|

David Swenson |

"Today's multinational corporations are facing the most challenging tax environment in history because of a combination of four global forces converging to create a perfect storm. The unstable environment created by these forces is resulting in a substantial increase in the number and size of tax audits, adjustments, and disputes. This surge … is placing significant strain on the traditional methods of resolving tax controversies." (Excerpt from an article co-authored by David Swenson and Garry Stone in 2008.)

These predictions of a growing perfect storm in the global tax controversy arena, accompanied by an unprecedented rise in tax audits and disputes, have in fact materialised. Independent empirical evidence now confirms that we are in the eye of the storm.

OECD statistics released in April show a dramatic surge in tax disputes worldwide over the past five years. For the most recent reporting year (2011), the OECD statistics reflect a substantial increase in new (and pending) mutual agreement procedure (MAP) cases, providing clear evidence of a significant rise in international tax controversies around the world. As a result, the global system for resolving cross-border tax disputes continues under pressure, with few prospects for immediate relief.

The OECD base erosion and profit shifting (BEPS) initiative, as well as the related tax planning debate, is adding to this turbulent environment. It appears clear that these forces and a confluence of other factors will trigger a second wave of aggressive enforcement actions by countries worldwide, leading to a further surge in international tax audits and disputes.

The first wave of the storm

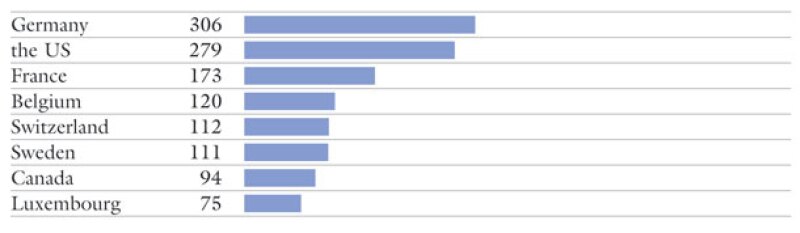

According to the most recent OECD statistics, 1,624 new MAP cases were initiated among OECD member countries during the 2011 reporting period, representing a 21% increase over 2010. The countries with the most new MAP cases filed in 2011 were:

The total number of new cases filed in 2011 represents a 57% increase over the new cases filed in the 2006 reporting period, and is the largest number of MAP cases ever filed in a single year.

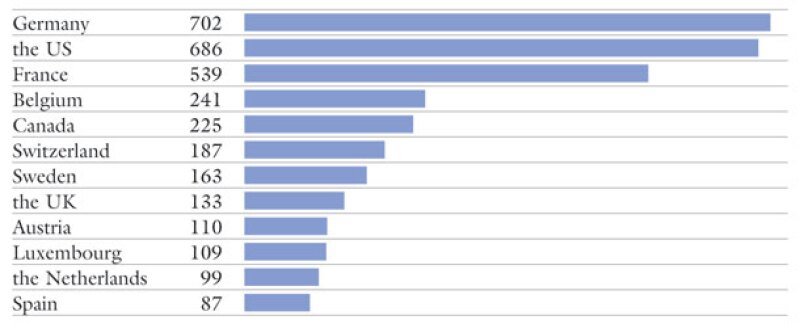

The OECD statistics also show that the number of open (pending) MAP cases reported by OECD member countries at the end of 2011 totalled 3,838 – a 15% increase over 2010 – and the total caseload continues to grow each year. The countries with the highest total of pending MAP cases at the end of 2011 were:

Significantly, the existing overall inventory of open MAP cases represents a 63% increase compared with 2006, and is the largest number of pending MAP cases in history.

The average time for completion of MAP cases between two OECD member countries in 2011 was 25.6 months. Although this represents an approximately two-month reduction in the average completion time (from 27.3 months in 2010), it remains well above the recent four-year average of approximately 21.6 months.

These OECD statistics provide dramatic evidence of the surge in tax audits and disputes among OECD member countries over the last five years. New MAP cases are increasing at a significant rate and the total open inventory of cross-border disputes is rising each year. For example, statistics recently released by the US competent authority office indicate that US- initiated MAP cases more than doubled in 2012 (over 2011).

With limited tax administration resources in many jurisdictions, the total MAP caseload likely will continue to grow and the average completion time may lengthen in the near future. Although the concept of mandatory binding arbitration holds promise as a release valve in the storm, those provisions are included in a limited number of double tax treaties, and any widespread positive impact may be years away.

The second wave is rolling in

The first wave of the tax controversy perfect storm has already delivered record numbers of tax audits, disputes, and MAP cases worldwide, and it has placed substantial strain on the existing framework for resolving cross-border tax disputes. Unfortunately, turbulent conditions are on the horizon and it appears that new forces will trigger a second wave of increased audits and examinations, presenting additional challenges for those facing the storm.

Driving factors

Nations throughout the world have an acute need to raise large amounts of revenue to fund a variety of short and long-term obligations, from infrastructure projects and defence initiatives to social programmes.

Governments must encourage voluntary taxpayer compliance and simultaneously develop tools to ensure compliance through cooperative engagements, documentation requirements, and enhanced enforcement initiatives. The primary enforcement actions include improved methods for reporting and sharing taxpayer information, robust risk assessment approaches, and aggressive audit and examination techniques. Governments are adding resources to audits and other enforcement initiatives and are supporting greater training and education of tax auditors and inspectors. These enforcement steps will inevitably lead to further audits and disputes in both developed and emerging countries worldwide.

Austerity measures implemented in many countries in response to the global financial crisis have placed a spotlight on tax obligations and enforcement. As deficit reduction measures are adopted and government services are decreased, stakeholders are focusing on obligations to pay tax and the enforcement of those obligations.

Unprecedented political pressure continues to escalate based on populist rhetoric. It has become politically acceptable to single out multinational corporations for intense scrutiny, even to the extent they have become targets of a crackdown on aggressive tax planning and perceived deficiencies in the historical architecture supporting the global tax system.

Nongovernmental organisations (NGOs) have raised issues related to tax fairness and tax morality, and several governments have held public hearings on issues related to the tax planning debate, double non-taxation, and tax evasion. Some observers believe that concerted action on tax fraud and tax evasion is a necessary step to ensure that austerity and deficit reduction measures are fair and equitable, and attention on these topics has spread to the more traditional areas of international tax planning. In turn, these developments have led to a focus by the G-20 countries on preventing tax evasion and aggressive tax planning. In response, the OECD has initiated its well-publicised BEPS project.

With an eye on the second wave, the OECD has taken the lead in addressing base erosion and profit shifting in a systematic manner. Following up on its February 2013 BEPS Report, the OECD released in mid-July a Coordinated Action Plan (the Action Plan), which addresses perceived flaws in the international tax rules and sets forth precise action points and a suggested timeline.

This highly anticipated Action Plan calls for fundamental changes – as opposed to wholesale amendment – to current mechanisms and the adoption of new consensus-based approaches designed to prevent and counter base erosion and profit shifting activities. Overall, the Action Plan reflects a balance in clearly identifying the gaps and a roadmap forward, while at the same time establishing a responsible tone by setting forth principles based on the need for clarity, predictability, and administrability for both governments and taxpayers. The Action Plan cautions, however, that inaction regarding base erosion and profit shifting may have more deleterious effects, likely including unilateral actions by individual nations, a second wave of audits and disputes, resultant global chaos, and a potentially higher incidence of double taxation.

At present, it is unclear whether the BEPS initiative will result in collective (multilateral) action by nations, or whether unilateral measures will be adopted in certain areas. Many observers believe that it will be relatively easier for countries to agree on coordinated action in some administrative areas, such as transparency of information, reporting requirements, exchange of taxpayer data, joint audits, and revisions of procedural rules to make MAP cases more efficient.

There is also a view that it will be far more problematic to reach broad agreement on major changes to fundamental taxing rights that have formed the foundation of the international tax system for many decades. As a result, because of the length of time necessary to achieve mutual understanding and consensus on changes to established technical rules, it may be extremely difficult to reach a holistic agreement on revised rules and common principles of taxing jurisdiction among developed and emerging nations on an expedited basis.

Some countries may believe that the historical international tax rules are no longer fit for purpose and need to be substantially rewritten, while others may believe that vigorous audits and aggressive enforcement of the existing rules, combined with allocation of additional resources to those efforts, will address the underlying issues raised in the OECD BEPS initiative.

Conversely, some observers believe that tax competition among nations must be addressed as a first step, thereby leading to a lack of uniformity on the best path forward. Based on a number of competing considerations, it appears that a combination of collective and unilateral actions may be forthcoming, with some countries and regional organisations – such as the European Commission – adopting interim measures. Regardless of the approach ultimately adopted, there is little doubt that tax administrations will feel emboldened, and even compelled, in the current environment to escalate enforcement activities, leading to a second wave of tax audits and examinations in the years ahead.

What to expect

As the global tax controversy area heats up and the second wave approaches, greater risk and uncertainty will emerge, and there likely will be renewed interest in cooperative compliance programmes among revenue authorities and taxpayers, such as the compliance assurance programme (CAP) in the US, the real-time working procedures in the UK, and horizontal monitoring in the Netherlands.

There may also be increased demand for private rulings and pre-filing agreements to reduce risk and uncertainty regarding specific transactions and operations, such as advance pricing agreements (APAs) in the transfer pricing area.

With the anticipated surge in new audits and examinations, and as more cases are thrown into the tax disputes hopper, an inevitable rise in the number of tax controversies will develop, as well as an increase in domestic alternative dispute resolution (ADR) options, including administrative appeals, mediation hearings, MAP cases, arbitration proceedings, and tax litigation. The existing system for resolving cross-border tax disputes will continue under growing pressure, and additional resources will be necessary in these areas to address the expanding caseload and to avoid delays and uncertainty in resolving these controversies.

Historically, there has been general congruence among OECD countries over the meaning of the arm's-length standard and the definition of permanent establishments (PEs), creating taxing nexus between a taxpayer and the relevant jurisdiction.

There appear to be growing differences, however, between residence- and source-based countries regarding those rules and such differences may lead to a divergence of views on basic taxing rights and fundamental tax principles. As differences emerge over the interpretation of the arm's-length standard and the PE concept, the potential for difficult and protracted tax disputes rises and the spectre of double taxation becomes more acute. The OECD's Action Plan calls for steps to provide clarity into the concept of PEs and for measures that are either within or beyond the arm's-length principle in certain circumstances.

In the new environment, a lack of uniformity on critical issues and concepts may continue to emerge without coordinated multilateral action. Indeed, differences among national tax regimes are inevitable without a uniform global tax system, which is not realistically achievable in the near future.

Further, some countries are likely to use the OECD BEPS initiative to justify taking extreme positions in tax audits and disputes. Major differences are already prevalent and some jurisdictions are adding local content to their interpretations of the historical international tax rules. Such unilateral actions risk triggering multiple tax claims on the same items of income. This lack of congruence on key issues may also lead to a further surge in cross-border disputes and a rise in the incidence of double taxation.

Several countries are considering enacting or revising general anti-avoidance rules (GAARs) or specific anti-avoidance rules (SAARs) to address issues raised by the BEPS initiative. Many observers believe that unilateral action on GAAR or SAAR legislation will lead to a further rise in cross-border disputes and a higher probability of double taxation. Others are of the view that although multilateral action on GAARs is preferable to separate country measures, the most appropriate response is through the proactive use of limitation on benefits provisions in double tax treaties. These differences of view will make finding common ground very challenging.

There are also differing views on other important concepts such as the need to respect the existence of separate legal entities, the validity of binding legal agreements and the allocation of risks among related parties. Further, there are divergent opinions concerning the need to respect transactions as structured by taxpayers and the limits on the ability of tax authorities to re-characterise bona fide existing arrangements. Expansion of the tax administration rights to re-characterise transactions and the ability to substitute government opinion for a taxpayer's business judgment will undoubtedly trigger more difficult and complex tax controversies.

The business world must be able to rely on the rule of law, and it needs legal certainty in these areas. A uniform set of principles is critical to managing global business operations. Indeed, the OECD Action Plan acknowledges that more clarity is required around identifying which types of transactions can be re-characterised. In the interim, however, the current global tax environment is creating less certainty and greater tax risks and exposures.

Proactive approaches

With the second wave of the perfect storm on the horizon, taxpayers should adopt proactive steps to prepare for the anticipated surge in tax audits and disputes. Strategic risk assessments (SRAs) are important tools to identify, evaluate, and manage tax risks and exposures around the globe. Proactive use of SRAs involving priority countries, operations, and transactions may identify material tax risks and exposures before an audit even commences. Implementation of SRA recommendations may also strengthen reporting positions, reduce uncertainty, and develop responses to anticipated tax authority positions.

In the current environment, many multinational corporations have 100 or more active tax audits and disputes underway around the globe. It is critical to proactively coordinate and manage those examinations, monitor statutes of limitations and treaty requirements, adopt consistent positions regarding facts and issues, and develop holistic approaches to resolving the controversies, taking into account local as well as multi-country tax attributes. Implementation of global coordination hubs and dispute resolution centres is useful to achieve these objectives.

It is also important to build defence into entity structures and transactional documents from the initial steps of establishing an organisational structure and throughout the operational lifecycle. Proactive strategies to craft contracts, agreements, and other documents with a defensive mindset will not only strengthen the taxpayer's position on audit, but may also lead to a more timely and favourable resolution of the tax dispute.

A pressing juncture arises when a tax audit commences. The taxpayer should develop an overall strategic plan for managing the audit and, if possible, resolve all issues at the audit level. Early development of the taxpayer's affirmative theory of the case is critical to a favourable resolution of the audit or dispute. Informed strategies for responding to information document requests, employee interviews, and facility tours are also key to successfully resolving the issues at an early stage in the controversy process.

As the number of audits and disputes rise, there will be a premium on gaining certainty early in the process through pre-filing rulings and APAs. Consideration of the affirmative use of APAs is part of a well-developed responsive strategy in the current environment. In many situations, an APA may act as an insurance policy against future audits, risks, and exposures. There are, however, a number of important considerations in pursuing an APA that should be carefully weighed depending on the countries and transactions involved. The allocation of human capital and financial resources, as well as transparency requirements, are among the many factors that must be balanced to determine the advisability of seeking an APA in a given situation or case.

As noted, the worldwide inventory of pending MAP cases is at the highest level in history and that level likely will rise in the years ahead. In this environment, it is critical for taxpayers to work cooperatively with the relevant competent authorities to resolve disputes quickly and efficiently. This approach includes transparent actions designed to assist the governments involved in a dispute to understand the facts, issues, and positions asserted and to draw the competent authorities together for a successful resolution of the issues and the elimination of double taxation.

Demand for effective ADR mechanisms

As the second wave approaches, there are also a number of proactive actions governments should adopt to reduce the unfavourable impact from the next surge of disputes, including the use of effective ADR mechanisms and improvements to existing domestic administrative appeals programmes.

A 2011 World Bank study found that more than 84% of nations around the world have an existing independent administrative appeals function, but almost 63% of the respondents thought those functions did not work efficiently. The OECD recognises this conundrum in its Action Plan and supports measures to make dispute resolution mechanisms more effective – such as resolving disputes where MAP does not work or is not applied – including the use of arbitration.

An effective administrative appeals process should reduce the number of disputes that reach the MAP level, arbitration, and tax litigation. Improvements to existing administrative appeals programmes are needed in many countries. Governments should consider the use of additional ADR approaches, such as domestic mediation and domestic arbitration, as alternative methods to deal with the anticipated increase in tax disputes. Equally important, tax administrations should ensure that increased resources are devoted to APA and MAP programmes in response to the rising inventory in these critical areas.

Finally, in the context of MAP cases, mandatory binding arbitration may offer a reasonable alternative for resolving complex or difficult cases. The use of specified time limitations, independent arbitrators, and a 'baseball arbitration' approach (winner takes all) may serve as forceful incentives to resolve cases early in the MAP process (actually, even before arbitration begins). For those cases not resolved before arbitration, these factors may also lead to an objective means of resolving the underlying differences between the two governments.

The bottom line

New forces are gathering on the horizon of the global tax controversy environment. If nations deviate from historical international tax principles, substantial additional resources will be necessary to address the flood of new audits and disputes. Ultimately, double taxation may become more pervasive as fewer disputes are successfully resolved. Divergent positions by nations worldwide and pressure on existing dispute resolution options will lead to greater uncertainty and more controversy, and an unwelcome haze may be cast over the environment for years to come. These forces will drive a second wave in the perfect storm of cross-border disputes. Carefully coordinated actions and informed strategies are needed now before the next wave rolls in.

Based on recent developments, this is an updated version of an article previously published in TNI.