The last two tax reforms in Mexico have included the addition, modification, and removal of various federal tax provisions. These changes have come into force over a two-year timeline.

Even though these modifications have not represented an increase in the income tax rate or VAT rate, at the moment, the Mexican tax authorities (MTA) have additional faculties and control elements to verify the application of tax provisions.

However, it is worth mentioning that the Mexican government has also issued new tax provisions to provide certain benefits for some specific industries and regions in Mexico.

The main modifications are summarised in Table 1 taking into consideration doing business in Mexico in the light of the new provisions in force.

Table 1

In force |

Main modifications |

Highlights |

January 1 2019 |

Elimination of the universal offset of taxes |

Taxpayers are unable to offset tax credit balances against other federal taxes. When a taxpayer generates a balance in favour of VAT, those who carry out activities are subject to 0% (i.e. selling food, medicine, on a regular basis) can only be recovered by requesting a refund on the total balance in favour and not against other taxes as previously done until 2018. |

January 1 2019 |

Decree by which tax incentives are granted to taxpayers located in the northern border region |

Provides a preferential income tax rate of 20% (instead of 30%) and 8% (instead of 16%) in VAT for certain specific taxpayers located in the northern border area; by an amendment to the decree an extension was granted until December 2024. |

January 9 2019 |

Decree by which tax incentives are granted to shareholders that held interest in a company prior to initial public offering |

The decree allows founding shareholders, among others, to apply the special regime (10% taxation rate on gain, for Mexican resident individuals and for non-Mexican residents) of sales on the stock market, subject to certain requirements and, is applicable until December 2021. |

December 9 2019 |

Thesis issued by the Supreme Court to consider the effective date for tax purposes |

Legal documents considered valid for tax purposes when they are filed on a Public Registry or notarized. |

January 1 2020 |

2020 Tax Reform |

Among other modifications, the following were included:

|

January 1 2021 |

Decree by which tax incentives are granted to taxpayers located in the southern border region. |

Provides a preferential income tax rate of 20%, and 8% in VAT, for taxpayers located in the southern border region, which will be applicable until December 2024. |

January 1 2021 |

2021 Tax Reform |

Among other modifications, the following were included:

|

April 24 2021 (in force as August 2 2021 for tax purposes) |

2021 Labour Reform |

Outsourcing prohibition allowing only contracting of specialised services or execution of specialised works that are not part of the corporate purpose or economic activity of the contracting company. Taxpayers paying permitted specialised services shall collect information from the service provider to be allowed to deduct for income tax purposes and credit the VAT. |

June 13 2021 |

Effective income tax rates for major taxpayers (major taxpayers in general terms are those with taxable income in their annual tax return of more than US$75.8 million, banks, public companies). |

The MTA published the effective tax rates, on income tax, for certain economic activities. |

As discerned from Table 1, since 2018, President Andrés Manuel López Obrador, the Mexican Congress, and the MTA have been constantly adjusting the tax regulations, mainly to provide additional tools so that the MTA may (i) exercise its power of verification to audit taxpayers; and (ii) adapt the means to interpret laws.

Considering the last two modifications mentioned on the list, additional analysis for the effective tax rate and the labour tax reform due to its recent modifications is discussed.

Effective tax rate

Regarding the effective tax rate list referenced in the final figure of Table 1, the chief of the MTA has mentioned that major taxpayers now have a metric to review their tax situations over previous years.

The chief of the MTA has also expressed that the MTA is expecting that the effective rate to major taxpayers encourages self-correction, without the need for audits, and it supports them in order to facilitate voluntary compliance.

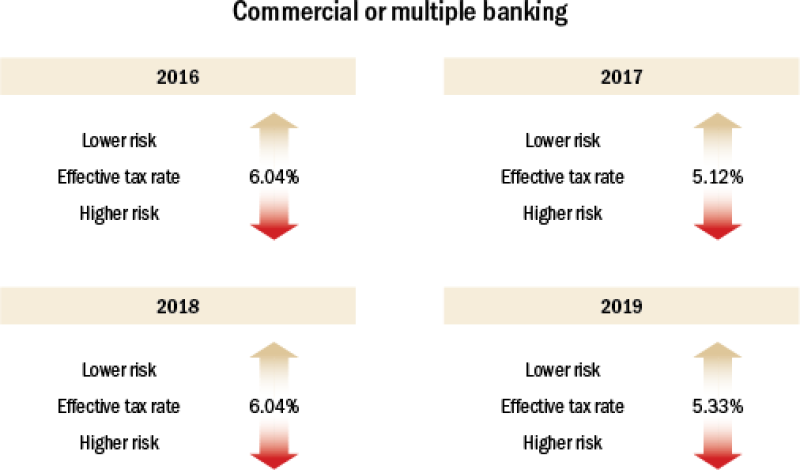

As an example, for a better understanding, the effective tax rates for the banking system issued by MTA are shown in Figure 1.

Figure 1

In 2019 the MTA expects that banks would effectively contribute a 5.33% or higher income tax on their annual tax return, which is determined by subtracting from gross income earned in the fiscal year, the deductions authorised, the employees’ profit-sharing and, if applicable the tax loss carryforwards from previous years at a 30% tax rate; that is, with these numbers a profit margin of 17.77% is expected.

It seems that if a bank’s effective rate was below those published by the MTA, then the taxpayer will have to review its tax situation, to determine the reason for which it had a lower rate.

Therefore, if a taxpayer has a lower rate than the ones established by MTA, then the taxpayer could be subject to an audit process, so if this is the case, all the accounting and the supporting documentation must be gathered and made available to the MTA in order to prove the reasons for which its tax rate varies from the ones determined for its industry.

This is a good opportunity to mention that the status of limits in Mexico continues to be five years as a general rule, and maybe 10 years in some cases, such as when the taxpayer is not registered in the federal registry of taxpayers, does not keep account records, as well as the years when the taxpayer does not file the annual tax return.

Labour reform

There will be relevant effects to be observed in business groups due to labour reform and the corresponding impact on its taxes, as many groups of companies have been restructured to be aligned with the new labour regulations, either with mergers or integration of personnel, consequently, in some cases, changes in the taxation of companies or business groups will be significant.

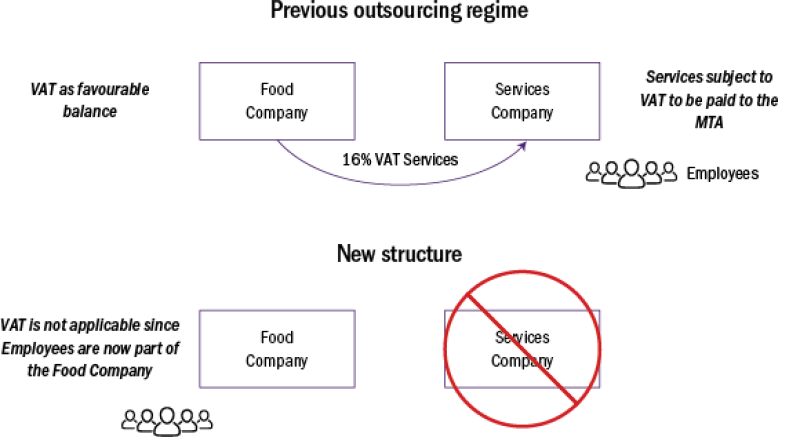

To ease the understanding, Figure 2 is a basic example of a food company and some expected general tax implications due to the labour reform.

Figure 2

If Figure 2 is considered, VAT would not be collected at any time. However, it is expected that the company now holding the employees will be paying social contributions for the employees (previously paid by the services company).

We must also remember that employees are attributable to profit distribution of a 10% of the company’s tax profits; since they will now be part of the operating company, this will benefit the employees and would not be a direct benefit on the government.

What can be expected in the future?

The economic package for 2022 must be published in September 2021. This will be reviewed and published by the Mexican Congress and will be in force as of January 2022 (except for provisions that are postponed in transitory terms).

On June 14 2020, the chief of MTA stated that the main goal of the 2022 Tax Reform is to collect taxes through modifications and the incorporation of provisions that will result in major taxpayers contributing more.

According to figures provided by the chief of MTA, it is expecting to audit 600 major taxpayers, this considering that in Mexico approximately 12,000 companies are considered as major taxpayers.

The Mexican government will be continuing to modify the tax provisions to incorporate elements that support MTA in the review, their audits and collection of taxes to major taxpayers.

At the time of writing, the chief of MTA has not stated if it is intended to increase the tax base by taxing assets, wealth, inheritances, as it has been implemented in other Latin American countries, such as Argentina, or by taxing the consumer foods, as was recently proposed in Colombia.

The issue of inheritances and donations has been proposed several times to the Mexican Congress in recent years: even the OECD itself has already recommended to Mexico the incorporation of these mechanisms.

Nonetheless, it is expected that there could still be relevant changes, which will not be known until September 2021 when the proposals will be turned in to the Congress for discussion and approval.

Click here to read this article in Spanish

Click here to read all the chapters from ITR's Mexico Special Focus

Antonio Vite |

|

|---|---|

|

Partner VCG Partners T: +55 6800 3965 Antonio Vite is a partner at VCG Partners. His experience includes providing tax advice on the mergers and acquisitions, restructuring of companies and assets, raising public and private capital, in processes of placement of shares, debt, development capital certificates and real estate trust certificates. Antonio has advised various national and foreign funds in their investment process, from their structuring, investment analysis (due diligence), portfolio management and project exit. He has provided advice to projects in the infrastructure, energy and agriculture sectors. Antonio is a member of the College of Public Accountants of Mexico and is certified by the Mexican Institute of Public Accountants. |

Andrés Alvarado |

|

|---|---|

|

Senior associate VCG Partners T: +55 2728 9493 Andrés Alvarado is a senior associate at VCG Partners. He has participated in various national and international projects to structure sales and company mergers. In these processes, he has been involved in the analysis of the interpretation of international treaties signed by Mexico with other countries. Andrés has also advised infrastructure projects and real estate structuring for their development and commercialisation, participating in processes of placement of development capital certificates, investment promotion certificates (CERPI) and real estate investment trusts. Andrés has a master’s degree in tax law from the Universidad Panamericana. |