The Alternative Investment Fund Managers Directive (AIFMD) – a product of the financial crisis – entered into force on July 21 2011.

The goal of the AIFMD is to regulate the management and marketing of alternative investment funds (AIFs) in the EU and thus, affecting a part of the financial industry that in the past was mostly unregulated or only subject to light regulations.

The Directive applies to alternative investment fund managers (AIFMs) that manage AIFs in the EU, non-EU fund managers that manage AIFs established in the EU and non-EU fund managers that market units, or shares of EU or non-EU AIFs, in the EU (unless an exemption applies).

EU member states had to implement the Directive in their local law by July 22 2013. Due to transitional periods in many EU member states the Directive becomes fully effective only after July 22 2014.

The benefit of the AIFM licence is that the licence will give the AIFM the EU-wide "passport" that will permit the management of AIFs based in any EU member state and an EU-wide marketing passport to market AIFs to professional investors in the EU.

How are Swiss portfolio managers affected by the AIFMD?

Swiss portfolio managers (or advisers) are affected by the AIFMD if (i) they manage and/or (ii) market an EU-AIF or (iii) market units or shares of non-EU AIFs to professional investors in the EU (unless subject to de-minimis exemptions or grandfathering rules). Further, Swiss portfolio managers (or advisers) are affected by the AIFMD if the portfolio or risk management is delegated to them by an EU-AIFM. According to the AIFMD EU member states may apply local regulations with regard to AIF marketed to retail investors in their territory.

Thus, if a Swiss portfolio manager or adviser intends to manage EU-AIFs and/or market AIFs to professional investors in the EU, a licence from an EU member state of reference is required. A licence in an EU member state of reference is also required if an EU or non-EU AIFM delegates the portfolio management or risk management tasks to the Swiss portfolio manager.

To receive the licence the Swiss portfolio manager needs to be fully compliant with the AIFMD. Thus, apart from being fully compliant with the Swiss Federal Act on Collective Investment Schemes (CISA) the Swiss portfolio manager needs to be fully compliant with AIFMD, to the extent that the AIFMD regulations are not in contradiction to the regulations in the home country of the non-EU fund manager. On the other hand, not only has the Swiss portfolio manager to fulfill the AIFMD requirements but there are additional 'home-country' requirements that the country of residence of the non-EU AIFM needs to fulfill. First, it is required that Switzerland has concluded a comprehensive double tax treaty including the information exchange according to article 26 of the OECD model tax treaty with the country of the EU member state of reference. Second, it is required that Switzerland is not among the blacklisted non-cooperative countries and territories on the list of the Financial Action Task Force (FATF) and last but not least, the Swiss regulator FINMA has concluded cooperation agreements regarding the regulation, cooperation and exchange of information with regard to the supervision of AIFM with all EU member states.

However, even if all the requirements are fulfilled, Swiss and other non-EU AIFM may only benefit from the management and marketing EU-passports after 2015. During the blocking period Swiss and other non-EU AIFM may still manage and market EU and non-EU AIFs to professional investors in the EU if they comply with the national marketing and private placement regimes of the respective EU member state in which marketing activities take place (subject to certain AIFMD requirements). However, EU member states may impose stricter rules to non-EU AIFMs marketing EU and non-EU AIFs in their jurisdiction. According to AIFMD, national private placement regimes may be phased out in 2018 and the EU-passport will become the standard requirement.

Can the traditional offshore-fund structures still be maintained under AIFMD?

Investment managers are typically subject to regulation and taxation in the country in which they are located. Traditionally, the fund management of AIFs was based offshore (for example, Bermuda, Bahamas, Cayman Islands, Guernsey, Jersey, etcetera) often delegating advisory and risk management services to a Swiss entity. This set-up – in light of international profit allocation and taxation – allowed for compensation of the formal offshore fund manager and the adviser service provider according to their functions and liabilities under the fund management and advisory agreement. If the offshore-manager did not have much substance (own personnel and infrastructure) most Swiss cantonal tax authorities only allowed for limited remuneration in accordance with the duties and liabilities performed by the offshore manager. In general, the traditional set-up allowed for a favourable overall taxation of management and performance fees.

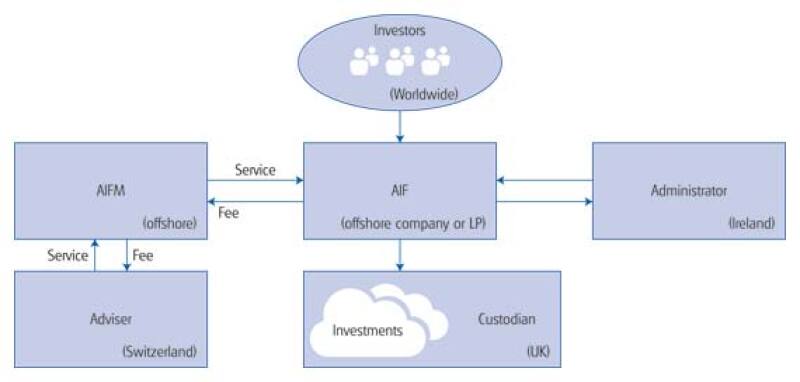

The traditional offshore-fund management structure can still be maintained by non-EU AIFMs managing and marketing non-EU AIFs in non-EU jurisdictions (see Diagram 1).

For non-EU AIFMs with Swiss advisers managing traditional offshore AIFs and marketing them in the EU there are the following options: (i) rely on reverse solicitation; (ii) rely on national private placement regimes as long as possible; (iii) rent-an-EU-AIFM (at least until 2015); (iv) make improvements to the offshore AIFM with the required substance to get compliant for the EU pass after 2015 and rely on national private placement regimes in the meantime; (v) make the Swiss adviser compliant with CISA and AIFMD for the EU passport after 2015 and rely on national private placement regimes in the meantime; and (vi) make the Swiss adviser compliant with CISA and set up a new EU-AIFM to get the EU-passport before 2015.

Diagram 1: Traditional offshore structure (example) |

|

Structuring of new AIF with Swiss adviser or sub-manager

Swiss portfolio managers or advisers anticipating the set-up of a new fund structure with the intention to market to professional investors in the EU before 2015 might consider the set-up of an EU-AIF with an EU-AIFM delegating the investment advisory to a Swiss entity. To fulfill the requirements for the delegation norm, the Swiss adviser (or sub-manager) will need to be fully compliant with CISA.

Can the low-tax requirements from an investor's point of view be met by an EU-AIF?

Traditionally AIFs have chosen offshore domiciles for various reasons, among them: (i) favourable tax regimes; (ii) confidentiality; (iii) low levels of administrative burden; and (iv) the quality of fund infrastructure available in these locations. As offshore funds will only benefit from the EU-passport after a transition period, AIFs domiciled in the EU will increase in demand. Among the major European onshore fund centres that have established themselves for the set-up of AIFs are Luxembourg and Ireland and, more recently, Malta.

From a tax point of view, the ideal fund structure should meet the following requirements: (i) no taxation of the investment fund; (ii) no withholding tax on distributions to investors; (iii) availability of double tax treaties and eligibility to reclaim foreign source taxes; and (iv) no securities transfer stamp duties on transactions.

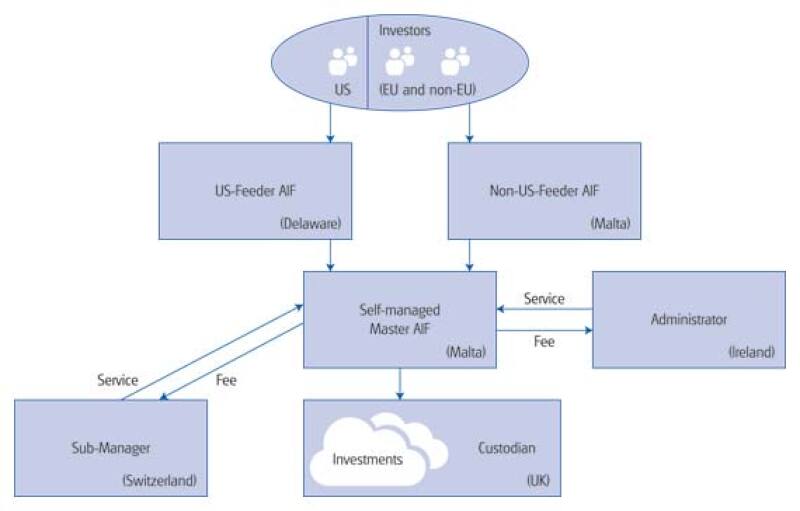

With Malta offering one of the most competitive tax structures in the EU, setting-up a Maltese SICAV and getting the EU-passport right away, might be considered as a veritable option to an offshore AIF. If a self-managed Malta fund is chosen, the investment management and/or risk management functions can be delegated to a sub-manager licensed in another EU member state or, for example, Switzerland. To get a license as a self-managed fund in Malta the directors and investment committee members need to have the necessary expertise in the investments in which the AIF will invest. Further, active presence of at least two officers with sufficient managerial seniority is required in Malta.

The Malta-registered SICAV is tax-exempt, provided it has less than 85% assets situated in Malta (non-prescribed fund) and no income arising from immovable property or investment income in Malta. Capital gains realised on transfers or redemptions by non-resident investors in the Malta-registered SICAV are exempt from withholding tax in Malta. Distributions to non-resident investors are not subject to withholding tax in Malta. Malta has access to a broad double-tax treaty network (see Diagram 2).

Diagram 2: Potential onshore fund structure with EU passport |

|

Remuneration of sub-manager (former adviser) in Switzerland

Under the traditional offshore fund management set-up most Swiss tax authorities would only accept compensation of the formal offshore manager according to the functions that were factually carried out by the offshore manager and would demand that the Swiss adviser would receive an adequate share of the management and performance fees (for example Zurich cantonal tax authorities generally accepted remuneration of the offshore manager without adequate substance, resulting in a 20/80 profit split).

In light of the AIFMD the formal fund manager has to be adequately staffed to be fully compliant with AIFMD. Thus, Swiss tax authorities will have to accept that a larger part of the management and performance fees is used to remunerate the functions of the formal fund manager that are required by AIFMD, or – in case of a self-managed Maltese SICAV – accept that a larger part of the profit will remain with the self-managed SICAV.

The acceptance of the chosen remuneration of sub-manager and formal AIFM by the Swiss tax authorities will likely depend on the functions that are carried out by the formal AIFM (or – in case of the self-managed SICAV, by the employees of the SICAV) and the functions that are delegated to the Swiss sub-manager and whether the respective functions are considered routine or non-routine. The license of the Malta self-managed SICAV generally requires directors and an investment committee with expertise and knowhow in the investment management the fund will invest in, as well as the active presence of at least two officers with sufficient managerial seniority. The function normally linked to such level of substance should qualify from a Swiss tax perspective as non-routine in nature and therefore adequate remuneration should be accepted by the Swiss tax authorities.

If the equity shares in the Malta self-managed SICAV (or in case of a Malta Feeder – the equity shares in the Malta Feeder) are held by a Maltese private holding company (owned by a non-resident shareholder or shareholders) dividend distributions by the Malta SICAV (or the Malta Feeder) to the holding company are not subject to income tax.

The net profit of the Maltese holding company deriving from dividend distributions by the SICAV (or the Feeder) is allocated to the untaxed account of the holding company, and distributions by the holding company will not be subject to income tax in Malta. Other income of the holding company may be subject to income tax at the tax rate of 35% (subject to any double taxation relief including the Flat Rate Foreign Tax Credit (FRFTC)) depending on the source of the income. Distributions from the untaxed account of the holding company to non-resident shareholders are gross of any taxes as there will be no withholding tax on distributions to non-resident shareholders.

|

|

Alberto LissiTax Partner – Taxand, Zurich Tel: +41 44 215 7706 Alberto Lissi is one of 11 partners at Tax Partner – Taxand, the Swiss leading independent firm of tax advisers. He has a Ph.D. in international taxation and more than 15 years' experience in local and international tax. Alberto's activities are mainly focused on tax planning for national and international corporations and entrepreneurs. He has wide experience in M&A and reorganisations of national and international corporations. Furthermore, he also advises banks and financial institutions. Tax Partner is one of the leading tax firms in Switzerland. With 32 professionals, the firm has been advising important multi-national and national corporate clients as well as individuals. Tax Partner co-founded Taxand in 2005 – the first global network of more than 2,000 tax advisers and 400 partners from independent member firms in 50 countries. |

|

|

Monika Gammeter UtzingerTax Partner – Taxand, Zurich Tel: +41 44 215 7729 Monika is a senior manager of Tax Partner – Taxand, the leading independent Swiss firm of tax advisers. She has more than 18 years' experience in local and international tax law. Monika's activities are mainly focused on tax planning for national and international corporations and entrepreneurs, restructuring of national and international corporations and tax advice in the area of banking, financial services and financial products. Before joining Tax Partner AG in 2003, Monika worked for several years for the cantonal tax authorities in Zurich. Monika has studied business administration at the Zurich University of Applied Sciences and later became a Swiss certified tax expert. She has published several articles in leading publications. Monika is fluent in German, English and French. |