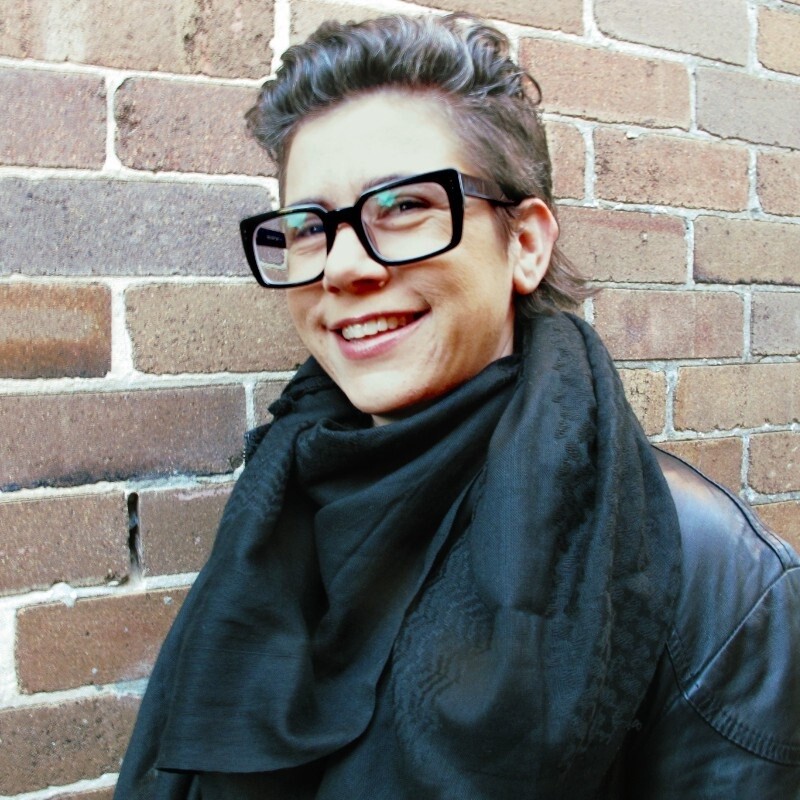

With a background as a campaigner, Katie Hepworth has built a strong profile in the tax industry.

In 2021, she became responsible tax lead at the Pensions & Investment Research Consultants (PIRC) – one of Europe’s largest independent corporate governance and advisory consultancies.

Now she is a political and strategic adviser at the Australian Manufacturing Workers’ Union.

At PIRC, Hepworth supported tax standards including the Global Reporting Initiative (GRI), which pushes companies to adopt stronger tax transparency standards. The GRI aims to show tax receipts to shareholders in the countries where companies operate.

Companies including Amazon, Microsoft and Cisco Systems were highlighted by Hepworth for not implementing enough tax transparency measures.

“All this proposal asks for is that they make this information public, to provide investors with greater oversight of the structure of their business and how their tax planning strategy corresponds with their business and sustainability strategies,” she said at the time.

This year, Hepworth reaffirmed her role as an advocate for the GRI standard, where companies would implement public country-by-country reporting (CbCR) on a voluntary basis.

While many companies already comply with CbCR requirements at a regional level, the GRI aims to further increase the transparency of information.

Hepworth may have worked on the GRI only briefly, but some of the biggest companies in the world faced transparency demands from investors as a result of her work.