Read Part 1 here: TP lifecycle planning stage

Read Part 2 here: TP lifecycle policy formation and monitoring

Documentation stage

Last, but not the least, is the documentation stage. The significance of documentation has grown sharply over the past few years, as the number of countries requiring transfer pricing documentation has increased steadily. This requirement is expected to persist as tax authorities across the globe continue to view transfer pricing as a revenue generating area. With the three-tiered documentation approach suggested in the BEPS Action 13 already in effect, documentation is going to become the most important aspect of a healthy TP lifecycle going ahead.

Some of the best practices that multinationals can adopt for enhancing the robustness of their TP documentation are as follows:

· It is important to understand the overall business well, and capture the right function, assets and risk (FAR) profile of the different businesses within the organisation. This involves making the business people aware of the purpose they are being interviewed and also involving them in the end-to-end process in order to understand the minutest of the details of the business.

A detailed FAR analysis really reflects the actual operations of the business and it should not be looked upon as just another document. Bringing out the small facts of the business can make a huge difference at times. Not all businesses are the same and there will definitely be some facts peculiar to a company which can become distinguishing factors to other companies in the same industry.

· It is always good practice to include the pricing determination model or methodology for all the transactions in the group TP report. For example, how has the organisation fixed the export or the import transfer prices?; How has the organisation arrived at the royalty amount paid to the overseas group company? or How has the local company arrived at the cost allocation for the global cost?

Mentioning such pricing methodologies brings transparency to the report to be submitted to the tax authorities. Though most of these aspects are generally covered in the TP policy of the group, it is not always possible to have the entire policy as a part of the report and so relevant extracts or the crux of the policy can be incorporated in the report.

· Finding the right comparable companies is key to good TP documentation. If there are differences between the FAR profile of the taxpayer and the comparable companies, then it is necessary to make adjustments to factor in the differences. The fine details of companies such as whether a company is forward or backward integrated, or companies not incurring working capital costs, can make a significant difference to the economic analysis. Just doing a standard roll–over, without analysing the impact of these changes on the business, will not always help in achieving an apple-to-apple comparison.

Generally, there are both quantitative and qualitative parameters around which taxpayers decide on companies for comparisons. While the quantitative filter is mechanical, the qualitative search is more manual in nature and requires an in-depth analysis after going through the websites, annual reports and other publically available information about the companies.

· Along with the core documentation of the TP study maintained by the taxpayer every year, the time has now come to also have good ancillary documentation for certain transactions. Companies should be pro-active in identifying the requirements from a local tax authority perspective for certain transactions. This includes keeping track of what kind of judgments are pronounced in the public domain and what kind of stands are being taken at higher courts for certain transactions and, accordingly, maintain adequate documentation for this. In India, when there were adjustments happening in the public domain on transactions including share capital issues, outstanding receivables from group companies, corporate guarantees, interest on loans, intra-group services, royalty transactions and more, it was only ancillary documents that were accepted as corroborative evidence by tax authorities for proving the arm’s-length-price. These documents were things like a share valuation report based on the discounted cash flow (DCF) method, or documents such as emails and internal presentations demonstrating the benefits received for intra-group services received and royalty paid..

· One should prepare documentation at the time when the transaction takes place. Most of the time the documentation is not prepared until the tax assessment comes up at a later date which causes problems if the documentation was not prepared at the time. Assessments in India come up around two or three years after the financial year in which the transaction takes place. By that time, either the people who were aware of the transactions have changed or the details of the transaction are no longer available. Also, many companies have an IT policy wherein emails are not stored beyond two years, so it is advisable to create the documents as, and when, the transaction takes place.

· It is also a healthy practice to get the TP documentation vetted by business colleagues once it is prepared by the tax team, or the consultants, to ensure that the facts are correctly captured in the TP study. Often, one may find that even after having a good FAR interview with the business team, when the final TP study is prepared, some facts are not captured or sometimes the key facts captured have diverged from what was explained or brought out during the interviews.

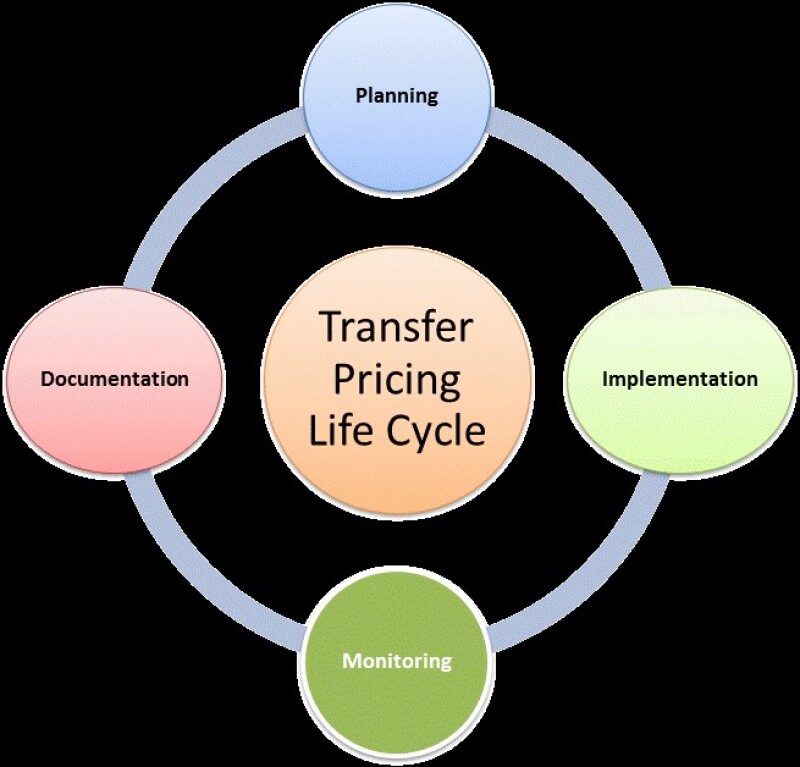

The BEPS project has highlighted the need for taxpayers to re-examine their TP documentation, as discussed in Action 13. It contains the three-tiered approach to the global standard for TP documentation and significant focus has been placed on ensuring that the documentation complies with the proposed standard. However, has the same focus been applied to the rest of the TP lifecycle? Truly effective TP management is only complete if the policies set out in a document have been implemented and the monitoring of the implementation is an ongoing process.

Conclusion

With the increasing importance of TP across the globe, more and more organisations are being impacted by TP and it is imperative that they start reviewing the internal setup of intercompany transactions. Multinationals should start making these changes sooner, rather than later, in order to align with the dynamic external environment. Having a robust TP lifecycle is the need of the hour for multinationals in order to wade through the turbulent waters of TP.

Every phase is crucial in achieving an optimum end-to end TP lifecycle. Implementing the best practices mentioned in each of the phases, as mentioned in this series, will only help organisations and tax teams to smooth their related party processes and compliance management.

However, one should also keep in mind that along with a robust TP lifecycle the tax team needs to identify and prioritise the TP issues that a company is facing, or may face in the future, and take proactive steps in tackling them. The tax team needs to explain recent developments, and key areas of focus for national tax authorities, to the people responsible for executing the TP lifecycle.

Being reactive rather than being proactive in resolving the TP issues, or taking corrective action only after looking at the past litigation of the company and analysing what kind of adjustments have happened in the past, will only result in a cost to the company through big TP adjustments.