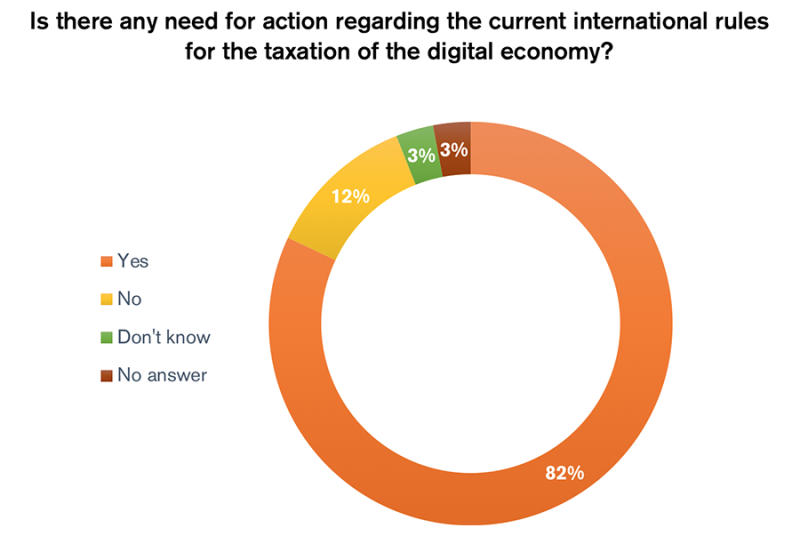

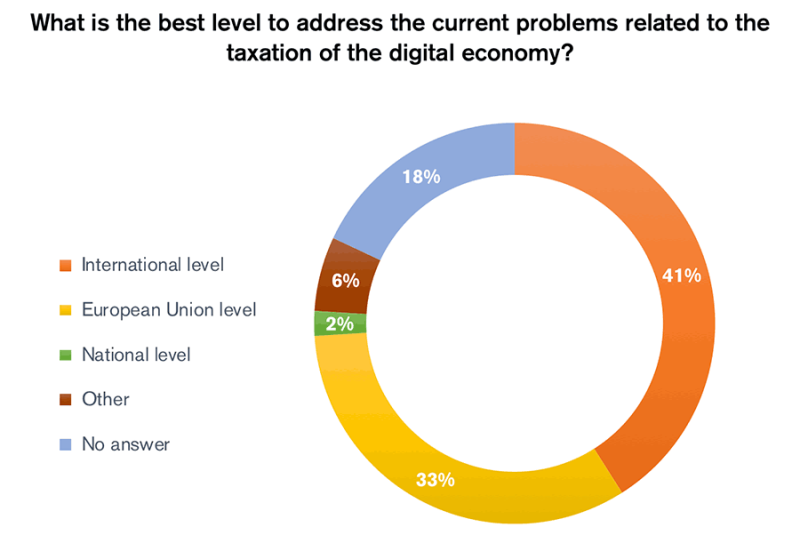

An overwhelming majority of respondents (82%) in the consultation agreed there was a need for action to reform current international rules for the taxation of the digital economy. Forty-one percent said the issue should be addressed at an international level, while 33% of respondents believed an EU level discussion would be the most appropriate, and only 2% said this debate would be best suited for the national level.

A total of 446 stakeholders* submitted their responses to the consultation and the majority of respondents were based in Spain, Germany, Italy, Belgium and the UK.

The public consultation will inform the EC’s approach to taxation of the digital economy ahead of the release of a proposal by the end of March – a proposal that will “create a consensus and an electroshock”, according to European Commissioner for Economic and Financial Affairs, Taxation and Customs Pierre Moscovici.

The public consultation gives detailed insights into the positions of the various stakeholders.

While two-thirds of respondents (66%) said current international taxation rules did not allow for fair competition between traditional and digital companies, more than two-thirds of respondents (69%) to the consultation said current international tax rules were already adapted to the digital economy.

Amsterdam-based travel website Booking.com did not believe there was a need for action regarding the current international rules for the taxation of the digital economy, or that temporary solutions should be adopted.

In their submission to the public consultation, Booking.com commented: “We do not see a need for a separate tax regime for digital businesses and strongly believe in coordination at the OECD/G20 level. Moreover, we believe that any such corporate taxation should remain based only on realised income, rather than taxing revenue as contemplated by the proposed ‘equalisation tax’. The taxing of revenue would be unfair and harmful to economic growth, as it would reduce the funds available in our businesses and seriously hamper our ability to create further employment in Europe.”

Fear of unilateral action

The majority of respondents agreed that international taxation rules allow digital companies to benefit from certain tax regimes and lower their contributions (74%), that states are not able to collect taxes on the value that some digital companies create on their territory (67%), and that the current situation could push some member states toward adopting uncoordinated measures that would lead to the fragmentation of the EU’s Single Market (82%).

In the consultation submission, the Federation of German Industries (BDI) stated that it feared the current situation could push member states towards adopting uncoordinated measures that would lead to the fragmentation of the single market.

The BDI pointed to the OECD’s findings in BEPS Action 1 Report that any ring-fencing of the digital economy for tax purposes was not possible, and that “any specific tax legislation targeted at digitised business models will most likely also affect ‘traditional’ industries which are currently in a digital transformation process,” also known as Industry 4.0.

Italy has already proposed unilateral action through a digital sales tax, and the UK has set out a position paper with various short-term solutions, as well as already having implemented a diverted profits tax.

Competitiveness of EU businesses

The majority of respondents (58%) said they expect a digital tax to level the playing field for businesses operating in the EU, and 41% of respondents agreed that adopting a digital tax would improve the competitiveness of digital companies in the EU.

The European Casino Organisation lamented that current international taxation rules did not allow fair competition between traditional and digital companies, citing companies’ access to customers in national markets without being effectively taxed in the market country and an unfair advantage over local companies due to lower taxation of companies operating cross-border as the main challenges that digitalisation brings for national tax systems.

“[…] Unlicensed operators do not pay taxes in the country where the player is located and instead seek out the country with the lowest tax regime. This leads to a situation where licensed and unlicensed operators in the same country are treated differently. It unfairly shifts the benefits in favour of unlicensed online gambling operators that can seek out low-tax and low-regulation jurisdictions,” the European Casino Organisation said.

According to a European Casino Organisation’s position paper, only an estimated 50% of online gambling companies are nationally licensed operators and taxed appropriately, with the remaining half more often than not providing services from low-tax and low-regulation jurisdictions, resulting in them having higher marketing budgets and higher pay-out rates.

Nevertheless, close to one-third of respondents believed that a digital tax would not improve the competitiveness of European businesses, with 19% strongly disagreeing that this would be the case. Another third of respondents (32%) believed that the adoption of a digital tax would go as far as to slow down the development of digital technologies in Europe.

For example, the BDI strongly agreed with the notion that a digital tax would increase the tax and compliance burden for business and slow down the development of digital technologies in the EU.

“Only a coordinated approach in line with the OECD can achieve an appropriate taxation of digitalised business models and prevent both double taxation and distortions of globalised value added chains,” the BDI stated in the consultation.

Disputes and compliance

A major concern for corporates are the potential increase in compliance cost and administrative burden arising from a digital tax. If a digital tax were adopted, 55% agreed or strongly agreed that it would increase the compliance cost for businesses, 58% expected it would increase the tax burden on businesses and more than half (53%) also anticipated a rise in disputes.

The consultation also addressed the perspective of tax authorities, showing that more than half of respondents (54%) expected the administrative burden from collecting the digital tax would increase.

As the three main challenges that digitalisation brings for businesses, respondents highlighted uncertainty related to tax obligations when operating in different countries (63%), uncertainty on exact allocation per jurisdiction of the business’ value creation (61%), and uncertainty related to future taxation solutions for new business models (44%).

Short-term fix

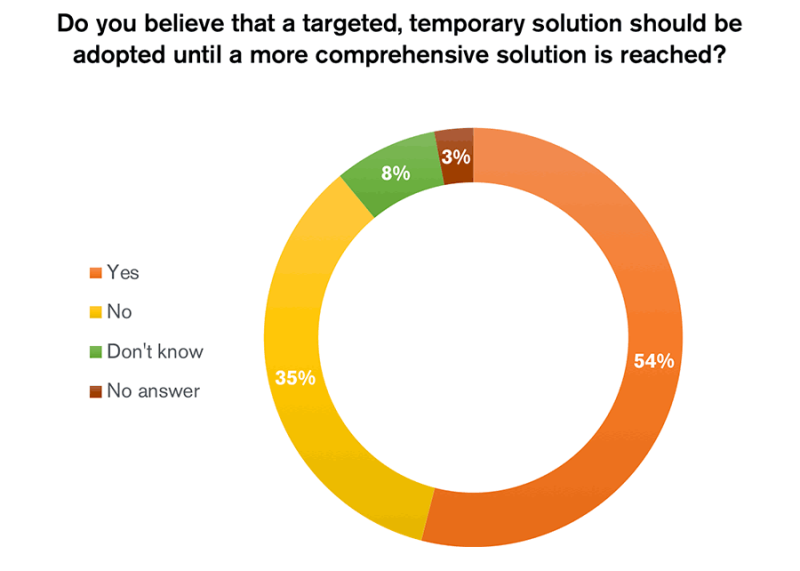

The majority of respondents (54%) in the consultation believed a targeted and temporary solution should be adopted until a more comprehensive solution is reached.

The most-favoured short-term solution was a tax based on the revenue from certain digital transactions concluded remotely with a non-resident entity that has a significant economic presence, e.g. revenue from the sale of online advertising. Twenty-nine percent of respondents said this solution would to a great extent solve the current problems in international taxation ruled for the digital economy.

The least-favoured solution, with 34% saying it would not at all solve the issue, was a digital transaction tax that would apply early in the value-creation process, such as the collection of personal and other data.

Digital music service Spotify stated in the consultation its position that there were no special problems with digital business and thus no solution was required. International tax rules applying BEPS recommendations would in time make sure taxes will be paid where value is created, Spotify stated.

“If all participating governments determine that short-term action is needed, we strongly recommend that any is based on taxing only realised income. Further, any solution based on realised income should ensure this income is taxed only once. These requirements are only fair and reasonable – nobody should pay taxes without an income from which the tax can be paid.”

“Lastly, we would like to stress that the effect of any taxation not based on realised income will have serious negative global effect on growth, employment and welfare. These negative effects will be incurred by both customers and businesses, and will be especially acute for start-ups, small- and medium-sized companies,” Spotify stated.

The most favoured long-term solution by a significant majority (58%) was to implement new EU rules for permanent establishment and profit attribution to capture digital activities of businesses in a stand-alone EU Directive, as stated in the “digital presence in the EU proposal”, approved by the European Parliament on February 21.

The planned Common Consolidated Corporate Tax Base (CCCTB) and Common Corporate Tax Base (CCTB) were approved by the Economics and Monetary Committee, and proposals include “benchmarks to determine whether a firm has a ‘digital presence’ within an EU member state which might make it liable for tax even if it does not have a fixed place of business in that country”.

Vianney Hennes, permanent representative of French Telecom Orange to the European institutions, said on his company’s behalf in the consultation that efforts should be focused on tax avoidance and not so much directed at specific digital indirect taxes, arguing that a digital tax would not only apply to large tech companies but also increase the tax burden of “virtuous actors” already paying corporate taxes in the countries they operate. Orange instead puts forth an argument in favour of anti-abuse mechanisms such as the British and Australian DPT.

“Harmonisation at international level is not an up-front condition but on the contrary would be a beneficial consequence of anti-abuses tax spreading across the world,” Hennes stated.

“The anti-abuse tax and the creation of a virtual establishment based on significant digital presence in national tax systems are the solutions capable of addressing the issue on a state-by-state basis, while not compromising the prospects for a global solution; it does not only target digital industries but embraces all large multinational companies using their globalised value chain as a powerful lever to organise tax avoidance,” Hennes concluded.

Meanwhile, Spotify in its submission to the consultation stated, “We believe that the whole discussion about significant economic presence simply is a discussion about whether value in addition to consumption is created simply by the presence of a ‘market’. We strongly believe that if the only value attributable to the ‘market’ is consumption which then can be - and in almost all major countries is - taxed through consumption taxes such as VAT etc.,” it stated.

“No value is added by mere significant economic presence, in effect the mere act of providing services in a particular territory. Applying the well-established and agreed principle of taxation of profits where value is created, no income should be attributed to mere ‘digital presence’. Attributing income to mere a significant economic presence would be a departure from the arm’s-length principle,” Spotify said.

Level playing field

A level playing field should be the main objective to consider when designing future legislative proposals for the digital economy, 40% of respondents said, while ensuring a competitive tax environment in the EU for the scaling-up of start-ups and all business to flourish was the second-most important objective, according to 34%. However, respondents were equally divided on the question of exemptions from a digital tax for SMEs, with 38% in favour of exemptions and 39% against it.

* The European Commission (EC) received 446 responses to the survey from individuals, businesses, trade and business associations, advisories, civil society organisations, academic institutions and international organisations. The consultation period was open to submissions between October 26 2017 and January 3 2018. Please visit the EC website for the results and a complete breakdown of the consultation.

All percentages in this article have been rounded to the nearest percent by TP Week.