Supply Chain management is aimed at examining and managing Supply Chain networks. The rationale for this concept is the opportunity (alternative) for cost savings and better customer service. An important objective is to improve a corporate’s competitiveness in the global marketplace in spite of hard competitive forces and promptly changing customer needs.

Supply chain management is one of the main keys to success within the automotive industry but at the same time one of the most critical elements in these times of global crisis.

Two years of the COVID-19 pandemic and geopolitical tensions across the world have taken their toll on the global economy and the automotive industry. In particular, microchip shortages, devastating logistics capacities, and energy price peaks as a result of high demand and low supply on the markets are causing a nightmare for suppliers and original equipment manufacturers (OEMs).

The industry is hit by external price shocks in various ways. Material and component prices soar as supply chains are disrupted. While many other industries continue to generate positive earnings so they might come away quite lightly from the situation, the challenges for the automotive industry will possibly persist for a long time and require a general rethinking towards higher flexibility of its supply chains.

Even before the pandemic, the automotive industry had been threatened with the prospect of having to fundamentally redesign its business models as a result of growth in the electric vehicle market requiring new activities in supply chain management. The transformation of mobility comes along with huge challenges for each member of the automotive industry, spanning from a partially new definition of the business model to an efficient and risk-optimised adaptation of the transfer pricing model.

In the following, the authors will analyse the effects of the current disruptions on supply chain management, evaluate such challenges from a transfer pricing perspective, and give recommendations for actions to transfer pricing experts in the automotive industry, outlining the business areas that need to be considered.

Macroeconomic and geopolitical shocks

The following challenges, among others, are forcing the automotive industry to set up its supply chain management in as agile a manner as possible to increase resilience to present and future shocks:

Raw material price increases and shortages;

Loss of manufacturing capacities;

Disruptions in transportation routes/logistic bottlenecks;

Increased energy prices;

Heavily fluctuating currency exchange rates;

Monetary tightening and interest rate increases; and

Lockdowns due to the COVID-19 pandemic occurring irregularly but suddenly.

Considering the disruptions mentioned above, automotive companies are busy with securing their delivery capability, are forced to make strategic decisions on how to cope with the challenges considering the overall business strategy, and need to ensure agility throughout the processes along the value chain and decrease their dependencies on third parties where possible.

A very important aspect is finding alternative suppliers to prevent shortages of material, which has a large impact on the supply chain. Alternatively, make or buy decisions again become important, with an even bigger impact on transfer pricing models.

Impact of disruptions to the value chain

The value chain of the automotive industry is affected by the current macroeconomic and geopolitical shocks at each stage. In the following, the previously mentioned challenges and their impacts on a commonly known value chain of the automotive industry are analysed further.

Figure 1: Common value chain in the automotive industry

1. R&D

If the material is not available, and no substitution is available, this may lead to the involvement of the R&D department to revise product lines and find new solutions with the available material.

2. Disrupted purchasing processes

Supply chain management and purchasing in disrupted times require resilience to the various external economic shocks.

If parts and input materials are not available at all or not in the quantity or quality, or at the time they are needed, challenges are posed to the procurement department as it needs to find alternative suppliers to avoid disruptions in the production process. If the supply of the required material is possible, this is usually at higher cost and has an impact on the supply chain itself, as well as on the overall profitability of the company.

3. Manufacturing

With regard to the manufacturing process, the scarcity of material can lead to slowing down the production or even bring the production to a complete stop. Some automotive companies were even forced to close or relocate production plants, leading to the risk that recurring losses of a supplier will force them into insolvency.

In general, production sites are designed for constant utilisation and not for situations where continuous tweaks are required (source: Deloitte publication (03/2020): “Neustart der Produktion und des Zuliefernetzwerks meistern”).

Ensuring transparency of the supplier network and assessing the situation quickly is key for a smooth production process and has become part of daily business, reflecting the current challenges due to the geopolitical situation, a scarcity of material, and the pandemic. This may also lead to localising steps in the value chain or insourcing steps along the supply chain to decrease the dependence on third parties, where possible.

4. Logistics

The effect of delayed production and production downtimes is quite substantial as just-in-time or just-in-sequence deliveries to customers are at risk and may also cause breaches of contracts and resulting compensation payments.

As a result of a disrupted production process, logistics are also impacted by longer shipping times and a sharp increase in freight costs due to rising fuel costs and delivery routes not being accessible. These factors may also lead to localising steps in the supply chain and decreasing the dependence on third parties.

5. Marketing and sales

With regard to marketing and sales departments that are usually directly interacting with the customer, the current challenges are to give reliable predictions on delivery periods while constantly dealing with new disruptions that lead to products not being available to the customer any more. This could result in, for example, OEMs not being able to provide the vehicle as originally promoted or configured by the customer, leading to frustration in the customer experience.

Order processes need to be adjusted or run all over again, with adjustments and delays creating an administrative burden for all parties involved. This requires a constant exchange with procurement departments on the availability of particular products and possible substitutes for parts unable to be supplied to customers.

From a supplier perspective, disruptions in the value chain of OEMs pose additional challenges. If an OEM only irregularly buys material from a supplier or changes its requirements frequently, this has a strong effect on the supply chain of the supplier itself. Fluctuating demand of material results in uncertainties in the planning, production, and sales functions of the supplier and can have severe economic consequences for the supplier.

6. Aftermarket business

As a result, the aftermarket business of OEMs and the used-vehicle market is gaining more importance as the availability of new vehicles decreases due to the pandemic and the microchip crisis. This leads to increased prices in all areas of the aftermarket business.

A slowdown in the production of new vehicles also decreases the number of used vehicles available on the market (fewer rental cars, company cars, etc. being available on the used vehicle market quite early), which is also affecting sales prices.

However, as the demand for used vehicles rises, spare parts and materials required for the maintenance of used cars increases, making the aftermarket business a focal point for OEMs.

As a conclusion, supply chain management, with its objective of maintaining competitiveness in the face of market trends and changes in consumer needs, must analyse the present challenges and the available supply chain data to foresee bottlenecks and ensure the flow of goods and services along the stages of the value chain and between the subsidiaries involved.

This shows the importance of supply chain management as an early-stage contributor to the overall success of OEMs and suppliers in disrupted times like these.

TP impacts

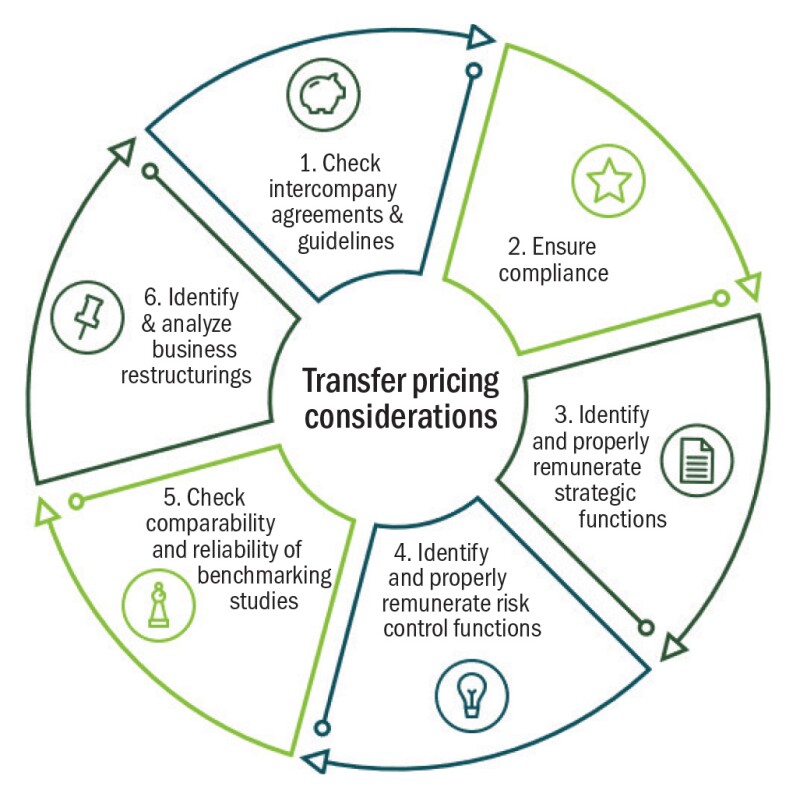

From a transfer pricing perspective, the disruptions along the supply chain raise various organisational and operational challenges. The authors will discuss these, along with recommended actions, in the following:

Figure 2: Transfer pricing cycle and considerations

1. Check intercompany agreements and guidelines

It is important to ensure that intercompany agreements are properly reflecting the behaviour of the contractual parties and ensure agility to a certain extent. If the responsibilities or the value added by certain intercompany services have changed, or if material deviations from the original terms and conditions are necessary, it might also be important to amend remuneration schemes or the like.

Additionally, transfer pricing guidelines might have to be updated in line with any changes in the operational transfer pricing system.

2. Ensure compliance

From a compliance perspective, all the above-mentioned aspects leading to changes in the transfer pricing system or remuneration scheme will need to be well documented in transfer pricing reports. This is particularly the case when major changes of a group’s operations are planned; for example, a relocation of manufacturing capacity, new service provisions, or the provision of financial guarantees or funds.

The relevant taxpayer also needs to consider mandatory disclosure rules (MDR), which are implemented by many countries aiming at increasing transparency regarding aggressive cross-border tax planning that would be perceived as such by the tax authorities. It is important to implement policies and procedures to identify the transactions that may be seen as reportable arrangements, because the penalties can be very significant.

3. Identify and properly remunerate strategic functions

From a group perspective, strategic functions along the value chain need to be identified and remunerated accordingly. Strategic functions are those with a global impact on the overall value chain and with an important risk control aspect over strategic risks, which may not only affect operational performance but the long-term direction of a business model.

The current and future function and risk profile of legal entities within a group of automotive entities needs to be re-evaluated with respect to the impact of the current macroeconomic and geopolitical shocks. As an example, the procurement function aims at maintaining supply chains and building an internal and external supplier portfolio to avoid strong dependencies.

When analysing the remuneration of the procurement function, it can be split into a strategic and operative role, which also applies to other functions along the value chain. The strategic role includes sourcing decisions for the group, also regarding the supplier portfolio, whereas the operative role of procurement focuses on the process of determining the needs and managing the supply from an administrative perspective.

During the current crisis, the strategic role of the procurement function gains higher importance and remuneration schemes might have to be revisited to account for this increase in value contribution. The question is whether a cost-based remuneration is still appropriate or if the strategic procurement function is entitled to a share of the residual profit. The higher costs on the level of routine entities may also be due to measures introduced at the group level to ensure the functionality and efficiency of the group during a disrupted environment.

As another example, the impact of higher cost bases for routine service providers and their profit elements should be in line with the risk control possibilities and a revision of their strategic importance. Then it must be concluded whether any adjustment on the remuneration is necessary from an arm’s-length perspective; be it an adjustment of the underlying cost base, the profit mark-up, or even an entitlement to a share of the residual profit or loss.

4. Identify and properly remunerate risk control functions

Another important strategic aspect to be considered during times like these from a transfer pricing perspective is the group’s risk management function.

The organisation of risk management includes defining processes, documenting risk control measures, implementing systems/tools, and continuously monitoring and mitigating potential risk factors to ensure quick reactions and a flexible set-up to avoid severe impacts on the supply chain. Such functions can gain enormous importance in times like these and be decisive for whether a group of companies makes profits or losses and also for who will be entitled to profits or have to bear losses resulting from a deviation of expected financial figures.

According to the OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations (OECD GL), the control over risk involves (i) the capability to make decisions to take on, lay off, or decline a risk-bearing opportunity, together with the actual performance of that decision-making function, and (ii) the capability to make decisions on whether and how to respond to the risks (OECD GL 2022, Chapter 1, Section 1.65).

In particular, groups that have implemented a strong price-setting mechanism will now face the question of who and how to implement price adjustments in the case of major deviations from forecasted financial figures. Risk management departments can be helpful in making this decision and might gain importance in the overall risk control management of their organisation.

5. Check comparability and reliability of benchmarking studies

Steering margins from intercompany transactions of entities that are routine in nature using the results from benchmarking studies is another challenge in disrupted times. The financial results from benchmark companies may not reflect the disruptions from current market threats as their financial KPIs are usually time lagged and might have to be considered incomparable to a current intercompany business relationship.

In addition, benchmarking studies usually disregard companies with permanent losses that in times of crisis could be considered to reflect the economic situation, or extend the period of the benchmarking study, manage and steer subsidiaries to the lower end of comparable results, perform capital adjustment calculations, include data from other comparable crises like the financial crisis in 2008–09, etc.

Neglecting the disruptive effects and steering a routine entity into a range of potentially incomparable benchmark companies may result in the entity earning overstated margins not in line with the value added by controlled parties within a group of companies.

6. Identify and analyse business restructurings with regard to compensation claims/exit taxes

All the above-mentioned challenges, and how multinationals are adapting to them, can lead to changes in the functional and risk profile of the separate legal entities, to business restructurings, or to temporary changes in their operational activities. Such developments need to be carefully reviewed from a transfer pricing perspective regarding a potential transfer of functions. Chapter IX of the OECD GL contains a detailed outline of how to review such cases and how to account for potential compensation claims if there are any.

Going forward, an agile and flexible business model being prepared for upcoming external shocks may include restructurings and production transfers along with the transfer of intellectual property (IP) more frequently. Whether the multinational’s internal policies and operational transfer pricing systems are properly prepared for such developments should therefore be thought through.

Summary

When implementing different measures to ensure resilient supply chain management considering all the challenges in the automotive industry, the aspects discussed above – such as ensuring compliance, analysing and remunerating strategic functions, the correct application of benchmarking studies, and the effect of business restructurings – need to be considered from a transfer pricing perspective.

More flexibility is needed in the management of intercompany agreements, and the economic pricing and valuation of functions and IP, as well as the implementation of such changes from an operational perspective.

It is to be assumed that the challenges in the automotive industry will not cease any time soon. This makes it even more important to properly review one’s value chain and supply chain activities, and evaluate the contribution each legal entity of the group makes, together with the risk controls it assumes. This will help to define and decide on necessary actions given an existing transfer pricing policy of a multinational group of companies.