The energy and resources (E&R) sector – which encompasses the oil and gas, mining and metals, and power and utilities subsectors – frequently experiences exogenous market shocks that can cause a ripple effect, given the pervasive influence of E&R on the broader economy.

Recent external shocks to the E&R sector’s supply chain have been amplified by war and a global pandemic. Transfer pricing responses to these recent shocks are relevant for the shaping of the future supply chain and ultimately how the E&R industry manages these challenges.

Price volatility

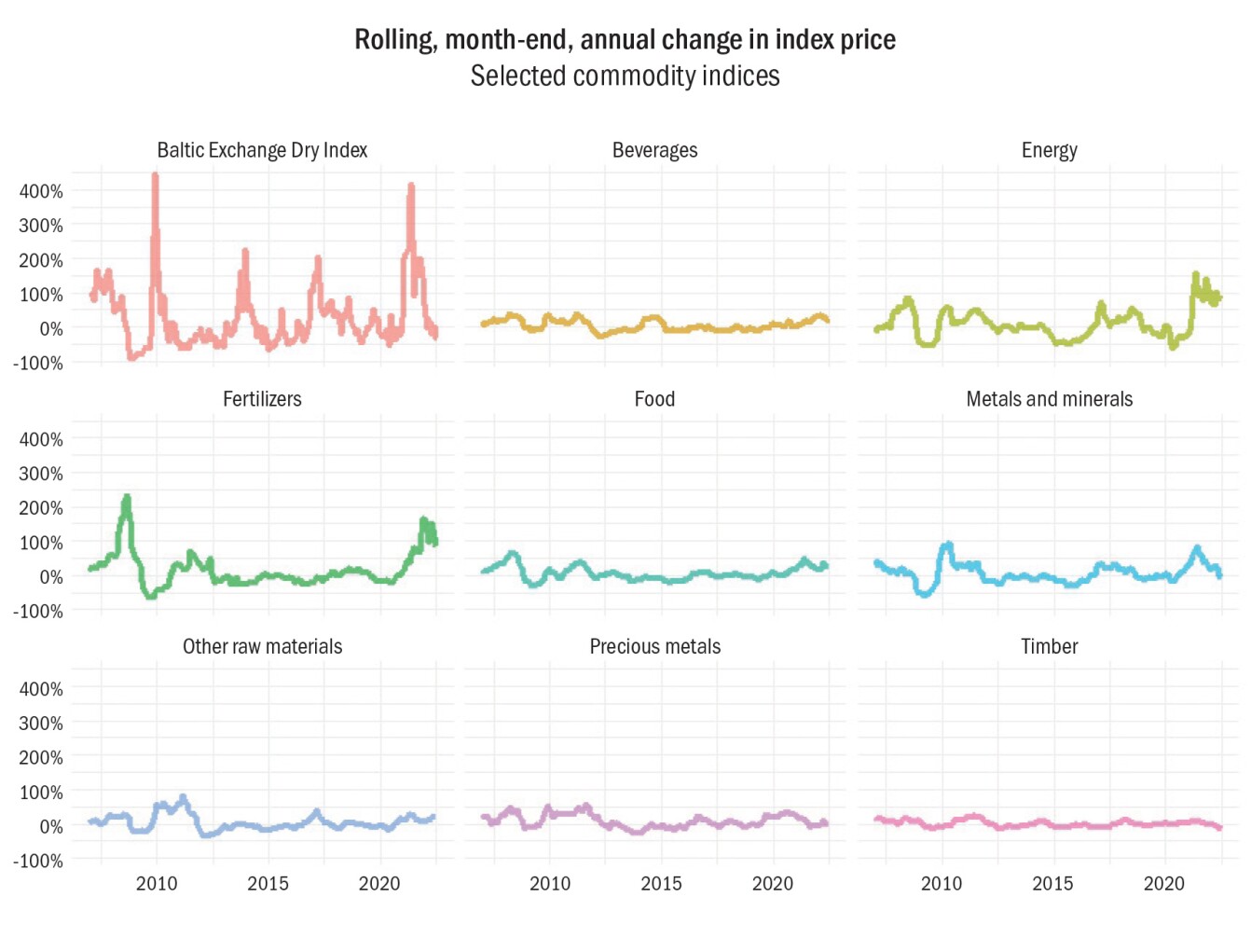

The industry has long been characterised by price volatility across many commodities, with volatility spiking from time to time, such as in the early days of the COVID-19 pandemic and after the start of the war in Ukraine, as evidenced in Figure 1.

Figure 1: Volatility in prices of commodities

Source: The World Bank: Commodity Prices Pink Sheets (July 2022) (except Baltic, sourced from Refinitiv Workspace)

Towards net zero

Many industries, E&R included, are looking to achieve net zero, where production and consumption levels are balanced. This transition may not reduce commodity price volatility, as traditional energy sources and metals are key components of the transition across industries.

Several countries are rethinking their energy security strategies and trying to accelerate the transition to renewables and reduce reliance on foreign energy sources. Stakeholder pressure for the E&R sector to contribute towards a rapid transition has additionally driven change as energy businesses plan for a future less reliant on fossil fuels.

Many factors drive volatility. Prioritising green technology over traditional sources, companies may only be able to bring new E&R sources online at prices higher than the past. Furthermore, green technologies drive demand for many metals and may push up metals prices. Meanwhile, shocks may constrict supply from traditional sources, which may already be receiving lower investment levels, amplifying price volatility.

In sum, E&R supply chains are changing, as E&R companies seek net zero and as their customers do as well. The levers for value creation are therefore changing, and E&R multinationals must adapt their transfer pricing to remain compliant.

TP considerations

The OECD’s Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations provide a cohesive transfer pricing framework that applies even as economies change. As an example, the OECD’s Guidance on the transfer pricing implications of the COVID-19 pandemic, published during the first year of the pandemic, reminded taxpayers and tax authorities that the OECD guidelines are flexible and robust, and should continue to be used to analyse transfer pricing during the pandemic.

Thus, even while the supply chain of the future may be reordered under new dynamics, the existing guidelines will remain relevant and applicable, even amid volatile price conditions and the economy’s fundamental shift to a net-zero future.

Managing price volatility

Price risk

The COVID-19 pandemic and the war in Ukraine have highlighted the impact of price risk. It is essential that E&R multinationals adopt risk management policies that navigate a turbulent business environment and ensure their businesses can withstand exogenous shocks. Given the OECD’s focus on ensuring transfer pricing outcomes align with value creation, risk and capital management (as addressed under Action 9 of the OECD’s BEPS project) is key.

Facts describing price risk management will be a key part of delineating transactions. Besides implementing risk management frameworks, companies may increase their resilience through hedging. Moreover, contractual arrangements with customers may also be adjusted to allow pricing flexibility amid dynamic market conditions (for example, price updates linked to market indexes, inflation, and changes in freight terms, including fuel surcharges).

As these functional components evolve and increase in prominence, explaining how these facts align with comparable transactions will increase in importance, as may transfer pricing adjustments.

In some cases, new pricing models may be needed. For example, the sharing of financial risks and responsibilities between related parties could change (such as sharing the burden of fixed-asset investment) by establishing minimum usage by customers and/or remuneration for funding required, long-term contractual commitments made in terms of volumes or pricing.

To ensure transfer pricing policies remain appropriate in these conditions, it will be important to accurately delineate intragroup transactions with reference to the conditions agreed, economically relevant circumstances, and the relevant risks assumed by each party. Assessing which party(ies) under the new models can, and actually do, make decisions regarding risk, and are capable of financially mitigating risk incurred, will be essential to support the arm’s-length nature of the terms agreed.

Supply chain management and security

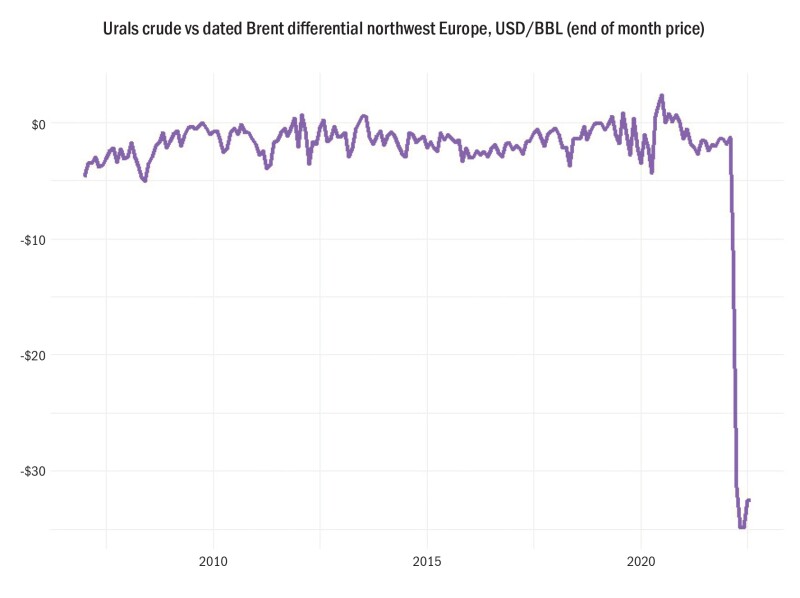

As countries seek to ensure sufficient energy supplies within the parameters set by sanctions, supply chains must evolve, regardless of negative financial impacts (Figure 2 shows how market prices react to such externalities).

Figure 2: Spread between Brent-Ural crude following sanctions

Source: Refinitiv Workspace

Changes to E&R supply chains could result from developing alternative sources of reliable supply; creating redundancies within the value chain, especially for critical materials (to minimise the impact on production or potential shutdowns at plants); securing additional critical inventory and capacity (when prices are relatively low or before periods of high consumption); or investing in additional transportation or logistics infrastructure.

These changes will impact the global value chain of the sector by driving up costs in the short term, making it more challenging for businesses to achieve predictable returns in the future.

Applying the arm’s-length principle will therefore require assessing what options are realistically available to related parties at the time each transaction is entered into and identifying any differences between the options under analysis that would significantly affect their value. For instance, some entities might be required to incur losses to ensure business continuity and comply with terms previously agreed with their customers or suppliers.

In these cases, supporting existing transfer pricing policies will require performing a more detailed analysis of comparables selected for benchmarking purposes to identify reasons that may justify abnormally large profits or significant losses, and determine whether (or the extent to which) these affect their comparability. In these circumstances, it will also be important to assess, for transfer pricing purposes, the plans for the business/entity with a view to substantiating, for example, expectations that future profits will be realised following the loss-generating period.

Shift towards net zero

Design of new operating models

With the world heading for a net-zero carbon future, it is certain the energy industry will have to commit to diversifying its business and investing in new technologies. Economies will be powered by a new energy mix including renewable energies, hydrogen, biomass, biofuels and supported by innovative technologies for power storage or carbon capture, usage, and sequestration (CCUS) (Deloitte, The 2030 decarbonisation challenge: The path to the future of energy).

From a transfer pricing perspective, it will be important for energy companies to support business development and help to determine reasonable intragroup models based on the stage of development of the technology, product, or service in question and the relative contributions provided by each related party in the value chain.

Given the cutting-edge nature of some of the technologies being developed, this might mean adopting different transfer pricing operating models for the start-up and matured business stages.

As part of the operating model design, some consideration might also need to be given to historical operating models adopted (in the industry overall and by each business) to ensure consistency where appropriate, especially in cases of groups with an integrated approach to energy production.

Increased focus on IP

The International Energy Association estimates in its ETP Clean Energy Technology Guide that around 800 new technologies across all sectors will contribute to achieving the goal of net-zero emissions. These technologies will form part of E&R’s future value proposition (and in some cases are already part of it).

New intragroup transactions will arise from owning these technologies. If parties in multiple countries share investment costs, a cost contribution arrangement may be formed. If one party licenses the technology from another party, a royalty may be due. Digital assets and services may be delivered together in a software-as-a-service, which may be analysed under principles historically applied to intangibles or services.

New technologies may not result in new increments of external revenue but may create value through other means. For example, they may help a company to achieve emission targets, which may positively impact cost of capital, or they may enhance operational efficiency. But to the extent that the income stream comprises cost savings inside integrated profit streams, transfer pricing methods based on profits attributable to a specific asset may be difficult to apply.

Also, comparable uncontrolled transactions in these emerging areas may be difficult to identify. Cost-based transfer pricing methods may be most appropriate when profits or prices are not reliably identifiable. While they may create new pricing challenges, intangibles transfer pricing will feature more prominently in the future E&R supply chain.

Changes to operating structures and pricing models

With current levels of fossil fuel production set to decline, some economies of scale will be lost. Funding is also expected to become more expensive (if available at all for new fossil fuel projects). The adoption of carbon pricing rules by several countries (Deloitte, The 2030 decarbonisation challenge: The path to the future of energy) and an increase in taxes or other disincentives for carbon production will also have a bearing on the energy sector.

This will make fossil fuel projects less economical, hence the increased focus on renewable energies will foreseeably require business restructurings to take place as a way of future-proofing energy businesses. From an operational perspective, this might include role changes and reshaping the organisational structure to ensure these remain effective and able to respond to business needs.

From a transfer pricing perspective, this will likely lead to the termination or substantial renegotiation of existing intragroup arrangements, the transfer of assets between related entities, or even the broader reorganisation or consolidation of legal group structures (causing exit taxes to become more prevalent).

Due care should therefore be given to what an independent party in comparable circumstances would have been willing to pay or receive for restructuring its activities. An assessment of the impacts of restructurings on the related parties involved, supported by all information used to help to inform any decisions made on potential compensations agreed between group entities, will be key to minimising the impact of disputes.

Concluding comments

The E&R supply chain is evolving, with recent strains from the pandemic and war highlighting changes in value creation and risk management. Economic sanctions, self-imposed business restrictions, and an increasing drive to align the sector with the net-zero societal goals have caused significant supply disruptions and will lead to substantial and permanent adjustments in the value chain.

These adjustments will require all industry participants to manage closely their transfer pricing and implement policies able to flex with the transforming business operations.

It is only natural that the E&R sector is required to transform and evolve as quickly as possible given its importance to the overall economy. Scrutiny from stakeholders will only be compounded as critical milestones in the world’s climate strategy are reached and countries continue to move towards a net-zero future.