Tax directors live in an era where everyone has to do ‘more with less’. In the case of tax departments, tax heads are often told to do many things by senior management, but at the same time see their budgets cut. This is a trend that many tax directors are grappling with.

“Every year, we are asked to start with last year's budget minus 7%,” said a vice president of tax at a waste management company. The “significant” budget cut has to include people's raises and bonuses, which is a challenge, she said.

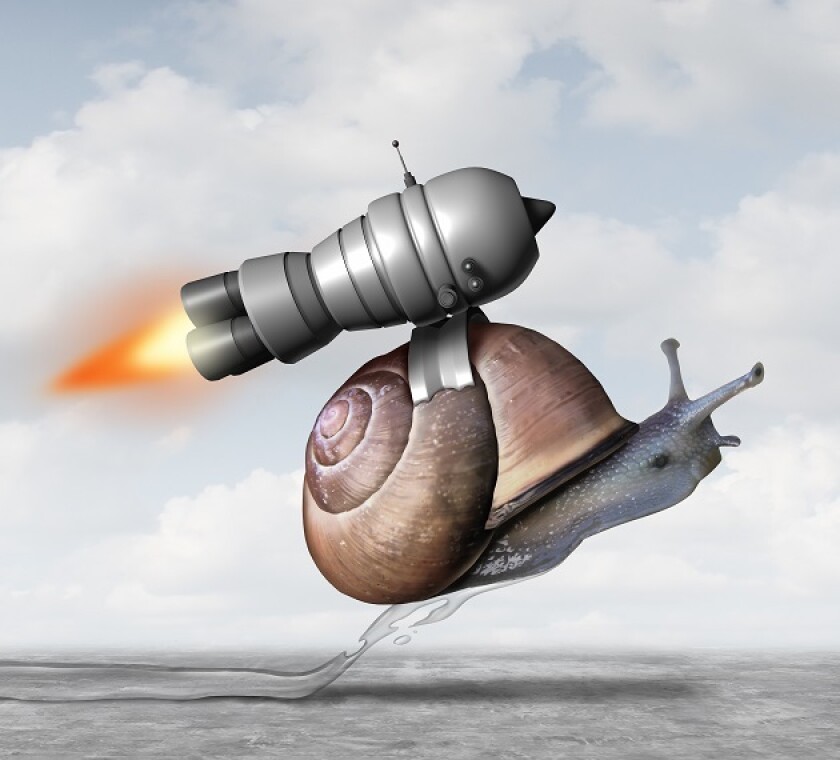

“But I think this just challenges us to think outside the box and, thankfully, the last couple of years, it’s been made slightly easier because of technology,” said the tax VP.

In many tax departments, tax directors re reassessing how they prioritise the needs of the business while also maximising the resources available.

“I'm not looking for people who work more hours,” said the tax VP, but rather for each member of the team to “work smart” and identify areas where automation and technology could offer a benefit and allow staff to focus on high-risk areas or add value.

However, for one managing director of tax at a private equity company, the tax function’s budget is increasing, but using the funds efficiently means not spending it on outsourcing or just another person. For her, the approach is two-fold, with one aspect being technology to take over repetitive tasks and the other about how to assign projects to team members.

“When I joined the company, the team was very task oriented,” said the managing director of tax. “When we were going through the busy season, we would do what was necessary and jump on it”.

With little time to tackle any ideas or projects, she decided to use her budget by assigning funds to each member of the team, making them responsible for their area of work. This created accountability and ownership that allowed each person to do more with their time and feel more fulfilled in their role.

“So far, it's been going really well, but we haven’t reached perfection yet,” said the managing director of tax.

However, this requires a tax director to have a team that is up to the challenge. This is tougher to achieve when tax departments feel they are in constant conflict between achieving their goals and dealing with the demands of tax authorities around the world that are getting smarter, more automated and requiring more data from taxpayers, often in real time.

The global head of tax at a New York-based corporation said one of her mantras is ensuring she has a fluid and flexible tax department.

“I don't think any more about someone saying, 'well, this is all I do’ and putting themselves in a box and the blinders on,” said the global head of tax. “It's about who can really adapt to change, try new things and take on new things because the world of tax is changing. All of us have been asked to do more, and to learn more and to do different things.”

Whether it's learning new technologies, or understanding an area of tax that maybe wasn't part of a person’s core responsibilities before, tax directors are asking their departments to be adaptive and flexible. In general, most tax leaders say they have not experienced any resistance from their employees as they see the positive outcomes.

For the global head of tax, explaining to her staff how she examines the input of resources and time versus the output has helped.

“To get it 80% of a task right it takes 40% of the actual time, for example. And if it’s going to take an addition 60% of time to get an additional 10% or 15% of it right, it is really worth it?” she asks. “You need to take a hard look at this as a tax leader and say: where are the risks that you can take.”

When it comes to gaining efficiency from a tax team, the tax VP said tax leaders “must think outside the box”. She explained that as people progress through their tax careers to tax manager and tax director, they need a team that has the expertise to work independently and be able to make decisions. Building a succession plan is a crucial part of that.

No matter how large or small a tax function is, tax leaders say the key is to have a team that know their tax area but who are willing to learn new areas and assist others. Being adaptive to the needs of the business and flexible enough to embrace change are also important qualities.