|

|

|

Myranda Chatzimatthaiou |

Michalis Zambartas |

The introduction of the Market in Financial Instruments Directive of the European Union marked a new era in the regulation of investment firms in Europe. Cyprus has implemented the directive, offering in this way a flexible and reliable entry point into the EU market for both EU firms that require a licence and for non-EU firms that wish to have a place of business in the EU.

CIF licence

The regulatory authority for licensing and monitoring investment firms is the Cyprus Securities and Exchange Commission (CySec). After the full application is submitted to CySec, the regulatory authority has an obligation to reply within six months, approving or denying the licence. Firms that are eligible to obtain an investment licence in Cyprus are Cyprus firms, branches of investment firms established in other member states and third country investment firms.

Basic requirements

At least four directors (two executive and two non-executive), the majority of whom must be Cyprus residents. They should also satisfy the fit and proper test (sufficient good repute, experience, professional knowledge);

A general manager, who can be one of the executive directors, with satisfactory knowledge of the activities of the CIF and must be a Cyprus resident;

Employees offering investment services must hold the certificate obtained from the Ministry of Finance and be registered under the public registry of CySec;

The head offices must be located in Cyprus;

There must be a fully staffed office with the necessary equipment and substance;

Accounting procedures and financial statements must be audited every year; and

A compliance officer must be present to ensure the application of anti–money laundering procedures.

Cyprus is a highly regarded and popular jurisdiction for obtaining a licence for investment purposes, forex, binary options and others; a door to the investment field and a 'passport' to the provision of those services in the EU.

Over and above the taxation advantages and enhanced tax planning, Cyprus has much more to offer to foreign investors: full implementation of the European directives, flexibility, a business-friendly environment, a great number of double tax treaties and the brilliant support of accounting, legal and banking professionals.

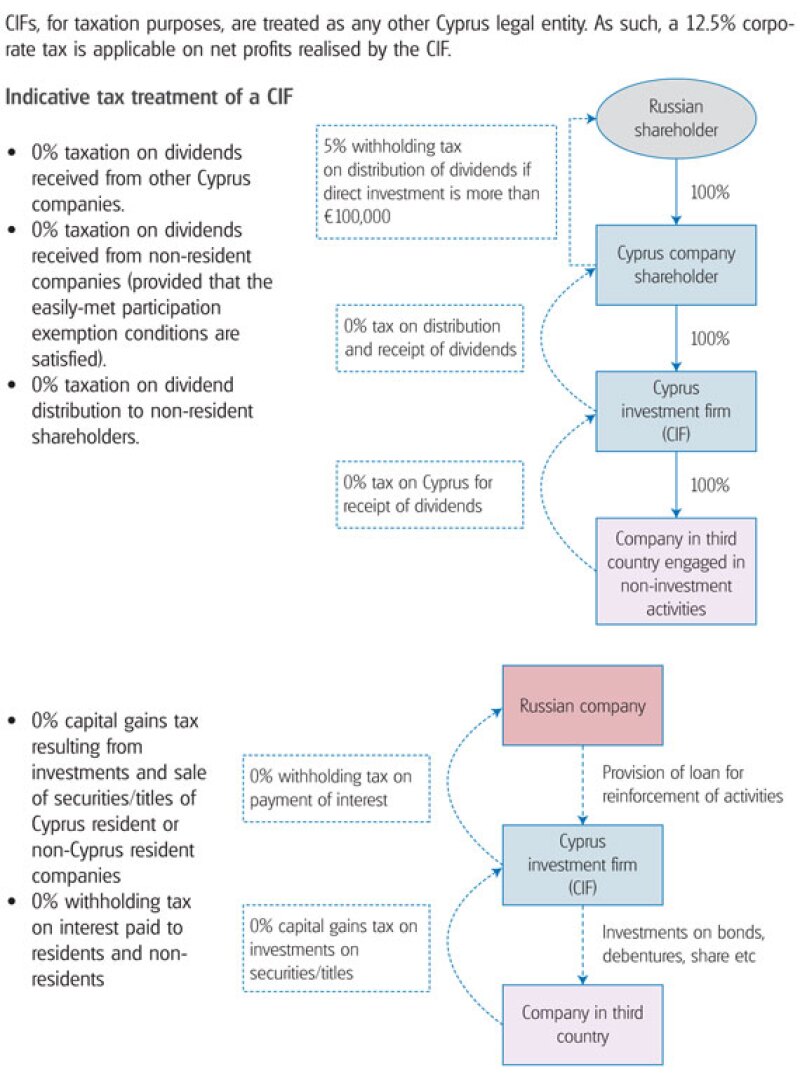

Taxation of Cyprus investment firms |

|

Myranda Chatzimatthaiou (myranda.chatzimatthaiou@eurofast.eu) and Michalis Zambartas (michalis.zambartas@eurofast.eu)

Eurofast, Cyprus Office

Tel: +357 22 699 222

Website: www.eurofast.eu