A rapidly changing world has widespread implications for payroll services. Digital and social disruption are fundamentally transforming all aspects of a company's business. Traditional payroll service and delivery is no exception: globalisation, increased legislation and the accelerated advancements of digital technology are among the most strident forces propelling multinational and global organisations to reimagine their payroll operations. The pandemic has also brought global payroll business continuity planning to the forefront.

Many companies are seeking to expand their global footprint to chase new revenue streams. This has payroll implications that companies need to consider as part of any exploratory process. As companies become more global, the need for greater compliance, stronger risk governance and standardisation across jurisdictions becomes more acute.

Meanwhile, legislation around the globe grows increasingly fragmented and complex. This is further exacerbated by the number of COVID-19 related legislation: work-time reduction, forced leave, release of short-term contractors or furlough. Governments contending with a perfect storm of declining revenues and rising costs of aging populations are pursuing more robust means of payroll tax collection, thanks to the advances of digital technologies. Digital technologies also lie behind the stance by governments for greater regulatory transparency of personal data collection and greater scrutiny of data privacy protection.

Some of these trends are discussed below, with a particular focus on business continuity planning being the cornerstone for unlocking payroll transformation.

Unlocking payroll transformation

Global expansion means prioritising payroll earlier

With carve-outs, it is all about speed and timing. A carve-out is always a delicate moment for a company and its employees. Risk mitigation and business continuity are essential. Companies need to determine what a day one operation would look like, what is achievable and what can be better done in the future. When expanding global footprints, through transactions or opening in new markets, ensuring there is an effective payroll framework from day one is of utmost importance.

The changing workforce is connecting payroll and mobility closer than ever before

As the workforce gets increasingly more comfortable to mobile working from different locations (either on long-term assignments or short-term business travel), mobility looks at the tax implications of this trend. When managing a mobile workforce, companies often have different providers for mobility and payroll, and they find themselves stuck in the middle coordinating between them. Bridging this gap is essential to manage compliance and risk, and to increase efficiency.

Digital technologies will drive the next wave of payroll operations

Digital technologies are creating both opportunities and challenges within organisations. Advances in third-party payroll applications are making organisations rethink their payroll environment as they are being forced to move away from legacy on-premise systems and towards a cloud-based model. At the same time, advances in robotics process automation (RPA), internet of things (IoT), artificial intelligence (AI), chatbots and blockchain, among others, are enabling payroll functions to automate repetitive processes that have historically consumed considerable time and resources.

Business continuity plans (BCPs) need to be more robust

Strong BCPs can mean the difference between employees being paid on time, correctly or not at all. Did your vendor stand up to the test? Now more than ever, robust business continuity plans are required: people, technology and processes. Assessing your payroll status quo and thinking through all the continuity scenarios is not an easy task.

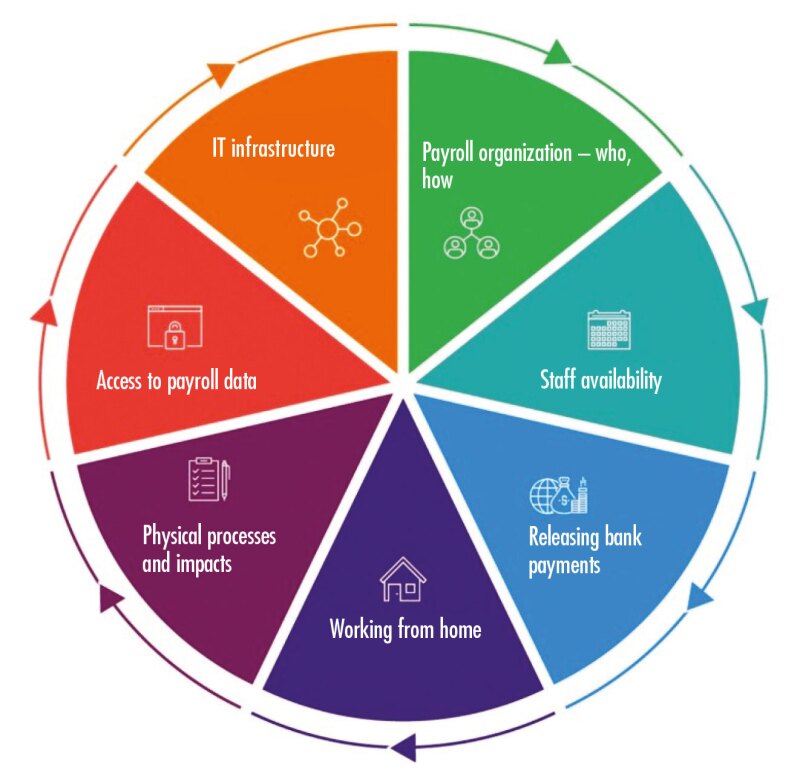

Below, seven areas to consider are outlined for companies to assess payroll risk exposure and business continuity readiness. Ensuring a clear answer for each will help build a stronger, more resilient payroll function.

Payroll business continuity planning

Seven areas to consider when it comes to payroll business continuity planning

Payroll organisation

Who is responsible for performing payroll activities in each location?

What are the key activities and how are they performed?

Are there effective BCPs in place for all locations, either in-house or third-party providers?

Staff availability and capability

What percentage of payroll staff or their direct family members might be affected?

What is the anticipated impact in cases of limited staff availability when considering care responsibilities?

Has overtime been factored into working arrangements?

How can you ensure your payroll staff are adequately qualified, and continuously trained and informed on new regulations and technologies?

Working from home arrangements

Are the key human resources (HR), payroll and finance personnel correctly equipped to work from home, i.e. use of a laptop, internet with adequate bandwidth, remote access to key applications, an additional monitor where necessary, etc.?

Does the home working scenario account for data confidentiality?

Is the work environment suitable?

IT infrastructure

What are the key technical vulnerabilities or weaknesses?

Are HR/payroll source systems (remotely) accessible?

Can all payroll inputs be received on time?

Is the IT infrastructure secure?

Physical processes

What physical processes exist in the payroll value chain (such as physical filings, signings)?

In the case of limited or no physical access, how will impacts be mitigated?

Access to payroll data

Are last month's payment files, pay-slips, pay register and general ledger files readily available?

Is (remote) access guaranteed and secured?

Releasing bank payments

Is (remote) access guaranteed to release bank payments?

What is the process for authorising exceptional payment procedures?

Payroll business continuity is critical

Considering and assessing the seven areas outlined above is only a starting point when it comes to strong payroll BCPs. When employees are what matters the most, ensuring the continuity of global payroll is paramount.

Payroll professionals, often working quietly in the background, are navigating unprecedented times. A strong payroll BCP could be the difference between employees being paid on time, correctly or even at all.

Final thoughts

Overall, we expect that the strategy and delivery of payroll will continue to evolve and shift to accommodate the global advancement and growth that many organisations are experiencing today. A resilient, compliant, global and agile payroll function is needed now more than ever.

Seven areas to assess payroll risk exposure and business continuity readiness

Click here to read the entire 2020 EY-ITR Asia Pacific Guide

Marjukka Maki-Hokkonen Partner T: + 61 2 9248 4397 marjukka.maki-hokkonen@au.ey.com Marjukka Maki-Hokkonen is a partner based in Sydney, who is responsible for global payroll operate services across the Asia-Pacific region. She has more than 20 years of international, multi-industry experience across payroll and human resources (HR) disciplines and has held leadership positions across Europe and Asia-Pacific in large payroll and HR technology and outsourcing firms. She has extensive knowledge in leading outsourcing/business process outsourcing (BPO), software as a service (SaaS)/cloud technology offerings and consulting businesses. Moreover, she is skilled on matters related to human capital management, customer relationship management (CRM) systems and enterprise resource planning (ERP) systems. She has vast industry experience and insights to drive innovation and continuous improvements to payroll operate services. |