In recent years, the Italian tax authority (ITA) has increasingly been carrying out inspections to check the consistency of the TP policy applied by multinational enterprises (MNEs), giving rise to a number of tax litigation cases.

Although alternative means of dispute settlement are likely to be predominant, judicial proceedings are still frequently used to settle TP disputes. At the same time, there is a significant increase in the number of cases where unilateral or international proceedings are activated to eliminate double taxation arising from TP claims.

Main developments in transfer pricing legislation and practice

In recent years, the Italian TP legislation has been substantially amended. The two major legislative developments refer to:

The alignment of the TP domestic statutory provision (Article 110, paragraph 7 of the Income Tax Code) with the OECD Transfer Pricing Guidelines (OECD guidelines) through the issuance of Law Decree No. 50 of April 24 2017 (converted, with amendments, by Law No. 96 of June 21 2017). In particular, an explicit reference to the arm's-length principle has been introduced.

Following this amendment, the Ministry of Economy and Finance published a Ministerial Decree signed on May 14 2018 (Ministerial Decree), containing general guidelines for the proper application of the domestic provision, making explicit reference to the OECD guidelines and OECD final report on BEPS Actions 8-10.

The introduction of a new statutory provision (Article 31-quater, Presidential Decree No. 600/1973) to allow Italian taxpayers to obtain a unilateral downward adjustment on their taxable income as a result of a TP adjustment made by foreign tax authorities. In particular, the ITA can recognise a downward adjustment when a MAP is executed and when a formal request is made by the taxpayer, as per Regulation No. 108954/2018 that regulates the terms and conditions for downward adjustment requests.

The primary purpose of the Ministerial Decree is to provide guidelines for the application of the arm's-length principle 'on the basis of international best practices' and, no doubt, in compliance with the provisions of the OECD guidelines, as amended.

However, in the preamble and Article 7, the Ministerial Decree mentions the OECD guidelines as a reference to 'take into account', which may give the impression of simply drawing on them to develop autonomous rules that summarise the definitions and principles provided in the OECD guidelines.

Furthermore, it only concerns some of the topics addressed by the OECD guidelines and transposes them in a few synthetic articles, losing the benefits deriving from the detailed clarifications and examples instead provided in the OECD guidelines.

As required by Article 9 of the Ministerial Decree, further interpretative documents would have to be issued through one or more regulations of the Director of the ITA during 2019. However, no documents have been published to date.

Transfer pricing scrutiny and related audits

No statistics are available on TP assessments concluded by the ITA, although these are probably of a large number, both in terms of cases and amounts involved.

Data are instead available on the inspection activity performed by the Italian Tax Police. In 2018, they assessed 1,702 international tax cases, corresponding to €38.1 billion ($41.2 billion) of higher taxable profits assessed. The amounts claimed for TP adjustments and for profits attributed to hidden permanent establishments (PEs) in Italy amount to €30.1 billion (i.e. 97% of the total).

This data, however, does not consider the inspections performed by the ITA, which is extensively conducting TP audits when material inter-company transactions are performed by the taxpayer.

The large amount of assessments relating to hidden PEs, which ultimately involve the attribution of profits based on TP rules, represent another important feature of the Italian TP landscape.

The approach generally followed by the ITA during tax audits on TP is mainly focused on understanding the role of the Italian companies under scrutiny in the group's value chain.

All types of inter-company relationships are deeply scrutinised as illustrated in the following examples:

Management fees and intra-group services: In cases where the cost for the service rendered is borne by the Italian subsidiary, one of the main issues raised by the ITA concerned the deductibility of such costs. In most cases, the claim made by the ITA on the deductibility of costs is based on the general principle of 'inherence'. In such cases, because the claim is not based on TP rules, the taxpayer is precluded from the application of the penalty protection regime and from starting a MAP. The ITA allows the deductions of costs only to the extent that they are connected to the taxpayer's activity and they refer to services that have actually been rendered. The other issue concerns whether the form of the consideration and amount of the intra-group charge is in line with the arm's-length principle.

Intellectual property-related transactions: In some audits, the ITA challenged the benefit derived by the Italian subsidiary from the use of certain intellectual property (IP) licensed (e.g. brands) by the foreign subsidiary, claiming that the IP licensee was of limited or no value. In other cases, a royalty payment was found to exist embedded in the purchase price of intermediate products. Under specific circumstances, the undue royalty payments exceeding the arm's-length value of the licensed IP can also trigger a secondary adjustment related to withholding tax.

Analysis of functions: In recent audits on Italian subsidiaries responsible for distribution activity, the ITA has conducted an analysis at the level of operating expenses incurred by the Italian entity to determine if it exceeds routine costs. If it is the case, the ITA may alternatively disregard the deductibility of the exceeding expenditure or make an adjustment to remunerate the non-routing functions.

Financial transactions: Where a cash pool arrangement remains outstanding for a longer term, or the funds are used for a different purpose, the ITA frequently re-characterises the nature of the transaction into a long-term loan for which a higher interest rate is generally applied.

Notable court cases

Recent tax court decisions have referred to the Ministerial Decree and provide detailed interpretations on the application of TP rules. As an example, the following decisions strictly follow the path indicated by the Ministerial Decree:

Arm's-length range: Recently, tax courts have stated that if the selected profit level indicator of the transaction falls within the arm's-length interquartile range of results, the ITA should not challenge it. The new definition of the arm's-length range provided by Article 6 of the Ministerial Decree seems to admit the relevance of the whole arm's-length range, which respects full comparability with the controlled transaction. However, ITA regulations are still missing and they might affect this conclusion.

TP methods: Recently, tax courts have stated that where an enterprise has used one of the TP methods expressly indicated in Article 2 of the Ministerial Decree, the tax audit carried out by the ITA should consider the TP method adopted by the taxpayer. The judicial decisions were based on the content of Article 4 of the Ministerial Decree.

In other cases, however, tax courts provided interpretations of the Ministerial Decree that apparently draw from existing outdated circulars (Circular No. 32/9/2267 of September 22 1980 and Circular No. 42/12/1587 of December 12 1981). These old circulars were drafted in 1980 based on the 1979 OECD Report and were never updated to reflect the developments in international tax practices.

This was the case in a recent decision involving the definition of control in Decision No. 2771 of June 27 2019 of the Regional Tax Court of Lombardy.

In fact, according to the Ministerial Decree, control requires that the dominant influence is exercised through contractual or shareholding constraints. However, in its decision, the tax court considered the concept of control extending to cases of economic influence – potential or actual – inferred from the circumstances. The tax court concluded that "the meaning of control is too narrow when limited to contractual or shareholding constraints, not allowing de facto considerations regarding the economic circumstances that are essential to regulate TP matters".

The need for a clear and coherent regulatory framework is essential in TP, which lends itself to different interpretations due to the subjectivity of any evaluation process. In this specific case, regarding the definition of control, it remains to be clarified what is to be meant by "contractual constraint", especially in cases involving commercial exclusivity agreements.

Mutual agreement procedures and arbitration

Double taxation arising from adjustments to profits of associated enterprises based on Italian TP law may be resolved through a MAP, which offers an alternative to the ordinary tax litigation procedure.

A MAP can be started pursuant to an Italian income tax treaty based on Article 25 of the OECD Model Tax Convention (in cases involving non-EU countries) or the EU Arbitration Convention of July 23 1990 (in cases involving EU countries). The two procedures differ in several aspects, among which the most important are the scope of application, the mandatory result and the interaction with domestic litigation procedures.

Further guidance is expected after the actual implementation of the OECD Multilateral Instrument (MLI). Indeed, Italy has opted for the introduction of a mandatory and binding arbitration provision in tax treaties.

From a practical perspective, the effectiveness of MAPs has not been satisfactory in the past in Italy. In fact, even though a number of proceedings were initiated, only a few were concluded. Things have changed due to a substantial increase in international tax disputes and as a result of the measures developed under BEPS Action 14 aimed at ensuring the consistent and proper application of tax treaties, including the effective and timely resolution of MAP disputes.

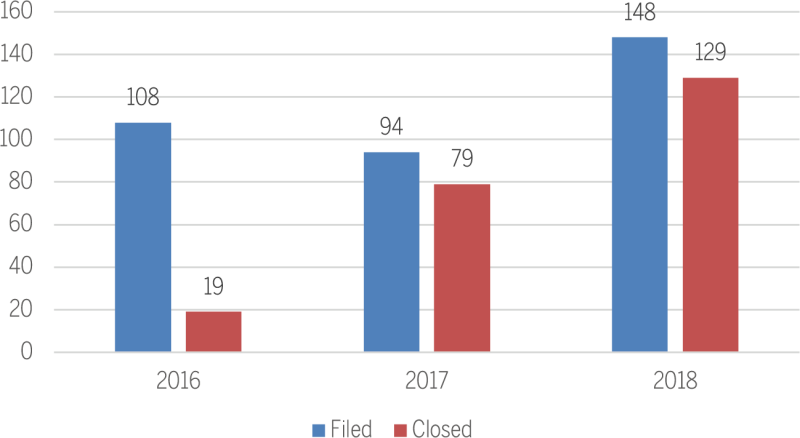

According to the official data presented by the EU Joint Transfer Pricing Forum (EU JTPF), statistics showed that the MAP activated under the EU Arbitration Convention is an instrument widely used by Italian taxpayers. This is confirmed by the constantly increasing number of cases filed and in 2018 it is the highest among EU countries at 148 (see Figure 1).

Figure 1: EU MAPs

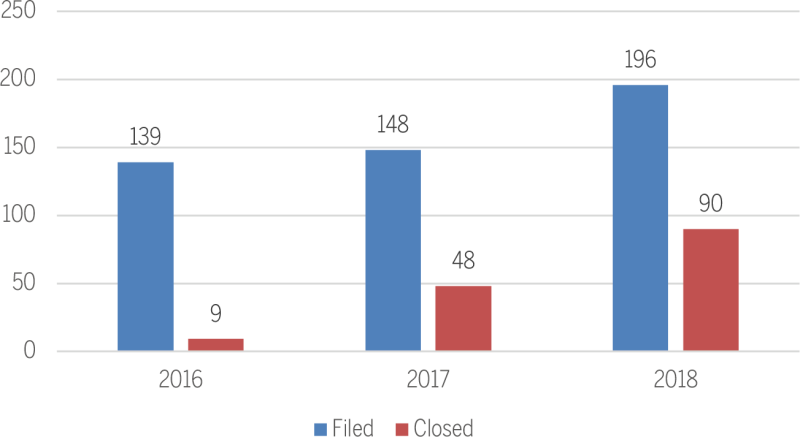

Figure 2: Transfer pricing MAPs under tax treaties in Italy

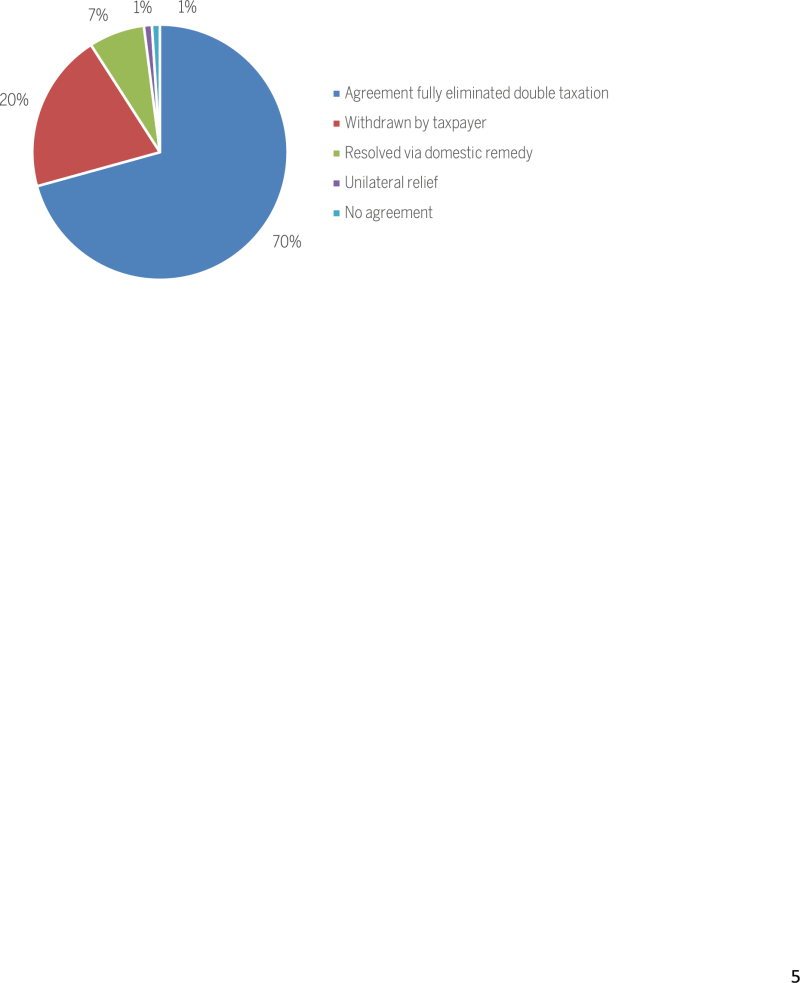

Figure 3: Tax treaty MAP outcomes in 2018 in Italy

The EU MAP graph also shows a significant improvement in the capacity of the ITA to process and close MAP cases over the 2016-18 period.

Regarding the official data presented by the OECD for 2018, there were 2,385 MAP applications filed in OECD member countries, of which 256 were activated in Italy (ranking sixth out of 89 countries for the number of activated MAPs).

Having reference to TP cases only, 196 MAP procedures were initiated in Italy in 2018, as reported in the graph on TP MAPs under tax treaties (Figure 2).

The graph also shows that MAPs under tax treaties are more complex and difficult to conclude despite an increasing trend in the capacity of the ITA in processing MAPs: only 90 cases were closed in 2018.

In terms of timing, OECD statistics show that the average time taken to close the procedures in Italy for TP cases started before January 1 2016 is approximately equal to 58.08 months (while for cases started after January 1 2016 it is 14.34 months).

The graph on tax treaty MAP outcomes (Figure 3) shows the MAPs outcome for 2018 related to TP procedures activated in Italy.

Given the growing attention on tax risks deriving from TP matters and the increasing number of MAP cases managed, the ITA is progressively aligning with the international best practices. On the other hand, domestic juridical procedures remain lengthy and uncertain.

In this context, the Ministerial Decree is an important step to ensure more certainty and possibly a convergence towards best international practices in the context of judicial proceedings.

However, the ITA is still in the process of drafting detailed regulations on issues addressed in the Ministerial Decree to clarify how the OECD's TP principle will be implemented within domestic law to improve the level of clarity and reduce possible future conflicts between taxpayers and the ITA.

Stefano Bognandi |

|

|---|---|

|

Partner LED TaxandTel: +39 02494864 Stefano Bognandi has a degree in economics from Università Cattolica del Sacro Cuore in Milan. He started his career in 1995 as a financial advisor at a German boutique firm and subsequently joined Ernst & Young in 2001. He founded an independent advisory firm in 2008 and, starting from 2010, he set up a transfer pricing team to exploit his economic background and his experience in cross-border transactions, valuation and corporate reorganisations. He started to work with Fantozzi & Associati, where he was a partner from 2016 until December 2017. He joined LED Taxand in January 2018. Stefano has been advising domestic and international corporate clients and investors for more than 20 years. He has a significant expertise in the area of TP, covering business reorganisations, IP and business valuation, documentation, tax disputes, APAs, MAPs and patent box. |

Alfredo Fossati |

|

|---|---|

|

Managing partner LED TaxandTel: +39 02494864 After completing a degree in economics at Bocconi University of Milan, in 1985 Alfredo Fossati started his career at Andersen Legal where he became partner in 1997 and from then he acted as managing partner for the North-East of Italy until 2002. After one year at Deloitte, he joined tax law firm Fantozzi & Associati in 2003 and developed the activities of its Milan office acting as managing partner. He founded LED Taxand with Guido Petraroli in 2018. Alfredo has extensive experience in the management of tax issues involving Italian and multinational groups and financial investors. He advises on the tax of transactions (M&A, group restructuring, distressed companies, etc.) for industrial and financial groups and private equity firms. He has strong competencies in international tax planning, transfer pricing and tax disputes. He has experience acting as a board member for various companies, including listed companies. |