The OECD, in collaboration with 141 countries that are part of the OECD/G20 Inclusive Framework on BEPS, designed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (the Multilateral Instrument, or MLI) as part of the BEPS project to swiftly modify the income tax treaty network of parties to the MLI.

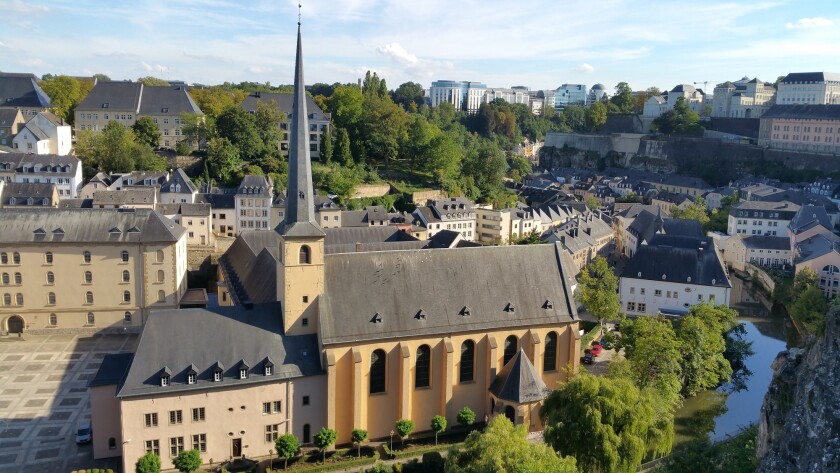

Unsurprisingly, the current state of play of income tax treaties (treaties) in real estate (RE) investments may be affected by the MLI. Deloitte’s Austrian, German, French, Luxembourgish and Polish RE tax experts explored the impact of the MLI on a common investment structure where investors pool money in a fund that in turn invests in a holding company (HoldCo) that will invest in local property companies (PropCos) or directly in RE assets, depending on commercial needs.

This article is part of a trio of articles that will analyse the impact of the MLI on RE investments in these jurisdictions, focusing on the provisions that are pivotal to the application of tax treaties in an RE investment context; namely, Article 3 (transparent entities), Article 5 (switch-over clause) and Article 9 (land-rich clause), without forgetting Articles 6 (purpose of the treaty) and 7 (prevention of treaty abuse).

Specifics per country

The five countries within the scope of the study have signed and ratified the MLI. However, not all their treaties should be considered covered tax agreements (CTAs) for the purpose of the MLI. France has decided to cover all its bilateral tax treaties, while Luxembourg and Poland have chosen to cover almost all theirs, and Austria has decided to cover about a third.

Surprisingly, Germany decided to cover only 14 of its 98 in-force treaties and chose a reservation under Article 35(7) of the MLI. To bring the MLI into effect for a particular CTA, Germany must notify the OECD when it has completed its internal procedures, instead of the effective date automatically being set following a specified period after the MLI has entered into force for each of the agreement’s contracting jurisdictions.

In Germany, anti-treaty-shopping rules override tax treaties as they are implemented by regular law. So, in addition to the specific internal procedures, this legal hierarchy may also explain Germany’s limited appetite for the MLI. As a result, most of the treaties concluded by Germany will not be affected by the MLI. In particular, the MLI will not apply to the treaty between Germany and Poland.

In addition, the MLI may not necessarily apply to the most recent tax treaties. Notably, France and Luxembourg have decided not to cover their in-force treaty as it is considered BEPS-compatible. However, the MLI applies to previous treaties between France and Luxembourg. Thus, these countries are showing their willingness to make their full treaty network BEPS-compatible.

Minimum standards

The MLI provides for minimum standard provisions that apply to the matching CTAs. Therefore, the treaty preamble will state that the purpose of the treaty is “to eliminate double taxation with respect to the taxes covered by this agreement without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance” (Article 6). The prevention of treaty abuse is also part of the minimum standards (Article 7) that contracting states to the MLI must implement. Article 7 provides for a choice of method to fight treaty abuse, including:

A principal purpose test (PPT);

A PPT together with a simplified limitation on benefits provision (S-LOB); and

An LOB together with an anti-conduit provision.

Austria, France, Germany, Luxembourg and Poland (as an interim measure) have chosen the PPT as the most flexible provision to fight treaty abuse. Hence, this provision will apply among those countries.

A flexible mechanism of reservations is defined for each article of the MLI, though it is less flexible for the minimum standards. It introduces the possibility to opt out of a provision entirely or partially. Additionally, countries that have not opted for some MLI provisions can include them bilaterally (as Luxembourg and the UK did with the land-rich provision in their recently signed treaty). The impact of the MLI on the state of play in RE investments should thus be analysed provision by provision.

Deloitte’s detailed analysis in subsequent editions of ITR will cover transparent entities, the switch-over clause and the land-rich clause.

The authors would like to thank several Deloitte colleagues for their contributors to this article: Sarvi Keyhani (France), Daniel Blum (Austria), Dr Alexander Linn (Germany), Benedikt Pignot (Germany), Piotr Maculewicz (Poland), Michal Siekierzynski (Poland) and Rafael Lourenço (Luxembourg).