Following our last article on Hainan Free Trade Port (Hainan FTP) published in September 2020, remarkable achievements have been made. These include the rapid launch of Hainan FTP policies for the liberalisation and facilitation of trade and investment, taxation and the free flow of cross-border investment, talent, and materials.

Some key 2021 metrics of progress in Hainan FTP include:

11.2 % GDP growth - ranking #2 amongst China provinces (China's GDP growth was 8.1% in 2021);

16.2% growth in deployed foreign capital;

92.6% growth in newly established foreign invested enterprises;

Hainan FTP Law took effect from June 10 2021, and 15 sets of associated regulations have since been issued;

Over 150 detailed measures implemented in relation to market access, the free flow of trade and funding support;

Successful opening of China’s 1st International Consumer Products Expo; and

Over CNY60 bn sales in the offshore duty-free market, with YoY growth of 84%.

Hainan FTP has several unique features to its tax regime, relative to the standard mainland China tax rules. These are the four pillars of ‘zero-tariffs’, ‘lower tax rate’, ‘tax regime simplification’ and ‘tax reinforcement’ and they have been pushed forward in parallel. Since 2020, 11 sets of Hainan FTP detailed tax measures have been announced in relation to ‘zero-tariffs’ and ‘lower tax rate’:

Six sets in 2020, covering the tourist shopping policy for the offshore duty-free market, the “double” 15% income tax policy for both companies and individuals (standard China marginal rates are 25% and 45%, respectively), zero-tariff list for raw materials and transportation vehicles, and preferential VAT policy for international vessels; and

Five sets in 2021, including zero-tariff list for self-used manufacturing equipment, and the bonded fuel policy in Yangpu district

As emphasised in the 2022 Government Report of Hainan Province, the year of 2022 is a critical preparation year for Hainan FTP for the island seal-off (i.e. Hainan island will be treated as outside China’s customs border) no later than January 1 2025. One of the highlighted tax tasks is ‘tax regime simplification’ before the seal-off, among which the streamlining of current indirect tax (i.e. VAT, consumption tax, vehicle purchase tax and local levies) into sales tax plays a rather substantial role.

In the Hainan FTP master plan, it is explicitly stipulated that the consolidation and streamlining of the abovementioned indirect tax will take place at the same time of seal-off, where sales tax will be imposed at the final B2C stage only.

Before the seal-off, general importing into Hainan is subject to customs duty, import VAT and in some cases also consumption tax (CT). After the seal-off, no more VAT and CT for imports together with ‘zero tariff’ treatment, and with the launch of sales tax at B2C stage is considered to facilitate liberalisation of trade and investment.

Five-into-one transformation to sales tax is not simply adding-on and moving the total tax burden forward, but to create a brand-new category of tax bring along tremendous impact and benefits to all stakeholders. The tax authority is expected to enhance collection efficiency with the regime simplification, while manufacturing plants in Hainan FTP will be free of the current indirect tax burden with easier tax management and lower tax cost.

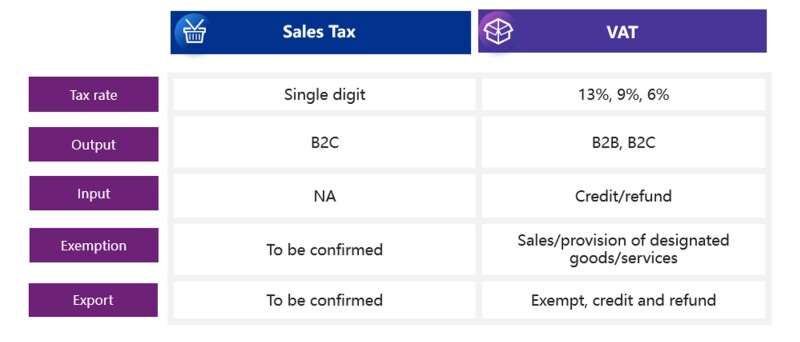

Based on our understanding, we uplifted the veil a bit to see the major differences between sales tax and current VAT:

This is another significant transformation of indirect tax since the nationwide VAT reform from 2012 to 2016. Based on our experience in advising our clients during the VAT reform, similar questions are yet to be answered for this sales tax scheme:

How to determine the B2C transaction? Sometimes it is quite difficult by the supplier to tell at the time of the transaction. Take a hotel for example, the accommodation services could be for business or for personal leisure purposes.

Are there any special sales tax treatment for cross-border sales or service provision, in particular those between Hainan and the mainland?

For the seal-off of the entire island, Hainan will launch a new customs clearance operation adopting an import and export management system featuring free flow between the ‘first line’, which links the overseas market to the island, and the ‘second line’ connecting the island to the mainland market, with efficient controls.

For the seal-off of the entire island, Hainan will launch a new customs clearance operation adopting an import and export management system featuring free flow between the ‘first line’, which links the overseas market to the island, and the ‘second line’ connecting the island to the mainland market, with efficient controls.

For sales of goods from Hainan sellers to mainland buyers, the principle is set up in the Hainan FTP Law that it shall be treated as imports. It is generally interpreted that the mainland buyer declares at the customs for duty and import VAT/CT as everyone does for importation from overseas. In this case, it is to make sure that the VAT chain will not be broken within the mainland domestic market. It is not clear now that in this case, whether the Hainan seller is subject to sales tax for such cross-second-line transaction as it is B2B in nature.

Are there any grandfathering measures to take care of creditable input VAT balance at the time of seal-off? Infrastructure development in Hainan (such as airport, harbour, highway, and warehouses) is under great boost-up before the island seal-off. It is known to all that the construction projects are with heavy capex. As the seal-off will take place in three-year time the longest, most likely during this period a large amount of input VAT will be retained by the project owner. It is critical for policy maker to consider a set of proper transitional measures to release their funding pressure, such as a one-off excess input VAT credit refund or creditable again sales tax in a certain period of time afterwards. It remains to be seen how to proceed.

What can we do for our ongoing and new contracts to avoid indirect tax leakage as much as possible before the seal-off? Are there any legal terms to be considered and incorporated into our contract template?

Consolidation of indirect tax will kick off the entire simplification process of the tax regime in Hainan FTP. Further detail on the implementation of these initiatives is set to be released soon.

Nicole Zhang

Partner

KPMG China

T: +86 898 6525 3230

Nicole Zhang is a tax partner in KPMG China and is also the partner-in-charge for KPMG’s Hainan business.

Nicole has over 15 years of experience in providing tax planning, corporate restructuring, due diligence, commercial and tax planning for business operations, tax-related forex management and other consulting services. She provides professional insights to both multinational and domestic enterprises in the area of corporate restructuring, listing, tax compliance review, and due diligence. She has been providing tax advisory services related to VAT reform since 2012.

Nicole has abundant experience in the field of replacing business tax with a VAT on the real estate industry. She is familiar with the tax administration informatisation requirements for large holding group and real estate projects.