The impact of the COVID-19 pandemic has been felt throughout the world. National governments imposed shutdowns of the economy to contain the spread of the virus, and such moves subsequently led to a large-scale breakdown of supply chains across many sectors. Companies worldwide are facing disruptions to operations and business models, while TP policies have been put under stress as a result of the economic downturn.

In South America, most governments have provided guarantees to the private sector to moderate the storm, but this may increase public debt to unjustifiable levels. The COVID-19 pandemic will have a serious impact for a multinational group's transfer prices, analysis and documentation. The OECD has warned that COVID-19 is the greatest risk to the world economy since the 2008 financial crisis.

It is expected that the pandemic will adversely affect the operating income of multinational enterprises (MNEs), and will probably impose a considerable burden on the cash flow of an MNE. Under this scenario, TP models may need to be adjusted to come in line with any commercially driven changes made to the global supply chain. In 2020 and the following years, tax governments may take enterprising actions to improve their fiscal position and this turn could potentially lead to tax environments becoming more aggressive.

How are companies in South America reacting to this and how do you evaluate, defend or align your model with this COVID-19 environment in a sustainable manner? What should you do to prepare? A look at some of the most significant developments in the region should provide some valuable insights.

Argentina

On May 14 2020, the Argentine tax authorities (AFIP) published General Resolution No. 4717 (GR 4717) which culminated the process of reforming the TP regime. Earlier, changes had been started through the publication of Law No. 27,430 and Regulatory Decree No. 1,170/2018, among other regulations.

GR 4717 introduced a number of TP requirements, which will impact both the planning and implementation of operations by Argentine companies with related companies abroad. It has established the formal requirements of the obligations for the fiscal years closed as of December 2018, which includes the TP tax form F. 2668, the TP study/local file in the F. 4501, and the master file.

This new resolution requires immediate attention, not only due to the scope but also due to the short time allowed for the submission. This urgency is further escalated when considering the operational limitations generated by the social, preventive and compulsory isolation in force in Argentina as a result of the COVID-19 pandemic.

Special filing deadlines

The deadlines, which include the presentation of the TP tax form F. 2668, the TP study and the master file, have the following special scheme:

Fiscal year end |

Filing deadline |

December 2018 to May 2019 |

June 10-14 2020 |

June 2019 to November 2019 |

August 10-14 2020 |

December 2019 to April 2020 |

October 10-14 2020 |

On July 13 2020, the Argentine tax authorities published General Resolution 4759/2020 which amended General Resolution No. 4717.

The affidavit form F. 2668 and the transfer pricing study, corresponding to the fiscal periods closed between December 31 2018 and April 30 2020, both dates inclusive, must be submitted, with exception, by the taxpayers on the dates indicated below:

From December 2018 to November 2019 (August, 3-7, 2020)

From December 2019 to April 2020 (October 2020)

Key modifications to the TP regulations

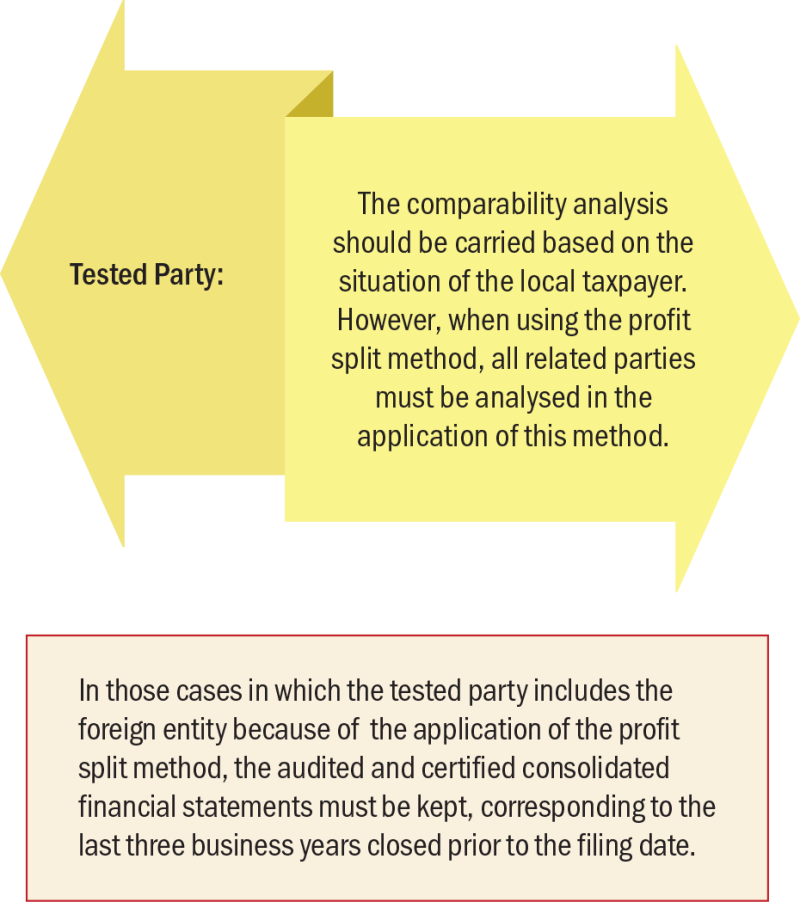

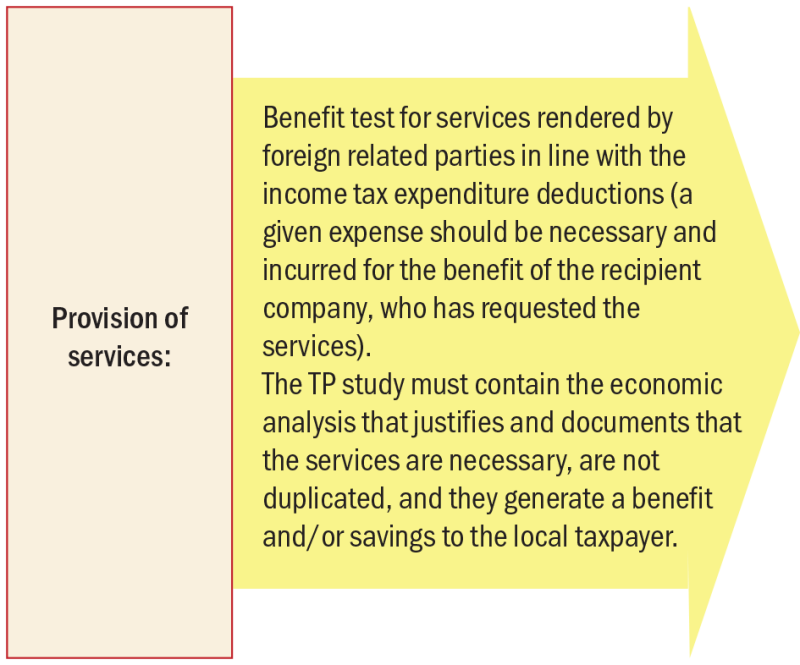

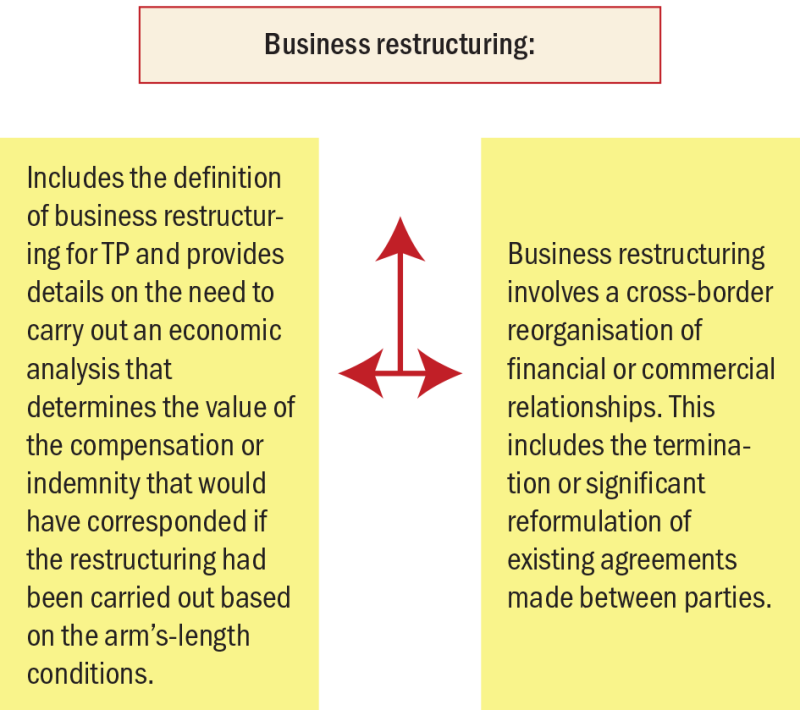

In relation to transactions ruled by the TP regime, GR 4717 specifies the information that the TP study and the master file must include. In this regard, it contains specific regulations mainly referring to the following aspects.

According to GR 4717, when using segmented financial information, the TP study must indicate the segmentation criteria, procedure and the way of calculating the margins. This includes the detail of the accounts used or rejected and, where appropriate, the coefficients or percentages used in the attribution of factors, income and segment operating expenses under analysis.

The resolution states that when using the transactional net margin method (TNMM) of the transaction, in relation to capital-intensive activities, the return on assets profit indicator must be calculated by computing the operating assets. That is to say, the total assets, is to be subtracted by the sum of current investments, non-current investments, intangible assets and other assets.

GR 4717 contains requirements for the presentation of detailed information on cross-border financial operations. Failure to comply with the presentation implies that the rate associated with the credit rating of the multinational group will be considered as the reference value to establish the market price. The resolution also calls for details on economic and financial capacities, issues related to credit ratings and explicit and implicit guarantees, information on participation in cash pooling, and the analysis of transactions with hedging derivatives.

In respect to intangible assets, details of marketing, advertising and sales promotion made by the local taxpayer, should be taken into account if the level of expenses corresponds to those carried out by independent entities.

For research, development or similar activities, the market value of the contribution to the development or improvement of intangible assets should be estimated from a functional analysis that allows identifying and evaluating the risks involved, and the magnitude and degree of importance of the activities, carried out by the local taxpayer. In the event that they exceed those that would have made third independent parties, those expenditures may be considered when they constitute a contribution to the value chain of the intangible asset.

GR 4717 also lists information regarding transactions with foreign intermediaries, including: details of the intermediary; the requirement to carry out a functional analysis of the intermediary; the need to document the reasonableness of the remuneration obtained by the intermediary; and detailed information to obtain and keep regarding the intermediary.

Additionally, if the taxpayer exports commodities to related parties, it should be assessed if its main activity does not consist either of realising passive income or carrying out trading transactions within or outside Argentina with members of the related economic group.

TP study and F. 2,668 |

Master file |

The TP report must be certified by an independent professional accountant or graduate in economics, with a signature authenticated by the Professional Council of Economic Sciences, college or entity that exercises control of their enrolment. The resolution establishes that the report must contain, among other data, the mathematical calculations and formulas that justify the prices or margins obtained and must be accompanied by the documentation that supports the calculations. F. 2,668 must be submitted, for imports and exports of goods between independent entities and for operations governed by TP regulations according to materiality thresholds. |

GR 4717 establishes the obligation to submit the master file, with certain thresholds for its application, and it must be signed by the legal representative of the taxpayer or responsible person. Annex II of the GR details the content to be included in the master file (structure and organisation, activities, intangible assets, financial activities between group entities, group financial and fiscal situation). This document must be presented in Spanish. When it is written in another language, it must be attached with a translation made by a certified translator. |

Other considerations

GR 4717 clarifies that the operations without remuneration must be analysed. It calls for detailed information regarding multinational groups, including information about the partners of each of the companies that comprise it, their participation and identification of who has served as president in the last three years.

It also establishes that exports of products, that own or adopt public prices, can be adjusted only when they are duly documented and justified. In light of this, in the export of hydrocarbons, the value of a product may be used as the basis for setting the price-denominated marker, as long as its quotation constitutes the basic value in the price formulas of the exports between independent subjects under comparable conditions. Likewise, adjustments to account for differences in quality of products (i.e. premiums or discounts) are only allowed if they reflect market conditions.

Finally, it is important to note that GR 4717 requires immediate consideration by businesses, not only due to the scope of its regulations but also due to the time allotted to fulfil requirements.

Chile

The Chilean authorities are constantly striving to improve the efficiency of tax collection. Alongside guidance given by the OECD and other multilateral institutions, recent demand has been fuelled by opinions delivered during the COVID-19 outbreak. The once relatively stable Chilean taxation system increasingly appears to suffer modifications, a trend which is often seen across the South America region.

The local tax authority is aware of the demands and it is actively encouraging taxpayers to discuss proposals in a friendly and professional fashion.

The Chilean authorities recently entered into the country's first-ever APA with a taxpayer. Interestingly, this APA involved both Chile's Internal Revenue Service (CIRS) and the National Customs Service (NCS) as parties to the agreement.

The signing of the APA marks a milestone that may be of interest, not only to national tax and customs authorities, but also to taxpayers who seek to increase their tax certainty and avoid potential TP audits and litigation. APAs constitute an opportunity for tax administrations and taxpayers to consult and cooperate to reach an agreement and even could be the first step towards obtaining consensus between the CIRS and other tax authorities in topics that generate double taxation for taxpayers.

The innovation of two authorities involved: CIRS and NCS

In cases where the agreement comprises transactions of imported goods, an important characteristic of the process in Chile is the involvement of two authorities, the tax and customs authorities.

For the effective coordination of the CIRS and NCS in these types of APAs, the authorities have issued a joint resolution. The said joint resolution establishes coordination instances between both institutions to evaluate taxpayer applications and jointly determine their acceptance or rejection, as both are affected in the APA process, either through customs duties (NCS), and VAT (CIRS) on imports, or on profitability and its effects on the income of companies that resell the said products (CIRS).

This internal consultation process between the NCS and CIRS includes a preliminary report and a joint technical meeting. In the event of reaching an agreement with both entities, an 'agreement act' is signed by the taxpayer and the commissioner of each authority.

The advantages of a pre-filing stage

Although not formally established, a good practice applied by the CIRS is to give to the taxpayer the possibility to have a pre-filing stage, before having to prepare all the information for the formal application of this APA. At this stage, the taxpayer is expected to express informally its intention to file an APA to the tax authority, in order to obtain feedback on its viability and provide an overview on the business model of the relevant taxpayer.

This stage may include the preparation of two or three presentations to be shown in meetings with the CIRS and NCS. The presentation should address aspects such as overall business description (group, company, history, etc.), motivation for signing an APA, proposed transactions to be included in the APA, proposed TP methodology and resolution of questions from the authorities generated in this process.

By having the opportunity of accessing this pre-filing stage, the taxpayer can understand if there is a real possibility for an APA for its business case before having to prepare all the supporting documentation for the formal submission. This documentation involves a lot more hours of preparation as it usually comprises a purpose made TP report, agreements, group´s ownership structure, financial statements, description and proper justification of assumptions on future economic conditions. It also should feature a description of the group's TP policy, identification of intellectual property (IP) rights and owners, information of other signed APAs, among other requested information.

In conclusion, with an active Chilean tax authority, the possibility to obtain an APA has become more attractive. This will make the advantages of such agreements more evident. There will be greater certainty on the pricing of multiple or complex transactions; a reduction of the probability of double taxation; the strengthening of a company's reputation regarding tax compliance; avoidance of long and expensive inspections and litigation process; and improvement in business planning by promoting an investment environment, among others.

Uruguay

During 2019, the first court case in Uruguay concerning a TP controversy reached its conclusion. The dispute involved the sale of a business between a Uruguayan corporation and a branch of a related foreign company and its corresponding valuation for tax purposes.

The Uruguayan Tax Court (TCA) ruled in favour of the tax authority after considering that the transaction between the corporation and the branch, both entities subject to Uruguayan corporate income tax, fell within the scope of TP rules. The decision was made in relation to the non-resident nature of the branch.

However, the TCA rejected the tax adjustment performed by the administration after considering that it failed to substantiate certain values which were used in order to determine the amount of the adjustment. This included factors such as the number of multiples under the market approach valuation method.

In terms of regulations, there has been little development during the past year. Master file requirements are still yet to be fully implemented, despite an approved law, as there are no guidelines or resolutions from the tax authorities on how to implement it. On the other hand, country-by-country reporting (CbCR) requirements are fully in place, with recurrent and timely filings of CbCR notifications and reports. In this respect, it is relevant to mention the case of local subsidiaries of US-based large multinational groups, which have been filing CbCR reports in Uruguay. They are subject to filing requirements due to the absence of CbCR exchange between the tax authorities of both countries.

Action to be taken

Unquestionably, the COVID-19 pandemic will affect transfer prices, analysis and documentation. Similar economic chaos was experienced by MNEs during the 2008 financial crisis. However, the TP landscape during that period was significantly different. Precisely, the BEPS Action Plans are in force, and the level of TP scrutiny is generally high across the South America region.

Companies with important operations in the region should consider the broader implications of their business decisions and potentially take the following actions:

Assess their 2020 tax planning based on the impact that such disruption could have on business models;

Re-examine their financing structure; and

Evaluate and document the impact on transfer prices due to adjustments made to supply chains during the crisis.

Based on the above, and from an economic perspective, companies should also look to amend inter-company transactions in line with actual conduct of the parties involved, and from a legal point of view, to review and amend the pricing in inter-company agreements. In fact, most companies may fail to comply with their contractual obligations because of the interruptions in business operations.

Considering these implications upfront, and gathering all the evidence to prepare documentation in order to mitigate the change in economic circumstances, will be crucial.

Click here for the entire Latin America guide from ITR

Silvana Blanco |

|

|---|---|

|

Partner Deloitte Argentina T: +54 11 4320 4046 Silvana Blanco is a partner based in Argentina, who works in the TP team. From the beginning of the application of TP standards in the country, she has participated actively with the tax administration officers. Silvana has more than 21 years of experience in the application of tax, economic and financial criteria in TP, valuation analysis of intangibles, planning, business model optimisation, structuring and economic consulting. She has a large experience in fields such as the coordination of multi-country TP assignments for multinational groups, the optimisation of tax burden, and information requests posed by tax authorities in key industries such as the automotive industry, the oil seeds industry and the pharmaceutical industry. Silvana graduated as a certified public accountant from Salvador University and holds a master's degree in strategic business administration and marketing from the Universidad de Ciencias Empresariales y Sociales (UCES). She is a member of the International Fiscal Association (IFA) and part of the TP Commission. |

Rocío Crespillo |

|

|---|---|

|

Partner Deloitte Chile T: +56 227 298 041 Rocío Crespillo is a partner based in Chile, who leads the national TP practice. She has more than 12 years of experience in TP matters, having held roles in Spain, Argentina and Chile. Rocío has experience in numerous planning and restructuring projects that have required complex economic and financial analyses and entailed significant interaction between the TP and other tax practices. She has also participated in several TP audit and controversy processes in different countries. Rocío graduated from economics from Universidad Argentina de la Empresa (UADE), Buenos Aires Argentina. She has completed further courses at the Financial Studies Center CEF in Barcelona, and a diploma in taxation from the Universidad de Chile, Santiago. |

Alejandra Barrancos |

|

|---|---|

|

Senior manager Deloitte Uruguay T: +598 2916 0756 Alejandra Barrancos is a senior manager based in Uruguay, working in the TP practice. She has worked in different areas of Deloitte's tax department since 1997 and spent a few months at Deloitte Argentina TP practice. Alejandra has accumulated significant experience in various advisory services to foreign companies, such as tax compliance, local and international tax planning, M&A and TP. Her experience in TP projects includes planning projects, documentation projects, either locally prepared or as part of a global documentation project, and tax and TP controversy. Alejandra has participated as a speaker in seminars and conferences at Deloitte and Jornadas Tributarias, among others. She is a professor of international tax for the post-graduate degree course in taxation in the Catholic University of Uruguay and a former assistant professor of taxes in Universidad ORT Uruguay. She is also a former assistant professor of tax legislation at the Faculty of Economics and Administration at the Universidad de la República. |