There is no dispute that the transportation and hospitality industry has been hit hard by the impact of COVID-19. Over the past 18 months hotels, restaurants, rental car companies, airlines, and related businesses have been forced to address the paradigm shift affecting operations around the globe.

This article discusses the change management and innovation processes undertaken by industry leaders as they redefine operational priorities in the wake of the pandemic. With pandemic turbulence still apparent, the article also discusses the collateral aspects of this change in focus, in particular, on the financial and tax implications.

The heart of the industry – trust and loyalty

At the heart of hospitality and transportation is the human experience, and at the heart of the human experience is loyalty and trust. From customers and guests to line workers and executive management, the human experience has shifted dramatically over the past 18 months.

After more than a year living with the response to COVID-19, including various activity restrictions, consumers of all ages and income levels are making travel plans. According to Deloitte’s State of the Consumer Tracker, 55% of respondents are planning a hotel stay for leisure travel in the next three months.

Similarly, on May 8 2021, passenger volume at Transportation Safety Administration (TSA) checkpoints surpassed 70% of 2019 levels for the first time since the TSA began publishing its data in March 2020 (source).

But despite the easing of local restrictions and increasing vaccination penetration, health remains top of mind for many travellers. Among those customers who are not planning to travel in the near future, 41% say health concerns will keep them home, compared to less than 30% citing financial concerns. Of the travellers choosing to stay in a hotel, 89% cited enhanced safety measures as a reason for choosing a particular brand (source).

Ongoing uncertainty means that customers who are travelling are more likely to make their plans with brands that they feel they can trust. In fact, 88% of consumers who highly trust a brand buy again (source). In hospitality and transportation, almost half of travellers who highly trust a brand travel with that brand even when it requires more effort. In short, trust drives loyalty. And yet, only 4% of consumers trust businesses to let them know when it’s safe to travel again (source). This creates a unique inflection point that may provide businesses the opportunity to build and maintain loyalty with consumers who are slowly beginning to reengage with travel and hospitality brands.

Many of these customers may be more open to switching their brand allegiances than ever before if they have lost their elite loyalty status over the past year or are planning for reduced business travel looking forward. Those brands that go above and beyond to deliver an exceptional customer experience that reflects the reality of our current environment may be more likely to capture and retain those customers in the future. To (re)build trust – and drive loyalty – brands need to be able to measure trust. This is not a simple task.

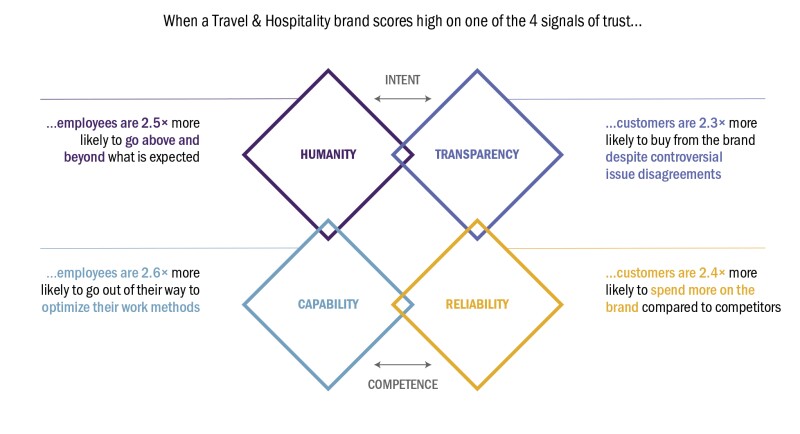

There are four signals that form the basis of trust and lead to positive consumer and employee outcomes. The first two signals, Humanity and Transparency, reflect a brand’s intentions, while Reliability and Capability demonstrate a brand’s competency in fulfilling those intentions. Taken together, these four signals indicate an organisation’s trust performance (or HX TrustID™) and correlate a brand’s trust scores to a range of actual behaviours that indicate customer loyalty and employee productivity. Figure 1 shows a few examples of how these signals influence human behaviours in this industry.

The value of focusing on customer experience is not a new development. The Deloitte 2019 Travel, Hospitality and Services survey shows that experience allows companies to differentiate themselves and earn customer loyalty. Overall experience factors, such as valuing feedback, being recognised and personally addressed, and aligning to brand values, amongst others, are 2.4 times more important than price across travel and hospitality overall (source). By focusing on delivering an exceptional experience across a customer’s entire journey, brands can build emotional relationships with consumers that result in lifelong loyalty.

Furthermore, the pandemic forced many brands to make swift changes to their business models in order to respond to the changing demands of their customers. While some of these shifts are already returning to ‘normal’, many new patterns of customer behaviour developed during the pandemic will likely endure.

In addition to adjusting to health concerns, travel providers should consider the ways the pandemic has reordered lifestyles – including continued remote work, increasing emphasis on privacy, lingering reticence to fly, and the continued expectation of flexibility in travel plans. The durability of these shifts will vary, but none seem likely to disappear as quickly as they emerged. Leading brands will need to continue to innovate to better meet evolving customer needs as we slowly emerge from the COVID-19 pandemic.

Businesses also need to consider how these pandemic-driven shifts in consumer behaviour impact their workforce. Rapid adoption of new technologies by consumers and businesses alike over the past year has accelerated several trends that had already started to emerge prior to the pandemic – such as the increased usage of digital channels, higher expectations for personalised and curated experiences, and demand for increased flexibility.

These are not temporary phenomena, but rather accelerations of trends that were already being observed in the market. Businesses will need to reevaluate how to integrate these trends and technologies in their operating models. Engaging employees and partners in that transformation effort is key to ensuring a business’s workforce is emotionally engaged and encouraging them to deliver the best experience to customers.

Overall, businesses are likely to have to continue making significant changes to the way they operate in order to meet continuously evolving customer needs. Such changes require a thoughtful change management plan that includes consideration of the financial and tax implications of these strategic and operational changes, including capital investment tax implications, transfer pricing (TP) implications, reconciliation of changes with existing tax positions, and consideration of the changing tax landscape.

HD TrustID™

Hospitality

The hospitality sector has made significant investments in technology, operational processes, and safety protocols and processes: reservation systems, call centers, cyber management, loyalty programme algorithms, pricing strategies, and resource allocations have all seen changes. These capital investments have driven the need for financial triage, change management and, ultimately, tax planning and compliance.

There are many tax considerations and potential opportunities. Tax incentives including research and development, property tax and other credits, accelerated depreciation, and TP often provide the most significant opportunities in the hospitality industry. Companies with established inter-company pricing strategies will likely have to revisit those strategies in the face of profits variance, increased compliance and reporting burdens, and possibly increased government audits.

Tax departments with limited resources must keep up with business agility as the company navigates the post-pandemic period. As a first step, it may be useful for companies to connect with brand, experience, technology and operation team leads to understand investment priorities and timelines. This information can not only help identify inter-company transaction changes but also identify new assets that will need clarification around ownership, funding, risk, and use. This can help drive tax strategy decisions such as deciding on the best location for these new assets and tax implications associated with location alternatives.

Use information will also help define the need for and the type of inter-company contracts needed to correctly document use rights and pricing associated with these new assets. Since TP analyses frequently involve comparable transaction and comparable company data, care needs to be taken to consider changes in these typical benchmarks. In certain situations, this may require predictive analytics to establish stable pricing anticipating future market volatility.

Further, in December 2020, the OECD issued guidance concerning application of the OECD Transfer Pricing Guidelines under unusual business conditions resulting from the COVID-19 pandemic. This guidance, which was intended to complement rather than to replace the general principles in the guidelines, addressed several key issues, including treatment of operating losses and allocation of pandemic-related costs, impact on uncontrolled comparable companies, and treatment of government subsidies by controlled parties and uncontrolled comparable companies. The OECD also provided observations concerning the potential impact of the pandemic on advance pricing agreements (APAs), including APAs still being negotiated as well as APAs that were already executed and in effect during the pandemic.

Compliance is an ever-growing burden, especially for hospitality companies with operations in scores of jurisdictions. Global minimum taxes, local country report requirements, and increased focus from taxing authorities, all in the context of an unpredictable economic climate may mean that the time and technical demands related to managing tax and in particular TP compliance are much larger than in prior years. Headquarter resource challenges may mean that companies must address these tax demands with a limited in-house tax team, or a hybrid team comprising an in-house team, temporary or new team members, and consultants. This can be challenging at the best of times, and perhaps more challenging when teams are working remotely.

These tax change management challenges are further compounded by the fact that we have a changing global tax landscape. Tactical steps such as contract rationalisation, pricing analyses, and TP reporting are all still very important steps. But for many companies in the hospitality industry, it is important to step back and consider the post-COVID landscape, revisit and ‘right-fit’ the global tax strategy to the changing business.

Airlines

While the hospitality industry is making strides in managing required COVID-19 transitions airlines continue to face challenges as the pandemic continues to erode customer activity, trust, loyalty, and expectations.

With several COVID-19 variants in play, challenges regarding physical limitations and social distancing requirements, and evolving government directions regarding safety, airline travel may take some time to return to the levels required to turn a profit. Bargain pricing, and the promise of no-penalty refunds may not be effective long-term solutions to attracting customers and engendering loyalty. There are some changing fundamentals to consider: business travel may take some time to return to pre-pandemic levels as major business customers consider restricting or discouraging travel for both health and cost reasons. The rediscovery of auto travel may have a significant impact on leisure customers’ demand for airline seats.

Reduced investment in new equipment may challenge maintenance budgets on older equipment and further challenge the trust and loyalty of both customers and employees. Addressing continued expectations around cleaning may also challenge operating budgets. Customer preferences towards a touchless electronic passenger experience may be difficult to address given investment challenges.

What can the future of airlines look like? There may be consolidations and restructuring, but there may be opportunities, as well. With a robust change management plan focusing on critical areas, including re-envisioning the customer journey, rationalising routing algorithms; challenging the operating model, and creatively reinvesting, the industry can evolve to a more bespoke model that provides quality service, premium pricing, and customer and employee loyalty.

Some airlines are experiencing tax losses. Thus, income tax considerations may not be an immediate priority. However, there are available tax attributes, credits, tax refund opportunities, and government incentives and subsidies that sometimes can be monetised.

While 2017 US legislation created a number of opportunities for airlines that are still available including bonus depreciation, more flexible net operating loss utilisation, excise tax holidays, improved interest deduction opportunities, property tax opportunities, training grants, and wage subsidies, proposed new legislation may also present tax opportunities such as enhanced ability to monetise certain credits and incentives related to decarbonisation and sustainable aviation fuels and risks such as the possibility of a minimum tax based on book earnings.

Conclusion

It is clear that COVID-19 has acted as an industry-wide catalyst for reevaluating operational priorities, investment strategies, and most importantly, customer and employee experiences. As business changes occur, companies must evaluate and align financial and tax management strategies accordingly.

Click here to read Deloitte's TP Change Management in Industries guide

Jacqueline Doonan |

|

|---|---|

|

Partner Deloitte US T: +1 415 783 5651 Jacqueline Doonan is a national partner in Deloitte’s US TP practice and the global TP leader of the transportation, hospitality, and service industry sector. She is also a member of the Deloitte Neuroscience Institute focusing on the neuroscience and psychology of consumer behaviours and choice. Jacqueline has managed hundreds of projects for Fortune-500 multinationals, including cost-segregation analyses, pricing automation, business/tax optimisation planning, intangibles valuations, and acquisition negotiations. She has represented taxpayers in TP disputes with tax authorities in numerous countries and has negotiated APAs in several countries. Her valuation experience covers a broad range of intangibles including, consumer and industrial brands, systems, processes, patents, and technologies associated with, integrated circuits, testing and calibration equipment, financial software algorithms, user interface display and design, database search and sort algorithms, database hierarchical design and storage, gaming algorithms, semiconductor capital equipment, pre-clinical efficacy models, genome sequencing, single molecule detection, and others. Jacqueline has authored numerous articles and is a frequent speaker on TP. She has been recognised by clients and peers as a leading TP practitioner globally for 21 consecutive years and has also been recognised annually as one of the World’s Leading Women in Business Law. |

Randy Crooks |

|

|---|---|

|

Manager Deloitte US T: +1 312 486 0886 Randy Crooks is an engagement manager within Deloitte Consulting’s customer and marketing practice, specialising in customer strategy and applied design. Randy brings deep experience working with a broad range of global clients across the travel and hospitality, retail & consumer products, and technology industries to drive innovative growth and transformation efforts. He specialises in advising clients on customer loyalty, product strategy, pricing analytics, and user experience to maximize impact. Randy is a leader in Deloitte’s Loyalty Modernisation practice, overseeing the development of innovative thought leadership on the future of loyalty and advising clients on leading practices to design and deploy effective loyalty programmes across a variety of industries. Randy works with clients to understand the disruptive trends impacting their business and architect effective loyalty strategies to achieve their goals. Randy received a master’s degree in Strategy and Marketing from the Kellogg School of Management at Northwestern University and a Bachelor of Science in International Political Economy from the Walsh School of Foreign Service at Georgetown University. |

John Breen |

|

|---|---|

|

Managing director Deloitte US T: +1 20 2220 2113 John Breen is a tax managing director at Deloitte Tax LLP. He has more than 20 years’ experience handling complex TP matters. He specialises in TP planning and controversy matters, attribution of profits to permanent establishments, and treaty-related issues. John served for 10 years in the TP branch (Branch 6) in the Office of Associate Chief Counsel (International), IRS, including service as senior technical reviewer and later as branch chief. While in the IRS Office of Chief Counsel, he served for five years as a US delegate to OECD Working Party 6. Before joining Deloitte, he was counsel at a national law firm, where he focused on TP, APAs, and related matters. John holds a bachelor’s degree from Cornell University, a JD degree from the University of Georgia School of Law, and a master’s degree in tax from Georgetown University Law Centre. He is a member of the District of Columbia Bar. |