On January 1 1996, the government of Korea enacted the Law for the Coordination of International Tax Affairs (LCITA) which included the first transfer pricing legislations in Korea. LCITA was drafted in accordance with OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (OECD TP Guidelines) and the government of Korea has been very active in incorporating the revisions of OECD TP Guidelines into the LCITA since its enactment.

In recent years, transfer pricing issues have attracted lots of attention from the Korean tax authorities. Significant efforts have been made to strengthen the transfer pricing regulations which included a series of amendments, including one made to reflect the most recent OECD TP Guidelines issued in July 2010, and development of specialists in the area of transfer pricing within the Korean National Tax Service (NTS). As a result, multinationals operating in Korea have been subject to greater transfer pricing scrutiny and have incurred significant costs in complying with the strengthened transfer pricing regulations.

Key changes to Korean transfer pricing regulation

Harmonisation of transfer pricing and customs valuation adjustments

In Korea, taxpayers who import from foreign affiliates often found it difficult to obtain customs refunds resulting from transfer pricing adjustments and vice versa. In an attempt to reconcile the differences in transfer pricing and customs valuation methods used by the two tax agencies, the Ministry of Strategy and Finance amended the LCITA and the Korea Customs Act to harmonise the transfer pricing and customs regulations. The newly enacted legislation, which became effective on July 1 2012, states that transfer pricing or customs valuation adjustments made by one tax authority should be respected by the other. Accordingly, the taxpayers are now able to protect themselves from overpaying taxes/duties resulting from adjustments made by one tax authority by requesting for corresponding adjustments to the other tax authority. This harmonisation regulation will provide an opportunity for the taxpayers to avoid potential double taxation arising from transfer pricing and customs valuation adjustments. According to the current interpretation of the legislation, there is a condition that must be satisfied for the refund application; the taxpayer must, within two months from the date the taxpayer became aware of the transfer pricing or customs valuation adjustments, apply for a refund to the other tax authority. Accordingly, taxpayers are being advised to understand and apply this new harmonisation regulation to obtain a refund on overpaid corporate taxes or customs duties resulting from the tax/customs audits.

Information exchange

In an effort to prevent offshore tax evasion by multinationals operating in Korea, the LCITA was amended to expand the scope of exchange of financial information under current tax treaties. Before the amendment, only non-residents and non-resident corporations were subject to the periodic information exchange. According to the amendment, the parties subject to the financial information exchange was expanded to include domestic residents and companies as well as any group of two or more individuals. In addition, financial institutions may be fined with a penalty up to KRW30 million ($28,000) for the lack of cooperation with the government's request. The effective date for the amended LCITA is January 1 2014.

In relation to the base erosion and profit shifting (BEPS) action plan, the Korean government is assessing the opinions of various stakeholders but has not expressed its stance regarding this matter.

Transfer pricing audit trends

In case of tax adjustments, NTS prefers year-by-year tax audit to term testing over multiple years. This preference can sometimes work against taxpayers who are unable to explain highly fluctuating yearly profits. However, it is not uncommon for the NTS to accept multi-year testing when dealing with transfer pricing adjustments and apply similar methods to the other years subject to review (subject to statute of limitations). The statute of limitations is five years from the day following the due date for filing the income tax return. When the taxpayers' transfer prices fall outside the arm's-length range, NTS generally adjusts the transfer prices to the median value from the benchmarking result.

Transfer pricing adjustments are subject to secondary adjustments in Korea. As a result, taxpayers may be assessed with additional taxes on the primary transfer pricing adjustments. Taxpayers are given 90 days to avoid the secondary adjustments. Most secondary adjustments are treated as deemed dividends subject to withholding taxes or as additional capital investment.

Recently, intercompany royalty charges for the use of brand names/trademarks have become a focus of the Korean tax authorities. In the past, the focus has been on whether the brand owner has been compensated for the use of its brand and there have been many cases where a significant tax assessment was made in this regard. However, because of the complexity involved in determining the value of the brands and the resulting royalty rates, the valuation method chosen by the taxpayer to determine its royalty rate has not been subject to many challenges. However, given the increasing interest by the tax authorities in the royalty charges, it is recommended that taxpayers be proactive in developing a reasonable valuation method and economic rationality to deal with potential challenges by the tax authorities.

Recent tax audits show that the tax authorities closely scrutinise excessive intra-group transactions among affiliates. LCITA enforcement decree article 6 paragraph 2 states that for the intra-group service fees to be deductible, the following conditions must be satisfied:

Actual services are provided in accordance with an agreement;

service recipients expect to increase profit or reduce cost from the services;

service fees are determined at arm's length; and

documentation that verifies the above is prepared.

Taxpayers paying large royalties, intra-group service fees and/or commission fees based on sales to foreign affiliates are facing higher risk of transfer pricing challenges by the NTS.

General compliance

Benchmarking study

In identifying potentially comparable companies whose businesses are similar to that of the tested party, Korean tax authorities generally do not accept a non-local benchmarking study and strongly favor the use of a Korean database called KIS-Line. KIS-Line contains financial and business information of more than one million Korean based companies that are subject to annual statutory audit requirements. The database is first screened for businesses that are engaged in the same or similar businesses which the tested party is involved in to arrive at the pool of comparables. The initially identified potential comparable companies are then screened using certain quantitative and qualitative criteria to eventually arrive at the final set of comparables. Examples of some of the most commonly used quantitative screening criteria used to eliminate non-comparable companies are as follows:

Companies without at least three years of audited financial statements are eliminated;

Companies that incurred consistent operating losses are eliminated; and

Companies with significant R&D expenses or marketing expenses are eliminated if the tested party does not incur those expenses.

Working capital adjustments are usually applied in order to improve the comparability.

Transfer pricing documentation

Although the preparation of transfer pricing documentation (TPD) is optional, a penalty relief can be provided to taxpayers who satisfy the contemporaneous documentation requirements. In case of a transfer pricing adjustment, underreporting penalty (that is,10% of the additional corporate income tax) may be waived if the taxpayer has maintained contemporaneous transfer pricing documentation by the corporate tax filing due date. A taxpayer who wishes to obtain the penalty relief should submit the documentation within 30 days when requested by the NTS and the documentation should contain the following information:

General descriptions of the business;

Information on foreign related parties and their relationships with the taxpayer;

Economic analysis and evidence supporting the selection of the most reasonable transfer pricing method; and

Profitability of the selected comparable companies and the descriptions of adjustments applied during the analysis of the arm's-length price.

Advance pricing agreement (APA)

The APA programme was first introduced on January 1 1997 in Korea and the number of APA applications per year has been increasing every year as taxpayers try to avoid unexpected tax issues from their operations and mitigate potential risks. In 2012, more than half of the concluded APAs were bilateral APAs requested by foreign multinationals. APAs can be unilateral, bilateral or multilateral, and can be sought for three to five-year period. A rollback can be granted for all three types of APAs up to five years. Unilateral APAs are usually concluded within 18 months while bilateral/multilateral APAs are generally completed within two to three years. Once the terms of the APA have been finalised, the results are legally binding to the NTS but not to the taxpayer. The taxpayer has the right to withdraw the APA without consequences.

The unilateral APAs are mandated by the LCITA to be completed within two years from the application date which makes the unilateral APA process to be more streamlined compared to the bilateral or multilateral APAs. Additionally, the approval process is handled by the International Co-operations Office, which is in charge of all APA negotiations, which allows the taxpayer to deal with the tax examiners who are specialised in transfer pricing. Accordingly, when dealing with transfer pricing issues, unilateral APAs provide more flexibility and benefits to the taxpayers than going through the general corporate tax audits which are generally conducted by tax examiners with limited transfer pricing understanding or experience. Having said that, taxpayers with moderate to high transfer pricing risks are encouraged to manage their transfer pricing risks through unilateral APAs.

When an APA approval is obtained, taxpayers are required to file an annual APA report which shows that the transfer prices have been determined by the method agreed upon under the APA. The due date for the annual APA report is within nine months following the end of the taxation year.

Transfer pricing audit process

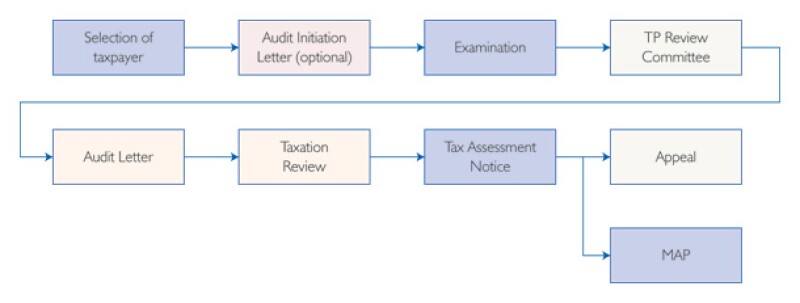

Diagram 1 |

|

Diagram 1 illustrates the transfer pricing audit process in Korea. The first process of the audit entails the selection of taxpayers for tax audits. Generally, tax audits are expected in five-year cycle but recently taxpayers have experienced more frequent tax audit cycle. Additionally, taxpayers whose profitability declined significantly are likely to be selected for the tax audits. Korean tax audit guideline stipulates that the duration of a tax audit should be as short as possible, especially for taxpayers with revenues less than KRW10 billion, the audit should be completed within 20 days from the commencement date. During the tax audit, transfer pricing issues are reviewed by the Transfer Pricing Review Committee (TPRC) before any tax assessments are determined and delivered to the taxpayer. TPRC is required to review transfer pricing adjustments over KRW5 billion, adjustments disapproved by taxpayers, or any other issues as determined by the TPRC. The purpose of the TPRC is to ensure that the proposed transfer pricing adjustments are reviewed by transfer pricing specialists before the completion of a tax audit. After receiving tax assessments, taxpayers can accept the assessments, pursue an appeal in court, or request for mutual agreement procedure (MAP).

Table 1 |

||

1st Level: |

• Taxation review |

The appeals must be filed within 30 days of the receipt of the tax audit letter. |

2nd Level (options): |

• Secondary review by the NTS • Request for ruling by the Tax Tribunal • Appeal to the Board of Audit and Inspection |

The appeals must be filed within 90 days of the receipt of tax assessment notice (taxpayers may also elect to only make the appeal in court). |

3rd Level: |

• Appeal in court |

The appeals must be filed within 90 days of the receipt of tax assessment notice. |

Taxpayers who want to pursue an appeal in Korea have the alternatives listed in Table 1.

Generally, transfer pricing disputes are resolved through MAP and the taxpayer may request for a suspension of tax payment resulting from the transfer pricing disputes until it is resolved by the competent authorities.

Biography |

||

|

|

Gil Won KangKPMG in Korea Gangnam Finance Center 10th Floor, 152 Teheran-ro Gangnam-gu, Seoul 135-984 Korea Tel: +82 2 2112 0907 Fax: +82 2 2112 0902 Email: gilwonkang@kr.kpmg.com Gil Won is the global transfer pricing services leader of KPMG Korea. He has an excellent reputation within the profession and has close relationships with the Korean tax authorities. Before joining KPMG, Gil Won led the outbound transfer pricing practice at Kim&Chang, Korea's largest law firm and helped establish its Chinese tax practice. He concluded the first Korean-Chinese APA and the first APA related to intra-group service transactions in Korea. Gil Won was a member of competent authority team of Korea's National Tax Service and handled various negotiations with G8 nations. He continues to hold seminars for the Korean government and Korean multinational companies on transfer pricing issues. During 2013, Gil Won has been appointed as the World's Leading Transfer Pricing Advisers by Euromoney's Guide and his transfer pricing team was also ranked as Tier 1 transfer pricing advisory group in Korea by International Tax Review 2013. |

Biography |

||

|

|

Dong Kwan KimKPMG in Korea Gangnam Finance Center 10th Floor, 152 Teheran-ro Gangnam-gu, Seoul 135-984 Korea Tel: +82 2 2112 0936 Fax: +82 2 2112 0902 Email: dongkwankim@kr.kpmg.com Dong Kwan is a director of the global transfer pricing services of KPMG Korea. He has 20 years of experience in the field of Korean and international taxation. He has been providing tax advisory and compliance services to multinational companies in wide range of industries. Prior to joining KPMG, Dong Kwan was part of the International Cooperation Office where he handled MAP and APA approvals with the US, UK and Japan analysing, reviewing and approving various MAP and APA cases. In addition, he was responsible for uncovering and resolving transfer pricing related issues for the multinationals doing business in Korea. During his time as a tax examiner, he was involved in various tax audits involving transfer pricing, beneficial interest, permanent establishments, thin capitalisation and offshore tax evasion issues. |

Biography |

||

|

|

Pius Tae Hyun ParkKPMG in Korea Gangnam Finance Center 10th Floor, 152 Teheran-ro Gangnam-gu, Seoul 135-984 Korea Tel: +82 2 2112 6757 Fax: +82 2 2112 0902 Email: taehyunpark@kr.kpmg.com Pius is a senior manager of the Global Transfer Pricing Services of KPMG Korea. He has 9 years of experience in the field of international taxation. He has managed many transfer pricing projects in North America, Asia and Europe, involving supply/value chain restructuring, APA/MAP negotiations, intra-group service arrangements, and transfer pricing documentations for multinational companies in wide range of industries. |