The complexity of the global tax environment has significantly increased in the last years, amongst others with the local implementations of the OECD’s BEPS Action Plan, ATAD I and ATAD II or the OECD’s 2020 Transfer Pricing Guidance on Financial Transactions. As these changes were generally not supplemented by clear administrative guidance and/or case law, they result very often in more uncertainty for taxpayers, including in transfer pricing (TP) matters.

This article focuses on how taxpayers could handle such uncertainty, or the unfavourable results thereof, in their TP matters by either avoiding challenges from local or foreign tax authorities in advance through the filing of an advance pricing agreement (APA) or ex post by engaging into a mutual agreement procedure (MAP). Obviously, a robust TP documentation that correctly reflects both the contractual relationships and the economic realities in the controlled transactions remains an absolute pre-requisite.

APAs to eliminate double taxation

The legal framework

The OECD defines an APA as “an arrangement that determines, in advance of controlled transactions, an appropriate set of criteria for the determination of the TP for those transactions over a fixed period of time” (OECD TP Guidelines, 2022, paragraph 4.134). An APA can have different forms as described hereafter (Annex II to Chapter IV of the OECD TP Guidelines):

Unilateral APAs that involve only the taxpayer and the tax authorities of the taxpayer’s country of residence. Unilateral APA are exclusively governed by domestic legislative requirements (e.g. in Luxembourg, unilateral APAs are governed by § 29a of the General Tax Law, supplemented by the grand-ducal decree dated December 23 2014) and only affect the purely national dimension of the transaction; and

Bilateral and multilateral APAsthat involve the taxpayer, the tax authorities of the taxpayer’s country of residence, as well as the tax authorities of the other countries impacted by the transactions. Bilateral/multilateral APAs are most often, although not necessarily, concluded under the MAP of applicable double tax treaties and rule on the tax or TP treatment of the transaction in the residence country of the taxpayer and the other country/countries concerned.

Unilateral APA are generally of limited use for cross-border transactions, since the risk of a challenge from the tax authorities of the other concerned countries is not avoided as only the local tax authorities are legally bound by the APA. The risk may however be removed by bilateral and multilateral APAs. Prior to initiating the process, taxpayers should however verify whether the local legislations of the concerned tax authorities foresee the possibility of bilateral and/ or multilateral APAs and whether the relevant tax authorities are willing to engage therein. Indeed, tax authorities are usually not legally obliged to pursue APAs. The formal conditions as well as the necessary information to be provided should be carefully reviewed in advance (e.g. in Luxembourg the procedure is quite straightforward and starts with a written request to the tax authorities, supplemented by the relevant documentation). Finally, the country in which the APA should be initiated must also be considered.

In case of success of the APA procedure, the risk of a double taxation should be definitely removed, which provides legal certainty and hence foreseeability as to the final tax treatment in advance, which is more convenient then an ex post solution (i.e. a MAP). However, it has to be noted that it is a lengthy procedure that may take usually 3-5 years, without any specific time limit being imposed. Furthermore, the tax authorities engaged in the process are not obliged to come to a final agreement.

APA trends

Statistics may be found in a dedicated report of the EU Joint Transfer Pricing Forum (European Commission (March 2021) – Statistics on APA’s (Advance Pricing Agreements) in the EU at the End of 2019):

Increase of the total number of APAs: at the end of 2019 1041 (intra-EU) and 593 (EU/non-EU) were in force, compared to 726 and 515 respectively in 2018, representing an increase by 43% and 15.1% respectively;

Unilateral APAs remain the standard: Unilateral APAs are far from disappearing and remain the standard in Europe, at least as of 2019, given the slight decrease of bilateral/multilateral APAs in force at year-end 2019 (i.e. 17.5%) compared to 2018 (i.e. 21.8%). The number of bilateral / multilateral APAs continued to increase at a slow path (i.e. from 271 to 286 cases), confirming a long-term trend.

APA requests are concentrated in a few countries: Belgium is the country which has the highest number of EU/non-EU APAs in force in 2019, i.e. 827 out of 1634 in total, representing 50% of all EU/non-EU APAs in force in 2019 in member states. Furthermore, out of 28 member states, the top five account for approx. 80% of all APAs;

Average time in months to negotiate an APA is highly variable: The average time in months to negotiate APAs reduced slightly from 32.3 months in 2018 to 32.1 months in 2019 for APAs between EU jurisdictions. For APAs between EU jurisdictions, the range lies between 16 months (Luxembourg) and 47 months (Sweden), whereas for APAs involving non-EU jurisdictions, the range lies between 16 months (Hungary) and 72 months (Sweden).

MAP

The legal framework

A MAP can be initiated under the following instruments:

MAP clause in a double tax treaty (DTT);

Council Directive (EU) 2017/1852 of October 10 2017 (Directive); and

Arbitration Convention (EU) 90/436/EEC of July 23 1990 (AC).

DTT – Article 25 of the OECD Model Tax Convention

The MAP is laid down in Article 25 of the OECD Model Tax Convention and allows competent authorities of the contracting atates to resolve situations (i) where taxpayers are not taxed in accordance with the provisions of an DTT or (ii) where difficulties or doubts arise as to the interpretation or application of the DTT. Taxpayers may initiate the MAP process when the actions of one or both of the contracting states have resulted or would result in double taxation.

|

|

“A robust TP documentation that correctly reflects both the contractual relationships and the economic realities in the controlled transactions remains an absolute pre-requisite.” |

|

|

According to Article 25 of the OECD Model Tax Convention, the case must be presented by the taxpayer within three years from the first notification of the action that gives rise to double taxation. It has to be noted that the MAP may however be initiated by the taxpayer as soon as the actions of one or both contracting states will result in a taxation that does not comply with the DTT and that such taxation appears as a risk that which is not merely possible but probable (OECD Income and Capital Model Convention, Commentary on Article 25, No.14). The formal conditions should obviously be checked in advance, as these may vary from one country to another (e.g. in Luxembourg the procedure is set forth in the Circular Letter L.G. – Conv. D. I. 60 dated March 11 2021).

Assuming the local legislation follows the OECD’s arm’s-length principle, the tax authorities should verify whether a unilateral corresponding adjustment may be granted to resolve the double taxation and if so, to which year it may be attributed (the year in which the controlled transactions giving rise to the adjustment took place or to an alternative year, such as the year in which the primary adjustment is determined – OECD TP Guidelines, 2022, paragraph 4.36). Subject to the limits of domestic tax law, the OECD TP Guidelines recommend reopening taxation for the years in question. This being said, certain countries’ legislation only allow for an upward adjustment, but not for a downwards adjustment, which then excludes the granting of a unilateral corresponding adjustment.

If no corresponding adjustment may be granted, the tax authorities should contact the competent authority of the other State(s) and try to find a mutual agreement to solving the dispute.

Although most of the MAP lead to a successful outcome, it has to be noted that, unless the DTT provides otherwise, the tax authorities are not obliged to resolve the double taxation.

The Directive

The Directive provides for a binding procedural mechanism with set timelines and taxpayer safeguards for resolving disputes between EU member states.

Under the Directive, the filing of a complaint must be made within three years from the notification of the action resulting in the question in dispute. The relevant tax authorities will have a time limit of two years, with a possible one-year extension to find a binding an enforceable agreement otherwise an Advisory Commission will be seized with the obligation to render an opinion within six months. The relevant tax authorities will have a time limit of six months with a possible three-month extension to take a final decision (for further details in selected EU member states, please refer to “Tax Dispute Resolution, A commentary on the EU Council Directive 2017/1852”, Wolters Kluwer 2020).

Although the Directive leads to a binding outcome, its application remains limited to the EU members states.

The AC

The AC provides for a unilateral corresponding adjustment and/or a MAP supplemented with an arbitration procedure which typically impose a binding obligation to eliminate the double taxation. Under the AC, a complaint must be filed within three years from the notification of the action resulting in the question in dispute. This filling may occur irrespective of the existence of any domestic remedies and shall be notified to the other state. If no agreement is found within two years, then an advisory committee is seized with the obligation to come to a binding solution within six months.

The AC provides for a binding outcome but may not be applicable if legal/administrative proceedings have resulted in a final ruling giving rise to a ‘serious penalty’, which is not clearly determined and leaves room for interpretation. Furthermore, certain countries seem not to accept MAPs under the AC to avoid being bound by the committee’s decision.

MAP trends

Based on the outcome of the peer review for the year 2020 covering 118 jurisdictions, the OECD has reported the following trends:

MAP requests are concentrated in a few countries: out of 118 jurisdictions, the top 25 account for 95% of all MAPs, the remaining 5% being split among 40 jurisdictions. Overall, approx. 5000 new cases were started in 2020, out of which 2400 were TP cases;

MAP inventory increases: the number of open TP cases in 2020 increased by 33% since 2016;

Slight increase in TP cases closed: the number of TP cases closed has increased by 6% since 2016;

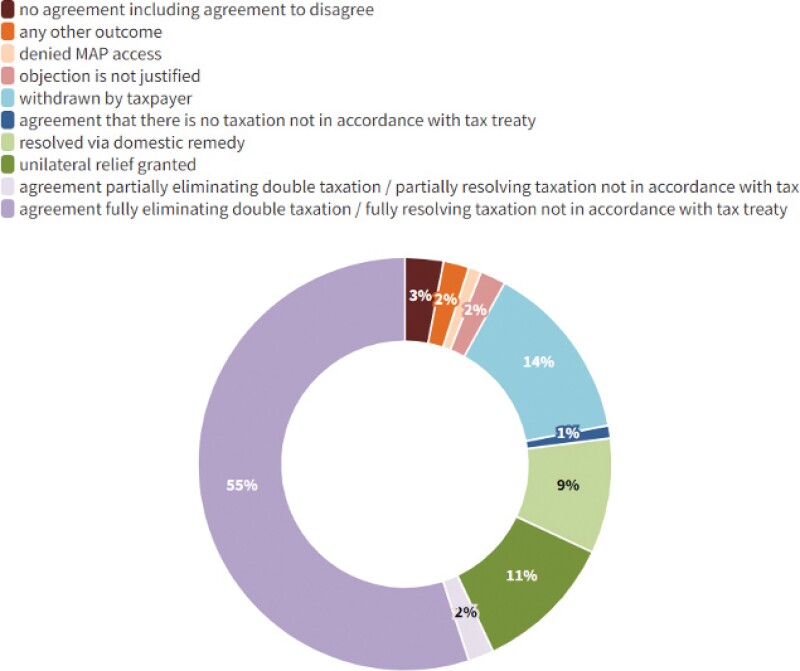

Positive outcome:77% of the MAPs concluded in 2020 resolved at least partially the double taxation in TP cases. This figure is slightly lower than in 2019 figure (85%). This slight decrease may be due to the COVID-19 pandemic. (See Figure 1.)

MAP remains a lengthy process: the MAP cases closed in 2020 showed that, on average, TP cases took 35 months (up from 31 months in 2019) and other cases took around 18 months (22 months in 2019). Some jurisdictions experienced delays, particularly for more complex cases. While it is not possible to estimate the time needed to close pending cases, the data shows that around 15% of the 2020 inventory relates to cases that have been pending for at least five years.

Figure 1

Source: OECD 2020 Mutual Agreement Procedure Statistics

Conclusion

The above-mentioned statistics look quite favourable for the use of bilateral/multilateral APA and MAP. Unilateral APA also seem to remain quite popular, although their scope and hence their protection is limited to the purely domestic TP treatment.

As always, there is no ‘one size fits all’ solution and every case needs to be individually analysed based on the countries involved, their legislation and the attitude of their tax authorities. However, both the bilateral/multilateral APA and the MAP option may provide reasonable solutions to avoid double taxation and the lengthy processes as well as the associated costs may be rewarding at the end. Hence, they should be duly considered at the outset of the implementation of significant cross-border transactions.

Choosing between an APA or a MAP depends of course on the availability of either option, but as a general rule, it seems that applying for an APA ex ante may be the preferred route: if the APA negotiations fail, the taxpayer could still apply for a MAP ex post, ideally under the Directive or the AC in order to obtain a binding agreement.

Click here to read all the chapters from ITR's TP Special Focus

Alain Goebel |

|

|---|---|

|

Partner Arendt & Medernach T: +352 40 78 78 512 Alain Goebel is a partner with Arendt & Medernach. He advises international clients on the tax and TP aspects of Luxembourg and cross-border transactions, focusing on corporate reorganisations, acquisitions and financing structures. Alain has been a member of the Luxembourg Bar since 2002. He acted as president for the Young IFA (International Fiscal Association) Network between 2013–2016 and as Luxembourg’s national representative for the International Association of Young Lawyers (AIJA) between 2012–2015. Alain holds a master’s degree in business law and a postgraduate degree in tax law from Paris 2 Panthéon-Assas University, as well as a LLM in banking and finance law from King’s College London. He has worked as a lecturer in business taxation at the University of Luxembourg from 2009-2016 and is a regular speaker at tax seminars. He has published several papers on tax law, including national reports for IFA and AIJA. |

Danny Beeton |

|

|---|---|

|

Senior TP economist Arendt & Medernach T: +352 621 395 102 Danny Beeton is senior TP economist with Arendt & Medernach. Danny advises clients on the determination of arm’s-length prices for all types of related party transactions, including goods, services and intellectual property, but with a special focus on financial transactions such as loans, guarantees, group treasury policies and asset management fees. His assistance is often sought in the context of TP compliance and reporting, controversy and planning, and he has provided expert reports in the context of litigation. Danny holds a master’s degree in economics from the University of Essex as well as a PhD in economics from the University of London. He has been a member of two HMRC advisory committees, and committees of the Confederation of British Industry and the Chartered Institute of Taxation. |

Benjamin Tempelaere |

|

|---|---|

|

Senior associate Arendt & Medernach T: +352 40 78 78 7684 E: benjamin.tempelaere@arendt.com Benjamin Tempelaere is a senior associate with Arendt & Medernach. He specialises in TP. Benjamin advises institutional clients and multinational companies on the pricing of all types of transactions and the valuation of intangible assets, with a particular focus on financial services and asset management. Before joining Arendt & Medernach in 2015, he worked as a TP consultant for two Big Four companies in Luxembourg and France. Benjamin holds a master’s degree in Management and a Master of Science (LLM) in legal and tax management from EDHEC Business School as well as a master’s degree in business, tax and financial market law from Paris-Saclay University. |