In today’s dynamic global transfer pricing (TP) environment, where most of the OECD and G20 countries are looking to incorporate the BEPS action plan into their local TP regulations, it is very important for multinational enterprises (MNEs) that still do not have a TP lifecycle in place to develop one.

In the case of organisations where there is already a TP lifecycle in place, it is time to inspect whether it addresses the critical issues outlined under the BEPS action plan. Along with the robustness of the TP lifecycle, the multinationals should review the processes they have in place to achieve the desired end result of the TP lifecycle.

The benefits of a good TP lifecycle are the invisible gains in the form of risk mitigation and tax saving, rather than any other apparent tangible benefits. Conversely, an organisation without a robust TP lifecycle or with one which is ineffectively implemented, may experience devastating effects.

With a well-defined TP lifecycle in place organisations can expect improved communication between different functions and, as a result of this, an increase in the overall efficiency of the intercompany transaction reporting process. Further, there could also be opportunities to improve the organisation’s TP strategy through more informed decision making.

Phases of a typical TP Lifecycle and best practices:

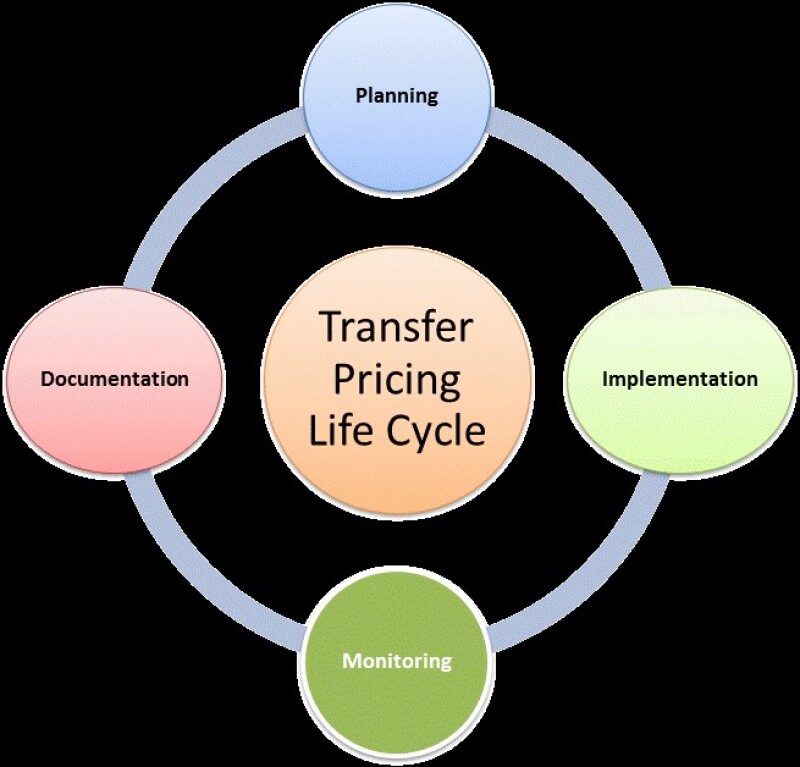

A typical TP lifecycle can be broken down into four broad phases: planning, implementation, monitoring and documentation.

Planning Stage:

The TP lifecycle starts with the planning phase. It is imperative to keep all the relevant stakeholders involved in the planning stage by forming a committee of key people from different functional lines within the organisation such as accounting, finance, sales and marketing, and control.

Representatives of these functions should meet periodically and discuss the latest business or non-business events such as products in the R&D pipeline, products which are about to be launched for commercial sales, the availing of new services from an overseas associated company or changes in any of the business models. Apart from the recurring meetings, the tax team should also develop a detailed checklist for identifying new transactions or changes in the existing transactions.

An inclusive approach will enable the tax team to plan its transfer pricing strategy in a more holistic manner which is in line with the organisation’s broad business objectives. It will also make those outside the tax department aware of the organisational risks which are prevalent while developing the TP policy.

It is important that the committee should have adequate representation from all key functional constituents. Each committee member should have defined responsibilities to oversee the execution of all processes in accordance with tax policy and accounting requirements.

The committee should also be responsible for identifying improvement opportunities, making recommendations to senior management and implementing required changes to continuously improve the inter-company environment.

Once the governing committee is in place, operational level teams can be formed which will be responsible for day-to-day process execution, monitoring and reporting of the results.

Ideally, the flow of information through the organisation should be such that not only is the business kept abreast of the changes in the TP lifecycle, but there should be a mechanism to alert the tax department when changes are made by the business in inter-company transactions.

As a part of the planning process companies should also have a formal communication, training, and a knowledge management programme in place. Even with formal policy documentation in place, having knowledge concentrated in a select few individuals can risk any business process.

A risk also exists that employees in the finance and accounting functions, which typically see a higher rotation of staff than tax departments, have no context to understand its role in the TP process. Organisations should look to put in place communication and training frameworks that extend across the tax, legal, finance, accounting and operational functions. This helps prevent personnel changes from causing significant disruptions in inter-company processes.

At times, organisations do not take a pro-active approach in planning their international group company transactions but follow an ex-post rather than an ex-ante approach.

The planning stage is a base or a foundation for developing the TP lifecycle in an organisation and the stronger the foundation, the stronger will be the implementation and the monitoring of the TP lifecycle.