As part of the OECD's BEPS initiative, captive insurance arrangements have come under the microscope of tax authorities globally in the transfer pricing (TP) and wider international tax arena. The revised OECD Guidelines issued in July 2017 included an example on captives, and in July 2018, the OECD issued a public discussion draft with respect to financial transactions, which also included a section on captives.

In February 2020, a final version of the paper, 'Transfer Pricing Guidance on Financial Transactions' was released, which continues to include material on captives and will form a section of the OECD Guidelines. In parallel, there has been an increasing number of tax audits of captives and resulting court cases, and captives have generated heightened interest from tax authorities from a TP perspective.

Given the developments, taxpayers should look to understand the TP landscape for captives, and consider how shifting perspectives might apply to their circumstances. This article focuses on the February 2020 OECD material on captives and recent US case law on abusive micro-captives.

Captive insurance companies

First, what is a captive? A captive insurance company is an insurance company that is created and wholly owned by a non-insurance group to underwrite risks for the operating subsidiaries and/or the parent company itself. In general, captive insurers:

Put their own capital at risk;

Work outside the traditional commercial insurance market, instead forming part of the alternative risk transfer (ART) market; and

Remain subject to regulatory, actuarial, accounting and capital requirements.

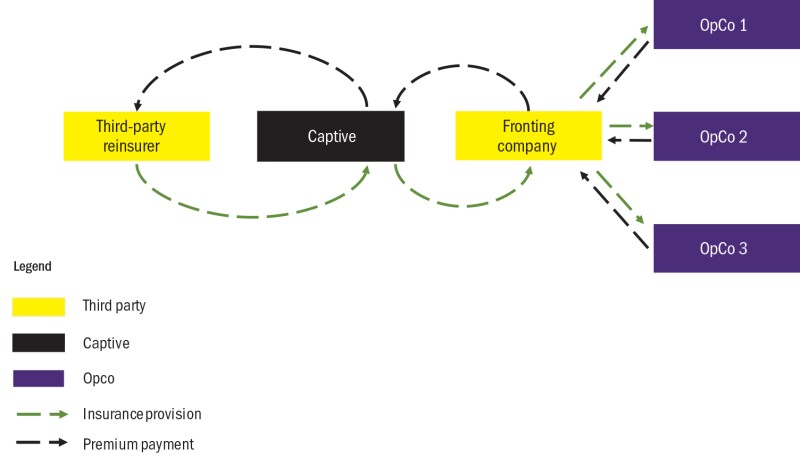

Figure 1 sets out one type of captive structure and the flow of transactions for a captive.

Most operating companies (OpCo) enter into an insurance transaction with a fronting company for regulatory reasons. In turn, the fronting company places the risk with a captive. For TP purposes, even though a third-party entity is involved in the chain, tax authorities could view the actual controlled transaction as between the OpCo and the captive.

Meanwhile, the captive retains a proportion of the risk and in some cases may seek external reinsurance with a third/unrelated party for certain layers.

Figure 1: Example of a captive structure

Commercial benefits

Captives can provide a number of advantageous benefits to multinational groups. Firstly, they can provide coverage for risks that may be difficult or impossible to obtain in the open market due to the low frequency and high severity nature of the risk (e.g. oil spills, contingency business interruption, product liability risk, etc.). They can reduce volatility in the profits at the OpCo level by ring fencing assets to pay claims as they arise rather than the OpCo bearing the full economic effect of covered losses.

Furthermore, they can stabilise premiums paid by group members within the multinational group, and they can help the group gain access to third-party reinsurance markets, where the captive can reinsure certain risks to third-party reinsurers.

OECD guidance

Section F of the OECD's guidance covers background on captives, the commercial rationale for captive insurance/reinsurance arrangements, accurate delineation of the transaction, and pricing methods and issues. This article will also focus on the last two criteria as these will likely be of most interest to taxpayers.

Accurate delineation of a transaction: A genuine insurance transaction?

A significant emphasis of the guidance is on accurate delineation of the transaction. According to the guidance, in order for the transaction to be delineated as a genuine transaction of insurance, such that it can be respected and priced as such for TP purposes, the following criteria must be met:

There is diversification and pooling of risk in the captive insurer;

The economic capital position of the group has improved as a result of diversification and, thus, there is a real economic impact for the group;

Both the insurer and any reinsurer are regulated entities with broadly similar regulatory regimes and regulators that require evidence of risk transfer and appropriate capital levels;

The insured risk would otherwise be insurable outside the group;

The captive has the requisite skills, including investment skills, and experience at its disposal; and

The captive has a real possibility of suffering losses.

While the majority of captives should meet many of these criteria, two in particular stand out as being at odds with some captive arrangements.

The first challenge concerns diversification. The guidance stresses that this is important because this is how third-party insurance companies are able to be profitable. This relates to the seminal insurance industry concept of the contributions of the many (premiums) covering the losses of the few and the operation of the 'law of large numbers' to fairly accurately model expected losses. Third party insurance companies can quite easily achieve this through lines of business (e.g. property versus liability) and geographic diversification. Even monoline insurers such as motor insurers will achieve diversification through factors such as geography and types of drivers and vehicles. However, for a captive insuring risks emanating only from one multinational enterprise (MNE), this can be more difficult unless the MNE is a conglomerate.

The second challenge is whether the insured risk would otherwise be insurable outside the group. Captive insurance companies exist in some instances precisely to insure risks that for all practical and commercial purposes are not insurable externally, whether for cost, or on account of the challenges and administrative hurdles (e.g. extensive documentation required) associated with insuring unique or special risks with third parties.

It may nevertheless be commercially rational and in the best interests of the insured to purchase captive insurance coverage for risks that are not insurable externally, which is acknowledged by the OECD in paragraph 10.194 of the new guidance. Therefore, this criterion is at odds with paragraph 1.122 of the OECD Guidelines on non-recognition, which states: "Importantly, the mere fact that the transaction may not be seen between independent parties does not mean that it should not be recognised" and that only transactions which are not commercially rational should be disregarded.

The final OECD recommendations also briefly touch on substance requirements, which fall under accurate delineation of insurance. In essence, the concepts of 'control over risk' and 'financial capacity' in order to perform a proper risk allocation based on actual conduct rather than on contractual relationships should fully apply to captives. In particular, in situations in which part of the underwriting function is outsourced to a third-party service provider, special consideration should be given to the retention of control functions, which in this context would refer to oversight or management of the outsourced underwriting function. In this respect, the competency (educational background and professional experience) of the employed staff of the captive as well as the level of information available to it, should be considered when evidencing exercise of such control activities.

It remains to be seen how tax authorities will interpret and apply the rules in practice; that is, whether they treat each of the six criteria listed above as absolutely required to delineate the transaction as one of insurance, or whether achieving a majority of the six criteria is sufficient to qualify as bona fide insurance. Regardless, taxpayers should prepare and maintain TP documentation evidencing each of the six criteria above to the extent this is possible, based on the facts and circumstances of the captive in question.

Finally, despite all the updated guidance provided in Chapter X of the OECD TP Guidelines regarding the TP treatment of captives, tax authorities around the globe still focus on tax audits on more traditional issues like the effective place of management of the captive or permanent establishment (PE) risks resulting from remote decision-making.

OECD TP approaches

The guidance also sets out which of the TP methods may be appropriate to use for captive insurance transactions. This includes the comparable uncontrolled price method (CUP), as well as the transactional net margin method (TNMM), where the profit level indicators (PLI) are combined ratio and return on capital, benchmarked by reference to third-party insurance/reinsurance companies.

However, the quality of these types of comparables vis-à-vis captive insurance may be in question, given the likely higher level of diversification in third-party carriers compared to a captive, in line with the point above on diversification. Furthermore, independent insurers/reinsurers have an incentive to hold additional capital (the denominator in the return on capital calculation) over and above regulatory requirements given that additional capital can provide a third-party insurer/reinsurer with a rating benefit from third-party rating agencies such as AM Best. Captives generally have no such incentive to hold additional capital.

The guidance also covers the concept of 'group synergies', where the captive is used as a pooling vehicle to access the reinsurance market. For example, this could be through achieving economies of scale or by negotiating a bulk discount on premiums with a third-party reinsurer, such that the reinsurer accepts a lower premium as a result of a larger, more diversified pool of risks in a captive. In this instance, the guidance stresses that any such benefit should be passed on to the insured OpCos in the form of discounted premiums, and not retained in the captive.

However, this does not consider that the captive should still be due some remuneration for whatever activities it performs in line with basic TP purposes, based on the functional analysis. For example, do personnel in the captive negotiate the discounted premiums with the third-party reinsurers, such that this is an activity that should be compensated for, even if only on a cost plus basis?

Given the challenges inherent to the above approaches, captive owners may wish to consider performing an independent actuarial analysis of premiums paid to the captive. This involves assessing the reasonableness of key assumptions and parameters (e.g. claims history and expense loadings) to determine whether these assumptions and parameters are in line with the methodologies (e.g. 'severity' and 'frequency' loss curves) used to price insurance premiums in the third-party market. This is technically an application of an 'other' TP method under the OECD Guidelines.

Questions from an OECD perspective

In closing, for MNEs with captives, bearing the OECD Guidelines in mind, the following should be considered, evidenced, and documented:

Is the transaction in question one of insurance?

What is the commercial rationale for the controlled transaction?

Does the captive have the functional capability to manage the risks ceded to it, e.g. does it employ staff with relevant actuarial and underwriting experience?

Does the captive have the capital to assume the risks ceded to it?

Would the controlled transaction have been agreed to between unrelated parties under comparable economic circumstances?

Is the premium priced on an arm's-length basis and how is this supported?

Is there supporting documentation in place with regard to the negotiation process and TP position?

US perspective

The application of US captive tax principles may provide context for captive developments in the OECD and provide live examples for how a tax authority is engaging with captive insurance arrangements.

Specifically, captive insurance arrangements have been subject to particular scrutiny by the Internal Revenue Service (IRS). In recent years, taxpayers have fared poorly in a number of recent captive tax court cases. Given this backdrop, a US update is provided below.

LB&I's captive services provider campaign

In April 2019, the IRS large business and international (LB&I) division announced a compliance campaign focused on the pricing of inter-company arrangements with captive service providers, including insurance coverage issued by foreign captive insurance companies. The release largely indicates that US TP regulations under Section 482 of the US Internal Revenue Code (IRC) and the OECD TP Guidelines provide guidance for ensuring arm's-length pricing of services between affiliates, whereby:

"[The] arm's-length price [should be] determined by taking into consideration data available on companies performing functions, employing assets, and assuming risks that are comparable to those of the captive subsidiary."

The stated goal of the compliance campaign is to ensure that US multinational companies pay their foreign captive service providers (including captive insurance companies) no more than arm's-length prices in order to prevent erosion of the US tax base.

The campaign is envisaged to utilise issue-based examinations and so-called 'soft letters' to enhance compliance with the arm's-length standard. Furthermore, in February 2020, the IRS announced it has established 12 teams to audit what it has deemed to be 'abusive' micro-captives, i.e. captives that take in no more than $2.2 million of annual premiums and have elected under IRC Section 831(b) to be taxed only on investment income (but not underwriting income).

US case law update

Recently, the IRS challenged a number of captive insurance arrangements in court with favourable outcomes for the IRS. The most recent US tax court opinion was issued in April 2019, in the case of Syzygy Insurance Co Inc v Commissioner, 117 T.C.M. 1165 (April 10 2019). Here, the US Tax Court held that the coverage provided to S-corporation affiliates through a fronting arrangement by Syzygy, a captive company domiciled in Delaware, did not constitute insurance for federal income tax purposes.

The court's analysis considered all relevant facts and circumstances and focused on the four common law criteria that must be met for an arrangement to constitute 'insurance':

1) Insurable risk;

2) Risk transfer/risk shifting from the insured to the insurance company;

3) Risk distribution among the insureds; and

4) Commonly accepted notions of insurance.

It is worth flagging that these four criteria overlap with the OECD's requirements for a transaction to be accurately delineated as one of genuine insurance.

The court held that Syzygy did not qualify as an insurance company, making it ineligible to make a Section 831(b) election to exclude its underwriting income from taxable income. The court's analysis specifically touched on the last two criteria: (i) risk distribution among insureds, and (ii) insurance in the 'commonly accepted' sense. These are detailed below.

Distribution of risk

The court noted that the fronting arrangement was not actuarially validated and lacked terms and rates that an arm's-length buyer would require. As such, the tax court found that the fronting arrangement did not constitute bona fide insurance. In light of this finding, the court held that the arrangement did not achieve risk distribution under the common law test.

Insurance in its commonly accepted sense

In analysing whether the arrangement was insurance in its commonly accepted sense, the court identified a number of unfavourable facts pertaining to this common law criterion. This included:

No claims being made although multiple claims could have been made;

Syzygy had no established claims management process;

More than 50% of the asset value in the captive consisted of split dollar interests in two life insurance policies that had ambiguous contractual terms; and

Premiums were unreasonably high.

Therefore, the Tax Court found that while Syzygy was adequately capitalised, the arrangement was not insurance in its commonly accepted sense.

While the court's opinion did not specifically address (1) the presence of insurable risk, and (2) risk transfer/risk shifting, it ultimately, both disallowed the deduction for premiums paid by the related party insureds and required Syzygy to include the insurance premiums in taxable income.

The decision in this case extends the run of Tax Court opinions unfavourable to certain types of captives, following Avrahami v Commissioner, 149 T.C. 144 (2017) (Section 831(b) micro-captive) and Reserve Mech Corp v Commissioner, 115 T.C. M. 1475 (June 18 2018) (Section 501(c)(15) tax exempt captive). Syzygy is also the first case in which the IRS both denied the purported insured's deduction for insurance premiums and forced the captive to include the 'premium' income in its taxable income.

The captive environment

The decision in Syzygy and the announcement of the LB&I TP campaign for captive services, taken together with other developments, evidence a trend of substantial increased scrutiny of captive insurance companies by the IRS and disapproval of certain captive insurance arrangements. This movement is further strengthened by the designation by the IRS of certain Section 831(b) captives as a 'dirty dozen' tax scam and the Tax Court decisions as noted above.

These recent developments highlight the importance of preparing premium pricing and risk transfer (FAS 113-type) analyses for all material captive transactions; an independent and reputable actuarial firm should complete this analysis. The reasonableness of the calculations should be closely reviewed. In addition, risk transfer testing associated with the captive transactions ought to be completed and documented contemporaneously, particularly for transactions involving loss portfolio transfers (i.e. a financial reinsurance transaction in which loss obligations that are already incurred and will ultimately be paid are ceded to a reinsurer).

In all captive cases, complete and accurate tax documentation of an entity's qualification as an insurance company under the local country tax rules, and appropriate pricing of insurance premiums paid to a captive, are essential self-defense mechanisms for MNEs and will go a long way in the event of an audit by the taxing authority.

Click here to read the entire 2020 Deloitte/ITR Financial Services Guide

Matej Cresnik |

|

|---|---|

|

Principal Deloitte US T: +1 212 436 7760 Matej Cresnik is a principal in Deloitte's global TP group and global strategies group focusing on strategic TP planning, and value chain alignment implementation projects. He leads the east region TP global strategies group and is the Americas head of insurance TP. Based in the New York office, he previously worked in the Deloitte UK and Deloitte Canada offices. Matej combines 15 years of TP experience working with emerging growth and established companies across a broad spectrum of industries, including financial services, technology, pharmaceuticals and real estate. With his international background and experience, he has built up a wealth of knowledge of global TP and broader tax matters and leads some of the Deloitte tax TP group's largest global client engagements. Matej has taught university-level courses in TP. He earned a BSBA degree from Kogod Business School at American University, and an MBA with Dean's Commendation from Said Business School at University of Oxford. |

Oliver Busch |

|

|---|---|

|

Partner Deloitte Germany T: +49 69 75695 6906 Oliver Busch is a partner who heads the financial services TP specialist group in Germany. Oliver leads projects involving the implementation of tax compliance systems, with respect to TP at major financial institutions. He also works on the branch capital allocation methodology for major banks and insurance companies, the alignment of the profit attribution between head offices and permanent establishments, and the determination of arm's-length fee splits for asset managers, among other areas. He has concluded many mutual agreement procedures (MAPs) and advised on several advance pricing agreements (APAs). Oliver publishes articles about hot topics in TP on a regular basis, in particular in regard to the profit attribution to permanent establishments, and recent OECD developments regarding taxation. Oliver is a German certified tax advisor and holds a PhD in economics. He is an assistant lecturer at the Goethe University and at the Frankfurt School of Finance. |

Jeremy Brown |

|

|---|---|

|

Director Deloitte UK T: +44 20 7007 5350 Jeremy Brown is a director in Deloitte UK's financial services TP team with 12 years of experience in TP. He is qualified as a chartered financial analyst (CFA) and holds a degree in economics. Jeremy's chief focus is advising multinational clients in the insurance/reinsurance sector on TP documentation, planning, economic analysis and engagement with tax authorities. He has considerable experience managing large, complex TP projects covering various types of transactions, including intra-group (re)insurance, revenue/profit splits, licensing of intellectual property, financing, and services. Jeremy serves as Deloitte UK's technical lead for TP of captive insurance arrangements. He has experience in advising captives across a wide variety of industries on economic substance, including board composition and underwriting, and pricing of premiums. |