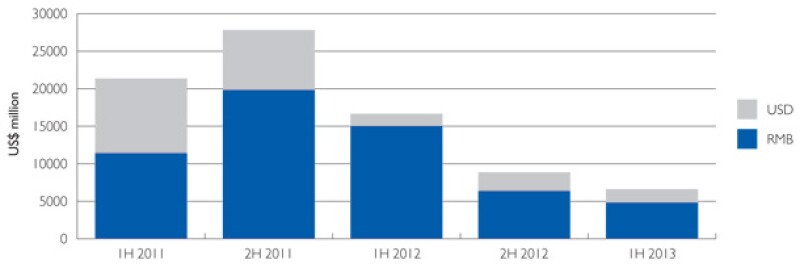

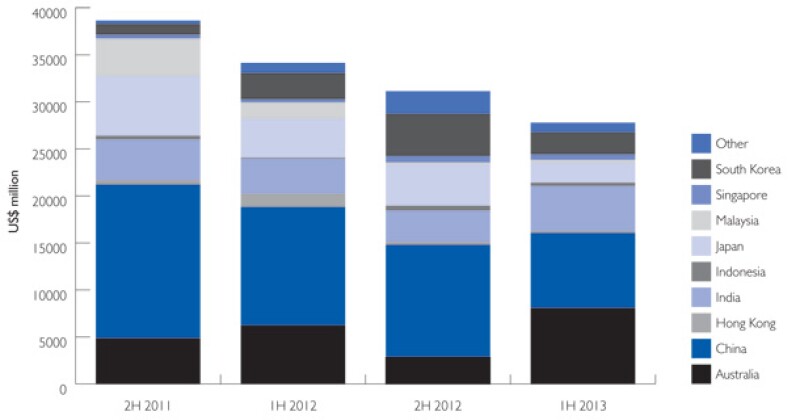

China remains as one of the Asia Pacific region's premier destinations for PE investments and fund raising in the first half of 2013. China funds drew 38% of capital allocated to, and 28% of the investments made in, the region in the first half of 2013, similar to the second half of 2012 (see diagrams 1 and 2).

Diagram 1 |

|

Diagram 2 |

|

While PE activities in China have grown steadily over recent years, Chinese tax authorities have correspondingly taken steps to protect its tax base and are sometimes perceived to have widened their tax net through increasingly sophisticated approaches on general anti-avoidance rules (GAAR) enforcement, including the use of the infamous Circular 698 to target, among other things, the offshore indirect disposal by PE investors of Chinese portfolio companies.

Along with the domestic approach, China has also actively participated in global efforts to clamp down on tax abuses. With the official accession to the OECD-led Multilateral Convention on Mutual Administrative Assistance in Tax Matters in August 2013, which enables the signatories to automatically and spontaneously exchange information, the Chinese government has another mechanism to combat any perceived aggressive tax planning and evasion.

Though Chinese tax authorities are moving to enforce stricter and more sophisticated GAAR measures, PE investments and structures are expected to continue, if subject to close scrutiny. There are some key tax challenges facing PE investors on managing exits from their investments in China.

Tax challenges under the stretching arms of GAAR and potential further development on Circular 698

Since its introduction in 2009, the potential Chinese tax risk of Guoshuihan [2009] No 698 (Circular 698) has quickly become a major Achilles heel for foreign PE investors when structuring, holding and exiting their Chinese investments, particularly via the use of offshore special purpose vehicles (SPVs).

To recap, the State Administration of Taxation (SAT) released the circular in December 2009 as part of its effort to ramp up the enforcement effort under the GAAR in the corporate income tax (CIT) law. Circular 698 imposes a reporting requirement on offshore transferors to report and submit specific information/documents to Chinese tax authorities on offshore equity transfer transactions involving an indirect transfer of the underlying Chinese entities.

Under the circular, where an offshore indirect transfer is viewed by the SAT as lacking reasonable business purposes and constitutes an "abuse of organisational form", the SAT may invoke the GAAR to re-characterise the transaction as a direct sale of the equity interests in the Chinese companies, thereby enabling them to impose a 10% CIT on the gains assessed.

As PE investors typically raise offshore funds to hold their investments in China through either single or multiple tiers of offshore SPVs and exit their investments by selling one of the SPVs at the offshore level, the enforcement of Circular 698 by Chinese tax authorities has resulted in serious ramifications regarding the investment structure and exit planning for PE investors.

In practice, the most challenging aspect of dealing with Circular 698 for PE investors remains the way in which Chinese tax authorities apply the "reasonable business" test in assessing whether the GAAR should be triggered. From the various published Circular 698 enforcement cases involving well-known PE investors and listed companies where millions of taxes were being collected, it is evident that when assessing the case, Chinese tax authorities are focusing predominantly on the economic substance level of the offshore SPV structure set up to hold the Chinese investments in determining whether the said structure has reasonable business purposes. They tend to ignore other commercial reasons such as the need to use offshore tax neutral SPVs to ring-fence liability, to introduce co-investors and financing as well as other commercial purposes. This approach was considered unfair and unreasonable to PE investors.

The critical criteria which Chinese tax authorities look at typically include the number of employees, the physical business premises, the scale of operation, the amount of business assets and the level of capitalisation of the offshore SPVs. These assessment criteria and angle do not help PE investors as they typically do not require a substantive operational presence in the offshore SPVs, their business models and investment holding structures.

During 2012-2013, industry and market intelligence suggest that the SAT may issue further guidelines on Circular 698 in the form of supplementary rules. The key scope of the draft supplementary rules under the SAT's consideration was widely believed to include:

A certain form of relief on Circular 698 reporting and tax imposition for qualifying internal restructuring;

Specific rules on tax cost base adjustment for purchasers in the event of non-conformity with Circular 698 reporting by the vendor; and

A deeming provision for the assessment of reasonable business purposes.

Private equity investors and the wider investment industry would welcome any Circular 698 relief on qualifying indirect transfer transactions which form part of an internal group restructuring, as it would remove a layer of uncertainty for portfolio company group reorganisations to achieve business strategy alignment.

As for the potential tax cost base adjustment mechanism, which the SAT is widely believed to be considering, the purchaser may run the risk that Chinese tax authorities revise down its Chinese tax cost base of the shares of the offshore SPV acquired so that the Chinese tax unpaid by the vendor in the transfer under Circular 698 can be recouped from the purchaser when the purchaser disposes of the shares in the future.

To mitigate the risk of the potential loss of tax basis from this proposal, it is evident that PE purchasers are increasingly forcing and requiring the fulfilment of Circular 698 reporting and settlement of any resulting Chinese taxes by the vendor as a condition precedent during deal negotiation for transactions involving offshore SPV structures. This has also become the main risk that PE investors need to manage on their exits from investments in China.

The proposed draft supplementary rules for Circular 698 moves one step further to enable PRC tax authorities to tax certain specific offshore transactions by deeming them as lacking reasonable business purposes. This is operated by the introduction of a deeming provision for the assessment of reasonable business purposes. In this regard, it is understood that if any of these conditions is present in an offshore indirect transfer transaction, Chinese tax authorities may be entitled to deem such transactions as lacking reasonable business purposes and may invoke the GAAR to impose the 10% CIT on the gains:

The offshore SPV being transferred has no substantive operating activities;

The transfer consideration is primarily based on either the valuation of the underlying Chinese entities or the immovable properties situated in China; and

The relevant equity transfer document or the public announcement released by the purchaser discloses that the actual target of the equity transfer transaction is to acquire the underlying Chinese entities or the immovable properties situated in China.

If officially released in this form, the draft deeming provision could adversely affect the exits of offshore real estate funds targeting Chinese real estate investments as such offshore transactions would nevertheless be treated as a direct disposal of PRC assets and 10% PRC withholding tax would be applied on the gains realised on the indirect disposal by offshore PE funds. Perhaps more importantly, it may be considered necessary for PE investors to factor in the potential 10% CIT in their valuation modelling when assessing the investment returns from such real estate transactions.

It is important to note that as of the date of this article, the draft supplementary rules for Circular 698 have not been officially released and there is no clear guidance on status of their release. It is understood that the SAT is considering the draft supplementary rules for Circular 698 in conjunction with other GAAR rules on a collective basis.

Enforcement

When selecting cases for enforcement, another trend that emerged from the published Circular 698 enforcement cases appears to indicate that Chinese tax authorities are becoming very adept to and resourceful in tracking down offshore indirect transfers of Chinese entities by PE investors and MNCs, in particular listed companies, through various online sources such as public announcements.

Hence, PE investors should pay greater attention to their exits from public companies as such transactions are more likely to be tracked and selected for Circular 698 enforcement.

Tax challenges under the stepping up of GAAR enforcement based on deemed tax resident enterprise (TRE)

In our article last year, we stated that Chinese tax risks may exist for foreign investors including PE investors for the disposal of shares in foreign incorporated companies in the absence of Circular 698.

This is evident in a 2010 case involving Vodafone's disposal of China Mobile, which was a Hong Kong (HK) incorporated company, but was treated as a Chinese TRE because its place of effective management was in China. The gains derived by Vodafone from the share disposal were deemed to be China-sourced income due to the TRE status of China Mobile, and as a result, were subject to Chinese CIT.

Under the prevailing CIT regulations, a foreign incorporated entity could be deemed to be a Chinese TRE if its place of effective management and control is located in China. In assessing the TRE, Chinese tax authorities typically examine factors such as the location where the day-to-day operation, production, financing and human resource decisions are made, the location of the board meetings, whether a majority of the board directors or key personnel of the entity are ordinarily reside in China, and whether the books and records and corporate seal are kept in China.

Recently, another high profile case was reported: Chinese CIT was assessed against a US PE investor based on a deemed Chinese TRE status of the foreign incorporated publicly listed company whose shares were being transferred, after a Circular 698 reporting by the vendor of the transaction.

In the case concerned, the shares of a HK publicly listed company's investment holding company (incorporated in the Cayman Islands), which held multiple Chinese entities, were transferred to a US publicly listed company under a take-private transaction. The Cayman Islands-incorporated vendor, which was controlled by a US PE fund, duly made a Circular 698 reporting. It was reported that the vendor filed the case with the PRC tax authorities under the circular and then had sought to argue that no Chinese CIT should be assessed under it on the transaction as the company whose shares were being transferred had business substance and the holding structure had reasonable business purpose due to its public listing status.

It was reported that the filed case received great interest from PRC tax authorities; while they gave due consideration to the argument regarding the public listing status of the company being transferred and acknowledged the difficulties in looking through the public listed company structure by asserting its lack of economic substance under Circular 698, Chinese tax authorities had still dug deeper to explore from all possible GAAR angles. This eventually led to a shift of focus of the Chinese tax authorities from "abuse of organisation form" under Circular 698 to investigating the TRE status of the HK publicly listed company whose shares were transferred.

Through the various publicly available financial documents, including the IPO prospectus, stock exchange announcements and audited accounts, and information requested from the seller, Chinese tax authorities concluded that senior executives and the management team located in China exercised the effective management of the HK publicly listed company and the same executives and management team also exerted effective management control on the group's Chinese operations.

Consequently, the HK publicly listed company was deemed to be a Chinese TRE and the seller was assessed with a 10% CIT on the gains derived, which was deemed to be Chinese-sourced income under PRC GAARs. While the conclusion appears to be clear, it is unclear whether the SAT has approved the TRE status of the HK listed company given the TRE status of the offshore company requires SAT approval and also requires a registration in the PRC under the law. It is also unclear whether the enforcement has also implicated other offshore investors in the HK listed company or whether the case simply represents a selective enforcement of the rules against one particular investor in that case.

The case highlighted the risk of the willingness and relentlessness of Chinese tax authorities in their continued efforts to protect the perceived erosion of the country's tax base or tax net by foreign investors using offshore SPVs. This can be effectively done by PRC tax authorities through taking countered actions in applying various GAAR measures and enforcement angles, other than solely relying on Circular 698.

The rules regarding Chinese TRE (including in the CIT law, its detailed implementation rules and various tax circulars) have been well publicised, so it should not be a surprise if Chinese tax authorities continue to scrutinise the place of effective management of overseas entities, including those offshore listed companies with substantial Chinese operations during GAAR enforcement, particularly in relation to public exits where the PE industry has a long understanding that a look-through should not apply to a publicly listed Chinese-controlled offshore company under Circular 698.

Whether attacking the TRE risk or not (as noted above) will become a future trend is unknown, but it reinforces the need for PE investors to ensure that the offshore structure adopted, not only by the PE funds, but also by the portfolio company, to hold the Chinese investments are considered and executed properly. This includes ensuring that the place of effective management of the key offshore entities are located outside China, so as not to fall within the Chinese tax net inadvertently, or leave room for PRC tax authorities to challenge.

Uncertainties surrounding the imposition of business tax (BT) on disposal of A-shares acquired pre-listing

Another common way through which foreign PE funds invest in China is to become a strategic or financial investor of a promising Chinese entity before its domestic listing in the A-shares market. The pre-listing equities acquired in the Chinese entity by foreign PE funds are typically non-tradeable. Upon the listing of the Chinese entity and the end of the lock-up period, the pre-listing equities would be converted into publicly tradeable shares through which an exit could be executed on the relevant domestic stock exchange.

From a Chinese tax perspective, it is clear that the disposal of A-shares held by foreign investors (for example, including foreign PE funds) would attract a CIT of 10% on gains (as a China-sourced income).

The relevant BT position on such A-share exits, however, has remained unclear and in dispute between the taxpayer and tax authorities over the years. The uncertainties are primarily due to a lack of clear rules to govern, in particular, whether the disposal of A-shares which were originally acquired as pre-listing non-tradeable equity, and which were subsequently converted to publicly tradeable shares, would fall within the scope of "trading of financial products", which is taxable under the updated BT Law effective from January 1 2009 for all taxpayers (including all domestic or foreign financial and non-financial institutions). Before January 1 2009, the old BT Law only imposed BT on financial institutions (not other taxpayers) for gains from the trading in financial products. Given the risk profile of the pre-IPO equity investment, an alternative view was that the disposal of A-shares acquired by PE and other investors as pre-listing non-public tradeable equity should be treated as an equity transfer transaction, which is specifically exempted from BT under a tax circular issued by the SAT in 2002 (Caishui [2002] No 91). Even if BT was determined to be imposed on the gains from such transactions, it is considered necessary that an allowance should be given to exclude the gain attributable to the holding the shares as equity interest before the company goes to an IPO and becomes publicly listed.

The lack of clear guidance from the SAT on the same issue, and the absence of previous BT enforcement precedence regarding similar disposals by Chinese tax authorities did not help defuse the long outstanding uncertainties regarding the BT position on post-IPO sales or exits of pre-IPO investment in A-shares.

In early 2013, a report of a BT enforcement case in Liuzhou (in Guangxi Province) was made public, signalling that Chinese tax authorities may start collecting BT on the sales of A-shares acquired as pre-listing non-tradeable equity.

In this case, a Chinese listed non-financial institution acquired the A-shares concerned as non-tradeable equities in 1999, as one of the pre-listing founders of a prominent domestic securities company. Upon the domestic listing of the Chinese investee entity, the equities acquired were converted into fully tradeable A-shares. The taxpayer subsequently disposed of the A-shares in tranches between 2009 and 2011, realising a significant amount of gains. No BT was assessed at the time of the disposals by the local in-charge tax bureau.

The public announcement released by the taxpayer after an inspection conducted by the SAT in 2012 stated that the local in-charge tax bureau was instructed to collect the BT (along with the applicable local surcharges) from the taxpayer arising from the previous disposal of the A-shares. Despite an appeal from the taxpayer, the amounts were settled in early 2013.

This case understandably provoked strong interest from investors including foreign PE funds, as the imposition of BT on A-shares acquired pre-listing as non-tradeable equity would adversely affect the expected return on investment, particularly on the expected exit gains. As we understand, it is not common that the investment valuation would have factored in the BT cost, principally because the long-standing position was that BT was not applicable on an equity transfer or the trading of financial products by non-financial institutions (including PE funds) before 2009.

To date, PE investors continue to be frustrated that there has been no further guidance from the SAT regarding the relevant BT position on post-IPO exits of pre-IPO investments. In practice, the BT enforcement on similar A-shares disposal cases appears to be inconsistent across the nation with BT enforcement cases reported from locations such as Fujian province, Liuzhou, Shenzhen, Tianjin and Nanjing while the local tax authorities in Beijing and Ningbo appear to have not imposed the BT on such transactions, pending official guidance from the SAT.

Even if BT were to be imposed on similar A-shares disposals going forward, it remains unclear what the calculation basis should be to arrive at the net gains amount for BT imposition. In particular, what cost base should be used?

In the Liuzhou case, it was reported that the SAT initially calculated the net gains based on the original acquisition cost of the founders' shares. However, the final BT liabilities were reportedly assessed based on the difference between the final selling price and the closing price of the A-shares on the first day after the non-tradeable equities were converted to fully tradeable. It remains to be seen whether the basis adopted under this case represents the standard for cost base determination for future cases.

It is also unclear how the VAT reforms, which are expected to replace the BT regime for the financial services sector, would interplay and affect this issue.

After the BT case in Liuzhou, it is notable that many local tax authorities have been encouraged by this case and have stepped up their efforts in collecting BT against public exits made by PE investors including both onshore and offshore funds. In many cases, except for Tianjin and Xiamen, due to the lack of specific guidance from the SAT, local tax authorities tend to apply the BT on the gains computed on the gross sale proceeds less the original costs of the investment by not allowing the deduction for the IPO price offered to public investors.

Given the inconsistent treatment adopted across different locations, it is hoped that the SAT will soon provide more clarity on the BT position on such post-IPO exits of pre-IPO investments and the tax cost determination basis for such transactions (and in due course, the VAT position under the VAT reform going forward). Meanwhile, PE investors holding the A-shares acquired pre-listing or planning to become the strategic investor of a Chinese entity through the same investment form, should factor in the relevant potential BT liabilities on future exits.

Looking ahead

With the continued policy push by the Chinese government to boost domestic spending through urbanisation and to drive economic growth, the changing economic landscape in China is expected to continue to offer foreign PE investors many good investment opportunities.

When it comes to managing tax leakages on China investments, PE investors should be mentally prepared that the PRC tax authorities would not be shy to apply the GAAR and other sophisticated approaches or measures to protect its tax net, as illustrated in recent enforcement cases.

Private equity investors should keep a keen eye on tax developments and enforcement practices in China. They will need to navigate carefully within the uncertain tax environment to achieve the expected return on investments on their Chinese investments.

Melvin Ng of KPMG China also contributed to this article.

Biography |

||

|

|

John GuTax Partner KPMG China 8th Floor, Tower E2, Oriental Plaza 1 East Chang An Avenue Beijing 100738, China Tel: + 86 10 8508 7095 Fax: + 86 10 8518 5111 Email: john.gu@kpmg.com John Gu is a partner and tax leader for inbound M&A and private equity for KPMG China. He is based in Beijing and leads the national tax practice serving private equity clients. John focuses on regulatory and tax structuring of inbound M&A transactions and foreign direct investments in the PRC. He has assisted many offshore funds and RMB fund formations in the PRC and has advised on tax issues concerning a wide range of inbound M&A transactions in the PRC in the areas of real estate, infrastructure, sales and distribution, manufacturing, and financial services. John has bachelor of business and master of finance degrees. He is also a member of the Institute of Chartered Accountants in Australia and a member of the Hong Kong Institute of Certified Public Accountants. |

Biography |

||

|

|

Paul MaTax Partner KPMG China 8th Floor, Tower E2, Oriental Plaza 1 East Chang An Avenue Beijing 100738, China Tel: +86 10 8508 7076 Fax: + 86 10 8518 5111 Email: paul.ma@kpmg.com Paul Ma is a M&A tax partner in KPMG China's Beijing office. His focus areas include advising on tax structuring issues in complex M&A transactions including cross-border and domestic acquisitions and divestments; corporate restructuring; take-private transactions and PIPE [Private Investment Public Entity] transactions; performing tax due diligence on a wide range of industries including real estate, telecommunications, energy and resources, consumer markets, e-commerce and financial services; advising on onshore and offshore fund structuring and formation and representing institutions' limited partners in general partner due diligence. Paul previously worked at Morgan Stanley in both New York and Hong Kong as an in-house tax counsel. He also worked at Ernst & Young New York as a US tax specialist. Paul has a masters of accounting degree from the University of North Carolina at Chapel Hill, a masters in economics degree from Kent State University and a bachelor in economics degree from Nankai University. He is a member of the American Institute of Certified Public Accountants (AICPA). |

Biography |

||

|

|

Henry WongTax Director KPMG China 50th Floor, Plaza 66 1266 Nanjing West Road Shanghai 200040, China Tel: +86 21 2212 3380 Fax: +86 21 6288 1889 Email: henry.wong@kpmg.com Henry Wong is a tax director based in Shanghai with KPMG China with more than 12 years of tax advisory experience in the financial services and M&A sectors. He focuses on serving clients across different industries on direct and indirect tax advisory projects, due diligence work, M&A advisory, cross-border tax compliance and tax planning. His involvement in the investment fund advisory sector includes all phases of the fund lifecycle, such as onshore and offshore fund formation and structuring advisory, profit repatriation planning, investment entry and exit planning, executives/employees compensation/incentive planning and carried-interest structure planning as well as helping clients address specific partnership taxation issues. Before joining KPMG China, he worked with KPMG Canada in Toronto, specialising in serving financial institutions and investment fund clients on international and Canadian tax matters. Henry has bachelor of mathematics and masters of accounting degrees from the University of Waterloo in Canada. He is a Canadian chartered accountant, US certified public accountant (Illinois State Board of Accountancy) and chartered financial analyst. |