DLA Piper’s head of international transfer pricing, Randall Fox, appreciates how the greatest challenges may eventually lead to the greatest rewards.

After moving across the pond to join the firm in June 2015, Fox was tasked with establishing and consolidating DLA Piper’s new TP practice in London.

“I was looking for a new challenge,” Fox tells ITR. “I had other offers which would have kept me in the US or I could have returned to the US competent authority.”

“However, here was the opportunity to start something new and rejoin the private sector in a new country – in a law firm environment, where I had never previously worked.”

There is little surprise when Fox calls the moment he joined DLA Piper as the ‘turning point’ of his career. Since creation, the firm’s London-based TP team has been consistently rated as a Tier 1 firm by World Transfer Pricing. In addition, the team won ITR’s UK Transfer Pricing Firm of the Year award in 2017, 2018 and 2019.

“It has been extremely fulfilling and I could not be happier that I made that decision,” says Fox.

Learning how the world works

Fox completed his bachelor’s degree at the University of Washington and his master’s degree at Miami University in Ohio, where he majored in economics. He admits that as a graduate student, he was still figuring out what he was going to do next.

“I wanted to learn more about how the world worked. I knew I was interested in international business and I always enjoyed solving problems and thinking strategically,” says Fox.

“It was an exchange with an alumni from my graduate programme that piqued my interest in TP. It checked so many boxes for me at the time – and it continues to do so now.”

Fox first worked in the TP team of a Big Four firm and then a multinational economic consultancy firm, before shifting his focus to the public sector. As a team leader with the Internal Revenue Service (IRS) competent authority team in Washington DC, he was responsible for leading TP case negotiations on behalf of the body for some of the largest cases in the history of the IRS’s advance pricing and mutual agreement (APMA) programme.

Fox also completed a two-year secondment to the World Bank Group, where he helped a number of international tax administrations build capacity and develop alternative dispute resolution programmes. He advanced and led training workshops on technical TP matters, and worked directly with tax administrations, finance ministry officials and the OECD on policy related to transfer pricing.

In conversation with ITR, Fox discusses how the TP function has evolved amid COVID-19 and increasing digital transformation. He also introduces his new colleagues in Spain and France and offers an insight into DLA Piper’s growing European TP strategy.

The shifting focus of TP

What trends are defining the TP function and profession?

Transfer pricing has been at the heart of international tax over the last few years, which makes it an exciting place to be.

The key trend we are seeing is an increased focus on the prevention and resolution of TP controversy. Multinationals are generally seeing a substantial increase in risk in many countries where they operate and are having to prepare for and adapt to this being a credible threat. They are looking for a range of solutions.

At the same time, the international tax rules are changing such that I believe the TP function will come to focus either on compliance or controversy. Policies will need to be put in place primarily with the goal of limiting controversy, and steps will need to be taken beyond compliance in order to prepare. In terms of resolution, companies will need well-developed processes to ensure controversies are dealt with in a strategic way across a number of countries.

How has the COVID-19 pandemic impacted the TP function and profession?

On the client side, I would say it has made the world a much smaller place. Before the pandemic, face-to-face meetings were the norm, and many of us spent a lot of time on planes. Now, with the widespread use of technology, teams can efficiently and easily exchange ideas and collaborate – in some cases more frequently than before. While I do miss the in-person interaction, we certainly have the tools now to seamlessly collaborate in some ways better than we did in the past.

From a technical standpoint, it has really brought the focus back onto the intra-group legal agreement. Many companies were required to make changes to their TP policies resulting from the pandemic, and how these changes were handled in the legal agreements themselves became critical. The intersection of law and economic analysis become critical for this.

For us, it was great to rely on our commercial contracts team to gain an understanding and be consistent with how these changes were being handled in third-party contracts, while also applying our economic tools to reflect the reality that companies were facing.

DLA Piper: Expansion in Europe

In early 2021, DLA Piper expanded its TP offering in Spain and France. Could you tell us more about the new arrivals?

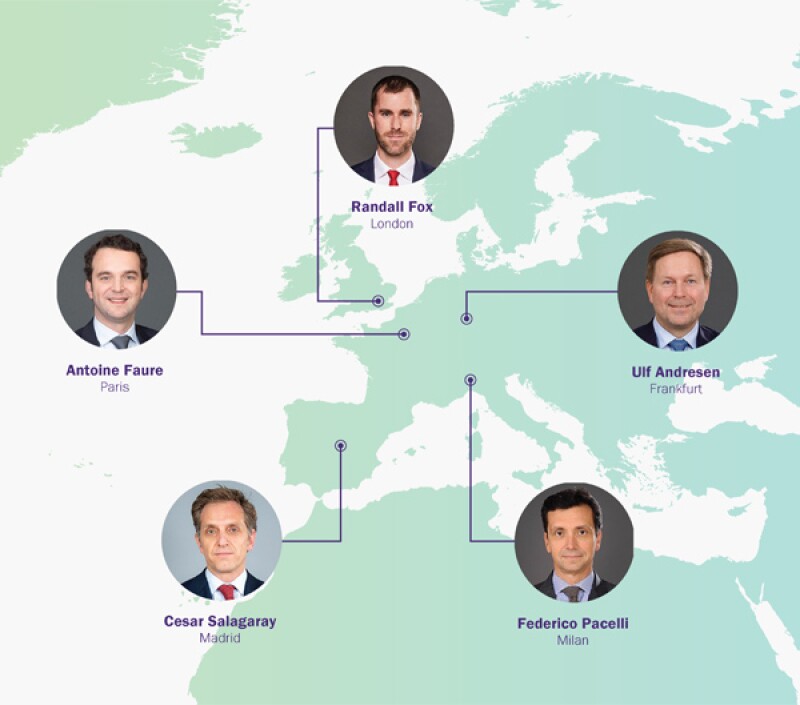

Definitely – we were really excited to expand the team into two new countries this year. We had great teams join us in Spain, led by Cesar Salagaray, and France, led by Antoine Faure. Both are outstanding advisors with intimate knowledge of strategic areas of TP such as operating model design and controversy. They are an incredible asset to our firm and our clients and are already having a significant impact. A number of outstanding TP professionals joined along with them, which is testament to their skills and leadership.

This is also an important development for our clients as it now allows us to offer TP controversy and related services in the US, UK, Germany, Italy, Spain, France, China as well as a number of other countries. With Cesar being an economist like myself, and Antoine being a lawyer, this also contributes to the multidisciplinary aspect of our practice.

How does the growth in personnel tie up with the firm’s European TP strategy?

We are really just adapting to the needs of our clients. When we formed our international TP practice in 2015, it was unusual for a law firm to have a TP team with both lawyers and economists, and the work was largely driven out of the US and UK.

With the global reach of the firm, many clients now see us as an alternative to the accountancy firms they have traditionally worked with, but there is an expectation that we have local TP presence in key European countries. Over the last two years we have welcomed 17 focused TP professionals in Europe and the UK. We all work very closely as an integrated team. We also have dedicated teams across Asia-Pacific and the US which we remain very close to.

We are also strongly integrated between our tax and TP teams and take a unified approach to providing international tax advice. We feel this is an uncommon and market-leading approach among law firms, and vital in an environment where international tax principles are coming to be dominated as much by questions of pricing and location of commercial substance, functions, assets and risks as they are by matters of domestic law.

The future of TP

What does the TP function of the future look like?

International tax and TP is becoming increasingly complex. In-house teams will be looking for consolidated, strategic advice to address and prevent risks and advisors will need to have a broad perspective on how different countries approach issues. We simply cannot look at things on a country-by-country basis anymore.

I also believe compliance will continue to be more and more heavily managed digitally, which will have an impact on in-house teams and advisors alike. As a result, the advisory function will need to focus more on strategic areas where in-house teams will need advice.

What words of advice would you give to somebody starting their career in TP today?

Transfer pricing is challenging but extremely rewarding. I would advise someone starting their career to focus on the strategic element of TP, but also maintain a broad perspective. Be inquisitive as well – try and understand the why behind what you are doing, sometimes asking why more than once!

Also put yourself in the shoes of the tax authority to try and identify the risks certain areas may create. Lastly, speak up! Don’t be afraid to express your opinion and take advantage of every opportunity that comes your way.

Randall Fox |

|

|---|---|

|

Head, International Transfer Pricing London T: +44 0 20 7796 6928 Randall Fox heads DLA Piper’s TP team in London, and leads the growth of the firm’s global TP practice. Since joining the firm, Randall has assisted a number of clients in operating model design and implementation globally, more than 25 bilateral advance pricing agreements (APAs) and mutual agreement procedures (MAPs) across 12 countries, financing structures, several large valuations of intangibles for cross border transfers, and defense-related strategies worldwide for a number of US and European-based multinationals. Randall has previously worked at a Big Four firm, the IRS, as well as the World Bank Group. |

DLA Piper’s European TP leaders