New regulations on Bonded Warehouses seek to support business

The Minister of Finance has issued Regulation Number 155/PMK.04/2019 (PMK-155) regarding Bonded Warehouses (BW). The regulation supports the national industry roadmap and increases economic growth through its customs facility. PMK-155 revokes the previous PMK-143/PMK.04/2011 (PMK-143) and became effective from December 4 2019.

The key points of PMK-155 are as follows:

Licensing

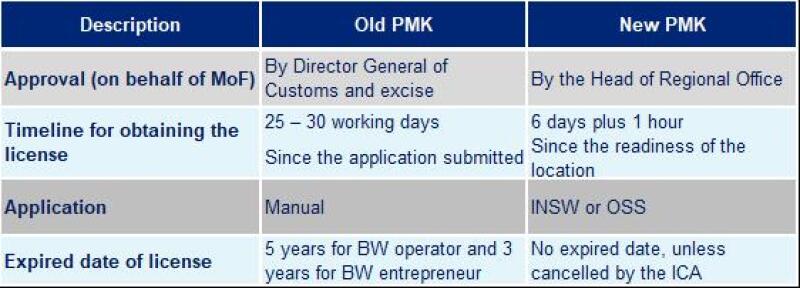

There are significant changes in BW’s licensing, especially in the timeline for obtaining the license, change from manual to electronic procedure etc. The summary of changes is as follows:

In addition, to support the ease of doing business and to enhance customs services and monitoring, the regional customs office may add certain treatment in the BW’s license, e.g. facility for introducing and releasing goods to / from BW for goods in bulk, shrinkage / volume deviation etc.

Stockpiling Purposes

The new PMK also changes the following stipulations regarding stockpiling:

The functions of BW in supporting industrial business are expanded; now it is to support manufacturer in other Indonesia customs area (TLDDP), bonded zone, special economic zone, free trade zone, or other economic zone. Previously this was limited to TLDDP and bonded zone;

The function of BW for ‘transit’ also expanded; now it is for export and/or supply for logistics, operational or other needs of sea / air transportation activities for overseas destination; and

Imported goods can be stored in BW for a maximum of two years after the importation date; previously this was only for one year.

Additional Facilitated Goods

The following goods are facilitated (import duty postponement, import VAT not collected, and excise exempted) under the new PMK:

Raw material, auxiliary raw material, machines, spare parts, factory equipment, heavy equipment, packing and or packaging tools introduced into BW for supporting industry;

Goods to be traded in duty-free shops;

Goods introduced for export purpose; and

Goods used to support BW’s operation such as forklift, measuring instruments, goods storage and other equipment needed in BZ.

Previously, capital goods for use in BW and for construction or expansion of matters, including equipment, were not facilitated.

Transitional Provisions

When this ministerial regulation came into force:

BW permits that were issued prior to the enactment of this ministerial regulation, whose time period was specified, are declared to remain in force until the BW permits are revoked;

BW permits that were issued prior to the enactment of this ministerial regulation, which have not yet complied with the provisions on establishment of a BW as stipulated in Article 9, are given a deadline no later than December 31 2019; and

For imported goods which at the time of entry received postponement of import duty, exemption from excise, and/or non-collection of import taxes, in accordance with Regulation PMK-143 regarding BW, the time period for their stockpiling shall continue to be based on the provisions in PMK-143.

Government amends tax allowances for certain entrepreneurs

On November 12 2019, Government Regulation no. 78 of 2019 (PP-78) was issued to amend the regulations on tax allowances available for companies that invest in certain business sectors and/or certain regions. This regulation replaces the previous regulation, i.e. Government Regulation no. 18 of 2015 (PP-18) as amended by Government Regulation no. 9 of 2016 (PP-9).

PP-78 introduces the use of the online single submission system (OSS System) to process the applications. The regulation covers 183 types of investments that meet the requirements, 166 certain sectors, and 17 investment categories in certain sectors and certain regions, including 20 new business sectors.

The income tax facilities are as follows:

Reduction in net income by 30% of the amount of the investment in the form of tangible fixed assets including land used for the main business activities (5% per year for 6 years starting from commercial production);

Accelerated depreciation and amortisation;

Withholding tax at 10% on dividends paid to foreign taxpayers other than a permanent establishment in Indonesia, or lower rate in accordance with an applicable double taxation avoidance agreement (DTA); and

Tax loss carried forward for more than five years up to a maximum of ten years. PP-78 updates the annual qualification to extend the tax loss carry forward period as follows:

Eligible investment - one additional year

Investment in new and renewable energy - one additional year

Using raw materials and/or components at least 70% made in Indonesia from the second year - one additional year

Using Indonesian workers - one additional year (300 persons for at least four consecutive years); or two additional years (600 persons for a minimum for four consecutive years)

The further detailed criteria and conditions for each type of business field are listed in the appendices of the regulation.

Please note that taxpayers that have enjoyed a tax allowance facility under PP-78 cannot obtain the following tax facilities:

The tax facility in Integrated Economic Development Zones.

The tax holiday as provided under Government Regulation no. 94 of 2010 (PP-94) as amended by Government Regulation no. 45 of 2019 (PP-45).

The super deduction facility on labour-intensive industries as provided under PP-94 as amended by PP-45.

PP-78 became effective on December 12 2019. The implementing regulations based on the old government regulation remain in force as long as not contradictory to the provisions of PP-78.

Indonesia and Tajikistan ratify long-pending treaty on double taxation

As published in the Official Gazette on November 29 2019, the Indonesian government has ratified a long-pending agreement with Tajikistan regarding the avoidance of double taxation and the prevention of fiscal evasion with respect to income taxes. The treaty, which had earlier been signed on October 28 2003, marks the first such treaty between the two countries.

The treaty will apply from January 1 2020 following its entry into force.

Endy Arya Yoga

T: +62 21 2988 0681

Fabian Abi Cakra

T: +62 21 2988 0681