With the emergence of the 2015 BEPS reports, the Korean National Tax Service (NTS) has been taking increasingly aggressive transfer pricing (TP) positions during tax audits, leading to greater uncertainty and the double taxation of cross-border transactions. When the NTS’ intended assessment is unreasonable and too substantial to justify, it is common for taxpayers to turn to mutual agreement procedure (MAP) to avoid double taxation, but there are cases in which TP issues are mixed with other issues that cannot be addressed via MAP or that slow down the MAP process.

An example of this would be the increasingly frequent situation in which the NTS deems a foreign company as having a Korean permanent establishment (PE) to which substantial profits are attributed. In such a case, it is difficult to get the Korean Competent Authority (CA) to agree to reverse the decision of the NTS auditors to conclude that there is no PE.

As a result, a decision to go to MAP generally will result in the acceptance of the existence of a PE by both CA, with the amount of income attributable to the PE being the subject of the MAP negotiations. This may resolve double taxation issues on the corporate income tax assessment, but the greater concern is generally the VAT assessment, which cannot be addressed through MAP. If a Korean PE is deemed to exist, the VAT assessment will generally far exceed the corporate income tax assessment, and it may be extremely difficult to obtain a refund.

Accordingly, it is often more effective to pursue a refund through a tax tribunal or court appeal when PE issues or VAT are involved as well as for issues involving the characterisation of income for withholding tax purposes or other (zero-sum game) issues that do not easily lend themselves to compromise. Every tax audit presents a unique mix of issues that can most easily be resolved through MAP and those that require a domestic appeal, which requires careful strategic planning to maximise the chance of success and minimise the amount of required time.

This article looks at both options and the possibility of pursuing both MAP and a domestic appeal simultaneously.

Mutual agreement procedure

Mutual agreement procedure is most commonly utilised to resolve double taxation issues when a tax assessment involves TP issues. Both Korean and foreign companies and residents are eligible to file MAP applications with either the Minister of Economy and Finance or the Commissioner of the NTS, when a tax assessment is believed (based on the Law for the Coordination of International Tax Affairs (LCITA) – which governs cross-border transactions) to have been made in violation of relevant tax treaties.

The MAP application can be declined under Article 42(2) of the LCITA if one of the following conditions is met:

1) If a Korean court or foreign court has rendered a final judgment on the issues involved; (except in cases expressly prescribed by Presidential Decree of the LCITA, such as when a corresponding adjustment from the other contracting state is required);

2) When the applicant is not eligible to apply for MAP under the relevant tax treaty;

3) When the taxpayer intends to use MAP for tax evasion purposes; and

4) When three years has elapsed since the date the taxpayer became aware of the assessment (generally, the date the tax assessment notice was received).

The italicised amendment applies when a corresponding adjustment is required due to a court judgment requiring an adjustment to the arm’s-length price. In such a case, the MAP will not be closed even if a final judgment has been rendered by a Korean court or foreign court.

Termination of MAP

The taxpayer is free to withdraw the MAP application at any time during the MAP process. Furthermore, if the CA for the countries involved are unable to reach agreement, the MAP is terminated in accordance with the LCITA five years after the commencement date, unless the CA mutually agree to extend the MAP discussions, in which case the MAP is terminated eight years after the commencement date.

The outcome of MAP neither establishes precedent for other cases having similar issues nor legally binds the taxpayer with respect to other tax issues.

Deferment of tax payments under MAP

Article 49 of the LCITA stipulates that a MAP applicant can request a payment deferment for taxes assessed (after receiving a pre-assessment notice and before receiving a final tax assessment notice) until the MAP is resolved. Once the deferment notice is accepted, tax will not become due until 30 days after the MAP closing date, at which point the taxpayer would be required to pay the revised assessment plus interest for the full deferment period.

However, requests for tax deferments are only accepted when the other contracting states involved also allow similar deferments (principle of reciprocity).

Domestic tax appeal

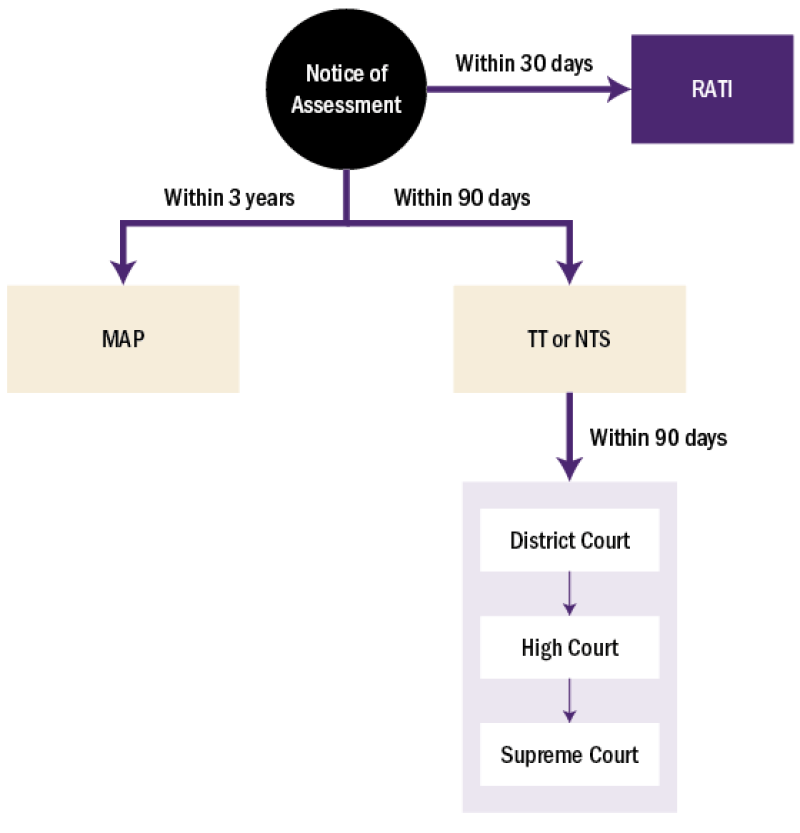

Within 30 days of receiving a pre-assessment notice, taxpayers can appeal to the regional tax office or district tax office that issued the notice in accordance with Article 81-15-(2) of the National Tax Basic Act (NTBA).

This procedure is called ‘Review of Adequacy of Tax Imposition (RATI), and it rarely results in a substantial refund or adjustment to the tax assessment, as the tax audit team generally coordinates closely with NTS superiors, who are usually in full agreement prior to the issuance of the pre-assessment notice.

Once the RATI is completed or if the taxpayers should decide not to proceed with RATI, they may pursue a Tax Tribunal (TT) appeal. The TT is an independent tax appeal board reporting to the Prime Minister’s Office with the authority to reverse and refund tax assessments and the authority to order the NTS to perform a second review or audit of the issues involved based on the TT’s specific guidance. TT cases are assigned to one of five committees, each comprised of four members (including two government officials and two external experts). The government officials generally come from the NTS, so though the TT does not answer to the NTS, TT decisions are generally carefully coordinated with the NTS.

While taxpayers need not pay the tax assessment to pursue RATI, the tax assessment should be paid in full prior to pursuing a TT appeal (together with any interest and penalties due).

If the taxpayer decides to skip RATI and appeal directly to the TT, the tax appeal should be filed within 90 days of receiving the final tax assessment notice. TT decisions are generally rendered within six months to one year of filing, though cases involving substantial assessments may be reviewed by all committee members, resulting in a delay.

If the outcome of the TT appeal is favourable to the taxpayer, the NTS cannot appeal the decision, and it is final. If the judgment is unfavourable to the taxpayer, a court appeal can be lodged within 90 days of receiving the final TT judgment.

Under current law, a taxpayer cannot bypass the TT in favour of an immediate court appeal. Article 56(2) of NTBA requires taxpayers to first appeal to the TT or NTS prior to pursuing a court appeal (and an appeal to the NTS is generally counterproductive).

A court appeal begins with the District Court, and decisions can (and usually are) appealed by the taxpayer or the NTS to the High Court and the Supreme Court. Most court appeals are resolved by the Supreme Court, and the entire process (from the TT to the Supreme Court) typically takes three to five years. The judges at all three court levels are completely independent from the NTS and have a history of rendering very independent decisions that often favour taxpayers. This has caused the NTS to complain and reorganise its internal litigation team in recent years.

Utilising MAP and a domestic tax appeal in unison

Even if a domestic tax appeal is filed, the taxpayer remains free to apply for MAP within three years of the receipt of the tax assessment notice.

Once the MAP commences, the statutory 90 day window for requesting a TT appeal will be frozen until the MAP is completed. In practice, however, it takes time to file for and commence MAP (generally more than 90 days). As a result, it is best to file a MAP and TT appeal concurrently immediately after receiving a tax assessment notice.

If the MAP is initiated while the TT appeal is in progress, the TT generally suspends the review of the case until the MAP is concluded (although there are occasionally cases in which the TT has been unwilling to wait until a long-outstanding MAP is concluded, which could result in the TT decision being rendered prior to the MAP decision). In such a case, depending on the issues involved, the Korean CA may refer to the results of the TT decision (though they are not obligated to do so), and the taxpayer would remain free to seek a court appeal within 90 days of the issuance of the TT decision, which 90 day window would remain frozen if the MAP has commenced.

Figure 1 depicts the tax appeal options available to taxpayers.

Figure 1

MAP statistics

Historically it has taken four to seven years to complete a MAP in Korea, which is longer than the three to five years generally required to pursue a domestic appeal from the TT to the Supreme Court. In recent years, however, the NTS has been endeavouring to increase resources dedicated to MAP and advance pricing agreement (APA) filings, and has also been lengthening the time required for pre-filing meetings and consultations. This has resulted in a decrease in the official time required to complete a MAP (as counted from the date the MAP application is accepted to the date of completion).

Average time taken from start to end (months)

TP cases |

Other cases |

|

Cases commenced before January 1 2016 |

55.05 |

80.82 |

Cases commenced from January 1 2016 |

20.81 |

20.96 |

Source: OECD |

||

Due to OECD oversight (peer review and monitoring process), the time required to complete MAP cases will likely continue to improve.

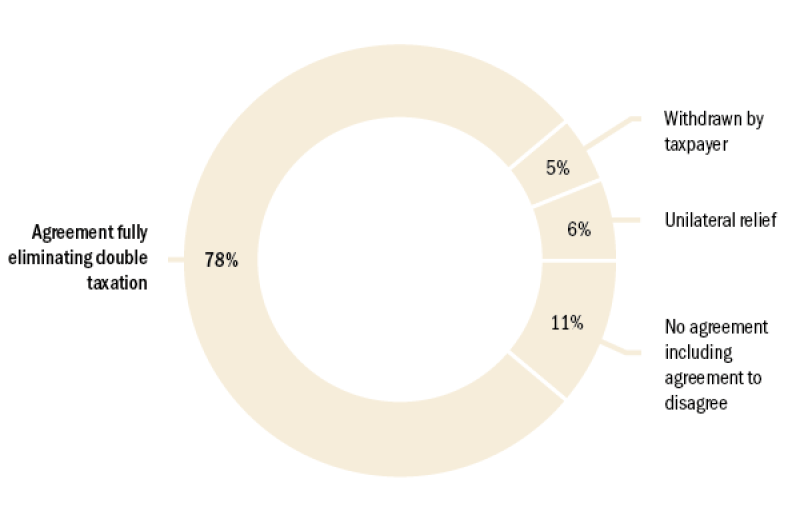

Figure 2 shows the outcome of recent Korean MAP cases involving TP.

Figure 2: MAP outcomes

Source: OECD

Taxpayers often combine a MAP filing with a bilateral APA to achieve certainty for future years and unaudited past years (through a rollback). The same Korean CA team handles both MAP and bilateral APA filings, and combining the two can provide greater flexibility, efficiency, and consistency in resolving MAP cases.

While taxpayers have historically preferred MAP for TP disputes and domestic appeals for PE, VAT, withholding tax, and other disputes, an increasing number of TP cases being decided by the TT and court have been observed. In examining the 74 TP appeal cases decided over the past five years, 44 cases resulted in a decision that was favourable to the taxpayer (approximately 60% win rate).

Again, Korean tax law does not prohibit taxpayers from pursuing both MAP and a domestic tax appeal simultaneously, allowing strategic decisions to be made that maximise the chance of overall success.

When tax assessments involve PE issues, management service fees or headquarter cost recharges, withholding tax issues, or VAT, a domestic appeal may prove more effective and less time consuming than a MAP filing.

When pure TP issues are involved, MAP may prove more effective at eliminating double taxation and ensuring a rational outcome that is consistent with OECD TP Guidelines (although recent TP decisions rendered by the Korean TT and courts have often been favourable to taxpayers and resulted in refunds).

When a tax assessment involves multiple issues that need to be appealed, it may be worth opting for a domestic appeal covering all issues (including TP) or a dual track approach involving the simultaneous filing of a TT appeal and MAP with careful monitoring of the situation at both levels.

Click here to read the 2021 TP Special Focus guide

Yun Heui Cho |

|

|---|---|

|

Partner Yulchon T: +82 2 528 5680 Yun Heui Cho is a partner and lead litigator in Yulchon’s tax litigation group. He joined Yulchon in 2016 and previously served as a judge for over 20 years in various capacities, including as the presiding judge of the Seoul Central District Court and head tax researcher and presiding judge at the Supreme Court of Korea. Yun Heui has assisted numerous foreign and Korean multinationals with successful tax tribunal and court appeals in every major industry. |

Yong Whan Choi |

|

|---|---|

|

Partner Yulchon T: +82 2 528 5709 Yong Whan Choi is a partner primarily focusing on international tax matters and currently co-leading Yulchon’s international tax team. Sitting in the Japan team, he assists numerous multinationals (particularly ICT, semiconductor companies, and investment funds) with issues associated with TP, permanent establishments, beneficial ownership, and restructuring. Yong Whan has a long history of successfully representing clients in tax cases before the tax tribunal and Korean courts. He obtained his LLM in international tax studies from New York University and his PhD from Yonsei University. He also spent time in Japan, where he was seconded to a major Japanese law firm. |

Kyu Dong Kim |

|

|---|---|

|

Partner Yulchon T: +82 2 528 5542 Kyu Dong Kim is a partner primarily focusing on international tax matters and currently co-leading Yulchon’s international tax team. He has extensive knowledge and experience dealing with the challenging tax issues multinational corporations face, including cross-border transactions and Korean tax matters, with a particular focus on global technology companies and financial institutions. He also specialises in structuring overseas fund investments into Korea and Korean fund investments overseas. Before joining Yulchon, Kyu Dong worked with PwC in London and Seoul. He is a director of the Korean branch of the International Fiscal Association and serves as an advisor to the government committee on tax law amendments. |

Jeremy Everett |

|

|---|---|

|

Partner Yulchon T: +82 2 528 5133 Jeremy Everett is a partner in Yulchon’s international tax group. He has lived in Korea for 26 years and has been advising foreign and Korean companies on inbound and outbound tax matters since 1994. He has extensive experience assisting a wide range of industrial and financial service clients with tax audits and dispute resolution, mergers and acquisitions (M&A), tax planning and effective tax rate optimisation. Jeremy previously led two of the largest corporate tax departments in Korea. He was the first foreigner to serve as the global head of tax for a Korean conglomerate, Doosan Group, and also formed and led General Electric’s tax team in Korea. |