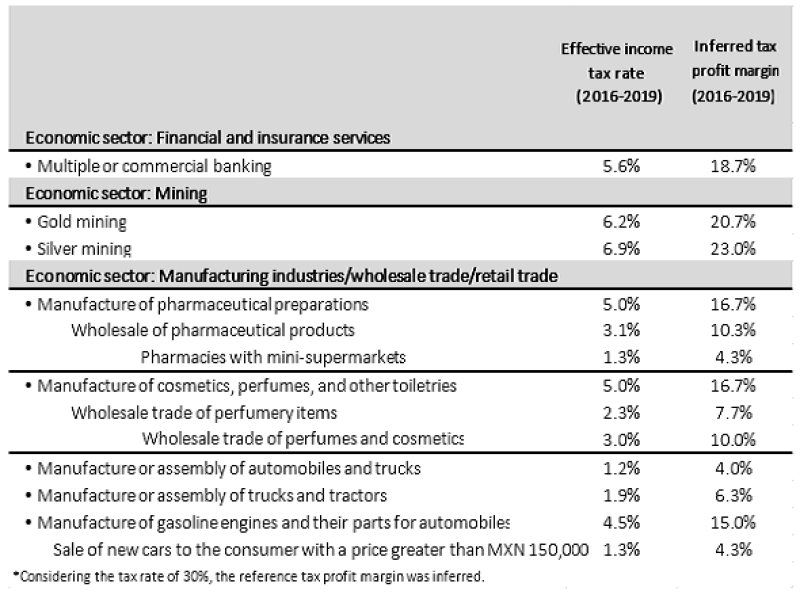

On June 13 2021, the Tax Administration Service in Mexico (SAT) published certain reference parameters related to the effective income tax rates by activity and economic sector for the period 2016–2019. The following are most notable.

The purpose of the SAT through this modality of assistance to the taxpayer (Article 33 of the Federal Tax Code) is to facilitate and encourage the voluntary compliance by taxpayers, especially to companies whose tax base is unstable, either due to internal or external causes, or those with some difficulty in their calculation, as multinational companies face when calculating their transfer pricing (TP) derived from transactions between subsidiaries of the same group.

The SAT has identified the following possible causes of tax non-compliance:

Tax planning;

Inter-company transactions;

Business restructurings;

Tax interpretations;

Application of international tax treaties;

Deduction of erosive payments; and

Simulated operations – billing companies.

The published benchmarks indicate the breaking point where, firstly, the SAT is indifferent to a possible implicit risk in tax matters, so if the companies that perform within an economic activity of those published in the SAT website, report tax results in proportion to the cumulative income lower than those proposed as a reference, they will be classified as having a higher tax risk, with which they are invited to review the situation, and if applicable, amend the fiscal results to avoid a possible audit.

For example, in the mining sector, when companies engaged in the extraction of gold, report a tax profit margin of less than 20.7%, they will presumably have a higher tax risk. The same case when a broader value chain is considered, for example from manufacturing to distribution of pharmaceutical products: with a minimum margin benchmark of 16.7% for manufacturers, 10.3% for wholesale distributors and 4.3% for retail distributors.

Reporting tax results above the parameters published by the SAT would minimise the possibility of an in-depth audit of the taxpayer's tax obligations, as indicated by the authority.

Although this is a great step that the SAT has taken towards transparency and certainty in tax matters, in accordance with experiences carried out by other countries such as Australia (i.e. small business benchmarks), it is important to recognise some improvement areas that the SAT will have to solve to make this tool effective:

The publication of the reference parameters does not clarify from which fiscal year this measure will be in force, especially since the 2020 and 2021 years have been affected by the COVID-19 crisis, and it would seem challenging to take the period 2016–2019 as a precise market reference.

Only 40 of the 1,140 economic activities listed in Annex 6 of the current Miscellaneous Fiscal Resolution were published, focusing on five specific economic sectors: mining, manufacturing, wholesale trade, retail trade, and financial and insurance services.

The benchmarks only cover large taxpayers, which are mostly those companies with income equal to or greater than $1,250 million pesos (approximately $63 million).

It would be convenient to know the procedure for the selection or possible exclusion of observations (financial information of taxpayers) used to calculate the reference parameters.

The composition and statistical quality of the sample of observations by economic activity is still pending, as well as to clarify the corresponding statistical measure applied: average, median, upper limit, or some other.

Both the publication of the parameters of other economic activities, as well as the periodicity of the update and publication of these parameters are key elements for the implementation of this measure.

Undoubtedly, the benchmarks represent a new and spontaneous approach to motivate an improved tax collection by taxpayers in Mexico, which implies solving the implicit challenges in handling a massive amount of data whose confidentiality characteristics make the task even more difficult, but at the same time, a great commitment to expand and maintain this useful tool for the benefit of simplifying the already complex income tax regime.

These benchmarks provide an opportunity to those taxpayers that are below the expected reference to confirm if they are properly classified in the economic sector (informative returns and tax ID), as well as to review and confirm that transfer prices are correctly calculated, and they meet the arm’s-length principle through a deeper analysis.

Carlos Pérez Gómez

Partner, HLB MAAT Asesores