High-technology companies frequently enter into cost sharing arrangements (CSAs) to develop intellectual property (IP) and facilitate expansion into foreign markets. When one party contributes pre-existing IP to a CSA, the other party is required under US transfer pricing regulations to make an arm's-length payment for the right to exploit those assets. The regulations under Treas. Reg. §1.482-7(g) provide several methods for valuing the contributed pre-existing IP.

There is some ambiguity in the transfer pricing community on how the useful life of the pre-existing contributed assets impacts valuation under the cost sharing regulations. Some believe the stipulated methods cause taxpayers to assume a long-lived asset, one that generates returns in perpetuity. Others believe the regulations allow for IP valuations over a finite asset life. These two regulatory interpretations may have a significant impact on the valuation and the resulting tax consequences of the transaction. Not surprisingly, the ambiguity around this issue has caused disputes during both tax and financial statement audits.

The ambiguity has been particularly frustrating for technology companies, which face an accelerated rate of technological change and rapidly shrinking product and technology lifecycles. Some industry analysts believe high technology companies operate in an era of "instant obsolescence", where equilibrium is viewed as a state of stagnation and irrelevance (see, e.g., the Jim Carroll blog "Innovating in the Era of Instant Obsolescence" at www.jimcarroll.com and the article "The Velocity of Obsolescence" by Lewis Gersh, Forbes, July 29 2013).

It does not require much imagination to see that these industry dynamics are inconsistent with the notion that technology IP is long-lived, let alone perpetual. It's therefore important for practitioners working with technology companies to understand (i) how IP life should be treated within the cost sharing regulations; and (ii) how industry dynamics impact the useful life of technology intangibles (meaning generally a company's portfolio of process and product technologies, as well as its specialised know-how and knowledge).

This article:

Summarises our interpretation of what the cost sharing regulations say about the treatment of useful life;

Presents a model used by academics and technologists for estimating how technology intangibles are expected to evolve over time; and

Provides some practical considerations for transfer pricing practitioners who provide services to technology companies.

Cost sharing regulations

The cost sharing regulations, at first glance, appear vague on how the useful life of pre-existing intangibles should impact the valuation of a platform contribution transaction (PCT). We believe this perceived vagueness has contributed to the ambiguity regarding whether PCT valuations generally should consider the useful life of an intangible. However, the regulations, as we will see, are quite explicit and practical with respect to the treatment of IP life within the context of a PCT valuation.

For example, consider the references under Treas. Reg. §1.482-7(g)(2)(ii)(A), which state:

"…each controlled participant's aggregate net investment in the CSA Activity…is reasonably anticipated to earn a rate of return….appropriate to the riskiness of the controlled participant's CSA Activity over the entire period of such CSA Activity."

"If the cost shared intangibles themselves are reasonably anticipated to contribute to developing other intangibles, then the period described in the preceding sentence includes the period, reasonably anticipated as of the date of the PCT, of developing and exploiting such indirectly benefited intangibles."

One interpretation of these references is that valuations should be performed over the life of the CSA. That interpretation is inconsistent with the example in §1.482-7(g)(2)(ii)(B), which illustrates the principles summarised above. In that example, parent and subsidiary enter into a CSA to develop a next generation software programme. The new programme will be based in part on a pre-existing programme that was developed solely by parent. Sales of the new programme will begin in year two; all the technologies embedded in the new program will be obsolete by the end of year 10. Parent and subsidiary apply a residual profit split method, of the variety described in Treas. Reg. §1.482-6 (whereby residual profit is divided between parent and subsidiary pro rata to their relative amortised historical and future R&D spending) over a four-year useful life to value parent's PCT. Under this method, according to the example, parent will receive none of the residual profit after year four; as a result, subsidiary's aggregate net investment in the CSA is at a rate of return higher than what would be achieved under a more reliable method.

In this example, there is no residual profit to share after year 10, because the pre-existing and any newly developed technologies are obsolete. Thus, the implied rate of return for subsidiary is higher than it would have been otherwise not because parent and subsidiary did not use a perpetual valuation horizon, but because the taxpayer assumed a four-year life when the intangibles have a 10-year useful life. As a result, the implied rate of return for subsidiary must be higher over the life of the CSA.

It is also illustrative to use the facts in the above example to examine the impact on parent and subsidiary's implied rate of return under a perpetual valuation horizon. Had the taxpayer implemented a valuation approach over a perpetual horizon, parent's implied rate of return would have been higher and subsidiary's rate of return lower than they would have been otherwise, since future residual profit after year 10 is no longer dependent on any pre-existing technologies.

Examples 3 and 7 in Treas. Reg. §1.482-7(g)(4) also support this contention. Example 3 applies a finite useful life in an application of the income method. The example reads:

"…it is reasonably anticipated that FS (foreign subsidiary) will have gross sales of $1000X in its territory for 5 years attributable to its exploitation of version 1.0 and the cost shared intangibles, after which time the software application will be rendered obsolete and unmarketable by the obsolescence of the storage medium technology to which it relates."

Example 7 under paragraph (g)(4) describes the condition under which the use of a "terminal value" is appropriate. The example reads:

"… FS (foreign subsidiary) and USP (US parent) do not anticipate cessation of the CSA Activity with respect to Z (the pre-existing technology) at any determinable date."

Examples 3 and 7 under Treas. Reg. §1.482-7(g)(4) and the example in (g)(2)(ii)(B) do not support the position that all PCT valuations should be done assuming a perpetual life to the underlying assets. Example 3 makes clear when a finite life application of the income method is appropriate. Moreover, example 7 demonstrates for taxpayers that a perpetual-life model is appropriate only when the taxpayer cannot anticipate when the contributed asset will stop benefiting the CSA. Finally, the example in (g)(2)(ii)(B) illustrates principles the IRS is trying to capture in §1.482-7 (g)(2)(ii)(A); namely, that taxpayers match the valuation horizon with the period of time that platform contributions are reasonably anticipated to benefit the CSA to confirm both parties' implied rate of return is consistent with their activities and investments under the CSA.

In addition to these examples, the cost sharing regulations do not indicate that taxpayers cannot use a finite useful life for purposes of valuing a PCT.

Valuation inputs involve some level of uncertainty, and the regulatory framework is complex and subject to interpretation, specifically given the lack of legal precedents. However, Tax Court observations on the VERITAS Software Corp. v. Commissioner case (133 T.C. No. 14) provide guidance on an appropriate valuation horizon, notwithstanding the IRS's action on decision (AOD) in the case. The Tax Court acknowledged that the regulation applicable at the time "requires a buy-in payment to be made with respect to the transfer of 'pre-existing intangible property", but it also stated that "no buy-in payment is required for subsequently developed intangibles". Further, the IRS has not clarified its position with respect to the valuation horizon outside of a vague reference in the Veritas AOD, wherein it seems to validate the concept of a finite useful life. The IRS also indicated that the Tax Court had erroneously concluded that the IRS was contending that the pre-existing IP had a "perpetual" useful life (Veritas AOD, footnote 4).

Although the Veritas transfer pricing case was decided under the old cost sharing regulations, the underlying economic principles could be deemed to apply to the new cost sharing rules. Specific to the technology industry, the Tax Court indicated that "…..product technologies in hi-tech industries are short-lived and require constant update and renewal". The court also concluded that "the useful life of the pre-existing technology did not last into perpetuity because at some point it became obsolete", a topic we will flesh out in the next section.

To recap, the regulations appear vague on the issue of useful life, and the reference to "the entire period of such CSA Activity" in paragraph §1.482-7 (g)(2)(ii)(A) may be misleading to taxpayers. However, the examples presented above are neither vague nor misleading. They indicate that a taxpayer's fact pattern should determine the valuation horizon. Arbitrarily valuing fixed-life intangibles using a perpetual horizon ignores a taxpayer's underlying facts and arguably violates the arm's-length standard, as outlined in Treas. Reg. §1.482-1(b)(1), since no third party would pay for rights beyond the exploitation period.

Technology evolution and diffusion

This section will discuss the two primary factors affecting the useful life of any given technology – technology evolution and technology diffusion.

Technology evolution

We use a simple S-curve model to illustrate how technology IP evolves over time. S-curves, sometimes referred to as growth curves, are one of the tools used by academics and technology forecasters to predict how and when an upper limit of a given technology is reached.

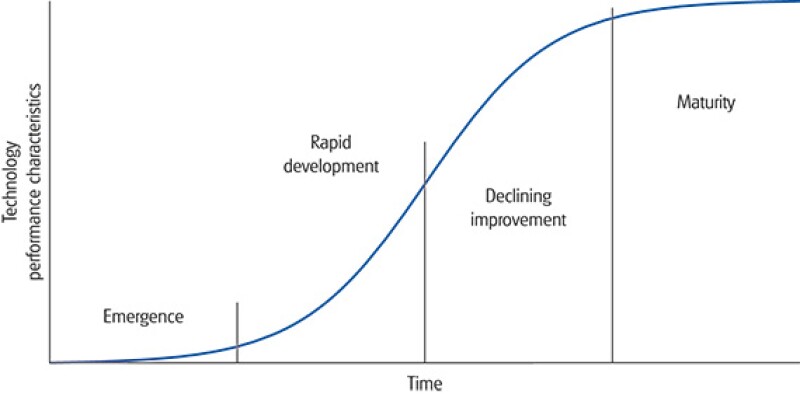

Technology evolution refers to changes in performance characteristics of a specific technology over time (Narayanan, 2001). History shows that once a new technology is introduced, growth in performance characteristics tends to be slow, followed by a period of rapid growth, followed again by a period of decline as the technology plateaus (Martino, 1993). Narayanan (2001) describes a technology's evolution through the following four stages: emergence, rapid improvement, declining improvement, and maturity. These stages are illustrated in Figure 1, along with a simple S-curve that maps the changes in performance characteristics over time.

Figure 1: Stages of evolution, S-Curve |

|

In the early stages of development, a technology operates far below its potential, due largely to a lag in learning processes. Once that lag is overcome and the know-how associated with a given technology becomes better understood, experience accumulates, resulting in high growth in the technology's performance characteristics. The rapid growth enjoyed during the second stage slows in stage 3 and eventually plateaus in stage 4 as the technology approaches its limit.

According to Narayanan (2001), while the trajectories for various technologies differ, "virtually all" technological developments display a similar pattern of growth as that captured by the general S-curve in Figure 1. A host of other researchers have also recognised the relatively stable pattern of growth in technology development predicted by the S-curve (see, e.g., Sahal, 1981; Martino, 1993; Vanston, 1996; Norman, 1998; and Roper, 2011).

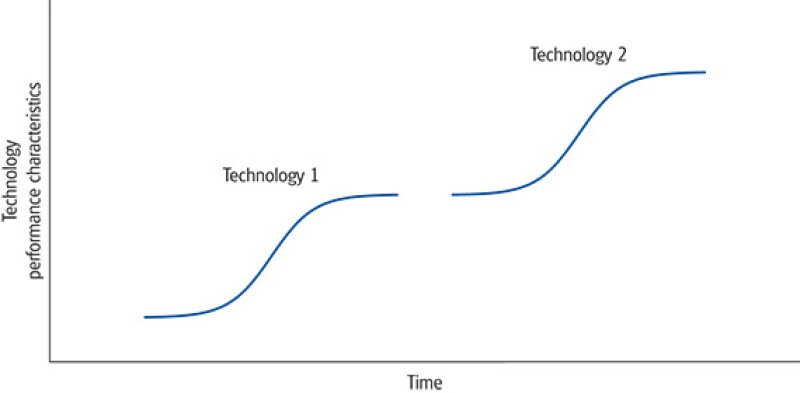

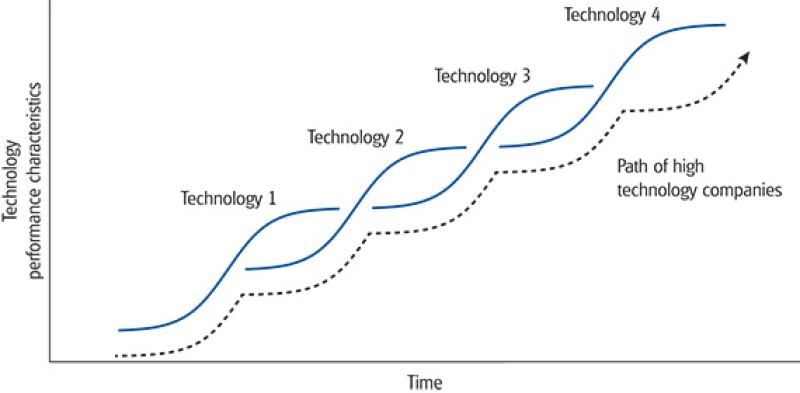

S-curves can also be used to illustrate technological progression. Whereas technology evolution refers to changes in the performance characteristics over time, technological progression describes the process by which new technologies emerge, making older technologies obsolete (Narayanan, 2001). Figure 2 illustrates technological progression.

Figure 2: Technological progression |

|

The performance characteristics of Technology 1 improve over time along its individual S-curve until the technology limit is reached. This is the point in time when future improvements are no longer possible; every technology is associated with a finite potential for improvement in its performance characteristics due to certain physical laws that can be pushed only so far (Narayanan, 2001 and Martino, 1993). Once a technology has reached its potential, improvements in characteristics have to wait until the next radical innovation. The S-curve for Technology 2 represents the next breakthrough, which makes the prior version of the technology obsolete.

The illustration in Figure 2 suggests that firms do not release the next technological breakthrough or radical innovation until they have exhausted all potential improvements from an existing technology. This dynamic may be true of some product-based companies, but as we'll see later in the article, high-technology companies pursue radical breakthroughs long before an existing technology has reached its potential.

Technology diffusion

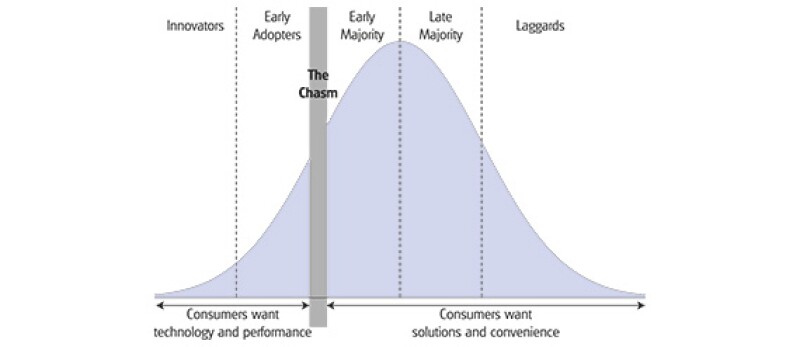

For our purposes, technology diffusion is the process by which consumers adopt a particular technology over time. While several researchers have studied diffusion (see Rogers (2003) for a review of this research), the model we will adopt is described by Moore (2014) as the Technology Adoption Life Cycle (TALC), which argues that initially a technology is adopted by Innovators, then Early Adopters, then the Early Majority, the Late Majority, and finally the Laggards. Moore defines these different groups as follows:

Innovators are aggressive at adopting new technologies. They sometimes adopt before a formal marketing programme has been launched. Innovators are often technologists themselves. In any given market, there are only a few innovators, but their adoption of the technology is important because their endorsement encourages other consumers in the market.

Early Adopters accept new technologies early in the life cycle, but they are not technologists like the Innovators. Rather, they appreciate the benefits that new technologies offer and rely on their insight in making buying decisions.

Early Majority are similar to Early Adopters in their appreciation of the benefits technology offers, but they formally adopt based on a keen sense of practicality. They understand that some technologies are passing fads, so they wait and see how other consumers are making out before formally adopting.

Late Majority wait until a technology has become an established standard before adopting. They tend to purchase new technologies only from large, well-known companies that offer adequate support.

Laggards want nothing to do with new technology, for both personal and economic reasons. They adopt technology only when it is bundled deep within another product.

According to Moore, the TALC model has become central to the entire technology industry's approach to marketing, because the high-tech industry, more so than other industries, regularly introduces radical innovations. The TALC model is illustrated in Figure 3 using a simple bell curve, where the area under the curve reflects the number of users who have adopted a given technology.

Figure 3: The technology adoption life cycle |

|

When a technology is first introduced, it cannot possibly meet all the needs of its consumers. Innovators and Early Adopters are willing to accept a new technology in spite of these shortfalls and the high purchase cost. As the technology matures, it offers better reliability, more technical support, and a lower price point. As a result, new types of consumers continue to enter the market. Thus, the TALC describes the overall progression or diffusion of technology adoption through the entire consumer base.

The grey shaded area is what Moore refers to as "the chasm", which illustrates two important ideas. First, the chasm represents a transition point where the technology, as Norman (1998) suggests, begins to satisfy the basic needs of the average consumer. In other words, the technology has less to do with performance and more to do with convenience. Second, the chasm reflects a time in a technology's useful life when many high-tech companies fail because they misunderstand the incompatible differences between the Early Adopters and Early Majority. To successfully pass the chasm, a high-tech company must transition to a product company, focusing more on ease of use, convenience, brand, and price and less on technological performance. According to Moore, this is a difficult transition for an industry dominated by technological advancement and higher levels of performance.

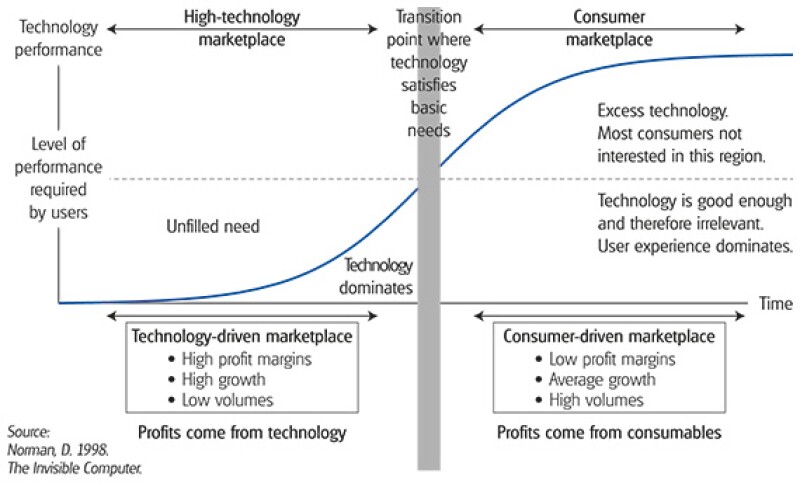

We can use the concepts of the TALC model and S-curves to illustrate how markets and companies change over the useful life of a given technology. This is presented in Figure 4.

Figure 4: Transition from technology-driven to consumer-driven markets |

|

The figure presents a simple S-curve that maps performance characteristics over time. The grey shaded area again reflects the chasm: the point in time when technology begins to satisfy the basic needs of the average user. To the left of the chasm, the consumer base consists of Innovators and Early Adopters; to the right, the Early and Late Majority and the Laggards. When a technology passes the chasm, consumers no longer buy based on technological performance; buying decisions are based on brand, reputation, convenience, user experience, price, and reliability. As the technology continues to mature, competition rises and substitutes emerge, which cause profit margins to drop. As a result of these changes, the company must change itself if it is to survive the transition from a high-technology company to a product-based, consumer-driven company.

Both Moore and Norman (2014 and 1998, respectively) recognise that high-technology companies often do not cross the chasm to a products-based company because either (a) they do not possess the organisational know-how to compete in a consumer-driven market; or (b) they strategically choose to do what they do well, which is innovate. Both of these reasons help to explain the high rate of technological introduction we see in the industry, and why some analysts believe technology companies operate in an era of "instant obsolescence". Utilising these concepts, Figure 5 illustrates the technological progression of a high-tech company that does not cross the chasm, and instead opts to strategically target the Innovators and Early Adopters through a series of radical innovations.

Figure 5: Technological progression for a high-technology company |

|

Figure 5 illustrates a typical trajectory for a high-technology company. A series of different S-Curves are presented, which again map performance characteristics over time. Each S-curve represents a new radical innovation, making the prior version of the technology obsolete. The company plans its technological breakthroughs to more or less confirm it continues to serve the Innovators and Early Adopters in technology-driven markets, earning high profits. This path is sometimes referred to as "jumping the S-curve" or "riding the S-curve".

The path of a high-technology company illustrates two important points. First, it helps to explain why high-tech companies have breakthroughs long before a solution has reached its technological limit. And second, it offers a rationale for the high rate of radical innovations we see in the high-technology industry.

The above discussion on technology evolution and diffusion, and the accompanying illustrations in Figures 1 through 5, are an oversimplification of what is otherwise a complex set of industry dynamics. But simplifications are useful if they capture the essence of the phenomenon and help to explain market behaviour, which is what we've tried to do here.

Transfer pricing implications

So what does this mean for the transfer pricing practitioner who is valuing a contribution of pre-existing technology IP? There are several important implications practitioners should be aware of:

The cost sharing regulations do not require PCTs to be valued in perpetuity. The regulations are flexible, allowing the underlying facts to dictate the period over which the valuation is performed.

Technology IP has a finite life and generally displays a pattern of growth as that captured by the S-curve.

Technology diffusion tends to follow a progression whereby a solution is first adopted by Innovators, then Early Adopters, then the Early Majority, the Late Majority, and finally the Laggards.

Markets change over the useful life of a technology, transitioning from a technology-driven market with high profits to a consumer-driven market with low profits. More importantly, once a technology passes the chasm, consumers place more value on brand, reputation, convenience, user experience, price, and reliability than they do on the technology itself.

This last statement suggests that what drives a firm's profits changes over time as technologies mature. For example, consider a low-tech company that manages to cross the chasm. In the early years of the technology, profits are primarily attributable to technological performance. In the latter years, it is brand and other IP that drive profit, even though the technology has not yet reached its technological limit (that is, the useful life of the technology is not yet zero). An important point is that these other intangibles, the intangibles that drive profit in the latter years, may not be developed when the practitioner initially values a contribution of pre-existing technology to a CSA.

High technology companies pursue a trajectory of jumping or riding the S-curve by regularly introducing radical innovations and strategically targeting the Innovators and Early Adopters in the marketplace.

References |

Henderson, R. and Clark, K. (1990), "Architectural Innovation: The Reconfiguration of Existing Product Technologies and the Failure of Established Firms," Administrative Science Quarterly, vol. 35, no. 1, pages 9-30. Martino, J. (1993), "Technological Forecasting for Decision Making," 3rd edition, Mc-Graw-Hill. Moore, G. (2014), "Crossing the Chasm," 3rd edition, Harper-Collins. Narayanan, V. (2001), "Managing Technology and Innovation for Competitive Advantage," 1st edition, Prentice-Hall. Norman, D. (1998), "The Invisible Computer," 1st edition, MIT Press. Sahal, D. (1981), "Patterns of Technological Innovation," 1st edition, Addison-Wesley. Vanston, L. and Vanston, J (1996), "Introduction to Technology Market Forecasting," 1st edition, Technology Futures. Rogers, E. (2003), "Diffusion of Innovations," 5th edition, Free Press. Roper, A., Cunningham, S., Porter, A., Mason, T., Rossini, F., and Banks, J. (2011), "Forecasting and Management of Technology," 2nd edition, Wiley. Sood, A. and Tellis, G (2005), "Technological Evolution and Radical Innovation," Journal of Marketing, vol. 69, pages 152-168. |

Michael J Bowes |

||

|

|

Director Deloitte Tax LLP 225 West Santa Clara St, Ste 600 San Jose, CA 95113 Tel: +1 408 704 4750 Michael J. Bowes is Deloitte's national technology co-leader for the US transfer pricing practice. He has more than 14 years' experience consulting on transfer pricing and tax issues for several of the world's largest technology companies, providing valuation and economic consulting services involving mergers and acquisitions, international tax planning, and the restructuring and reorganisation of international operations. He has negotiated US and foreign advance pricing agreements, managed US and foreign transfer pricing audits, and met with various competent authorities on behalf of his clients. Mr. Bowes directs a team of 25+ transfer pricing analysts across the Pacific Northwest from his offices in San Jose, California, and Portland, Oregon. Before joining Deloitte Tax, Mr. Bowes was an economist with another Big Four firm, an economist with Christensen Associates, and a graduate teaching fellow at the University of Oregon Economics Department. |

Jay Das |

||

|

|

Senior manager Deloitte Tax LLP 225 West Santa Clara, St., Ste. 600 San Jose, CA 95113 Tel: +1 408 704 4442 Jay Das is a Senior Manager in Deloitte's national transfer pricing service line and is based in the San Jose, California office. Jay has extensive transfer pricing experience and has provided several top multinational companies (including Fortune 500 companies) with valuation and economic consulting services involving business model optimization planning, mergers and acquisitions, implementation of IP migration strategies, headquarter services, international tax transfer pricing planning, and restructuring and reorganisation of international operations as well as controversy management and dispute resolution. Jay is also actively involved in training, and has developed training materials for Deloitte's US and global transfer pricing practice and has instructed at several internal and external events. Before joining Deloitte Tax, Jay was an analyst with Merrill Lynch & Co., Inc. in the Investment Banking division, a research assistant at the University of California, San Diego in the Physics department and a software developer for NASA. Professional Qualifications and Education M.B.A., University of California, Berkeley (Haas School of Business) M.S. (Management Science), Stanford University (Expected) B.A. (Mathematics & Economics), University of California |