaction are to be compared with the results of an uncontrolled transaction for the same basis year. The use of multi-year data is intended to identify whether the outcome of a particular year is influenced by abnormal factors. In practice, the median of the inter-quartile range is often used as the starting point when reviewing arm's-length pricing.

The TPG 2012 states that the MIRB prefers using local companies as comparables in a benchmarking analysis because of the availability of sufficient and verifiable information. Unless it can be proven to the MIRB that there are no good-quality local comparables, foreign comparables are normally not acceptable. Taxpayers who are using regional-based documentation should consider supplementing the regional comparability analysis with a local benchmarking analysis, to the extent relevant, to have the additional comfort that their related party transactions are arm's length from a Malaysian TP perspective.

Other than the typical TP documentation requirements as set out in the TPG 2012, the documentation requirements would be more onerous for specific transactions such as intra-group services, intangible property, cost contribution arrangements and intra-group financing. In order to address these issues in the Malaysian context, it is worthwhile to study them as these are also areas which are hotly debated during TP audits by the MIRB.

Enhanced transfer pricing compliance through desk audit

The MIRB has introduced a form – Form MNE [1/2012] – to collect certain information from selected taxpayers relating to their cross-border transactions. The form is modified for local related party transactions – Form JCK. The data collected through this form will enable the MIRB to assess taxpayers' TP risk. Presumably, those taxpayers that are considered high risk by the MIRB will be prioritised for a TP audit. It would not be unreasonable to expect that multinational companies with significant related party transactions and local groups with operations overseas would be targeted.

Other than targeting taxpayers through the Form MNE/JCK, the routine request for information for MIRB's desk audit is also carried out. In recent months, we have seen a significant increase in the number of taxpayers who are targeted for desk audits.

Transfer pricing audit framework

In line with the aim to provide further clarification on TP matters, the MIRB has released the TP audit framework to provide clarity and guidance on how TP audits would be carried out (effective from April 1 2013).

The new penalty framework is definitely a welcome move as the MIRB has officially acknowledged that good quality contemporaneous TP documentation can penalty protect the taxpayer. The MIRB has now introduced a new penalty regime in which a concession is given to taxpayers who opt for voluntary disclosure.

Against the backdrop of increased TP scrutiny, the number of tax disputes has risen and one taxpayer has appealed to the Special Commissioners of Income Tax (SCIT). This was the first TP court case in Malaysia and was heard at the SCIT over a two year period.

First transfer pricing case heard in the Malaysian Tax Court

Background

In August 2010, the first TP case was heard at the SCIT. A judgment in this first and only TP matter to face a Malaysian court was handed down by the SCIT in June 2012. KPMG acted as a Professional Witness in this case. The SCIT found in favour of the taxpayer. This case is currently under appeal by the MIRB to the High Court.

Table 1 shows the controlled transactions challenged by the MIRB in which the taxpayer was involved.

Table 1 |

||

Facts of the case |

MIRB’s contention |

Taxpayer’s defence |

Issue 1: Commission rate |

||

The taxpayer is principally engaged as a Malaysian shipping agent by its principal. Between the financial year 1998 and 2001, the commission rate paid by the principal to the taxpayer had reduced as follows: Reduction in Export commission 3.25% - 3.00% commission rate Export commission 1.25% - 1.00% The reduction of the commission rate did not affect the taxpayer from achieving healthy profits as the reduced commission still resulted in an overall arm’s length remuneration for the taxpayer based on a local benchmarking analysis prepared by KPMG. The MIRB alleged that the principal should not have reduced the commission income by 0.25% as the functions performed, assets employed and risks assumed (functional profile – FAR) has not changed. |

MIRB contended that the FAR did not change, and the MIRB found that the comparable companies recognised different income streams (freight income) as compared to the taxpayer (commission income). Thus, the MIRB concluded that the TP documentation did not substantiate that the transactions were conducted “at arm’s-length”. |

The MIRB did not give other reasons other than stating that the FAR of the taxpayer did not change, hence reduction in commission rate was not warranted. The adjustment by the MIRB was not acceptable as the adjustment of commission rate was a commercial decision and that the FAR had indeed changed as it no longer assumed the risk of the success/failure of the IT development function. The taxpayer also submitted TP documentation to the MIRB to support the arm’s length nature of the commission income. Further, the principal also had a third party transaction where the commission paid was in fact lower compared to the commission paid to the taxpayer. |

Issue 2: Service fees |

||

Between the financial year 1999 and 2002, the taxpayer paid service fee to their regional headquarter (HQ) in Singapore for business process improvement services. The taxpayer required the services from the regional HQ to function efficiently as a business organisation within the group. As a multinational company, the taxpayer needed to streamline its business practices to ensure that it was efficient especially in the services, cost and management aspects. Information was provided to the MIRB on several large projects carried out regionally for the benefit of the local operations. There was no duplication of services between those services rendered by the regional HQ and the taxpayer. The MIRB disallowed the service fee charges incurred by the taxpayer by way of a TP adjustment and alleged that the services were not rendered. |

During the field audit, MIRB alleged that the taxpayer failed to submit relevant documents to substantiate that the services were rendered. The service fee payment made to the regional HQ was considered as intra-group service and the taxpayer failed to substantiate the arm’s-length nature of the charge. |

The MIRB gave various reasons for disallowing the deduction claimed such as arguing that the charges were not at arm’s length and then, alleging that services were not rendered. The taxpayer was able to substantiate that services were rendered and the details have been provided to the MIRB during the audit as well as in Court. |

Note: The third issue, a non TP related matter, was in respect of the applicability of withholding tax on EDP charges. The MIRB is of the view that the expenses incurred for the EDP services paid constitute to royalty pursuant to Article XII of the relevant double taxation agreement (DTA). This issue is not elaborated in this article. |

||

Ruling released on November 7 2013

Issue one: Commission Rate

The SCIT accepted the taxpayer's contention and held that:

Although the comparables did not perform exactly similar functions like the taxpayer, the SCIT still accepted the fact that they performed generally similar functions as the taxpayer.

The taxpayer's ability to provide the necessary documentation to substantiate the reduction in commission rate showed that the taxpayer had acted in good faith and that the transaction was carried out at arm's-length.

Issue two: Service fees

The SCIT found merits in the taxpayer's documentation and that the services were indeed rendered from the regional HQ.

Our comments

The first TP case in Malaysia has affirmed some very important principles related to the determination of the arm's-length price. It was demonstrated in court that the judges recognise the taxpayer's efforts in preparing TP documentation to substantiate the arm's-length nature of the controlled transactions, hence, showed that the taxpayer had acted in good faith and took the necessary efforts to comply with the law. Also, preparation of a local benchmarking analysis is essential to justify the arm's-length nature of a controlled transaction from a Malaysian TP perspective.

With regards to services transactions, it is important for taxpayers to keep sufficient source documents to evidence that services have indeed been rendered for the relevant years of assessment as well as to demonstrate that the services are not duplicative.

Given these developments, we strongly urge taxpayers with sizeable related party dealings to prepare themselves and have in place contemporaneous TP documentation as a first line of defense in the event of a TP enquiry or audit. Tax audit activities are intensifying and the MIRB has plans underway to further tighten enforcement of TP compliance by Malaysian taxpayers.

Biography |

||

|

|

Bob KeeKPMG in Malaysia Level 11, KPMG Tower 8 First Avenue, Bandar Utama 47800 Petaling Jaya Malaysia Tel: +603 7721 7029 Email: bkee@kpmg.com.my Bob is currently KPMG's transfer pricing leader and a member of the KPMG GST strategic team in Malaysia. Bob advises on transfer pricing issues, including formulating defense strategies for tax audit situations and planning for transfer pricing risk mitigation, as well as transfer pricing planning services in relation to the supply chain restructuring of companies operating in various industries. In 2011, Bob earned the distinction of being the first expert witness in Malaysia's first transfer pricing court case. Bob is also experienced in indirect taxes and GST. His experience in transfer pricing and also customs' valuation rules enables him to provide sound transfer pricing planning and advice from both a direct and indirect tax perspective. |

Biography |

||

|

|

Mei Seen ChangKPMG in Malaysia Level 11, KPMG Tower 8 First Avenue, Bandar Utama 47800 Petaling Jaya Malaysia Tel: +603 7721 7028 Email: meiseenchang@kpmg.com.my Mei Seen advises multinational companies on transfer pricing matters, including preparation of transfer pricing documentation in compliance to the Malaysian transfer pricing rules and guidelines, advisory and planning for risk mitigation as well as involvement in dispute resolution on transfer pricing issues. Industry coverage extends to include logistics, pharmaceutical, automotive, insurance, semiconductor, commodities, oil and gas as well as FMCG. Mei Seen is also actively involved in advance pricing agreement (APA) applications. She was also involved in the first transfer pricing court case in Malaysia. |