The Gulf Cooperation Council (GCC) countries – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia (KSA) and the United Arab Emirates (UAE) – have not been immune to global TP developments. GCC-headquartered groups are already filing country-by-country (CbC) reports and preparing master files and local files in other countries in which they operate, and which have the underlying TP legislation.

Kuwait, Oman, Qatar and Saudi Arabia have laws requiring related-party transactions to be at arm’s length, but TP arrangements were not being challenged by tax authorities in much detail until recently.

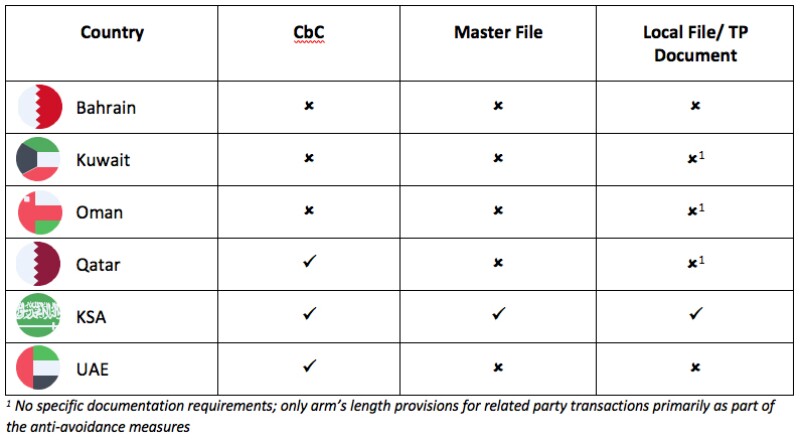

The following table summarises the TP legislation/ compliance requirements in the GCC countries:

As outlined in the table above, Bahrain does not have any TP legislation at present. Further UAE has also only recently issued CbC reporting regulations (effective for years beginning on or after 1 January 2019) and does not have any other TP legislation requiring related party transactions to be at arm’s length. This stems from a lack of corporation tax regimes in these countries to form the basis for TP legislation, warranting payment of appropriate taxes in countries where value-generating activities are performed.

While KSA has issued detailed TP bylaws and guidelines and prescribed formal TP documentation, the TP principles applied by tax authorities in Kuwait, Oman and Qatar are applied broadly as anti-avoidance measures. Accordingly, during tax audits, where it is determined that the taxable income is understated because of any related-party transactions, the tax authorities may request evidence to support the arm’s-length nature of such transactions.

Increasingly, many multinational companies with operations in these countries (especially in Oman) are preparing local documentation based on OECD TP guidelines to support and defend TP enquiries during audits, even in the absence of formal requirements.

A summary of KSA’s TP regulations

The KSA TP bylaws are broadly in line with the OECD TP Guidelines and contain the requirements for maintaining three-tiered TP documentation (from the year ending December 31 2018 onwards), i.e. master file, local file and CbC report for taxpayers meeting certain thresholds. Some of the key features of the KSA TP regulations are:

A broad definition of “controlled transactions”: departure from the OECD TP Guidelines and existing KSA income tax law;

A requirement of filing the disclosure form of the controlled transactions along with the income tax return and certification from a licensed auditor regarding consistent application of the TP policy;

It is not applicable to Zakat payers (except for CbC provisions); and

The KSA has signed the CbC MCAA in August 2019, providing for exchange of CbC reports between countries.

CbC provisions in UAE

The UAE Cabinet has issued CbC reporting regulations dated 30 April 2019 which are effective for financial years beginning on 1 January 2019.

Accordingly, UAE tax resident entities that are members of multinational groups having annual consolidated revenues of AED 3.15 billion or more ($858 million) in the preceding year are required to comply with the CbC report filing requirements in UAE for fiscal years commencing on or after January 1 2019. Also, prior to the regulations, UAE headquartered MNE groups were filing CbC reports with the jurisdiction of the Surrogate Parent Entity appointed for this purpose. Going forward, the same will mandatorily need to file such CbC report with the UAE’s Ministry of Finance.

UAE signed the CbC MCAA in June 2018.

CbC provisions in Qatar

Qatar published the CbC requirements in its Official Gazette on September 9 2018.

Accordingly, Qatar tax resident entities that are members of multinational groups having annual consolidated revenues exceeding QAR3 billion ($824 million) in the previous year are required to comply with the CbC report filing requirements in Qatar for fiscal years commencing on or after January 1 2017. Qatar signed the CbC MCAA in December 2017.

According to a circular released by Qatar’s Ministry of Finance, Qatar-resident entities that are not the ultimate parent entity of an MNE group are not required to file notifications or CbC reports for the years 2017 and 2018. Further clarity and instructions are expected soon.

The future of transfer pricing in the GCC

Five out of six GCC countries (not Kuwait) have joined the BEPS Inclusive Framework and, accordingly, are required to adopt the four minimum BEPS standards, one of which relates to TP documentation and CbC reporting. While KSA is the first one to adopt the three-tiered documentation requirements, other countries are also expected to issue detailed requirements in due course. This has begun with UAE and Qatar already issuing CbC requirements.

TP audits are on the rise in the GCC countries, and tax authorities have begun asking questions regarding the TP policies for intra-group transactions. This is also because of the global focus on TP issues. In the absence of local TP legislation, taxpayers and tax authorities in the GCC often refer to the guidance and principles listed in the OECD TP Guidelines.

There have been discussions around the potential introduction of a corporation tax framework in the UAE in future too. Once this happens, we can expect introduction of TP principles embedded in the corporation tax law.

Further, UAE has also recently issued the Economic Substance regulations for entities carrying on relevant activities. As companies look to meet the “substance tests” in the UAE, TP modelling and analyses used to determine arm’s length remuneration for activities undertaken in the UAE would support in demonstrating substance in the UAE.

In the context of the KSA, given that the year ended December 31 2018 was the first to be covered by the newly issued TP bylaws, one will have to wait to see how the GAZT implements the bylaws in practice. Also, once the CbC report exchanges begin, it will be interesting to see how the tax authorities in the GCC use the information documented in these reports to make transfer pricing risk assessments.

There are signs of shifting sands in the GCC!

This article was written by Nilesh Ashar and Vartika Jain of WTS Dhruva Consultants, part of the WTS Group.