Tax liability insurance (TLI) policies are a cost effective tool to transfer a potential tax exposure from a fund to the insurance industry, increasing the competitive nature of investment bids, alleviating the financial implications of tax risks in the structure and giving increased certainty around management incentivisation and returns to investors.

What are the benefits of using TLI to manage typical fund tax risks?

Where a tax risk is identified in respect of an asset disposal, TLI allows an M&A transaction to proceed without price chip or escrow;

Where used to manage operational risks of the fund, TLI can serve as a useful tool to promote adherence to operational guidelines (i.e. implementation of board meeting procedures);

Where a tax risk is identified at investment stage, use of insurance can increase the competitive nature of an investment bid;

May be used by investor relations teams to demonstrate prudent tax management strategy;

Offers financial certainty (compared to relying on tax opinion or diligence alone) and minimises tax leakage from waterfall distributions;

Can enhance incentivisation of management when used in respect of carried interest and co-invest arrangements;

Enhances investor comfort and potentially minimises side letter negotiation if used to manage fund structure risks; and

More expedient than seeking a tax ruling or clearance.

TLI in practice – how can it be used by the fund?

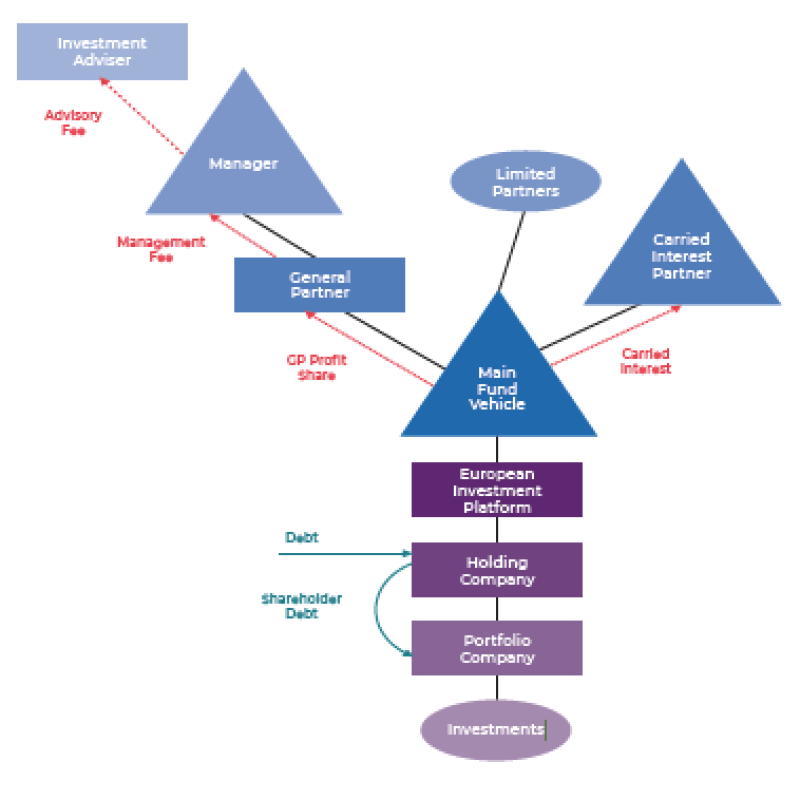

TLI can be used by an investment fund in a vast number of circumstances; whether at the fund level or at the investment level. Below is a typical European fund structure, illustrating just a few of the many examples of how TLI can be used to manage tax risk.

Residence and permanent establishment

Where the manager relies upon the services of an investment adviser (that is tax resident in a different jurisdiction) for making investment and divestment recommendations (i.e. a US manager and a UK investment advisor) this can give rise to residence and permanent establishment concerns. When operating guideline are implemented to manage these risks, insurance can safeguard against the financial consequences of a successful revenue challenge.

Management incentivisation

Given the importance of the tax treatment of management remuneration and participation (carry or co-invest) for incentivisation purposes, insurance may be sought to provide cover in the event that carry or co-invest returns are taxed as income rather than capital.

Substance

Where a fund structures certain investments through a single regional platform, there may be concerns regarding the substance of such platform and the availability of double tax treaty benefits. Subject to review of the operating practices of such regional platform, insurance may be able to provide cover in respect of this risk.

Investment level considerations

Whether at the investment, operating or divestment stage, tax concerns can arise in the context of a specific portfolio asset. Insurance can provide comfort that transactions can proceed in a timely manner with limited financial implications (i.e. price chip, escrow, etc.).

Special status fund vehicles

Certain special status fund vehicles may receive beneficial tax treatment provided that certain legislative criteria are met. Given the complexity of many fund structures, and the different requirements of their investors, there may be technical questions as to whether the requisite requirements can be satisfied. There may also be a change in circumstances that puts pressure on the underlying analysis. Subject to appropriate diligence, TLI can be of assistance.

Interest deductibility

In the case of shareholder debt, there may be uncertainty about the likelihood of a transfer pricing adjustment, leading to interest deductibility concerns. Insurance can be of assistance, provided appropriate benchmarking has been conducted. Interest deductibility concerns may also arise in relation to anti-hybrids legislation or the UK’s corporate interest restriction rules.

A solution as nuanced as the businesses it serves

Appetite to insure fund tax risks will inevitably vary across the market. Using a broker who appreciates these differences, and how this will impact on the availability of a policy for your business, is important. For example, TLI may also be of assistance:

In relation to tax concerns arising in respect of the use of alternative investment vehicles;

To obtain favourable leveraged finance terms; and

In an ‘end of fund life’ scenario (allowing a fund to be liquidated and proceeds to be distributed to investors).

Pricing will vary considerably depending on the jurisdiction and the nature of the risk. We would typically expect to see the premium for the majority of risks fall within 2–6% of the limit sought. Risks from as small as £1 million to £1 billion can be insured and the BMS team would be delighted to discuss your particular needs.

While it is not possible to list all of the circumstances in which TLI may be available, the BMS team has dedicated in-house tax counsel with extensive funds experience that will work with you and your advisers to ensure that a tailored insurance solution is acquired, wherever in the world it is needed.

A note on fund documentation

Private placement memorandum

Where a fund intends to consider use of TLI as part of a prudent tax management strategy, it may be beneficial to note this in the private place memorandum and investor relations documents from a marketing perspective.

Limited partnership agreement

It is important to ensure that the LPA expenses provisions allocate the TLI costs appropriately.

Side letters

TLI could potentially minimise side letter negotiation and investor requests for burdensome tax information provisions where investors know in advance that a tax risk can be insured.

Dean Andrews

Head of tax liability insurance, BMS Group

Jessica Bradley

Associate director, BMS Group

E: jessica.bradley@bmsgroup.com