In the past few years, steady economic growth and structural reform had boosted transactional activity in China. However, the failure of some high-profile unicorns to achieve their planned initial public offerings (IPOs) in 2019 cooled enterprise valuations. This has subsequently affected the volume and shape of China's M&A activity, which has been compounded further by the impact of the 2020 COVID-19 pandemic and accounting issues at some US-listed Chinese firms.

Emerging M&A trends include a number of overseas-listed Chinese enterprises 'going home' to China by de-listing from foreign capital markets, through so-called 'take private' transactions, and re-listing in China. This has also had a direct impact on several existing 'red chip' structures. Other overseas-listed Chinese enterprises have sought a dual listing in Hong Kong SAR (e.g. alongside existing US listings), facilitated by the recent regulatory changes in the jurisdiction. This is in addition to the general uptick in restructuring of Chinese holding structures by foreign multinational enterprises (MNEs) with Chinese operations and large domestic enterprises.

These transactional trends bring with them complex tax implications, which are explained in further detail below.

The emerging wave of Chinese firms 'going home'

Market drivers of the 'going home' trend

Recent years have seen a surge in the value of digital and sharing/gig economy enterprises, in China, the US, and other countries. Many primary market investors, mainly pre-IPO private equity investors have shown a willingness to invest at high premiums based on optimistic growth outlooks for market leading unicorns. Tensions emerged between these valuations and the more prudent view of secondary market investors, particularly with regard to the huge repeated losses incurred by these companies.

These 'valuation gaps' between the primary and secondary markets led to the failure of some unicorns' IPO attempts in 2019, and the cooling of valuations was compounded by the COVID-19 disruption in 2020. Lacking the expected cash injections from IPOs, some unicorns and their primary market investors have found themselves in a position where they need to restructure their existing operations.

This development has been evident in China and overseas. In addition, Chinese firms have suffered a further hit with accounting issues being identified with some US-listed Chinese firms; notably Luckin Coffee, which had to de-list from the NASDAQ. As of July 2020, there are over 240 Chinese firms listed in the US, with a total market value of more than $1.5 trillion.

With many of these firms expected to face more intense US regulatory scrutiny going forward, this has propelled some to look at relisting in mainland China or Hong Kong SAR. This has particularly been the case for life science businesses and technology, media, telecommunications (TMT) companies, which may be able to access higher valuations and more liquidity from such listings.

Policy drivers of the 'going home' trend

The Chinese stock market has experienced rapid development in recent years, having replaced Japan as the world's second largest in 2014 and has maintained this position in subsequent years. Already an increasingly attractive place to list, the 'going home' trend has been facilitated by recent changes to China's capital market regulations.

In 2019, China introduced a registration-based system to fast-track IPOs on the new science and technology innovation board (STAR). Previously, in order to list on the existing ChiNext and the main Chinese stock exchange boards, pre-approval was needed from the China Securities Regulatory Commission (CSRC). An enterprise typically needs to wait in a queue of hundreds of companies before the CSRC can review its IPO application documents, and typically the average waiting period is around 18 months. STAR listings do not require this, and the new expedited registration process has been officially implemented in ChiNext lately, which may be further extended to the main boards in the near future. The new STAR listing rules also open the door to listing companies that are yet to turn a profit, which is the case for many unicorns in the life sciences and TMT sectors.

Three further regulatory developments have made a major impact.

Firstly, Chinese companies have long arranged their overseas listings in the form of 'red chip' structures. This involves the establishment of a foreign company (e.g. Cayman Islands, British Virgin Islands, Hong Kong SAR, US) as an overseas listing vehicle, into which the Chinese founders inject equity into the Chinese operating companies. In a new development, STAR now allows for these foreign companies to be listed in China.

Secondly, the Chinese Depositary Receipt (CDR) regime has been introduced, allowing Chinese investors to invest through Chinese stock exchanges into certain overseas listed stocks packaged as depositary receipts. Beneficial tax treatment has been clarified for CDRs. These make it possible for Chinese firms to maintain their listings in offshore markets and still tap the capital markets back home in China.

Thirdly, founders of start-ups in the life sciences and TMT sectors frequently wish to put special arrangements in place to maintain control post-listing, such as multi-layer voting structures. The Hong Kong SAR stock exchange regulator, Hong Kong Exchanges and Clearing Market (HKEx) recently amended listing rules to facilitate this. It also made changes to enable dual listings (i.e. listed on both US and Hong Kong SAR stock markets simultaneously) and relaxed financial thresholds of revenue and profit for bio-tech firm listings.

Clearly, these changes facilitate a multitude of different approaches to re-listing/dual-listing in mainland China and Hong Kong SAR. Below, there is a focus on the hottest trends of the moment; de-listing overseas through a 'take private' transaction and re-listing in China, which can involve unwinding a 'red chip' structure.

It should be noted that, alongside tax, many other complex considerations arise including:

The funding of the restructuring;

The dismantling of variable interest entity (VIE) structures (i.e. structures that enabled the original foreign listed company to hold operations in sectors 'restricted' under Chinese foreign investment rules);

Choosing a re-listing capital market and listing vehicle; and

The use of employee stock option plans (ESOPs), among other prevalent issues.

Tax implications of 'taking private'

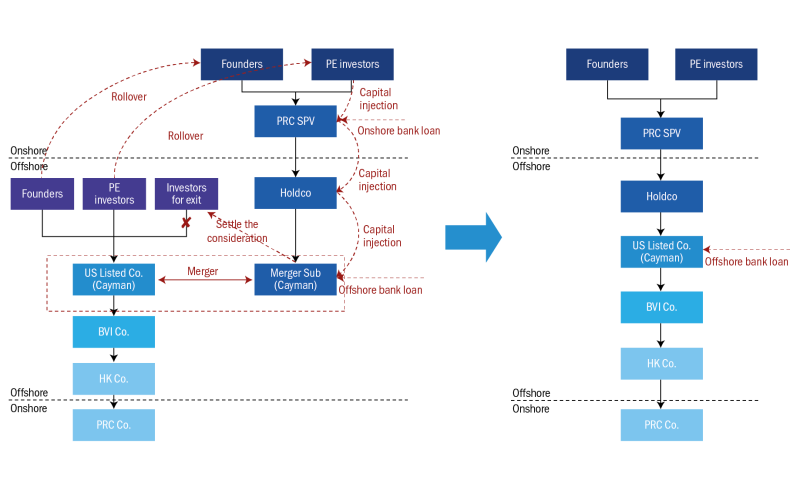

When taking private an overseas (e.g. US) listed group, the first step is typically for the Chinese controlling shareholders, acting through a Chinese entity (PRC SPV) to establish an offshore merger subsidiary (Merger Sub – Cayman) to acquire and subsequently merge with the originally listed entity, which is frequently also a Cayman entity. In the acquisition transaction, the originally listed entity ceases to be listed, with exiting shareholders receiving cash from the merger subsidiary, and the continuing shareholders (shareholders for privatisation) receiving equity in the PRC SPV. Post-acquisition, the merger subsidiary merges into the originally listed entity, with the latter as surviving entity.

In the post-merger structure, borrowings used to finance cashing out the exiting shareholders leaves debt at the level of the originally listed entity (i.e. a debt pushdown). This can be seen in Figure 1

Figure 1: ‘Taking private’ and post-merger structure

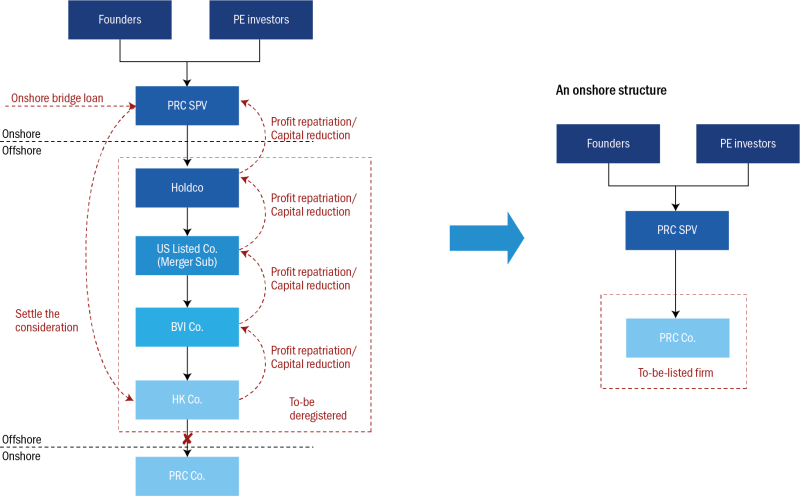

Figure 2: Using a bridge loan to fund the unwind of red chip structure

The merger results in a legal ownership change of the originally listed company (from original investors to HoldCo) and this is considered as an 'indirect offshore transfer' of the underlying Chinese entity, (PRC Co).

State Taxation Administration (STA) Announcement [2015] No.7 (Announcement 7) can potentially invoke the Chinese corporate income tax (CIT) law's general anti-avoidance rule (GAAR) to deem this as a direct transfer of PRC Co., and apply Chinese CIT on any gain arising at 10%.

There is, however, a safe harbour in Announcement 7 that excludes transactions in shares on public markets. While, technically speaking, the safe harbour can only be invoked by a disposer if they both buy and sell through the public market (which will not be the case for primary investors who built their positions pre-listing), the prevailing market practice is that no Chinese tax will be levied for such cases. This being said, caution should be exercised by primary investors because the Chinese tax authorities may revisit such cases, and could challenge arrangements that appear to 'lack reasonable business purposes', which is the threshold for taxation under the GAAR and Announcement 7.

Unwinding the red chip structure will involve PRC SPV acquiring PRC Co to eliminate the intermediate offshore entities from the structure. PRC Co will be subsequently listed in China. A key trade off arises in relation to the consideration paid for this step. A transfer for a nominal sum will diminish the base cost of investor equity in PRC Co (held through PRC SPV) for later disposal. This can heighten CIT and VAT exposures. However, setting a higher transfer price will lead to tax exposures at the time of transfer (i.e. tax exposure for HK Co on transferring PRC Co), and a need to use a bridge loan to fund the acquisition.

Re-listing a red chip structure on STAR

While a STAR re-listing for a red chip structure may intuitively appear to be a simpler alternative, a number of legal, administrative and foreign exchange hurdles arise. There are potential constraints on existing shareholders to sell stocks, such as the prolonged application timeline compared to an onshore structure listing, complicated foreign exchange administration procedures, potential obstacles for ESOP arrangements, etc. So far, only one firm (i.e. CR MICRO, ticker: 688396) has successfully listed on the STAR market with a red chip structure, and this is indirectly state-owned.

Due to a lack of precedent cases and ambiguity in existing tax regulations, a number of China CIT issues arise, notably in relation to permanent establishment (PE) risks and corporate tax residence rules. The actions of China-based staff within the group could, if not carefully managed, lead to the overseas entities having China PE tax exposures, with CIT applying at 25%. If the overseas entities are considered to have their effective place of management in China then they may be subject to CIT on their worldwide income as Chinese tax residents.

There are benefits though, as dividend income from Chinese subsidiaries would be exempt. Ultimately, which outcome is better would require case-by-case analysis. If tax residence is considered suboptimal, then a complete pre-listing assessment will need to evaluate various risk factors for tax residence including:

Place of daily operations, management and decision-making procedures;

Activities and residence of voting directors and senior management; and

Storage of core assets, accounting books, company stamps and shareholder, board meeting minutes, as well as other factors.

With regards to the taxation of overseas investors in a STAR re-listed red chip structure, there is a lack of clarity on how dividend income and capital gains would be treated. The common perception among tax practitioners is that both types of income would be subject to Chinese withholding tax (WHT) at 10% and that VAT would apply (i.e. that the STAR listed Cayman Top Co would be treated as a Chinese tax resident).

If the STAR List Co were to be considered a non-Chinese tax resident, Chinese investors in the List Co could be double taxed on dividend income. This is because Chinese WHT would apply on the flow of dividends from China operating companies to the Cayman List Co, and the Chinese investors would be subject to tax on receipt of the dividend from the Cayman List Co, without any tax credit being available.

Increasing restructuring activities in China

Another notable trend in the M&A market is the increase in restructuring activities among domestic companies and MNEs operating in China.

In December 2019, the CSRC officially released 'Several provisions on pilot domestic listing of subsidiaries of the spin-offs of listed companies', which opens the door for Chinese listed companies to spin-off subsidiaries for a separate listing in onshore capital markets. The benefits include:

Increasing the financing capability of subsidiaries to support business operations and long-term profitability;

Enabling separate pricing of the subsidiaries, allowing recognition of market premium on the assets of the listed companies and further elevate their overall stock price; and

Using shares in subsidiaries to provide incentives to management and key employees.

Considering these advantages, many A-share listed companies have expressed interest in spin-offs.

|

|

In the second quarter of 2020, global M&A amounted to $485.3 billion, having fallen 55% from a year ago. This marked the lowest total since the third quarter of 2009, while the number of deals completed were the lowest quarterly total since 2004. |

|

|

In parallel, restructuring of global value chains, including a trend by MNEs to diversify their production locations, and possibly move some manufacturing back to their home countries, is driving an uptick in China restructuring transactions by MNEs. At the same time, China's huge consumer market and highly-efficient manufacturing ecosystem means that many new investments are being 'made in China, for China', i.e. specifically to cater to domestic customer needs.

These commercial trends are paralleled by international tax law developments, such as BEPS 1.0 transfer pricing rule changes, the economic substance requirements in offshore jurisdictions, and common reporting standard (CRS) compliance requirements, which are prompting adjustments to MNE global structures, including re-balancing risks and function allocations among entities in China and the rest of the world. Further changes are anticipated in the future once the BEPS 2.0 rules are agreed and put into effect.

Tax implications of domestic and cross-border restructurings

For pure domestic restructurings, such as the spin-off of local subsidiaries by A-share listed domestic companies, CIT relief is potentially available under Caishui [2009] No. 59 (Circular 59), the principal tax regulation on restructuring relief. This takes the form of a CIT deferral, referred to as a 'special tax treatment'. As with restructuring rules in other countries, this contains tests of 'continuity of business' and 'continuity of ownership'. The Chinese rules in this space are quite restrictive, with:

A subjective test of the arrangement's reasonable business purposes;

A 12-month lock-up period for which new equity holdings, created during the restructuring, need to be held; and

Requirements (i.e. thresholds) on the percentage of an entity's assets/equity that need to be transferred, and the percentage of the consideration that needs to be in the form of equity.

For cross-border restructurings, i.e. for the foreign MNEs reorganising their Chinese operations, there are more stringent conditions to be satisfied. In particular, the lock-up period is extended from 12 months to 36 months. A particular frustration is that only share/asset transfers from offshore parent to offshore/onshore subsidiary can enjoy the special tax treatment. This is not allowed for subsidiary transfers to parents.

In addition, local interpretations of the rules in practice vary considerably across China. For instance, some local tax authorities interpret the 12-month lock-up period in the strictest sense. They demand that the shareholding structure of all involved parties shall remain unchanged for 12 months following the restructuring. This is while the plain wording of the national guidance is that solely the share consideration received by the transferor from the transferee is subject to the lock-up period. Another typical example of differing local practice is that some local tax authorities only permit vertical mergers to benefit from special tax treatment but reject application to horizontal mergers. By contrast, some other tax authorities permit the inverse.

Restructurings may also trigger VAT, land appreciation tax, deed tax and stamp duty obligations. There are restructuring exemption rules for each, but with different conditions and application in different restructuring scenarios (i.e. VAT relief might be available in a case where no CIT relief is available, and vice versa). Hence, a holistic approach is needed.

Amendments to Chinese M&A tax regulation are on the way

It is worth noting that the most significant restructuring tax rules in China, i.e., Circular 59 and Announcement 7, have already been in force for more than 10 years and five years, respectively. The huge increase in the volume of M&A and the emergence of new restructuring needs is recognised by policymakers and it is understood that the STA is proactively collecting comments and suggestions on a forthcoming revision to Circular 59.

It is anticipated that equity/asset transfer thresholds for tax relief could be loosened, particularly for cross-border intra-group restructurings, which might get closer to the more flexible conditions under Announcement 7. Looking ahead, it is to be hoped that the manner of enforcement of M&A tax rules will be such as to relieve taxpayers from severe tax burdens on restructurings, and encourage more M&A activity in China.

Click here to see the entire M&A guide from ITR

John Gu |

|

|---|---|

|

Partner KPMG China T: +86 10 8508 7095 John Gu is an M&A tax partner in the Beijing office, who advises on tax and regulatory issues for a wide range of M&A transactions in China. He also advises on private equity fund formation and structuring (in both Renminbi (RMB) funds and offshore funds), as well as on the structuring of real estate, infrastructure, structured finance, foreign investments and joint ventures in China. John has extensive experience leading a large number of tax structuring and due diligence projects involving direct and indirect foreign acquisitions of Chinese target companies in various sectors. This includes retail and distribution, advertising, e-commerce, real estate, infrastructure, mining, manufacturing, and financial services. |

Michael Wong |

|

|---|---|

|

Partner KPMG China T: +86 10 8508 7085 Michael Wong is an M&A tax partner in the Beijing office, who is also the national leader of the deal advisory and M&A tax teams in KPMG China. This encompasses the national outbound tax practice serving state and privately-owned Chinese companies in relation to their outbound investments. Michael has extensive experience leading global teams advising on large-scale overseas M&A transactions in the energy and power, mining, financial services, manufacturing, infrastructure and real estate sectors. |

Milano Fang |

|

|---|---|

|

Partner KPMG China T: +86 10 8508 7761 Milano Fang is an M&A tax partner in the Beijing office, who has more than 16 years of professional tax experience in providing China tax and regulatory consulting services to multinational companies and domestic enterprises, both private and state-owned. His main areas of expertise include private equity investment, and industrial, fast-moving consumer goods (FMCG), and logistics clients. Milano has led various high-profile and large-scale tax due diligence projects, and has in-depth knowledge and extensive experience in tax planning and M&A transaction structuring. In connection with this he leads the offshore indirect equity transfer team (i.e. Announcement 7) within KPMG China. |